Energy

These 9 Slides Put the New Tesla Gigafactory in Perspective

This week, Tesla Motors officially unveils its massive new Gigafactory 1 at a grand opening event on July 29, 2016.

The ultimate objective of the first Gigafactory is simple, but it is not for the faint of heart. Battery costs are the most expensive component of electric vehicles, and the multi-billion dollar Gigafactory aims to add scale, vertical integration, and other efficiencies together to bring lithium-ion battery costs down.

Costs have already come down faster than most analysts have predicted, and the Gigafactory could be the final catalyst to get below the industry’s holy grail of $100 per kWh. Cheaper battery packs could make electric vehicles competitive with traditional gas-powered vehicles – and if that happens, it is a game-changer for the auto industry.

It’s important to note that the Gigafactory is fairly modular by design, and construction is not completed in full yet. That said, here is what we know about the new Tesla Gigafactory and its possible impact.

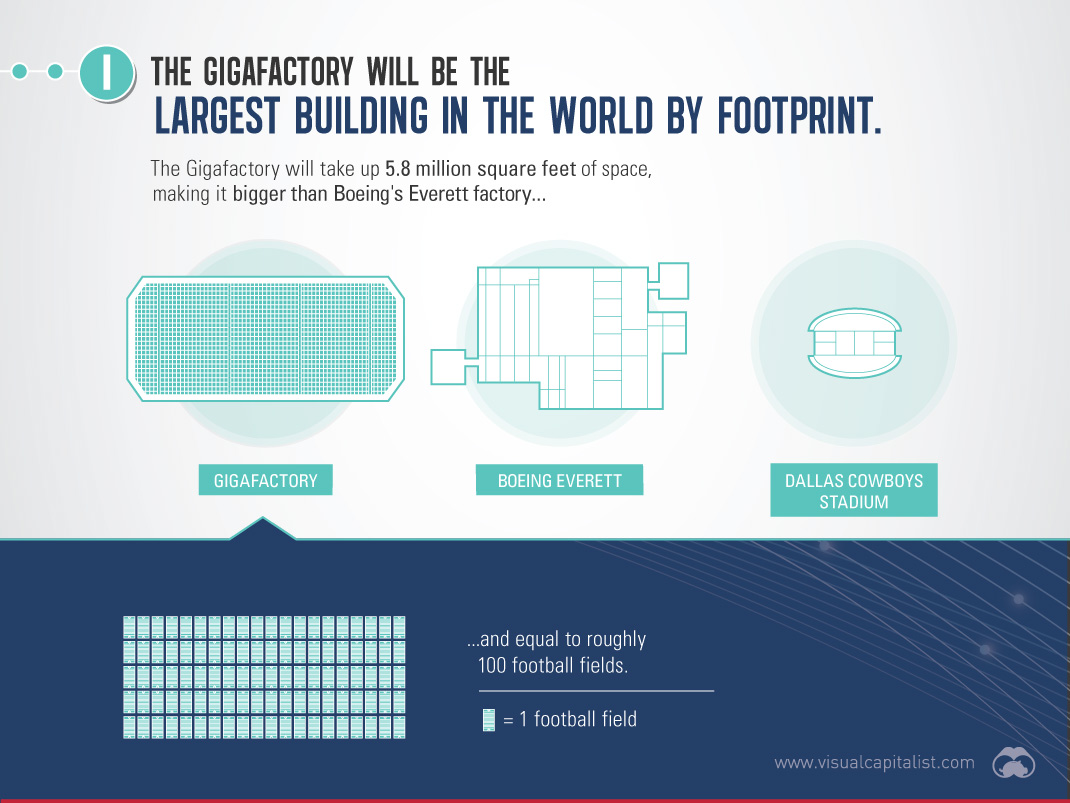

1. The Tesla Gigafactory 1 will be the largest building in the world by footprint.

The Gigafactory will take up 5.8 million sq. ft of space, making it bigger than Boeing’s giant facility in Everett, WA. That’s roughly equivalent to 100 football fields.

While the Gigafactory will certainly be one of the largest factories by volume, it will be hard to compete with Boeing for first place there. Boeing’s Everett facility, which is six storeys high to accommodate the construction giant planes, has a total of 472 million cu. ft of volume.

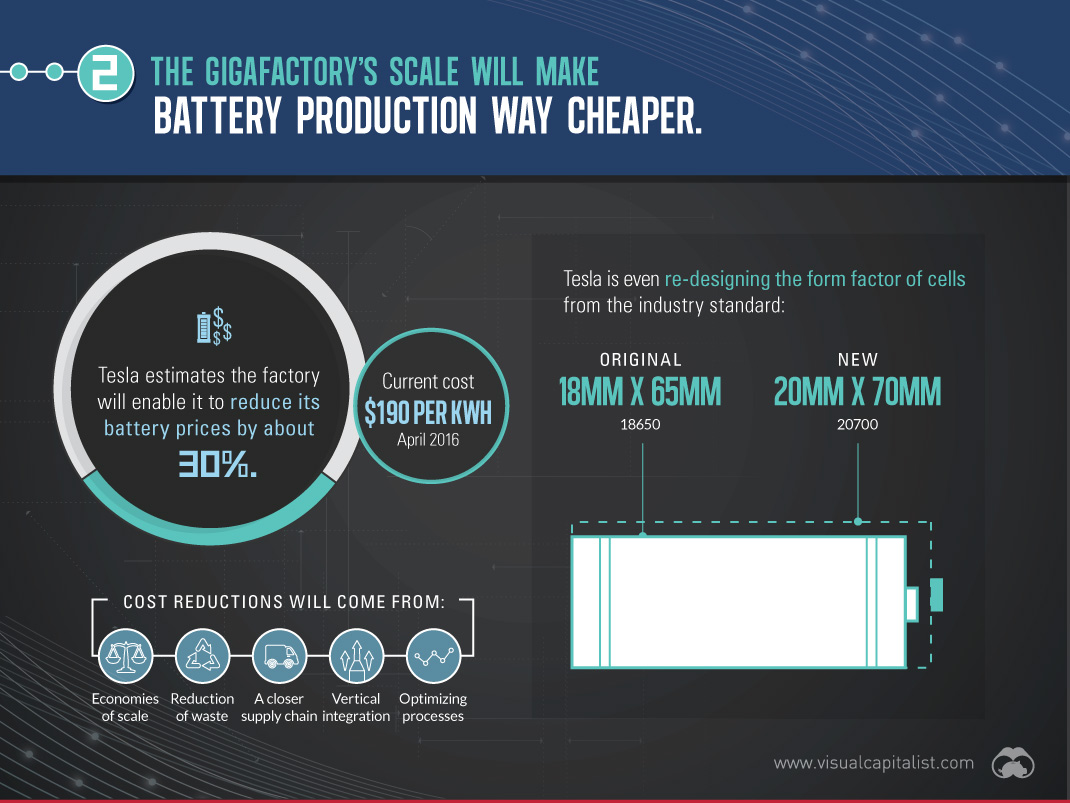

2. The scale will make production of lithium-ion batteries way cheaper.

Tesla recently stated that its current battery cost is $190 per kWh for the Model S.

The Gigafactory aims to reduce battery costs by 30%. Tesla expects this to happen through vertical integration, adding economies of scale, reducing waste, optimizing processes, and tidying up the supply chain.

Tesla CEO Elon Musk has also stated that the company is changing the form factor of the batteries away from the industry standard. Lithium-ion cells used for notebook computer batteries are typically produced in an 18650 cell format (18mm x 65mm), but Tesla will produce them in a 20700 cell format (20mm x 70mm).

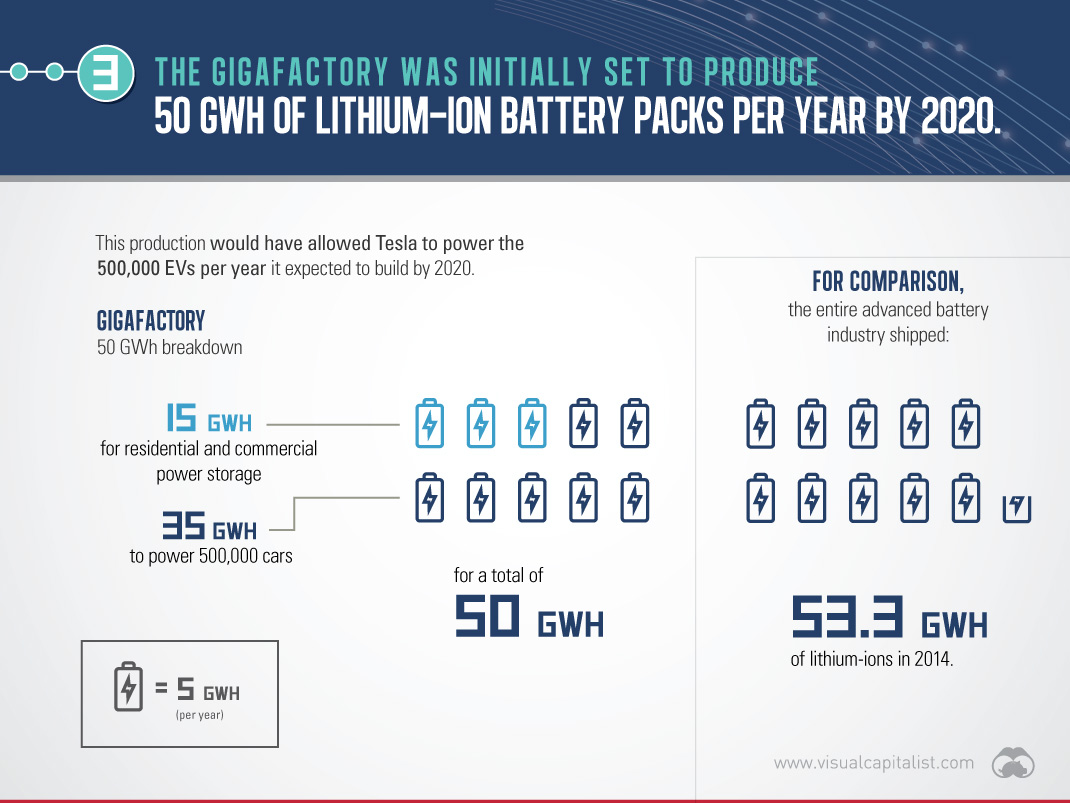

3. Tesla initially planned to produce 50 GWh of battery packs by 2020.

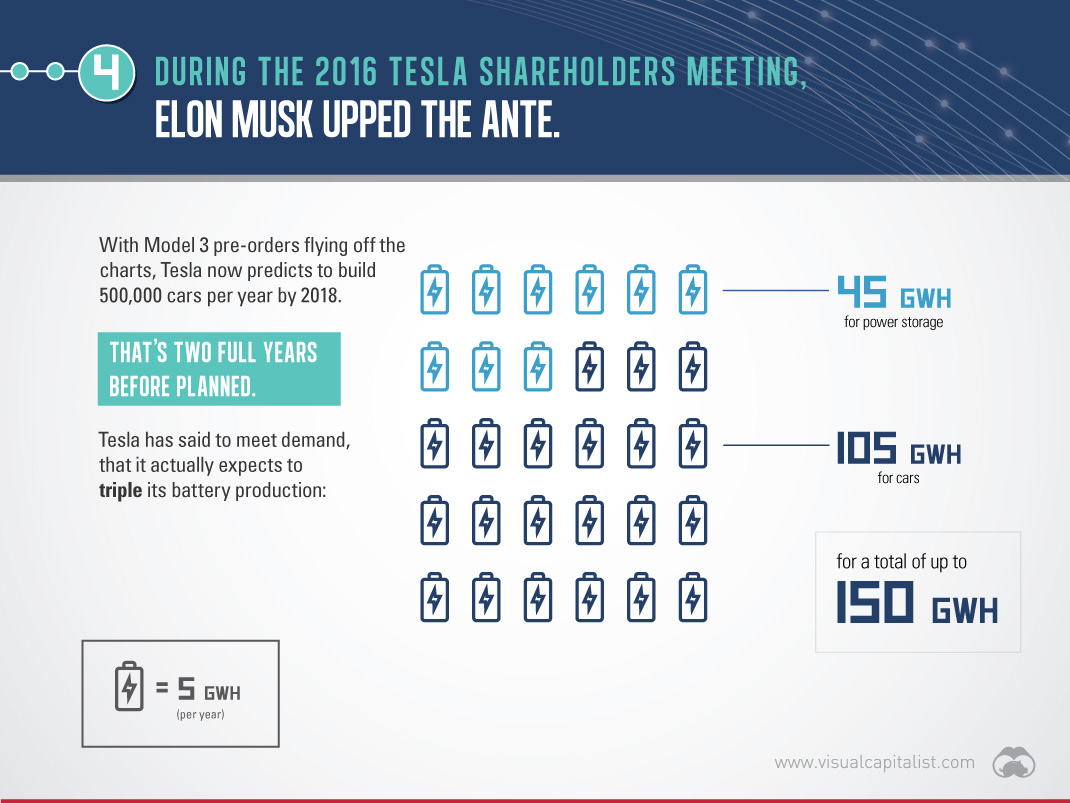

4. However, Tesla has now moved that target forward by two years.

Now, it’s anticipated that Tesla could triple battery production to meet this demand. This means it could produce up to 105 GWh of battery cells, and 150 GWh of completed battery packs. Musk says the current factory size will be sufficient for this ramp-up.

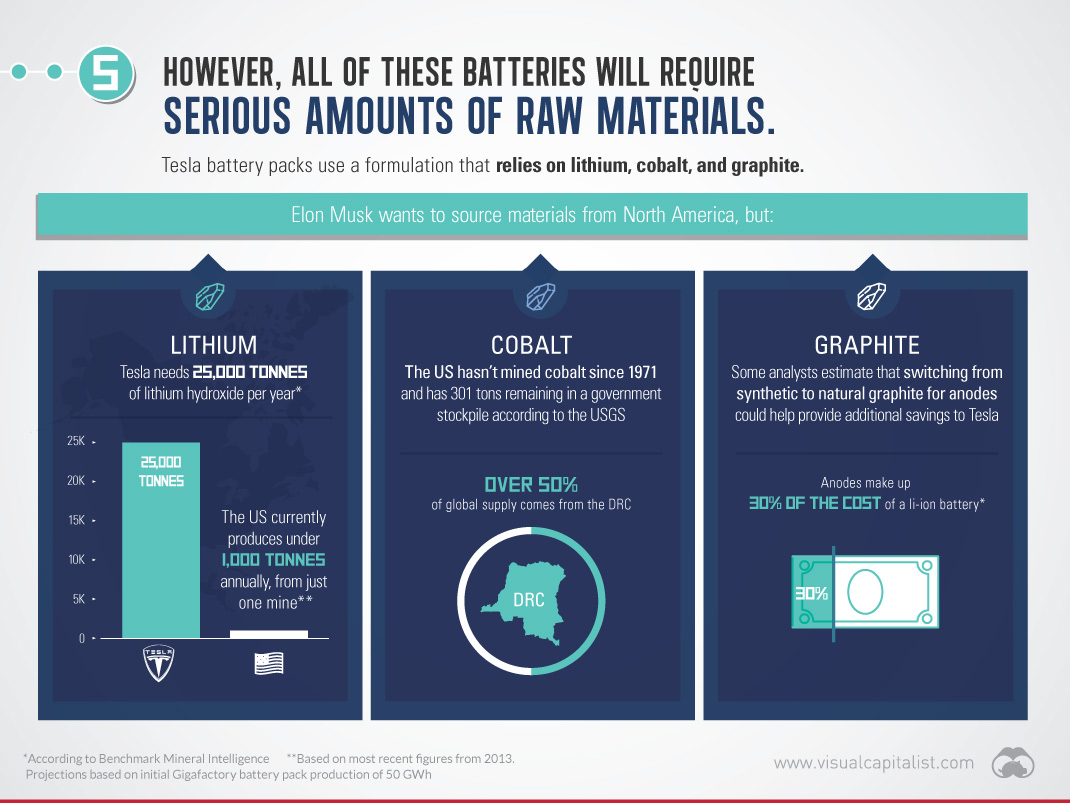

5. This will require serious amounts of raw materials.

We previously showed the extraordinary amounts of materials needed to build a Tesla Model S. The batteries, which currently use an NCA cathode formulation, need lithium, graphite, cobalt, nickel, and other base metals that aren’t used as much in an internal combustion engine.

This has created a significant rush for suppliers of these raw materials. It’s also something we are covering in our five-part Battery Series, in which we are looking at lithium-ion battery demand, as well as the materials that will need to be sourced as electric cars go mainstream.

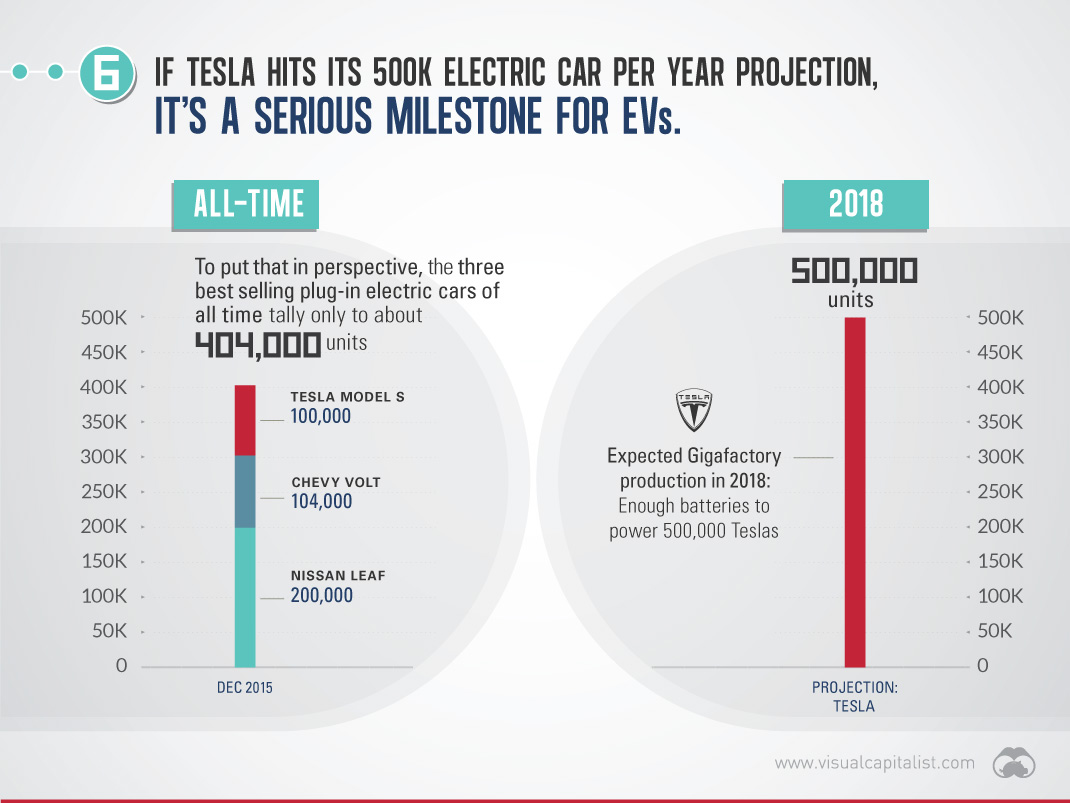

6. If Tesla hits its 2018 projection, it will be a serious milestone for EVs.

Tesla aims to sell 500,000 cars in 2018. If it hits the mark, it will be a big milestone for the electric vehicle market.

To put that number in perspective, the total amount of sales (all-time) for the three most popular EV models (Leaf, Volt, Model S) added up to only about 404,000 cars as of December 2015.

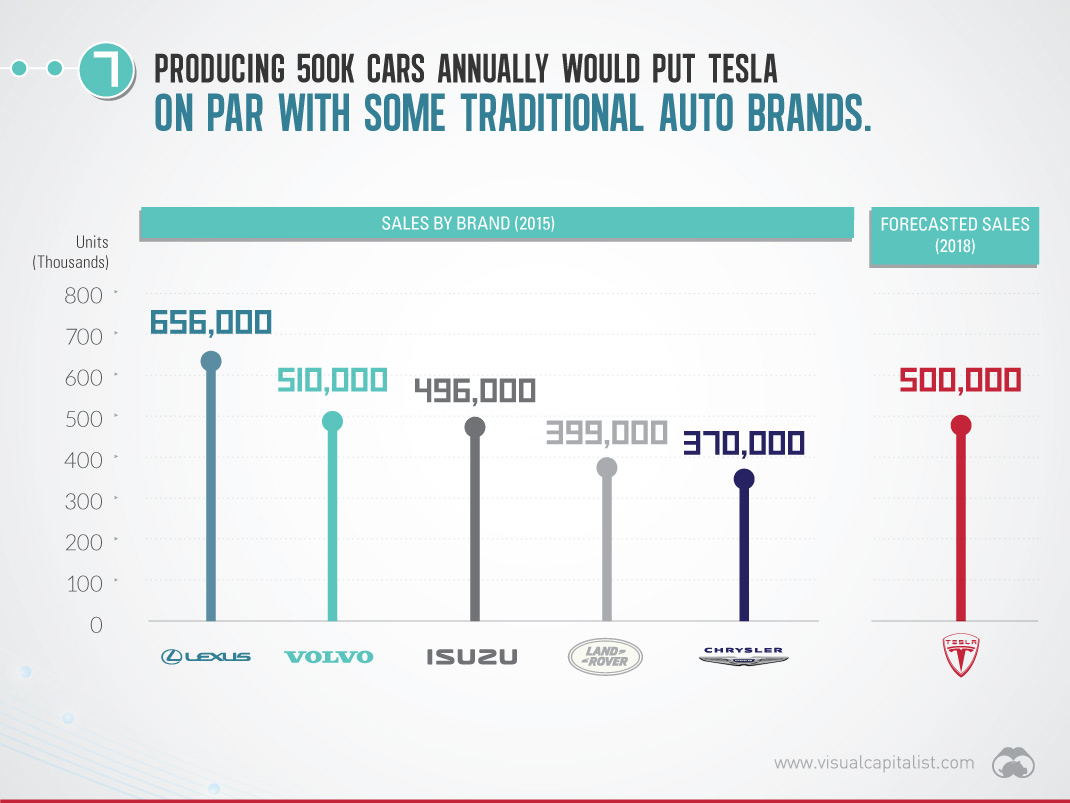

7. This would also put Tesla on par with major auto brands.

Tesla is still a small auto manufacturer – but if it meets its stated production goal of 500,000 vehicles in 2018, that will be comparable with brands like Chrysler, Land Rover, Isuzu, Volvo, and Lexus.

This still doesn’t compare to a giant like Ford, which sold 780,354 F-series pickups alone in 2015. But, it is a step in the right direction for Elon Musk’s company.

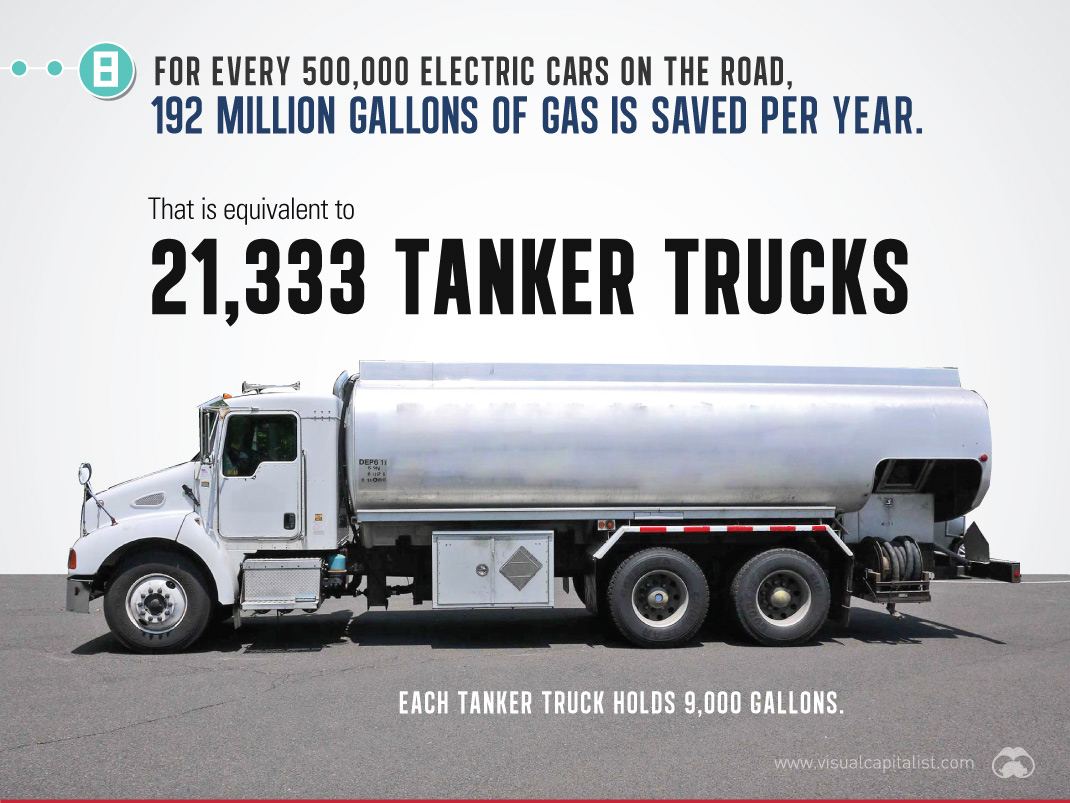

8. For every 500,000 electric cars on the road, 192 million gallons of gas is saved.

That’s equal to 290 Olympic-sized swimming pools filled with gasoline, or 21,333 tanker trucks.

Even taking into account coal power and pollution, driving a Tesla is already far better for the environment in most states.

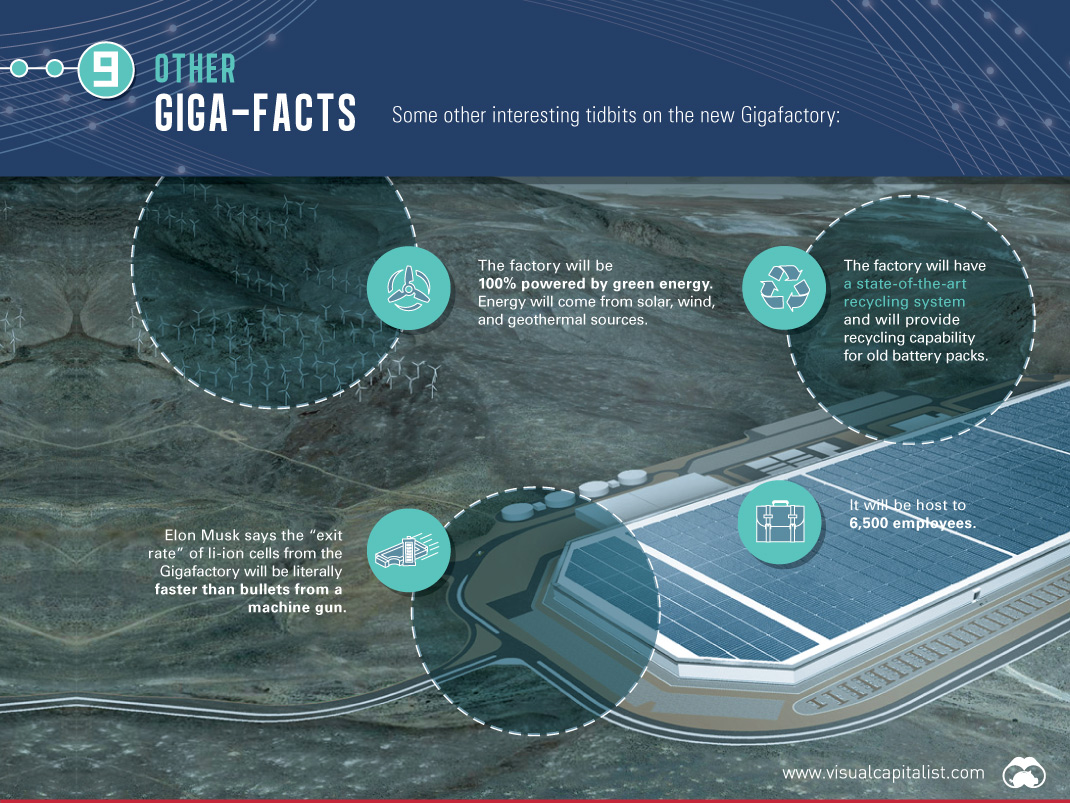

9. Other Giga-facts

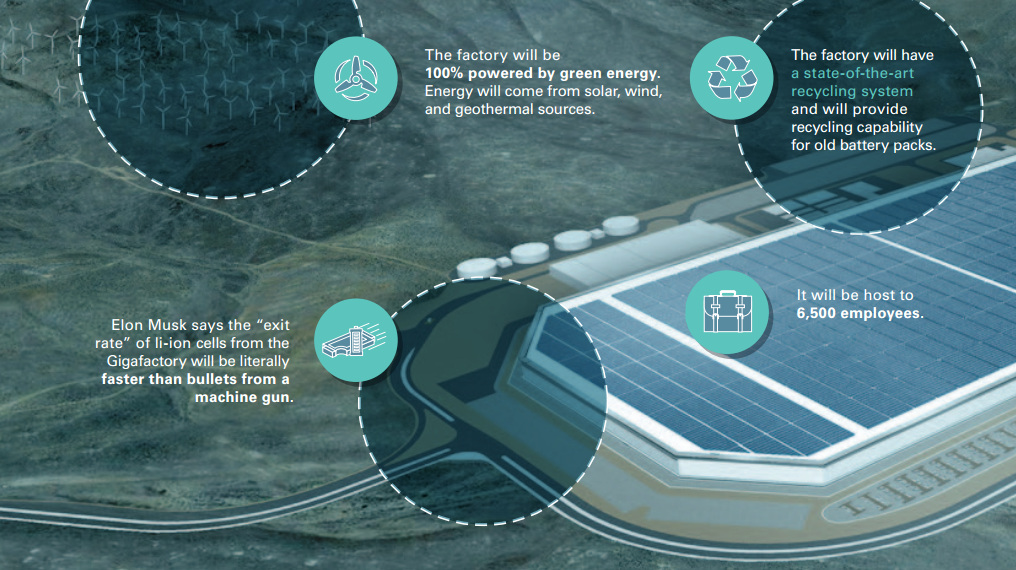

The Gigafactory will be 100% powered by renewable energy. It’ll have solar panels covering the roof, while also drawing power from wind and geothermal.

It will employ 6,500 people, and it will have a state-of-the-art recycling system to make use of old battery packs.

Elon Musk says the “exit rate” of lithium-ion cells from the Gigafactory will literally be faster than bullets from a machine gun.

BONUS SLIDE:

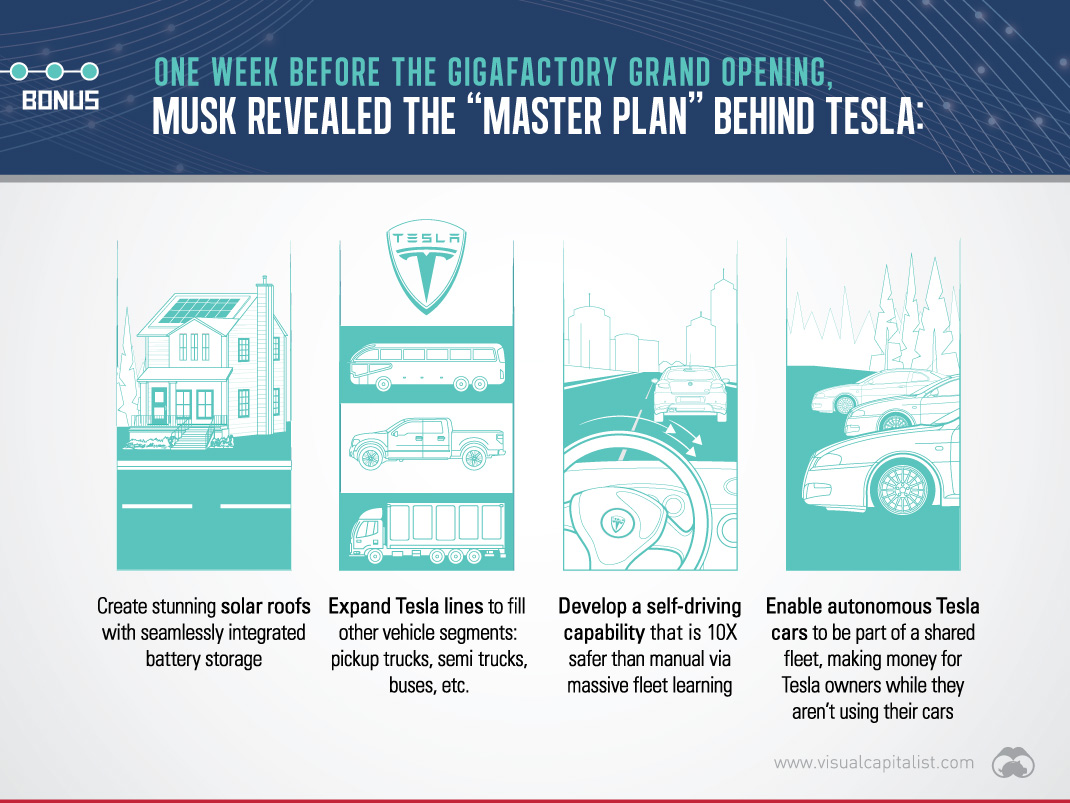

Last week, Elon Musk unveiled the “master plan” behind Tesla.

The Tesla Gigafactory will ultimately help to make these ambitions possible.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium5 days ago

Lithium5 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees