Technology

Charted: Changing Sentiments Towards AI in the Workplace

Is generative AI the catalyst for the next industrial revolution? Or is it a flash in the pan? Is the entire workforce destined to become AI makers and managers?

It’s possible that one, all, or none of these options could be correct. But despite how fast large language models (LLMs) and tools have grown the popularity of artificial intelligence, one thing that is clear is that there are no quick or easy answers.

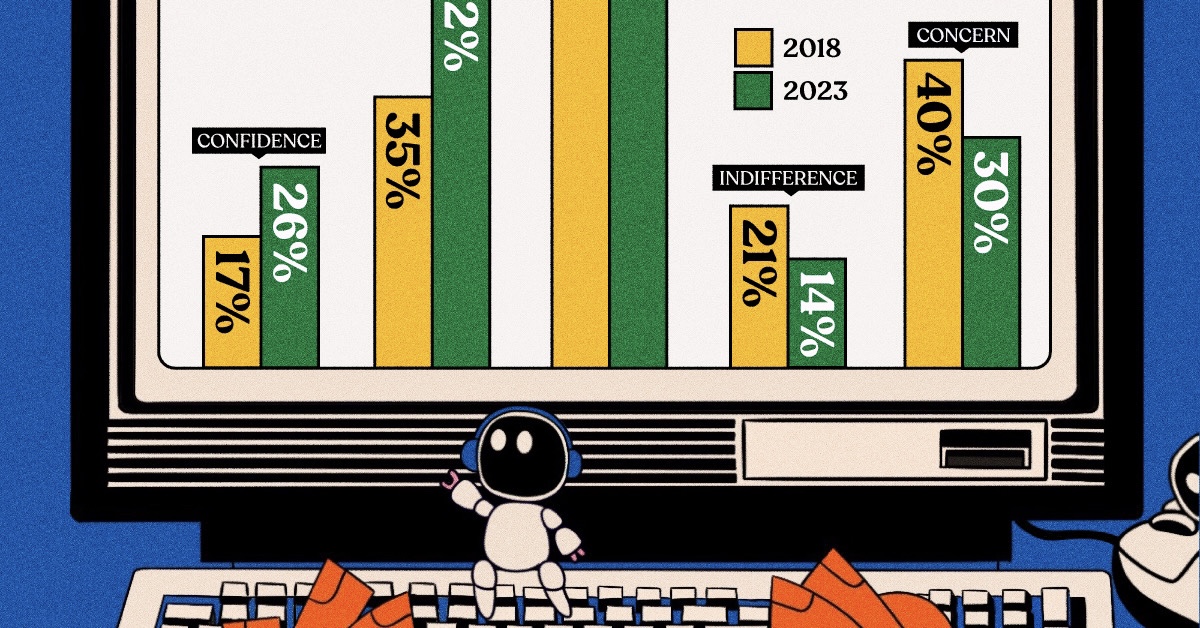

Amidst all this uncertainty, opinions on how we use AI in the workplace have evolved. Recent survey data from Boston Consulting Group (BCG) reveals how the labor force feels about AI in the workplace today, compared to how they felt five years ago.

The consultancy surveyed 13,000 people (C-suite leaders, managers, and frontline employees) in 18 different countries for the results, and divided their top two responses into five categories: Curiosity, Optimism, Concern, Confidence, and Indifference.

More Optimism, Less Caution Around AI

General curiosity about AI remains almost unchanged (at 60%) since 2018.

Meanwhile, despite how rapidly AI has advanced in the last five years, or perhaps because of it, more than 50% of workers surveyed are optimistic about AI’s impact on work, a 17 percentage point (p.p.) increase from 2018.

And though 30% remain concerned about AI, this fell 10 p.p. over the same time period.

| Sentiment towards AI | 2018 | 2023 |

|---|---|---|

| Curiosity | 60% | 61% |

| Optimism | 35% | 52% |

| Concern | 40% | 30% |

| Confidence | 17% | 26% |

| Indifference | 21% | 14% |

Clearly, respondents perceive AI in the workplace far more positively now than they did in 2018. But that’s not all. The respondents’ confidence in how AI can influence their work has also increased (+5 p.p.) and indifference towards it has shrunk significantly (-7 p.p.).

Given the explosive growth in generative AI since the end of 2022—ChatGPT gets 1.8 billion visitors a month—it’s not surprising that workers are far more aware of AI compared to just five years ago.

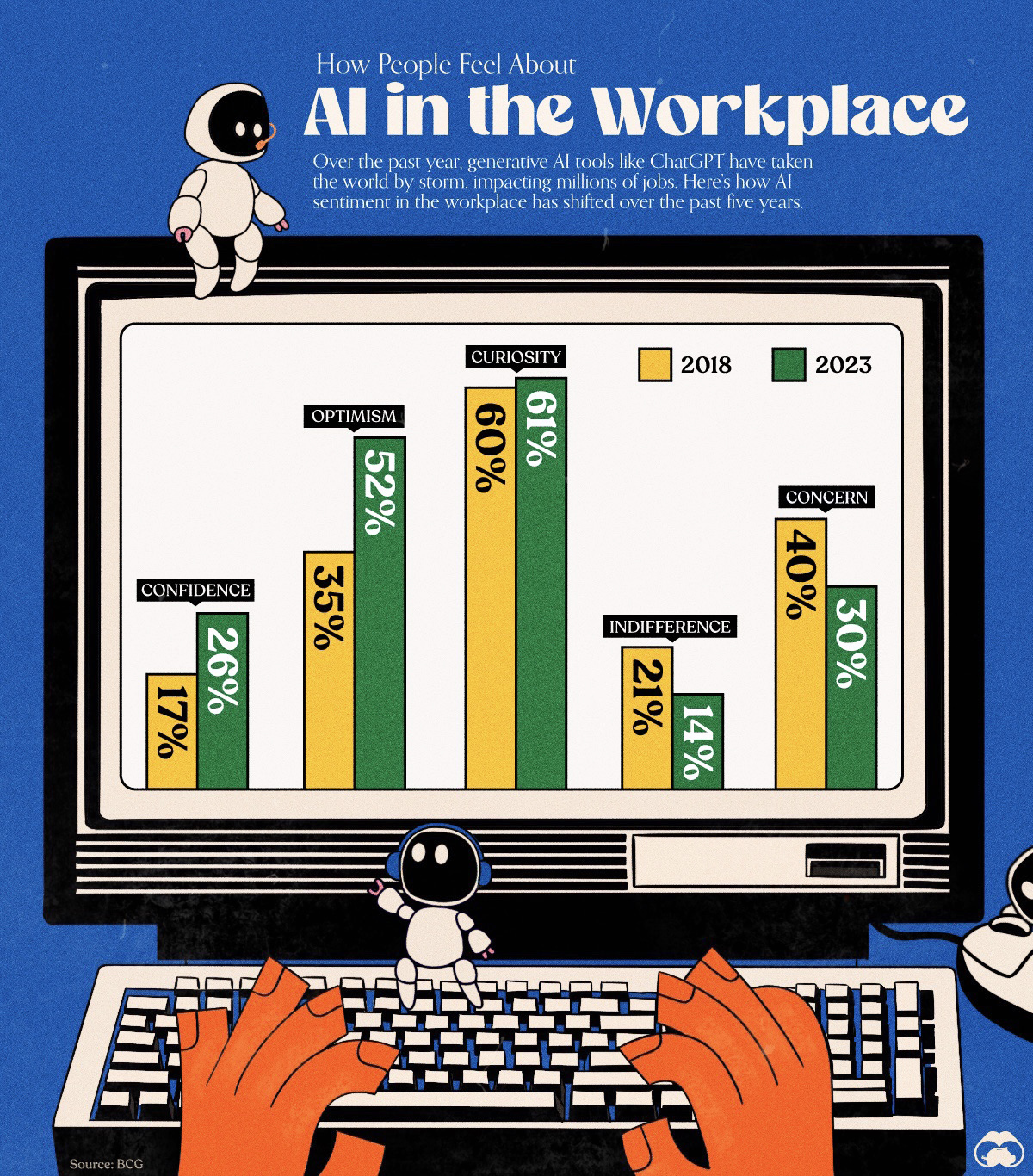

Optimistic Leaders, Cautious Employees

As with any survey data, the devil is in the details. BCG notes that the sentiments between rungs on the company ladder differ sharply around AI.

While two-thirds of polled leaders are optimistic about AI in 2023, less than half of polled frontline employees shared the same sentiment. Frontline employees were also the biggest group that responded with concern (nearly 40%).

Importantly, frontline employees are almost as optimistic as they are concerned about AI in the workplace.

| Position | Optimism | Concern |

|---|---|---|

| Leaders | 62% | 22% |

| Managers | 54% | 28% |

| Frontline Employees | 42% | 39% |

Managers were closer to leaders in their AI optimism, though some experts believe their jobs might actually be the most at risk of being replaced all together.

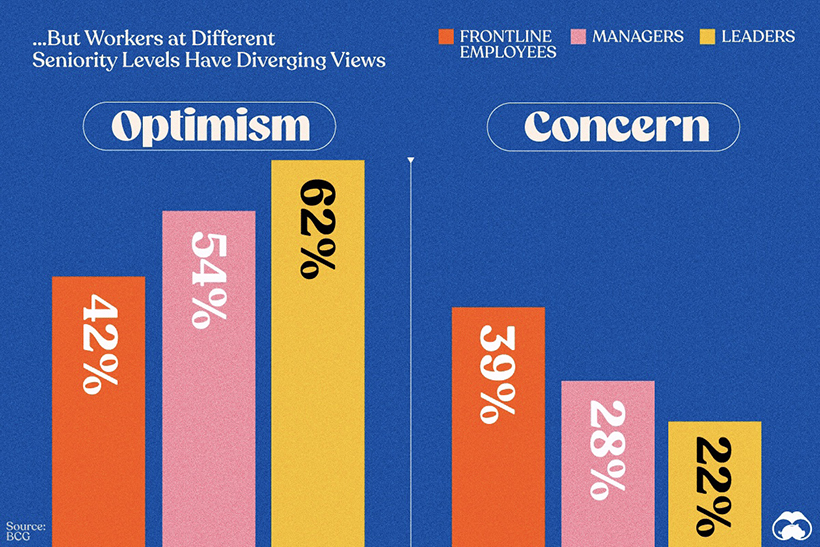

More Use, More Optimism Around AI

With ChatGPT reaching 100 million active users just two months after launching, it’s clear that more and more people are experimenting with generative AI.

In BCG’s poll, regular AI users—categorized as people who use it at least once a week for work—are nearly three times more optimistic than concerned about AI’s impact on their work in 2023.

| AI Use Level | Optimism | Concern |

|---|---|---|

| Regular | 62% | 22% |

| Rare | 55% | 27% |

| None | 36% | 42% |

Even rare users are two times more optimistic than cautious, with the non-user category registering the most concern.

Which brings us to who these regular users are.

A staggering 80% of the leaders polled say they’re already regular users of AI, compared to 46% managers and 20% frontline employees.

While eyebrow-raising, these figures are not surprising.

People in leadership positions tend to have a mandate to stay ahead of the curve on current business trends, and along with their less strictly defined roles, have more freedom to try, use, and adopt AI tools while they formulate policies for their workplace.

| Position | Regular User | Rare User | Nonuser |

|---|---|---|---|

| Leaders | 80% | 12% | 8% |

| Managers | 46% | 23% | 31% |

| Frontline Employees | 20% | 20% | 60% |

At the same time, AI tools may not be green-lit en masse in many workplaces yet, preventing frontline employees from giving them a go.

So Is AI Coming For Jobs or Not?

Regardless of how definitively one can make a claim about artificial intelligence taking away people’s jobs, the survey respondents were unanimous that AI in the workplace will have some kind of an impact on their employment.

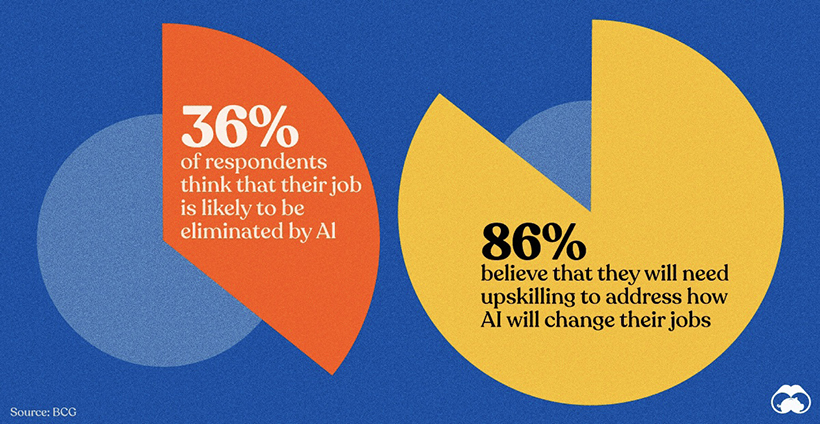

Slightly more than one-third felt that their job is in jeopardy as of 2023, while an overwhelming 86% polled said they needed training to adapt to how AI will transform their work.

With how fast the field is currently transforming, upskilling could be the safest path to follow as the AI revolution unfolds.

Where Does This Data Come From?

Source: The AI at Work: What People Are Saying report from the Boston Consulting Group.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001