Green

Visualized: The Top 5 Questions on Sustainable Investing for Advisers

Visualized: The Top Five Questions on Sustainable Investing

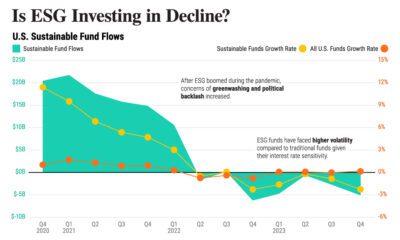

Today, the surge in green investing has been compared to the dot-com boom of the 2000s.

Back then, the internet was anticipated to radically reshape economies. Many companies fell to the wayside, and now 20 years later, tech stocks currently make up roughly 40% of the S&P 500 by market capitalization. Like the dot-com era, green firms are projected to structurally change the way businesses function.

Given the rising interest in green assets, this infographic from MSCI answers the most important questions advisers need answered on sustainable investing.

1. Which type of sustainable investing is right for my client?

First, let’s start with the basics—understanding the terms used to describe sustainable investing:

- Sustainable investing: An umbrella term that typically refers to all types of sustainable, impact, and environmental, social, and governance (ESG) integration approaches

- Impact investing: A type of investing approach that generates measurable social or environmental benefits

- Socially responsible investing (SRI): An investing approach that aligns with an investor’s ethical, religious, or personal values, while actively reducing negative environmental or social consequences

- ESG integration: Considers material environmental, social, and governance factors to enhance long-term risk adjusted returns through its investment approach

- Climate investing: Looks to reduce exposure to climate risk, identify low-carbon investment opportunities, or align portfolios with “net-zero” climate targets

Knowing the key terms of the sustainable landscape allows advisers to more accurately address client objectives, goals, and beliefs.

2. How can I start a conversation with clients about ESG?

Begin by asking what motivates clients. Typically, motivations fall into one of three core objectives:

- Can ESG factors improve my risk-adjusted returns?

- Can I have a positive impact on society through my investments?

- Are my investments consistent with my ethical, political, or religious beliefs?

Client priorities could include financial returns, impact, values, or a combination. Once these have been established, investors can choose from a universe of funds and investment vehicles that more strongly align with their goals.

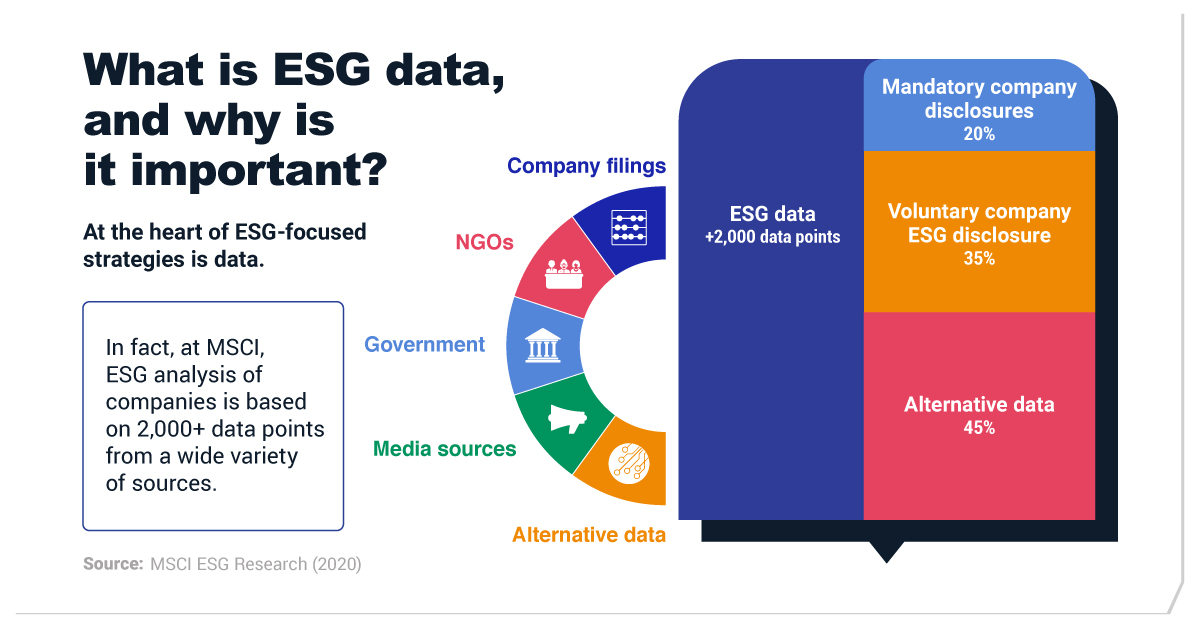

3. What is ESG data and why is it important?

At the heart of ESG-focused strategies is data. In some cases, ESG analysis of companies is based on over 2,000 data points from a wide cross-section of sources. For MSCI ESG Research, they fall within these three categories:

- Mandatory company disclosures: 20%

- Voluntary company ESG disclosure: 35%

- Alternative data: 45%

Alternative data commonly makes up 45% of the total ESG dataset—constituting far beyond what a company publicly discloses. Still, ESG data can seem vague or elusive. But this doesn’t have to be the case. Rather, ESG data can be broken down and obtained from the following five sources:

- Company filings: Shareholder results, voluntary ESG disclosures

- Non-governmental organizations (NGOs): Global Reporting Initiative (GRI), Task Force on Climate-related Financial Disclosures (TCFD), UN Sustainable Development Goals

- Government: U.S. Environmental Protection Agency (EPA), European Central Bank (ECB)

- Media sources: Major headlines

- Alternative data: Geo mapping, water scarcity data, flood risk analysis

Importantly, after ESG analysts identify the risks and opportunities most relevant to a company, multiple data points coalesce to inform a company’s ESG profile.

4. Why are environmental risks becoming more important?

Rising global temperatures and ecological disruptions pose imminent risks to humanity.

Along with this, other future risks could include: eroding shareholder value, blocked project proposals, regulation compliance costs, and higher borrowing costs. In response, national, corporate, and investor commitments to achieving net-zero emissions in alignment with the Paris Agreement have proliferated.

How does this affect the risk-return profile of investments?

According to research, climate change could erase $7.75 million in value over five years from a hypothetical $100 million portfolio that shared similar returns and volatility over a five-year period to the median global developed market fund as of December, 2019.

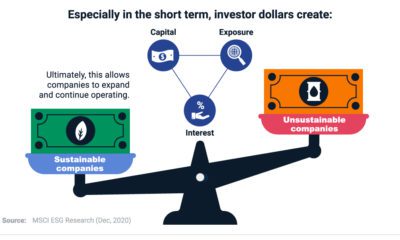

5. Will the consideration of ESG in a portfolio lead to underperformance?

Let’s turn our attention to performance, one of the most pressing questions surrounding ESG.

Companies with strong ESG profiles have an MSCI ESG rating of AAA or AA, meaning they lead their industry in managing the most significant ESG risks and opportunities. Studies show that companies with better ESG ratings have illustrated stronger performance, higher dividend payouts, and stronger earnings stability historically, on average.

They have also illustrated the following attributes:

- Lower cost of capital

- Less exposure to systemic risk

- Lower volatility

- Higher profitability

In addition, companies with strong MSCI ESG ratings may possess greater resilience. Stocks with high MSCI ESG ratings have had lower financial drawdowns during crises compared to their market-capitalization-weighted parent index.

Sustainable Investing: Shaping the Dialogue

Companies with higher environmental risks—including heavy carbon polluters, waste emitters, and poor water management—are facing greater scrutiny. At the same time, client demand is shifting to ESG, and the conversation is changing.

These questions can serve as a launching point for advisers to help clients seize new opportunities and mitigate investment risks.

Green

The Carbon Footprint of Major Travel Methods

Going on a cruise ship and flying domestically are the most carbon-intensive travel methods.

The Carbon Footprint of Major Travel Methods

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Did you know that transport accounts for nearly one-quarter of global energy-related carbon dioxide (CO₂) emissions?

This graphic illustrates the carbon footprints of major travel methods measured in grams of carbon dioxide equivalent (CO₂e) emitted per person to travel one kilometer. This includes both CO₂ and other greenhouse gases.

Data is sourced from Our World in Data, the UK Government’s Department for Energy Security and Net Zero, and The International Council on Clean Transportation, as of December 2022.

These figures should be interpreted as approximations, rather than exact numbers. There are many variables at play that determine the actual carbon footprint in any individual case, including vehicle type or model, occupancy, energy mix, and even weather.

Cruise Ships are the Most Carbon-Intensive Travel Method

According to these estimates, taking a cruise ship, flying domestically, and driving alone are some of the most carbon-intensive travel methods.

Cruise ships typically use heavy fuel oil, which is high in carbon content. The average cruise ship weighs between 70,000 to 180,000 metric tons, meaning they require large engines to get moving.

These massive vessels must also generate power for onboard amenities such as lighting, air conditioning, and entertainment systems.

Short-haul flights are also considered carbon-intensive due to the significant amount of fuel consumed during initial takeoff and climbing altitude, relative to a lower amount of cruising.

| Transportation method | CO₂ equivalent emissions per passenger km |

|---|---|

| Cruise Ship | 250 |

| Short-haul flight (i.e. within a U.S. state or European country) | 246 |

| Diesel car | 171 |

| Gas car | 170 |

| Medium-haul flight (i.e. international travel within Europe, or between U.S. states) | 151 |

| Long-haul flight (over 3,700 km, about the distance from LA to NY) | 147 |

| Motorbike | 113 |

| Bus (average) | 96 |

| Plug-in hybrid | 68 |

| Electric car | 47 |

| National rail | 35 |

| Tram | 28 |

| London Underground | 27 |

| Ferry (foot passenger) | 19 |

| Eurostar (International rail) | 4.5 |

Are EVs Greener?

Many experts agree that EVs produce a lower carbon footprint over time versus traditional internal combustion engine (ICE) vehicles.

However, the batteries in electric vehicles charge on the power that comes straight off the electrical grid—which in many places may be powered by fossil fuels. For that reason, the carbon footprint of an EV will depend largely on the blend of electricity sources used for charging.

There are also questions about how energy-intensive it is to build EVs compared to a comparable ICE vehicle.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023