Politics

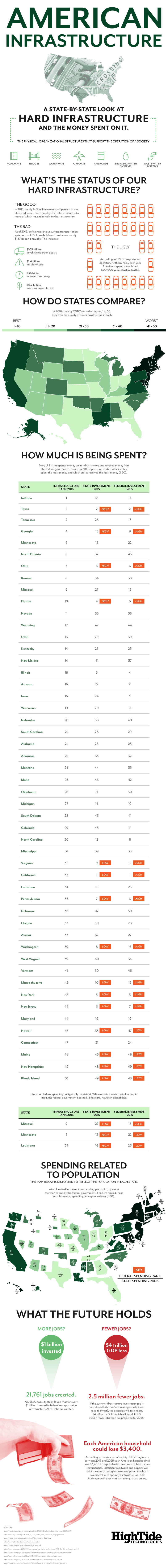

The Sad State of America’s Infrastructure in One Infographic

Every year, Americans spend a combined 600,000 years stuck in traffic.

If you’re thinking that time could be spent a little more productively, you’re not the only one.

In fact, even politicians are taking notice of aging and insufficient infrastructure in the United States. Recently, President Trump has started mapping out his $1 trillion plan to rebuild the country’s roads, bridges, and airports – and it is worth mentioning that infrastructure spending was also a key component of Bernie Sanders’ platform as well.

A Look at America’s Infrastructure

Today’s infographic is from HighTide Technologies, and it dives into the infrastructure situation in the United States, including a comparison of federal and state spending.

According to the American Society of Civil Engineers, the United States currently has an “infrastructure gap”. If the discrepancy is not closed between what needs to be invested in infrastructure and what is actually invested, it could ultimately create a $4 trillion drag on GDP by 2025.

As a result, between 2016 and 2025, each American household will lose $3,400 in disposable income due to infrastructure inefficiencies.

What Needs To Be Fixed?

Should money go to roadways, airports, water systems, broadband networks, or rail?

The biggest challenge facing America’s infrastructure problem is where to get the biggest ROI from infrastructure investments. Putting a trillion dollars towards problems that don’t really exist would be a catastrophic failure to everyone involved, with the exception of any crony capitalists that find a way to profit.

One viewpoint on this again comes from the American Society of Civil Engineers: they figure that by 2020, the U.S. needs to put $1.7 trillion towards roads, bridges and transit, $736 billion to electricity and power grids, $391 billion towards schools, $134 billion to airports, and $131 billion to waterways and related projects.

But even with these kinds of targets in place, how the decisions are actually made is another potential issue. Infrastructure investments are notoriously hard to gauge and often run overbudget. They are also capital-intensive, constrained by regulations, and disrupting to daily life at a local level, where the investments are being made.

Trump’s current plan is to provide $137 billion in tax credits to create incentives for private industry to spend the dough – but it remains to be seen how this will play out to mitigate the above risks, while solving the most important problems at both state and local levels.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

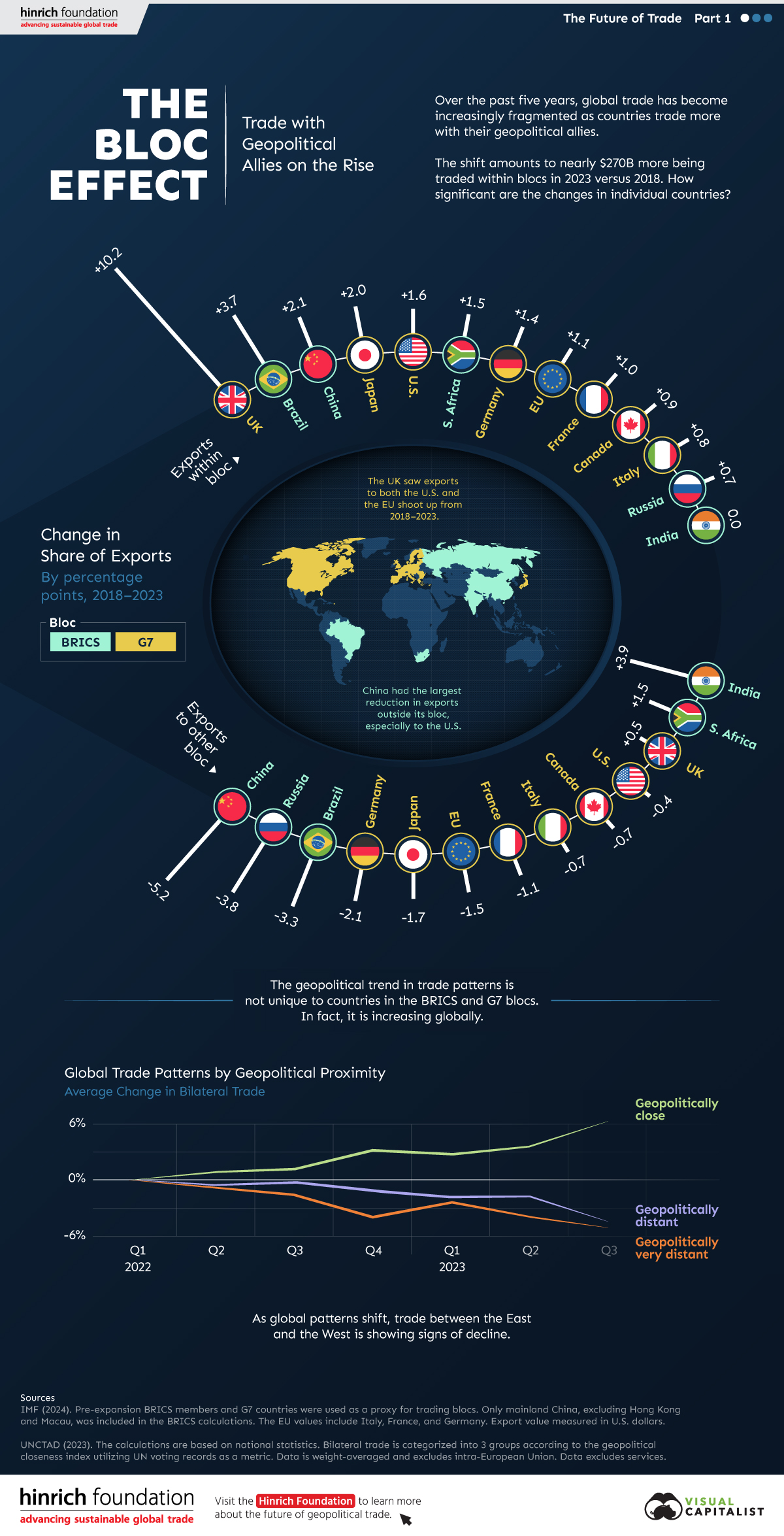

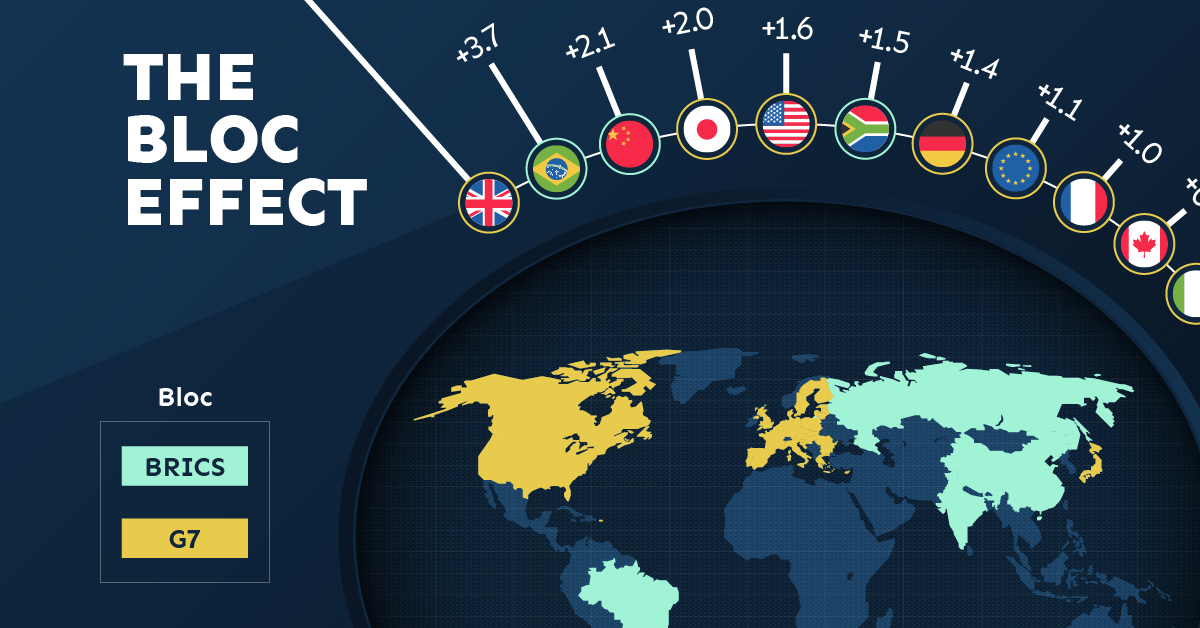

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy3 days ago

Economy3 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy1 month ago

Economy1 month agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy1 month ago

Economy1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

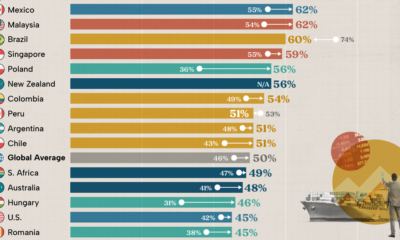

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees