Technology

The COVID-19 Impact on App Popularity

The COVID-19 Impact on App Popularity

Pandemic-induced social isolation has altered the relationship consumers have with technology.

With the physical world now slowly receding, consumers are suddenly more reliant on apps for communication, shopping, staying healthy, and entertainment.

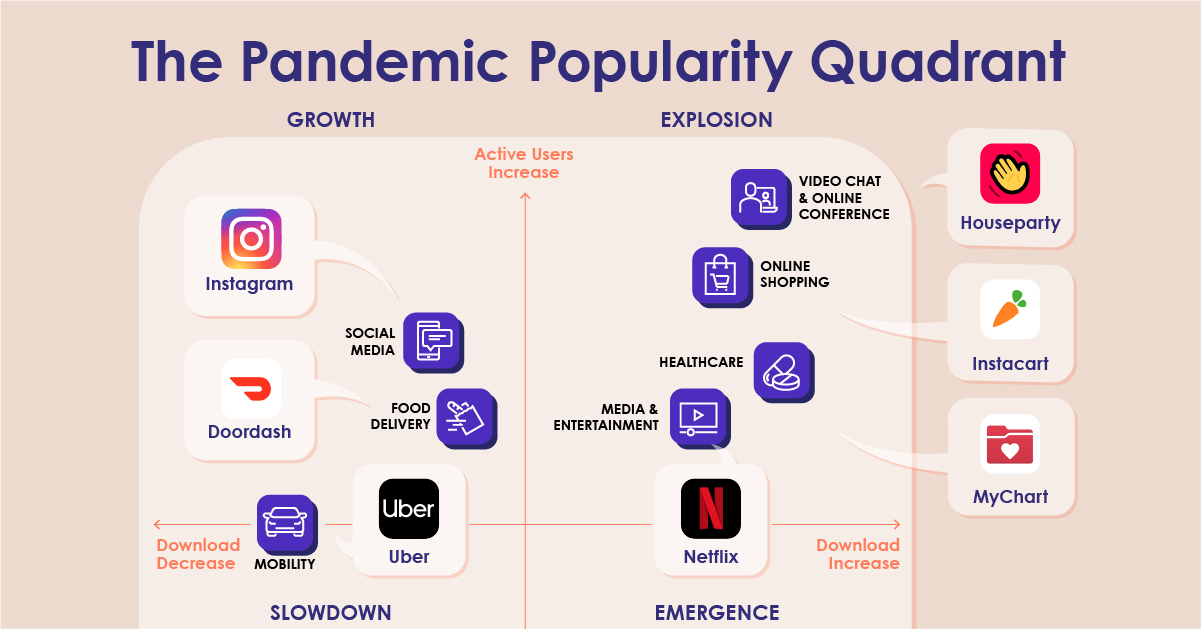

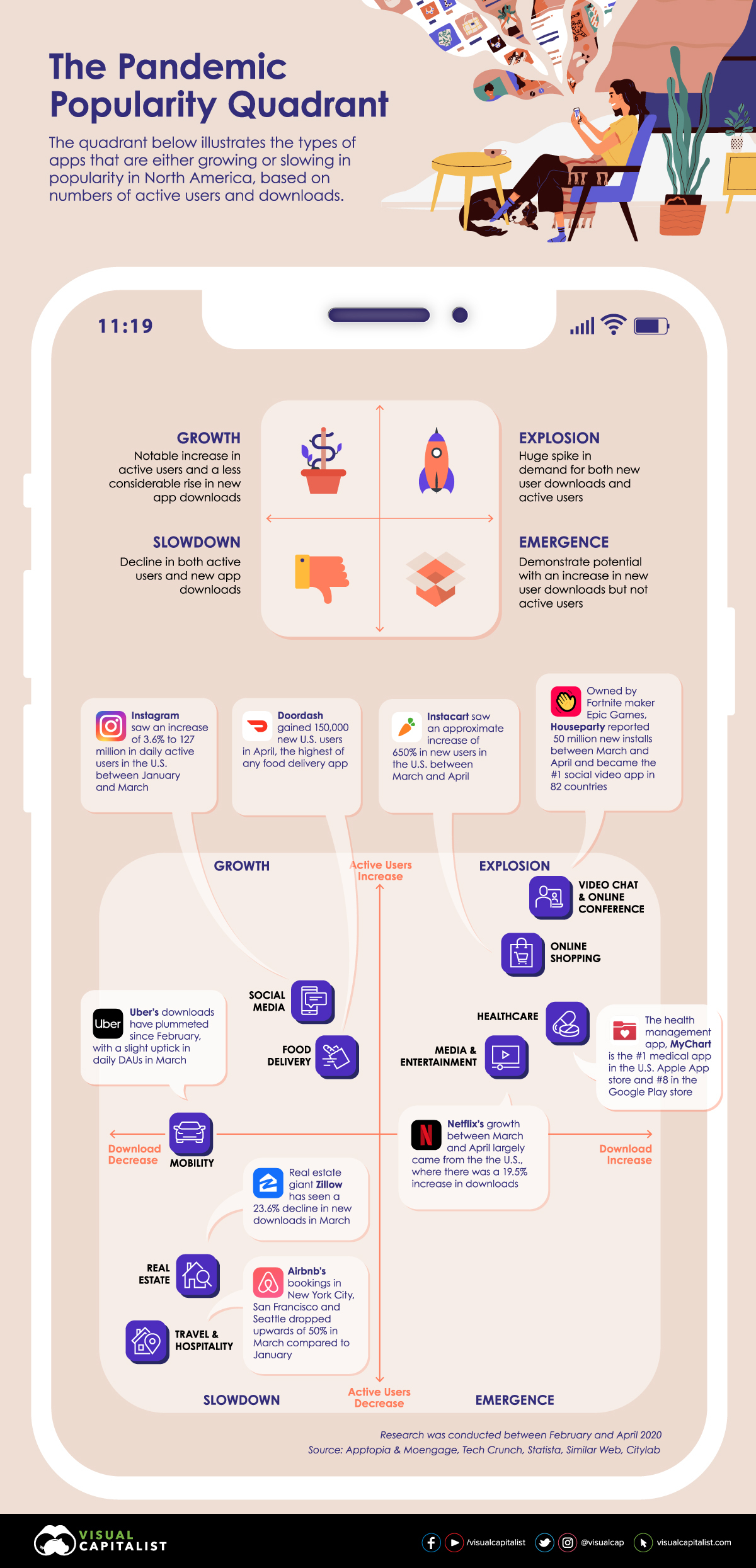

Today’s graphic pulls data from a new report by MoEngage and Apptopia, and it plots the winners and losers of the pandemic from the app world in North America.

Embracing the App Economy with Open Arms

Consumers are looking for different ways to manage their lives while in lockdown, and in some cases, apps could provide the perfect solution.

In fact, people spent 20% more time using apps in the first quarter of 2020 compared to 2019. During that time, consumers also spent over $23 billion in app stores—the largest spend per quarter recorded to date.

While consumers across the globe lean on apps to support them in times of crisis, what exactly are consumers in North America using?

Climbing to the Top

Given the sheer volume of people working remotely, it’s no surprise to see video chat and online conference apps experiencing explosive growth. In North America, these apps witnessed an astronomical 627% increase in downloads, and a 121% increase in daily active users (DAUs).

Video conferencing app Zoom expanded its worldwide user base by 300% in just under a month. Upwards of 500 participants can attend a meeting at any one time, hence why it has become a popular option for virtual conferences, festivals and even religious sermons. As we adapt to life indoors, the Zoom boom shows no signs of slowing, even despite the app’s recent data privacy and security scandal.

Slowing to a Standstill

Unfortunately, indoor living is not conducive to globetrotting. As travel and hospitality app downloads in North America decline by 12%, this is the harsh reality that the industry needs to come to terms with for the foreseeable future.

Interestingly, airlines in the U.S. did not see a reduction in app downloads until early March, which may be attributed to the later timing of the COVID-19 shutdowns as in comparison to other countries around the world.

In the short-term rentals space, Airbnb has experienced a drastic decline in bookings, and is adopting new cleaning protocols in an attempt to appease both hosts and guests. The tech company has since lowered its internal evaluation, from $31 billion to $26 billion, which could disrupt the company’s plan to go public in 2020.

Emerging Victorious

Because the largest social media networks already boast a significantly large audience, new downloads is not necessarily a metric that could make or break this cohort. Instead, DAUs are a much better indicator of success, and from what the report suggests, people have become more devoted to these platforms.

For U.S. adults, social media usage jumped from 20% of total mobile app usage in the early part of the year, to 25% in mid-March. In fact, between January and March, daily active users on Instagram and Facebook rose to 127 million and 195 million, respectively.

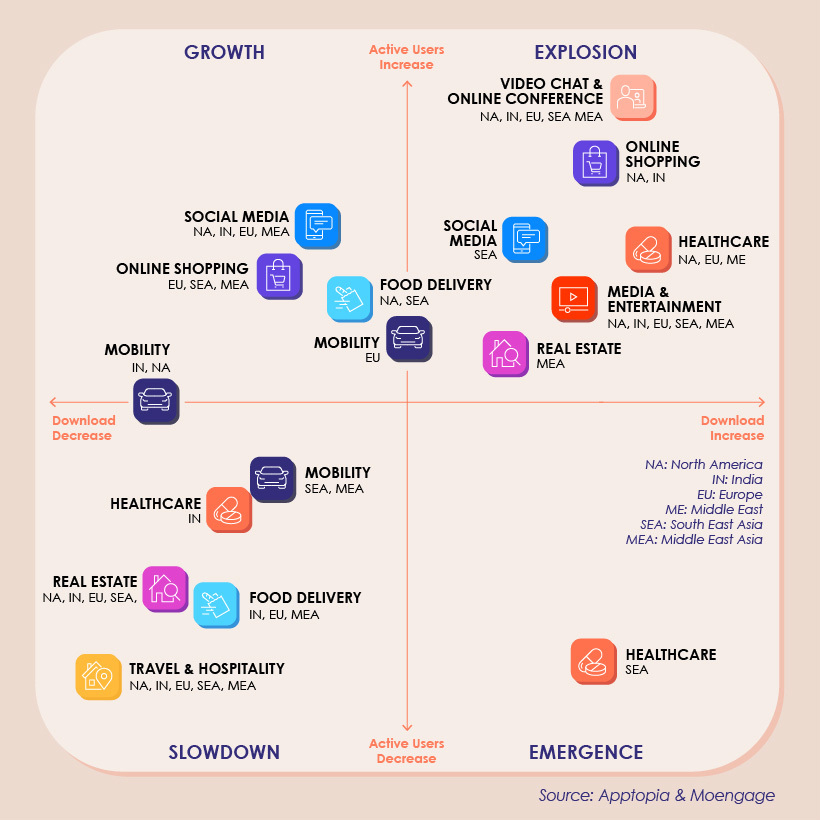

Measuring the Global Impact

When we look at the popularity of apps across different parts of the world, some interesting observations appear. First of all, healthcare apps in South East Asia are categorized as emerging—meaning they show promise, but have minimal active users.

Although DAUs of healthcare apps in South East Asia are declining, fascinatingly, there has been a 110% increase in spend on these apps during the outbreak. The report suggests that this could be attributed to the user base becoming more loyal as a result of trust-building advertising campaigns in this space.

Real estate is a sector seeing a simultaneous increase and decrease in users worldwide. In Middle-East Asia for instance, these apps are exploding in popularity, but in other parts of the world they are experiencing a slowdown. This could be due to restrictions in certain parts of the world slowly starting to lift.

An Unsung Hero

Technology is becoming an increasingly divisive topic. Data security scandals, the spread of false information, and its impact on mental health are just some of the reasons why technology’s role in society regularly comes into question.

However, it has allowed us to remain connected in a time of crisis, and has also been pivotal in facilitating the spread of reliable information during lockdown.

If anything, the pandemic has shown us how vulnerable we are without technology—and how instrumental apps are in keeping us busy, informed, and sane.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023