Markets

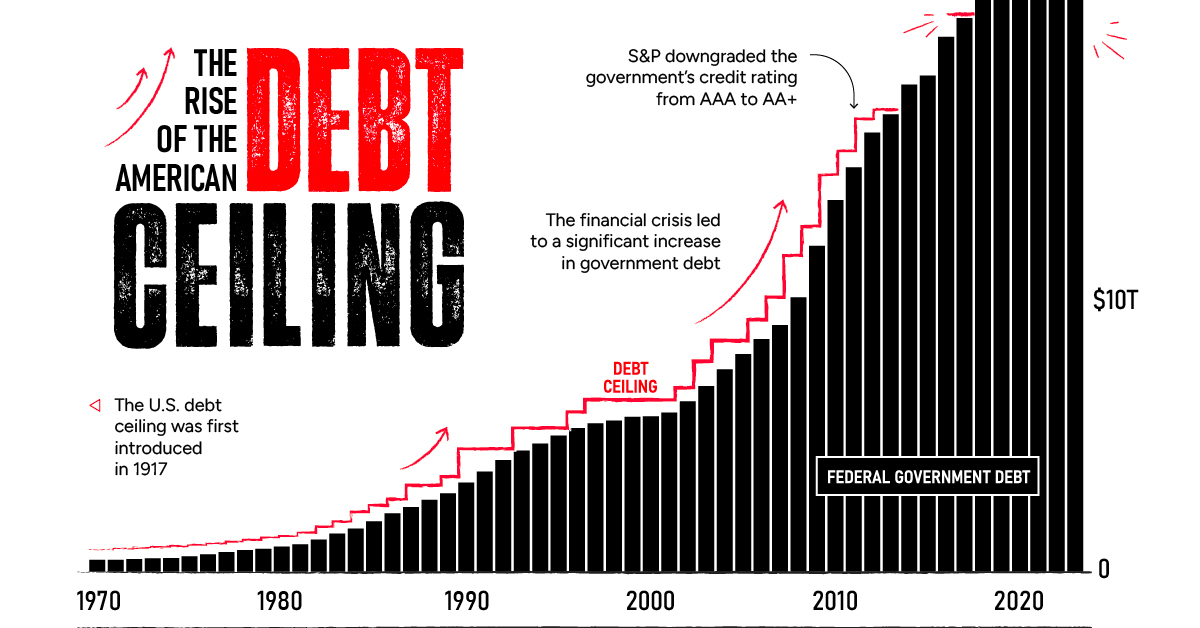

Charting the Rise of America’s Debt Ceiling

Charting the Rise of America’s Debt Ceiling

Every few years the debt ceiling standoff puts the credit of the U.S. at risk.

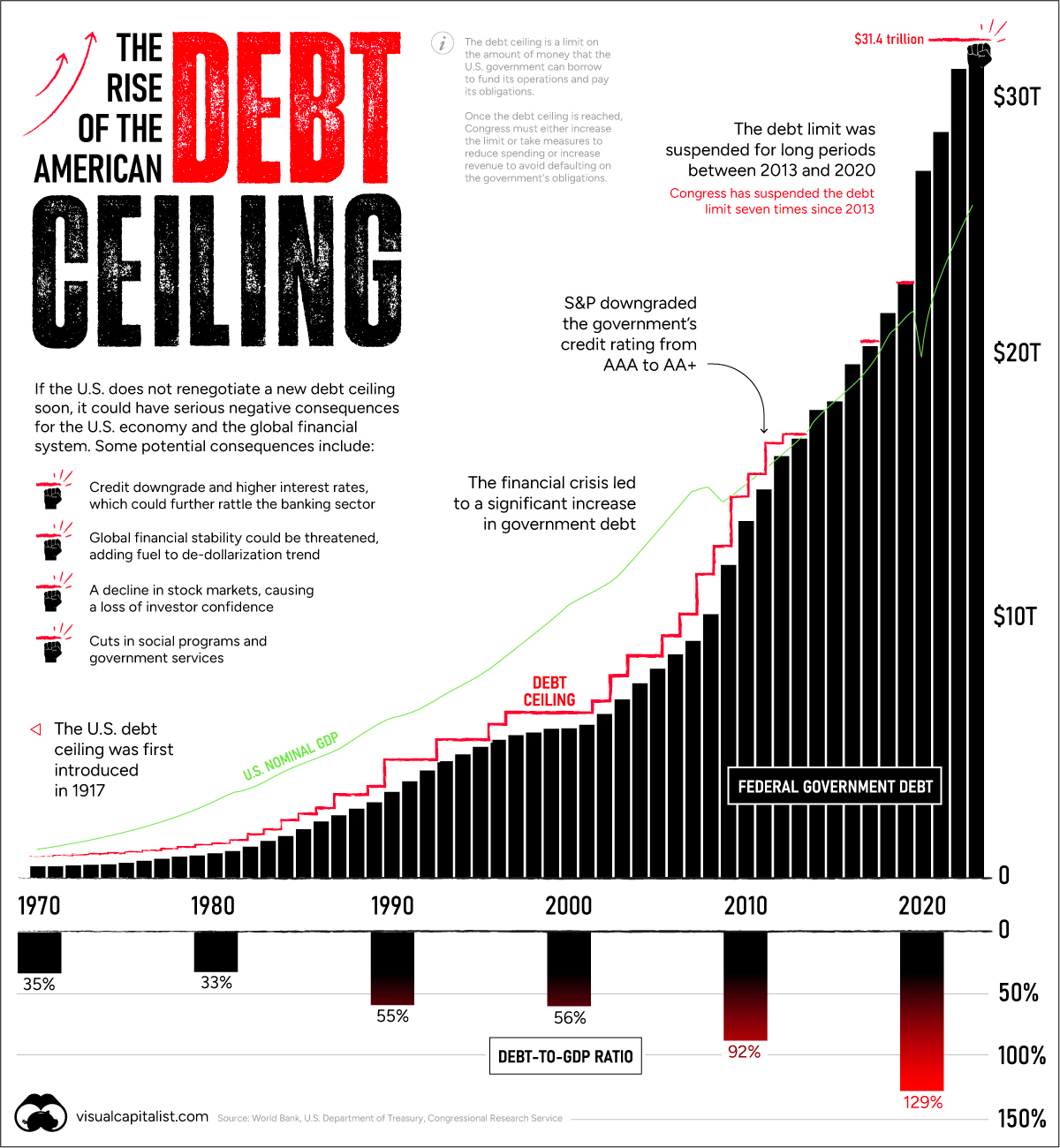

In January, the $31.4 trillion debt limit—the amount of debt the U.S. government can hold—was reached. That means U.S. cash reserves could be exhausted by June 1 according to Treasury Secretary Janet Yellen. Should Republicans and Democrats fail to act, the U.S. could default on its debt, causing harmful effects across the financial system.

The above graphic shows the sharp rise in the debt ceiling in recent years, pulling data from various sources including the World Bank, U.S. Department of Treasury, and Congressional Research Service.

Familiar Territory

Raising the debt ceiling is nothing new. Since 1960, it’s been raised 78 times.

In the 2023 version of the debate, Republican House Majority Leader Kevin McCarthy is asking for cuts in government spending. However, President Joe Biden argues that the debt ceiling should be increased without any strings attached. Adding to this, the sharp uptick in interest rates have been a clear reminder that rising debt levels can be precarious.

Consider that historically, interest payments on the U.S. debt have been equal to about half the cost of defense. More recently, however, the cost of servicing the debt has risen, and is now almost on par with the defense budget as a whole.

Key Moments In Recent History

Over history, raising the debt ceiling has often been a typical process for Congress.

Unlike today, agreements to raise the debt ceiling were often negotiated faster. Increased political polarization over recent years has contributed to standoffs with damaging consequences.

For instance, in 2011, an agreement was made just days before the deadline. As a result, S&P downgraded the U.S. credit rating from AAA to AA+ for the first time ever. This delay cost an estimated $1.3 billion in extra costs to the government that year.

Before then, the government shut down twice between 1995 and 1996 as President Bill Clinton and Republican House Speaker Newt Gingrich went head-to-head. Over a million government workers were furloughed for a week in late November 1995 before the debt limit was raised.

What Happens Now?

Today, Republicans and Democrats have less than two weeks to reach an agreement.

If Congress doesn’t make a deal the result would be that the government can’t pay its bills by taking on new debt. Payment for federal workers would be suspended, certain pension payments would get stalled, and interest payments on Treasuries would be delayed. The U.S. would default under these conditions.

Three Potential Consequences

Here are some of the potential knock-on effects if the debt ceiling isn’t raised by June 1, 2023:

1. Higher Interest Rates

Typically investors require higher interest payments as the risk of their debt holdings increase.

If the U.S. fails to pay interest payments on its debt and gets a credit downgrade, these interest payments would likely rise higher. This would impact the U.S. government’s interest payments and the cost of borrowing for businesses and households.

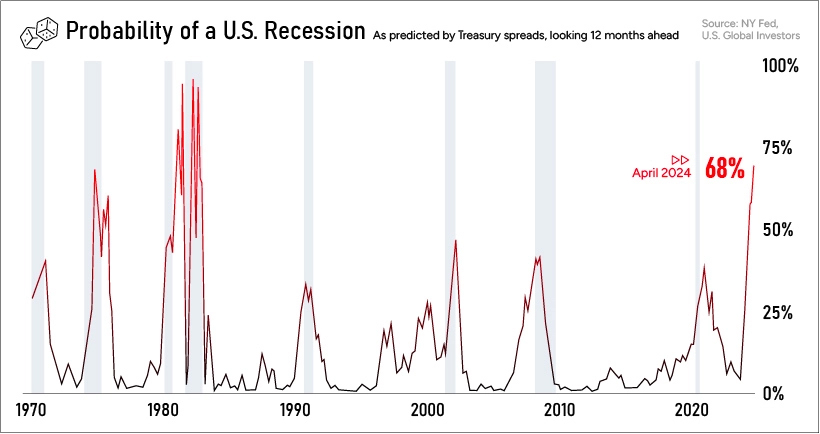

High interest rates can slow economic growth since it disincentivizes spending and taking on new debt. We can see in the chart below that a gloomier economic picture has already been anticipated, showing its highest probability since 1983.

Historically, recessions have increased U.S. deficit spending as tax receipts fall and there is less income to help fund government activities. Additional fiscal stimulus spending can also exacerbate any budget imbalance.

Finally, higher interest rates could spell more trouble for the banking sector, which is already on edge after the collapse of Silicon Valley Bank and Signature Bank.

A rise in interest rates would push down the value of outstanding bonds, which banks hold as capital reserves. This makes it even more challenging to cover deposits, which could further increase uncertainty in the banking industry.

2. Eroding International Credibility

As the world’s reserve currency, any default on U.S. Treasuries would rattle global markets.

If its role as an ultra safe asset is undermined, a chain reaction of negative consequences could spread throughout the global financial system. Often Treasuries are held as collateral. If these debt payments fail to get paid to investors, prices would plummet, demand could crater, and global investors may shift investment elsewhere.

Investors are factoring in the risk of the U.S. not paying its bondholders.

As we can see this in the chart below, U.S. one-year credit default swap (CDS) spreads are much higher than other nations. These CDS instruments, quoted in spreads, offer insurance in the event that the U.S. defaults. The wider the spread, the greater the expected risk that the bondholder won’t be paid.

The US now has higher credit risk than Mexico, Greece, and Brazil pic.twitter.com/je4klBvHZ6

— Genevieve Roch-Decter, CFA (@GRDecter) May 11, 2023

Additionally, a default could add fuel to the perception of global de-dollarization. Since 2001, the USD has slipped from 73% to 58% of global reserves.

Since Russia’s invasion of Ukraine led to steep financial sanctions, China and India are increasingly using their currencies for trade settlement. President of Russia Vladimir Putin says that two-thirds of trade is settled in yuan or roubles. Recently, China has also entered non-dollar agreements with Brazil and Kazakhstan.

3. Financial Sector Turmoil

Back at home, a debt default would hurt investor confidence in the U.S. economy. Coupled with already higher interest rates impacting costs, financial markets could see added strain. Lower investor demand could depress stock prices.

Is the Debt Ceiling Concept Flawed?

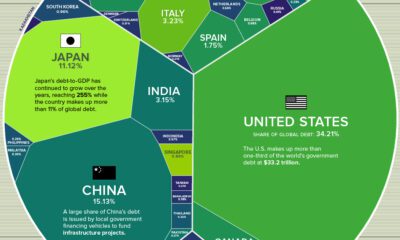

Today, U.S. government debt stands at 129% of GDP.

The annualized cost of servicing this debt has jumped an estimated 90% compared to 2011, driven by increasing debt and higher interest rates.

Some economists argue that the debt ceiling helps keep the government more fiscally responsible. Others suggest that it’s structured poorly, and that if the government approves a level of spending in its budget, that debt ceiling increases should come more automatically.

In fact, it’s worth noting that the U.S. is one of the few countries worldwide with a debt ceiling.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy3 days ago

Economy3 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

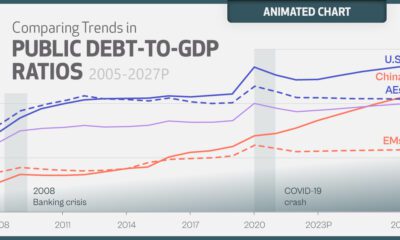

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees