apps

How Long it Took for Popular Apps to Reach 100 Million Users

How Long it Took for Popular Apps to Reach 100 Million Users

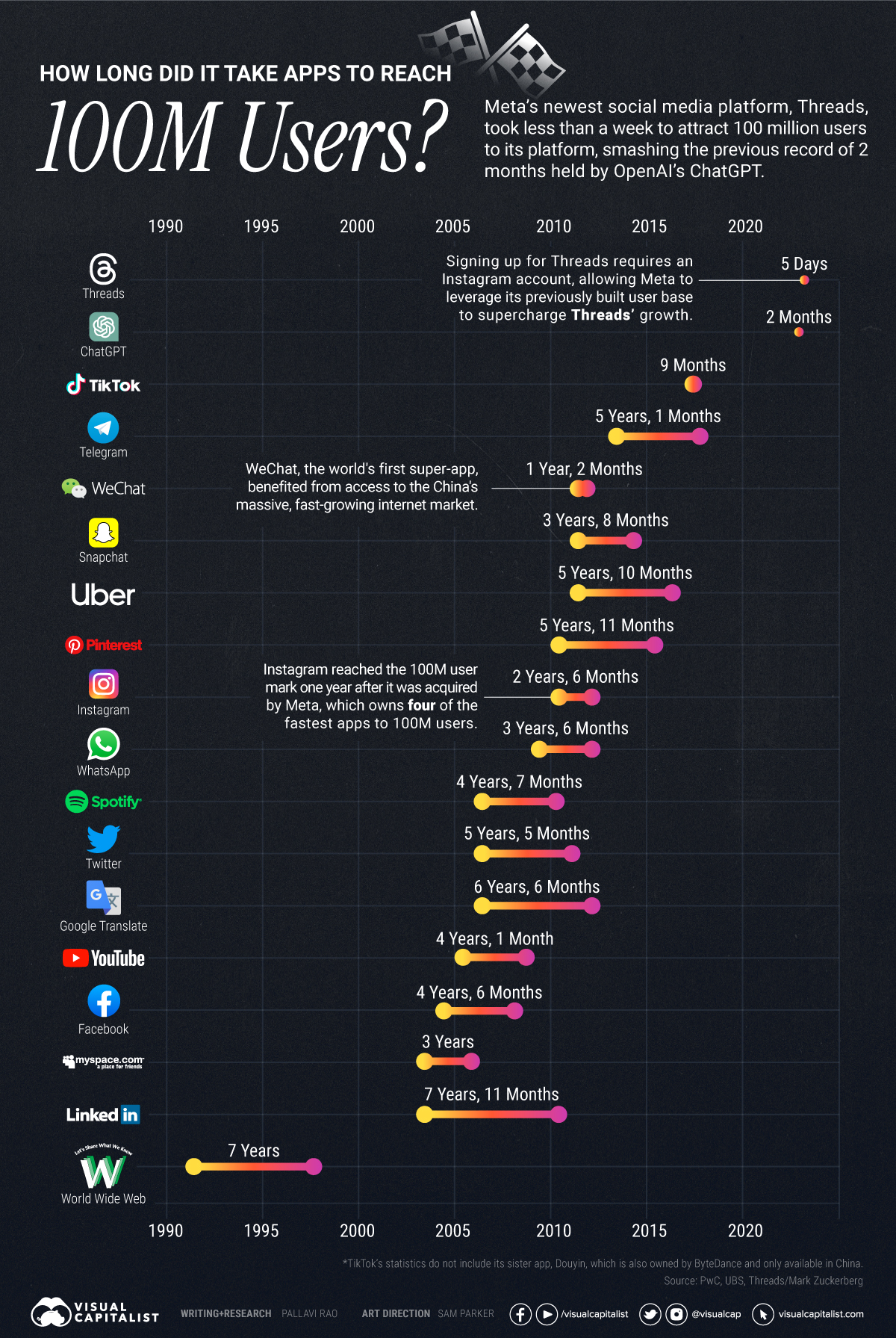

Of Twitter’s many new rivals, Meta’s newest social media platform Threads has established its presence with a bang.

According to Meta founder Mark Zuckerberg, Threads took only 5 days to reach the key threshold of 100 million users. It achieved this milestone through organic demand—and no paid promotions required—smashing all previous records.

But how long have other popular platforms—TikTok, Instagram, and YouTube to name a few—taken to build their user base? Pulling data from PwC and Yahoo, we rank how long it took popular platforms to get to 100 million users.

Ranking Every Apps Journey to 100 Million Users

In first place, Threads has a significant lead over the rest of the pack with its five day achievement, and may have built a significant moat in holding on to this record.

Firstly, its launch coincided with Twitter’s viewing limit decision, and rode the wave of dissatisfaction aimed at Twitter’s current owner, Elon Musk.

Secondly, new users on Threads need an Instagram account to register, thus eliminating sign-up barriers and leveraging Instagram’s 1.2 billion-strong user base.

Here’s the journey length of popular platforms to attaining 100 million users:

| Rank | Platform | Launch | Time to 100M Users |

|---|---|---|---|

| 1 | Threads | 2023 | 5 days |

| 2 | ChatGPT | 2022 | 2 months |

| 3 | TikTok | 2017 | 9 months |

| 4 | 2011 | 1 year, 2 months | |

| 5 | 2010 | 2 years, 6 months | |

| 6 | Myspace | 2003 | 3 years |

| 7 | 2009 | 3 years, 6 months | |

| 8 | Snapchat | 2011 | 3 years, 8 months |

| 9 | YouTube | 2005 | 4 years, 1 month |

| 10 | 2004 | 4 years, 6 months | |

| 11 | Spotify | 2006 | 4 years, 7 months |

| 12 | Telegram | 2013 | 5 years, 1 month |

| 13 | 2006 | 5 years, 5 months | |

| 14 | Uber | 2011 | 5 years, 10 months |

| 15 | 2010 | 5 years, 11 months | |

| 16 | Google Translate | 2006 | 6 years, 6 months |

| 17 | World Wide Web | 1991 | 7 years |

| 18 | 2003 | 7 years, 11 months |

Ranked second, Open AI’s ChatGPT launched in November 2022 and hit 100 million users by the start of the new year. ChatGPT introduced the incredible capabilities of large language models to the masses, prompting a rush of sign-ups, and reviving old conversations around the potential consequences of AI.

Coming in at third place, ByteDance’s TikTok took just 9 months to reach 100 million users after its launch in 2017. Like Threads, TikTok benefited from another app, accessing popular lip syncing app Musical.ly’s existing user base after it was acquired and folded into TikTok.

WeChat and Instagram round out the top-five, also with interesting advantages. WeChat, an instant messaging platform similar to WhatsApp, benefited from its unique access to China’s notoriously closed internet market of 500 million users in 2012.

Meanwhile, Meta acquired Instagram when the photo-sharing platform had 30 million users, and more than tripled that number past 100 million in just one year.

And while Facebook ranks solidly middle-of-the-pack for fastest to 100 million users, it remains the platform with the most monthly active accounts, at nearly 3 billion. In fact, Meta’s lessons learned from Facebook have been well-leveraged, and the company owns 4 of the fastest apps to register 100 million users.

So What Does Threads Success Mean for Twitter?

Coming back to Threads’ incredible feat, however, it’s still early days whether an en-masse switch from Twitter is on the cards for Meta’s newest platform.

For one, Threads has faced significant criticism due to its intensive data collection practices and lack of accessibility features. It also is missing some key features from its rival, including trending topics, hashtags, and direct messages.

Meanwhile Elon Musk has been less than pleased with Threads’ success, deeming it a copy of Twitter and even threatening legal action.

Competition is fine, cheating is not

— Elon Musk (@elonmusk) July 6, 2023

So where does this leave the increasingly-crowded social media space? The next decade will set the stage for either more platform consolidation, or even further audience fragmentation.

apps

How Much the Most Followed Instagram Accounts Earn on Posts

Singers, athletes, actors and Kardashians—here are the most followed Instagram accounts and their estimated earnings per sponsored post.

Most Followed Instagram Accounts and Sponsored Post Costs

Instagram is not only one of the biggest social media platforms, it’s also one of the most profitable for high profile creators.

Despite having fewer users than platforms like Facebook and YouTube, Instagram’s higher engagement rate gives it one of the highest advertising costs. In 2023, average ad prices on Instagram were estimated at $3.56 cost per click, ahead of every platform except LinkedIn.

For the celebrities with the most followers on Instagram, and the brands trying to profit from their followers, that translates into million-dollar costs for some sponsored posts. Pablo Alvarez has visualized Instagram’s biggest accounts, and their estimated earnings per sponsored post, using HopperHQ data from September 2022.

Calculating The Earnings Per Sponsored Post

It’s easy to assume that the most followed Instagram accounts make the most money on sponsored posts, but that appears to be only partially true.

In conducting research for the dataset, HopperHQ utilized both publicly available data and reports and privately researched statistics to measure the impact of different factors:

- Number of followers

- Levels of engagement (legitimate views, likes & comments)

- Influencer’s category (sports, music, acting, etc.)

- Audience makeup

- Influencer status (previous endorsements, number of endorsements, etc.)

And though the number of followers was the biggest influencing factor, some stars earned more from followers than others.

Costs of the Most Followed Instagram Accounts in 2022

The most followed person on Facebook and Instagram, soccer star Cristiano Ronaldo leads the list of the most expensive Instagram accounts in 2022 for sponsored content.

It’s estimated that the former Manchester United and Real Madrid star was able to charge an estimated $2.4 million per sponsored post in 2022. With 442 million followers at the time of calculation, Ronaldo was estimated to charge nearly half a million dollars per post more than the next person on the list.

| Name | Category | Followers | Earnings Per Post |

|---|---|---|---|

| Cristiano Ronaldo | Sport | 442,267,575 | $2,397,000 |

| Kylie Jenner | Celebrity | 338,626,294 | $1,835,000 |

| Lionel Messi | Sport | 327,954,875 | $1,777,000 |

| Selena Gomez | Celebrity | 320,082,515 | $1,735,000 |

| Dwayne ‘The Rock’ Johnson | Celebrity | 315,999,932 | $1,713,000 |

| Kim Kardashian | Celebrity | 311,685,198 | $1,689,000 |

| Ariana Grande | Celebrity | 311,302,908 | $1,687,000 |

| Beyoncé Knowles-Carter | Celebrity | 256,957,282 | $1,393,000 |

| Khloé Kardashian | Celebrity | 243,609,638 | $1,320,000 |

| Kendall Jenner | Celebrity | 237,977,121 | $1,290,000 |

| Justin Bieber | Celebrity | 236,391,845 | $1,281,000 |

| Taylor Swift | Celebrity | 210,659,702 | $1,142,000 |

| Jennifer Lopez | Celebrity | 208,469,193 | $1,130,000 |

| Virat Kohli | Sport | 200,703,169 | $1,088,000 |

| Nicki Minaj | Celebrity | 190,264,361 | $1,031,000 |

| Kourtney Kardashian | Celebrity | 177,874,659 | $964,000 |

| Neymar da Silva Santos Junior | Sport | 174,248,989 | $945,000 |

| Miley Cyrus | Celebrity | 171,147,090 | $928,000 |

| Katy Perry | Celebrity | 163,620,880 | $1,029,000 |

| Kevin Hart | Celebrity | 143,895,754 | $780,000 |

Kylie Jenner, the world’s “youngest self-made billionaire” according to Forbes, was second with earnings of $1.8 million per sponsored post on Instagram. Jenner, a member of the Kardashian–Jenner family with five of the top 20 most followed Instagram accounts, is also the youngest person among this cohort of big earners on Instagram.

But the most commonly followed celebrities in the top 20 were musicians with household names, including Ariana Grande, Beyoncé, and Taylor Swift. They accounted for 45% of the most followed accounts.

The Biggest Earners per Follower

Though almost all of the most followed accounts were estimated to cost more than those with lower follower counts, Katy Perry (Rank: 16th) stands out.

Perry was estimated to better utilize Instagram’s reach and earn more in total than #17-19, despite tens of millions fewer followers. In fact, she was calculated to earn more per follower than all of the top 20.

| Rank | Name | Earnings per Follower |

|---|---|---|

| 1 | Katy Perry | $0.0062889 |

| 2 | Neymar da Silva Santos Junior | $0.0054233 |

| 3 | Miley Cyrus | $0.0054222 |

| 4 | Beyoncé Knowles-Carter | $0.0054211 |

| 5 | Taylor Swift | $0.0054211 |

| 6 | Virat Kohli | $0.0054209 |

| 7 | Dwayne ‘The Rock’ Johnson | $0.0054209 |

| 8 | Kendall Jenner | $0.0054207 |

| 9 | Kevin Hart | $0.0054206 |

| 10 | Selena Gomez | $0.0054205 |

| 11 | Jennifer Lopez | $0.0054205 |

| 12 | Cristiano Ronaldo | $0.0054198 |

| 13 | Kourtney Kardashian | $0.0054195 |

| 14 | Ariana Grande | $0.0054192 |

| 15 | Justin Bieber | $0.005419 |

| 16 | Kylie Jenner | $0.005419 |

| 17 | Kim Kardashian | $0.0054189 |

| 18 | Nicki Minaj | $0.0054188 |

| 19 | Khloé Kardashian | $0.0054185 |

| 20 | Lionel Messi | $0.0054184 |

The earnings per follower round up to just under a cent each, but tens of millions of followers make a sizable impact. In addition to Perry, Neymar (Rank: 18th) and Miley Cyrus (Rank: 19th) had the highest earnings-per-follower, ahead of accounts with hundreds of millions more followers.

But a new year can bring a lot of changes. The most followed Instagram accounts have already been reshuffled, with Lionel Messi now the second-most followed and Selena Gomez overtaking Kylie Jenner as the most-followed woman. How will potential earnings be impacted this year?

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

Creator Program

Creator Program