Technology

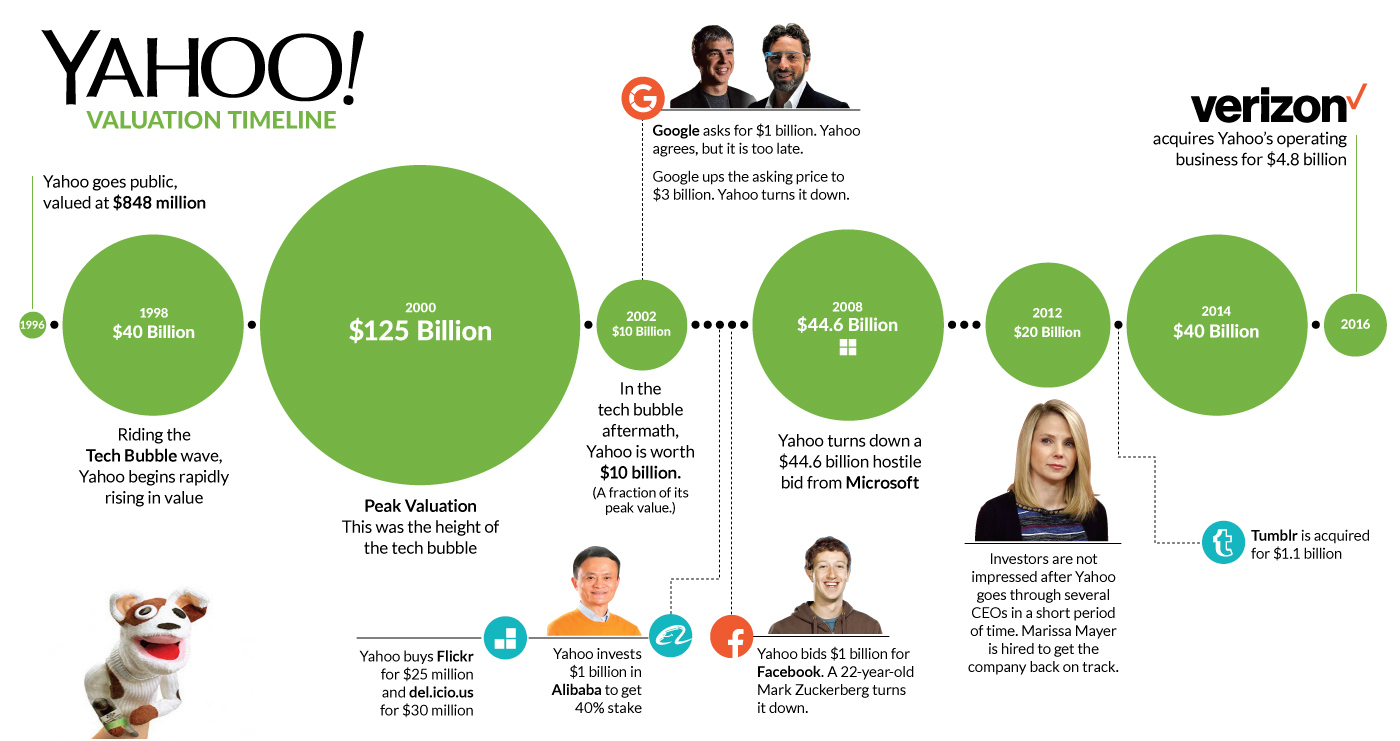

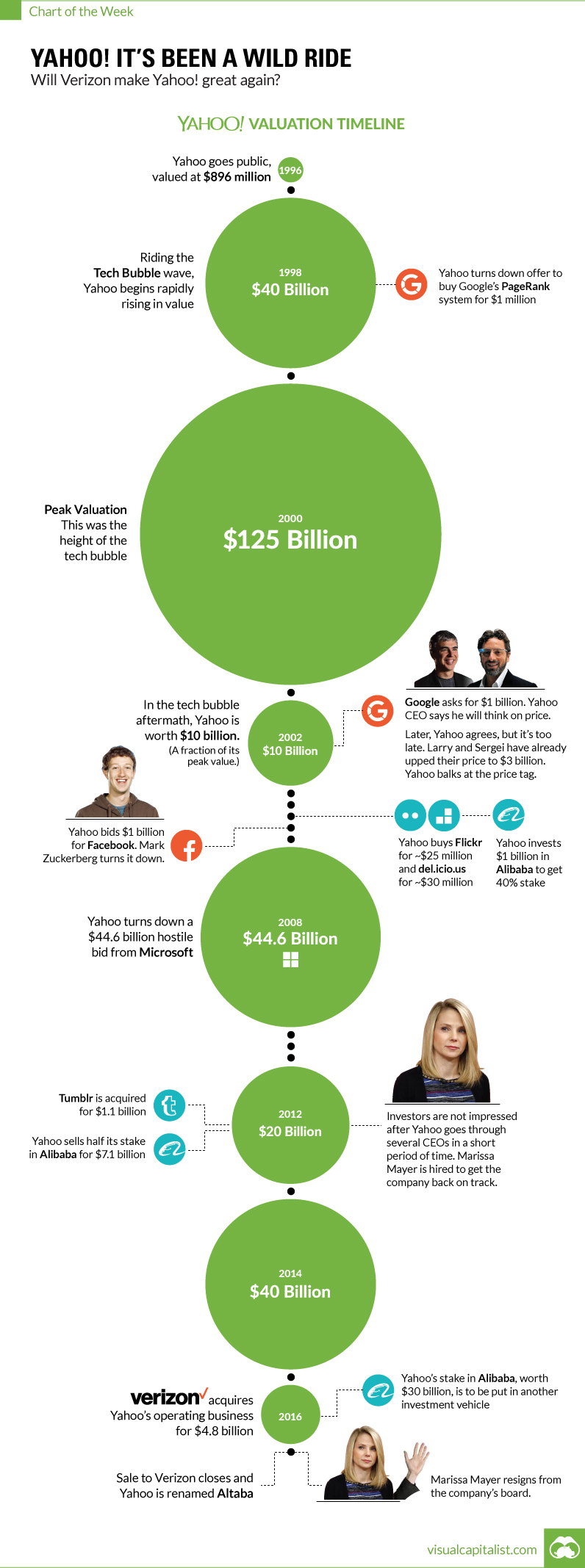

Chart: The Rise and Fall of Yahoo

Chart: The Rise and Fall of Yahoo

The 20 year roller coaster for Yahoo finally ends

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

The saga surrounding one of the world’s most recognizable internet stocks has come to a close.

Yahoo has finally sold its operating business to the highest bidder. The winner was Verizon – and the price was $4.8 billion.

That’s worth less than 1% of the company it had multiple opportunities to buy: Google (now Alphabet).

What Happened?

Technology changes fast, and successful companies must leverage smart acquisitions in building for the future. Facebook bought Oculus Rift and Instagram, and Google bought companies like Youtube, DoubleClick, Boston Dynamics, and DeepMind to help flush out its strategy.

The executives running Yahoo have a rough track record in reading industry tea leaves. It’s not just about the deals they made, but it’s also the deals they failed to make.

In the end, a lack of execution with acquisitions proved to be the company’s Achilles’ Heel.

Missed Opportunities

In 1998, Yahoo was approached by two young Stanford Ph.D. students to buy their search engine algorithm. Larry Page and Sergey Brin had created PageRank – a quick way to find the most relevant website for a given search query. Yahoo skipped out on buying it for $1 million, rationalizing that it would take people off of Yahoo’s website, while decreasing traffic and ad revenues.

Even later on when Google’s search business was well-established, Yahoo CEO Terry Semel balked at Larry and Sergey’s $1 billion asking price. He would eventually agree to it, but by then it was too late. The Google guys had already decided to up their price to a heftier $3 billion.

Around that same time, Yahoo was turned down by a 22-year-old Mark Zuckerberg. Yahoo offered to buy Facebook for $1 billion, but Zuckerberg declined. This was a moment that billionaire Facebook investor Peter Thiel lauds as the major turning point for the company that allowed it to become the behemoth it is today. Some sources even say that if the offer was increased to $1.1 billion, that Facebook’s board would have forced Zuckerberg to take it.

But it’s not just the offers made that were missed opportunities. Yahoo also turned down a hostile takeover from Microsoft in 2008 for $44.6 billion that valued the company for far more than it is worth today.

Deals that Bombed

Finally, the deals that did close were unable to add any value to the company.

Yahoo famously made two acquisitions in 1999 that are now ranked by Forbes as some of the worst internet acquisitions of all-time.

The first was a $4.58 billion deal for Geocities, a site that enabled users to build their own personal websites. While Geocities was a pioneer in this regard, it eventually was shuttered in 2009 after failing to deliver any value to Yahoo shareholders.

The second was the famous $5.7 billion deal for Broadcast.com, an online television site that was founded by Mark Cuban. Perhaps way ahead of its time, internet connections were too slow in 1999 to run this type of video content off the web.

Yahoo also bought Tumblr for $1.1 billion in 2013. While it is not ranked as one of the worst acquisitions of all time, it is not doing particularly well either.

Yahoo’s Saving Grace

There was one M&A decision that wasn’t a whiff. In 2005, the company bought a 40% stake in emerging online retail company Alibaba. The remainder of those holdings, now worth $30 billion, make up the majority of Yahoo’s market capitalization today.

In the context of the recent Verizon deal, the Alibaba shares are likely being spun off into a separate investment vehicle.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)