COVID-19

How U.S. Consumers are Spending Differently During COVID-19

In 2019, nearly 70% of U.S. GDP was driven by personal consumption.

However, in the first quarter of 2020, the COVID-19 pandemic has initiated a transformation of consumer spending trends as we know them.

Consumer Spending in Charts

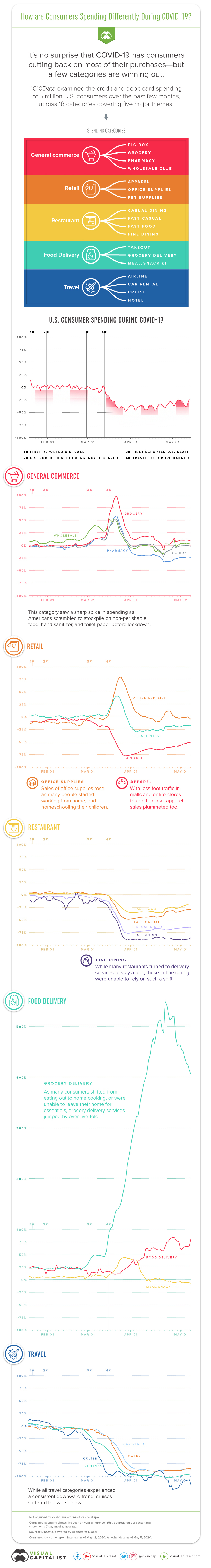

By leveraging new data from analytics platform 1010Data, today’s infographic dives into the credit and debit card spending of five million U.S. consumers over the past few months.

Let’s see how their spending habits have evolved over that short timeframe:

The above data on consumer spending, which comes from 1010Data and powered by AI platform Exabel, is broken into 18 different categories:

- General Merchandise & Grocery: Big Box, Pharmacy, Wholesale Club, Grocery

- Retail: Apparel, Office Supplies, Pet Supplies

- Restaurant: Casual dining, Fast casual, Fast food, Fine dining

- Food Delivery: Food delivery, Grocery Delivery, Meal/Snack kit

- Travel: Airline, Car rental, Cruise, Hotel

It’s no surprise that COVID-19 has consumers cutting back on most of their purchases, but that doesn’t mean that specific categories don’t benefit from changes in consumer habits.

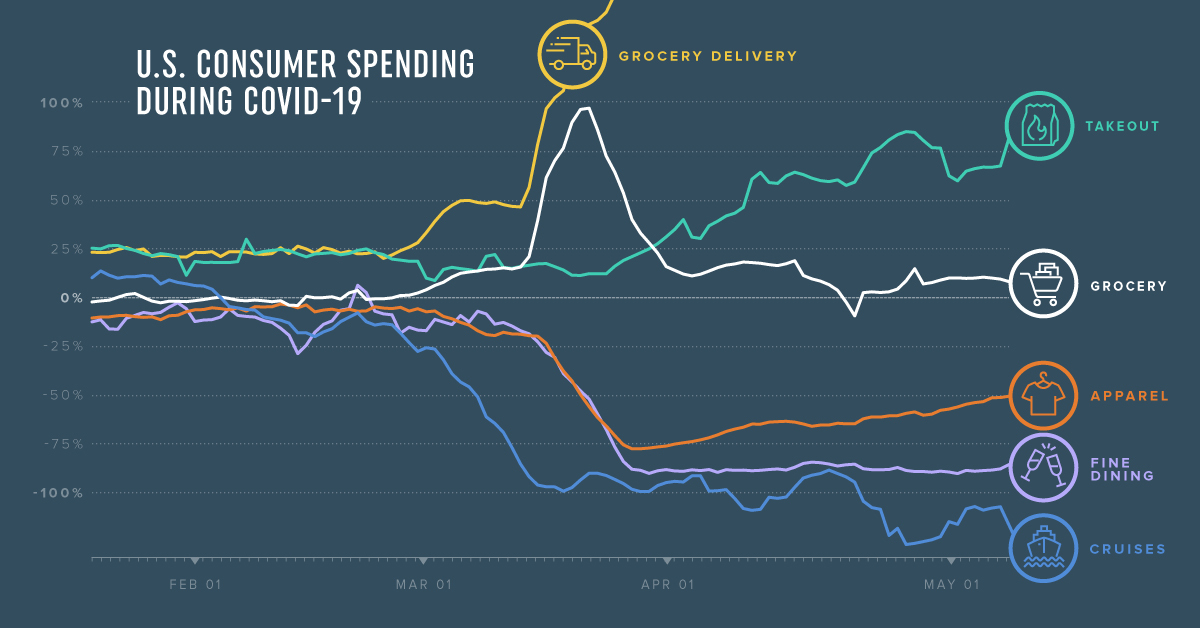

Consumer Spending Changes By Category

The onset of changing consumer behavior can be observed from February 25, 2020, when compared year-over-year (YoY).

As of May 12, 2020, combined spending in all categories dropped by almost 30% YoY. Here’s how that shakes out across the different categories, across two months.

General Merchandise & Grocery

This segment saw a sharp spike in initial spending, as Americans scrambled to stockpile on non-perishable food, hand sanitizer, and toilet paper from Big Box stores like Walmart, or Wholesale Clubs like Costco.

In particular, spending on groceries reached a YoY increase of 97.1% on March 18, 2020. However, these sudden panic-buying urges leveled out by the start of April.

| Feb 25, 2020 YoY Spending | May 5, 2020 YoY Spending | Overall Change | |

|---|---|---|---|

| Big Box | +14.2% | -1.5% | -15.7% |

| Grocery | +1.0% | +9.4% | +8.4% |

| Pharmacy | -3.6% | -23.8% | -20.2% |

| Wholesale Club | +13.0% | +2.6% | -10.4% |

Pharmaceutical purchases dropped the most in this segment, possibly as individuals cut back on their healthcare expenditures during this time. In fact, in an April 2020 McKinsey survey of physicians, 80% reported a decline in patient volumes.

Retail

With less foot traffic in malls and entire stores forced to close, sales of apparel plummeted both in physical locations and over e-commerce platforms.

| Feb 25, 2020 YoY Spending | May 5, 2020 YoY Spending | Overall Change | |

|---|---|---|---|

| Apparel | -5.6% | -51.9% | -46.3% |

| Office Supplies | -8.9% | -2.8% | +6.1% |

| Pet Supplies | +2.7% | -18.5% | -21.2% |

Interestingly, sales of office supplies rose as many pivoted to working from home. Many parents also likely required more of these resources to home-school their children.

Restaurant

The food and beverage industry has been hard-hit by COVID-19. While many businesses turned to delivery services to stay afloat, those in fine dining were less able to rely on such a shift, and spiraled by 88.2% by May 5, 2020, year-over-year.

| Feb 25, 2020 YoY Spending | May 5, 2020 YoY Change | Overall Change | |

|---|---|---|---|

| Casual Dining | -2.7% | -64.9% | -62.2% |

| Fast Casual | 4.2% | -29.6% | -33.8% |

| Fast Food | 2.0% | -20.9% | -22.9% |

| Fine Dining | -18.6% | -88.2% | -69.6% |

Applebees or Olive Garden exemplify casual dining, while Panera or Chipotle characterize fast casual.

Food Delivery

Meanwhile, many consumers also shifted from eating out to home cooking. As a result, grocery delivery services jumped by over five-fold—with consumers spending a whopping 558.4% more at its April 19, 2020 peak compared to last year.

| Feb. 25, 2020 YoY Spending | May 5, 2020 YoY Spending | Overall Change | |

|---|---|---|---|

| Food Delivery | +18.8% | +67.1% | +48.3% |

| Grocery Delivery | +23.0% | +419.7% | +396.7% |

| Meal/ Snack Kit | +7.0% | -5.9% | -12.9% |

Food delivery services are also in high demand, with Doordash seeing the highest growth in U.S. users than any other food delivery app in April.

Travel

While all travel categories experienced an immense decline, cruises suffered the worst blow by far, down by 87.0% in YoY spending since near the start of the pandemic.

| Feb 25, 2020 YoY Spending | May 5, 2020 YoY Spending | Overall Change | |

|---|---|---|---|

| Airline | -7.7% | -99.1% | -91.4% |

| Car Rental | -6.3% | -86.0% | -79.7% |

| Cruise | -18.7% | -105.7% | -87.0% |

| Hotel | -7.0% | -85.9% | -78.9% |

Airlines have also come to a halt, nosediving by 91.4% in a 10-week span. In fact, governments worldwide have pooled together nearly $85 billion in an attempt to bail the industry out.

Hope on the Horizon?

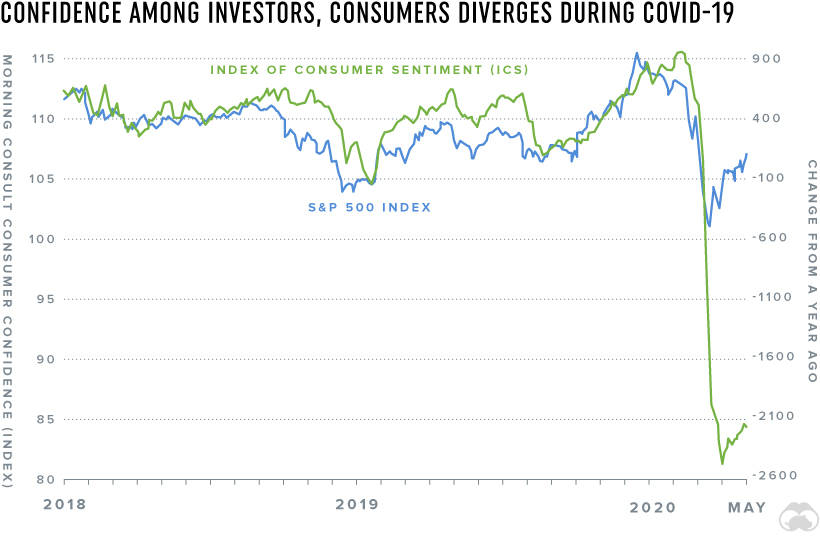

Consumer spending offers a pulse of the economy’s health. These sharp drops in consumer spending fall in line with the steep decline in consumer confidence.

In fact, consumer confidence has eroded even more intensely than the stock market’s performance this quarter, as observed when the Index of Consumer Sentiment (ICS) is compared to the S&P 500 Index.

Many investors dumped their stocks as the coronavirus hit, but consumers tightened their purse strings even more. Yet, as the chart also shows, both the stock market and consumer sentiment are slowly but surely on the mend since April.

As the stay-at-home curtain cautiously begins to lift in the U.S., there may yet be hope for economic recovery on the horizon.

Healthcare

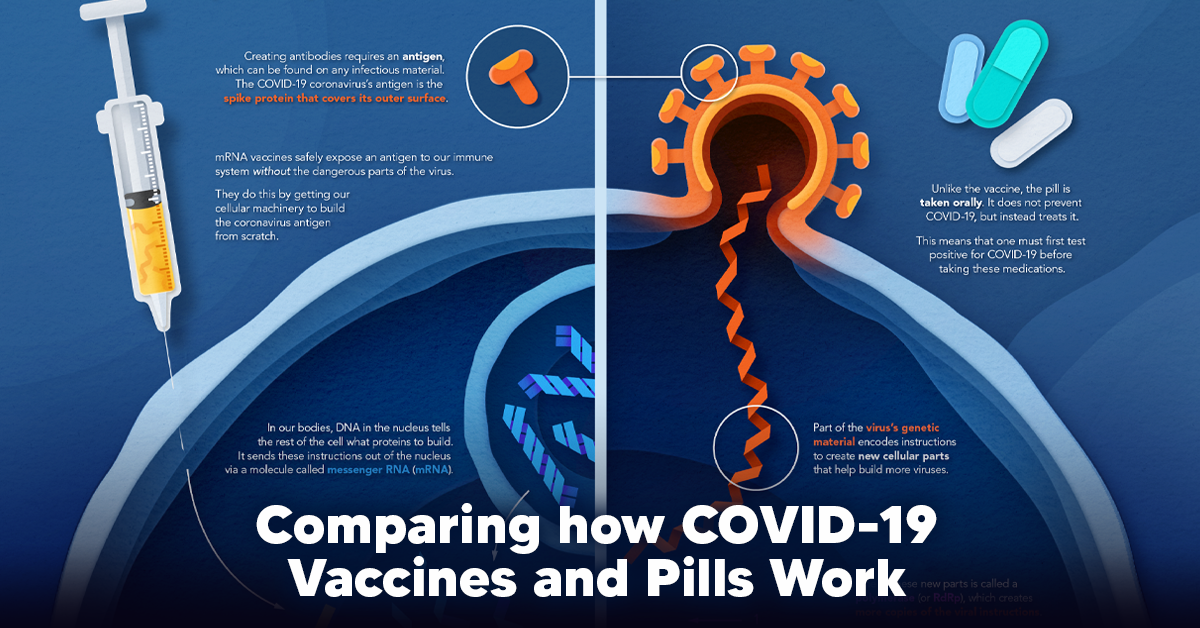

Visualizing How COVID-19 Antiviral Pills and Vaccines Work at the Cellular Level

Despite tackling the same disease, vaccines and antiviral pills work differently to combat COVID-19. We visualize how they work in the body.

Current Strategies to Tackle COVID-19

Since the pandemic started in 2020, a number of therapies have been developed to combat COVID-19.

The leading options for preventing infection include social distancing, mask-wearing, and vaccination. They are still recommended during the upsurge of the coronavirus’s latest mutation, the Omicron variant.

But in December 2021, The United States Food and Drug Administration (USDA) granted Emergency Use Authorization to two experimental pills for the treatment of new COVID-19 cases.

These medications, one made by Pfizer and the other by Merck & Co., hope to contribute to the fight against the coronavirus and its variants. Alongside vaccinations, they may help to curb extreme cases of COVID-19 by reducing the need for hospitalization.

Despite tackling the same disease, vaccines and pills work differently:

| Vaccines | Pills |

|---|---|

| Taken by injection | Taken by mouth |

| Used for prevention | Used for treatment only |

| Create an enhanced immune system by stimulating antibody production | Disrupt the assembly of new viral particles |

How a Vaccine Helps Prevent COVID-19

The main purpose of a vaccine is to prewarn the body of a potential COVID-19 infection by creating antibodies that target and destroy the coronavirus.

In order to do this, the immune system needs an antigen.

It’s difficult to do this risk-free since all antigens exist directly on a virus. Luckily, vaccines safely expose antigens to our immune systems without the dangerous parts of the virus.

In the case of COVID-19, the coronavirus’s antigen is the spike protein that covers its outer surface. Vaccines inject antigen-building instructions* and use our own cellular machinery to build the coronavirus antigen from scratch.

When exposed to the spike protein, the immune system begins to assemble antigen-specific antibodies. These antibodies wait for the opportunity to attack the real spike protein when a coronavirus enters the body. Since antibodies decrease over time, booster immunizations help to maintain a strong line of defense.

*While different vaccine technologies exist, they all do a similar thing: introduce an antigen and build a stronger immune system.

How COVID Antiviral Pills Work

Antiviral pills, unlike vaccines, are not a preventative strategy. Instead, they treat an infected individual experiencing symptoms from the virus.

Two drugs are now entering the market. Merck & Co.’s Lagevrio®, composed of one molecule, and Pfizer’s Paxlovid®, composed of two.

These medications disrupt specific processes in the viral assembly line to choke the virus’s ability to replicate.

The Mechanism of Molnupiravir

RNA-dependent RNA Polymerase (RdRp) is a cellular component that works similar to a photocopying machine for the virus’s genetic instructions. An infected host cell is forced to produce RdRp, which starts generating more copies of the virus’s RNA.

Molnupiravir, developed by Merck & Co., is a polymerase inhibitor. It inserts itself into the viral instructions that RdRp is copying, jumbling the contents. The RdRp then produces junk.

The Mechanism of Nirmatrelvir + Ritonavir

A replicating virus makes proteins necessary for its survival in a large, clumped mass called a polyprotein. A cellular component called a protease cuts a virus’s polyprotein into smaller, workable pieces.

Pfizer’s antiviral medication is a protease inhibitor made of two pills:

- The first pill, nirmatrelvir, stops protease from cutting viral products into smaller pieces.

- The second pill, ritonavir, protects nirmatrelvir from destruction by the body and allows it to keep working.

With a faulty polymerase or a large, unusable polyprotein, antiviral medications make it difficult for the coronavirus to replicate. If treated early enough, they can lessen the virus’s impact on the body.

The Future of COVID Antiviral Pills and Medications

Antiviral medications seem to have a bright future ahead of them.

COVID-19 antivirals are based on early research done on coronaviruses from the 2002-04 SARS-CoV and the 2012 MERS-CoV outbreaks. Current breakthroughs in this technology may pave the way for better pharmaceuticals in the future.

One half of Pfizer’s medication, ritonavir, currently treats many other viruses including HIV/AIDS.

Gilead Science is currently developing oral derivatives of remdesivir, another polymerase inhibitor currently only offered to inpatients in the United States.

More coronavirus antivirals are currently in the pipeline, offering a glimpse of control on the looming presence of COVID-19.

Author’s Note: The medical information in this article is an information resource only, and is not to be used or relied on for any diagnostic or treatment purposes. Please talk to your doctor before undergoing any treatment for COVID-19. If you become sick and believe you may have symptoms of COVID-19, please follow the CDC guidelines.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001