Markets

Vegetarianism: Tapping Into the Meatless Revolution

Vegetarianism: Tapping into the Meatless Revolution

The way people choose and consume their food is changing, and it’s encouraging a sweeping shift from animal-based to plant-based food products.

Whether it’s from the perspective of environmental impact, cruelty to animals, or health benefits, meatless diets are quickly becoming a new normal for people around the world—but where did it all begin?

Today’s infographic unearths the origins of vegetarianism and explores how the industry erupted into a lucrative web of sub-categories that are whetting the appetite of investors the world over.

The Origins of the Meat-Free Diet

Taking a holistic view of vegetarianism, there are several different diets that people typically adhere to. A vegetarian for example, doesn’t eat meat but still consumes animal products such as dairy and eggs. On the other hand, a vegan eats a strictly plant-based diet.

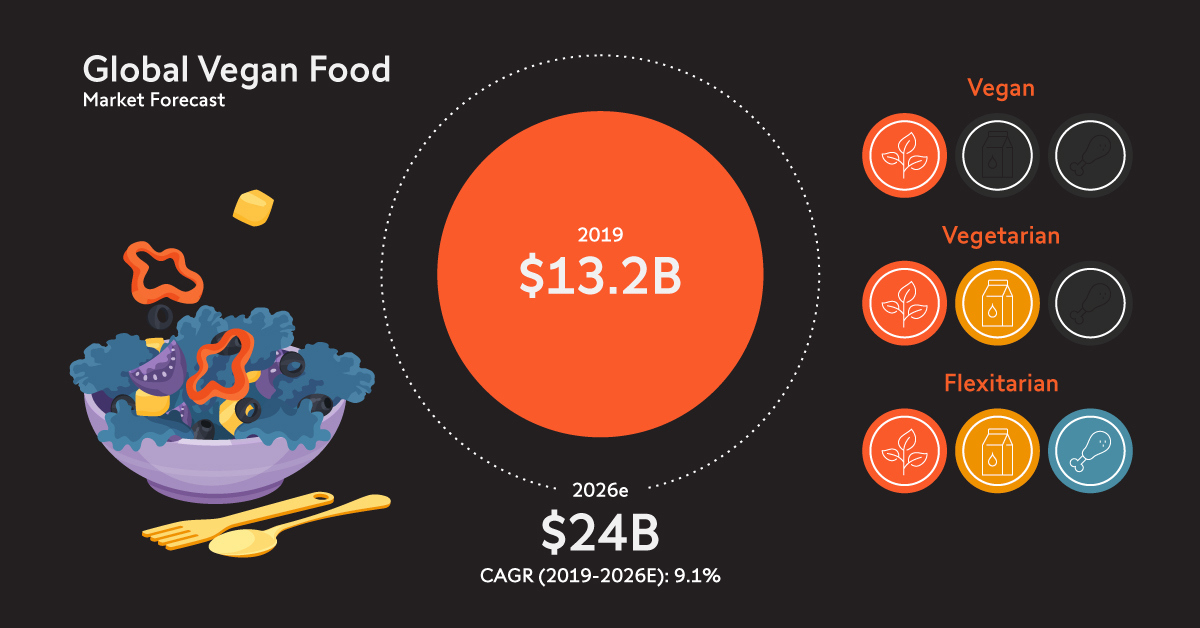

With 70% of the global population now reducing their meat intake, veganism has become a lifestyle choice for many. By 2026, the global market is projected to be worth over $24 billion.

While this seems like a relatively new phenomenon, the meatless revolution has been quietly building for almost two centuries.

- 1847: The first vegetarian society is formed in England

- 1898: The world’s first vegetarian restaurant opens in Switzerland

- 1944: The term “vegan” is coined

- 1994: The first World Vegan Day is introduced

- 2014: Influential breakout documentary Cowspiracy is released

- 2017: 6% of the entire U.S. population claim to be vegan

- 2018: Roughly 8% of the global population claim to eat plant-based

- 2020: Acceptance of plant-based diets by both the medical community and general public is at an all-time high

Although vegetarian and vegan diets were once heavily stigmatized, global support is now growing.

Towards a Plant-Based Future

Today, people in dozens of countries are making big strides towards plant-based lifestyles.

China, for example, introduced guidelines to help its population of 1.3 billion people reduce their meat consumption by 50%. These ambitious goals will be driven by consumer’s growing understanding of the positive impacts of eating less meat, such as:

- Health benefits

According to the American Heart Association, reducing meat intake could reduce the risk of stroke, high blood pressure, type 2 diabetes, and even certain cancers. - Environmental impact

Animal agriculture creates more greenhouse gases than the world’s entire transportation systems combined, but shifting to a plant-based diet could significantly reduce this problem. - Animal welfare

Roughly two thirds of the 70 billion animals farmed annually are cramped in close quarters and given heavy medication. Plant-based diets eliminate animal suffering while lowering demand for other animal food products.

In fact, if more people commit to embracing a plant-based lifestyle, it could result in up to $31 trillion—or 13% of global GDP—in savings for the economy.

Big Players Fight For a Piece of the Pie

Given the newfound consumer demand for meat alternatives, it’s no surprise that global companies are clamouring to enter the market.

Many established food companies such as Nestlé and Danone are either advancing their own formula for plant-based proteins, or acquiring companies with existing experience.

Meanwhile, fast food chain McDonald’s features vegan products as permanent staple on their menu, and report an 80% uplift in customers buying these products in certain countries.

Big Meat Shifts Gears

As new players in the space attempt to cut into the $1.8 trillion global meat market, big meat companies are responding in kind.

Tycoons such as Tyson Foods and Cargill are placing bets on plant-based startups and filling shelves with their own plant-based products.

But while plant-based products created by traditional meat companies may appeal to less rigid flexitarians, vegans and vegetarians may not accept them so readily due to their strong ethics.

Food For Thought

Along with the uncertainty of how these products will be received, there are other challenges that the market must overcome in order to be considered truly accessible. For instance, plant-based alternatives boast higher price points than their predecessor’s products, which may deter consumers from entering en masse.

Regardless, it is clear that the shift to plant-based diets is a disruptive force that could change the food industry over the long term. Early movers are dangling a golden carrot in front of investors—but will they take a bite?

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets2 weeks ago

Markets2 weeks agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets3 weeks ago

Markets3 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees