Markets

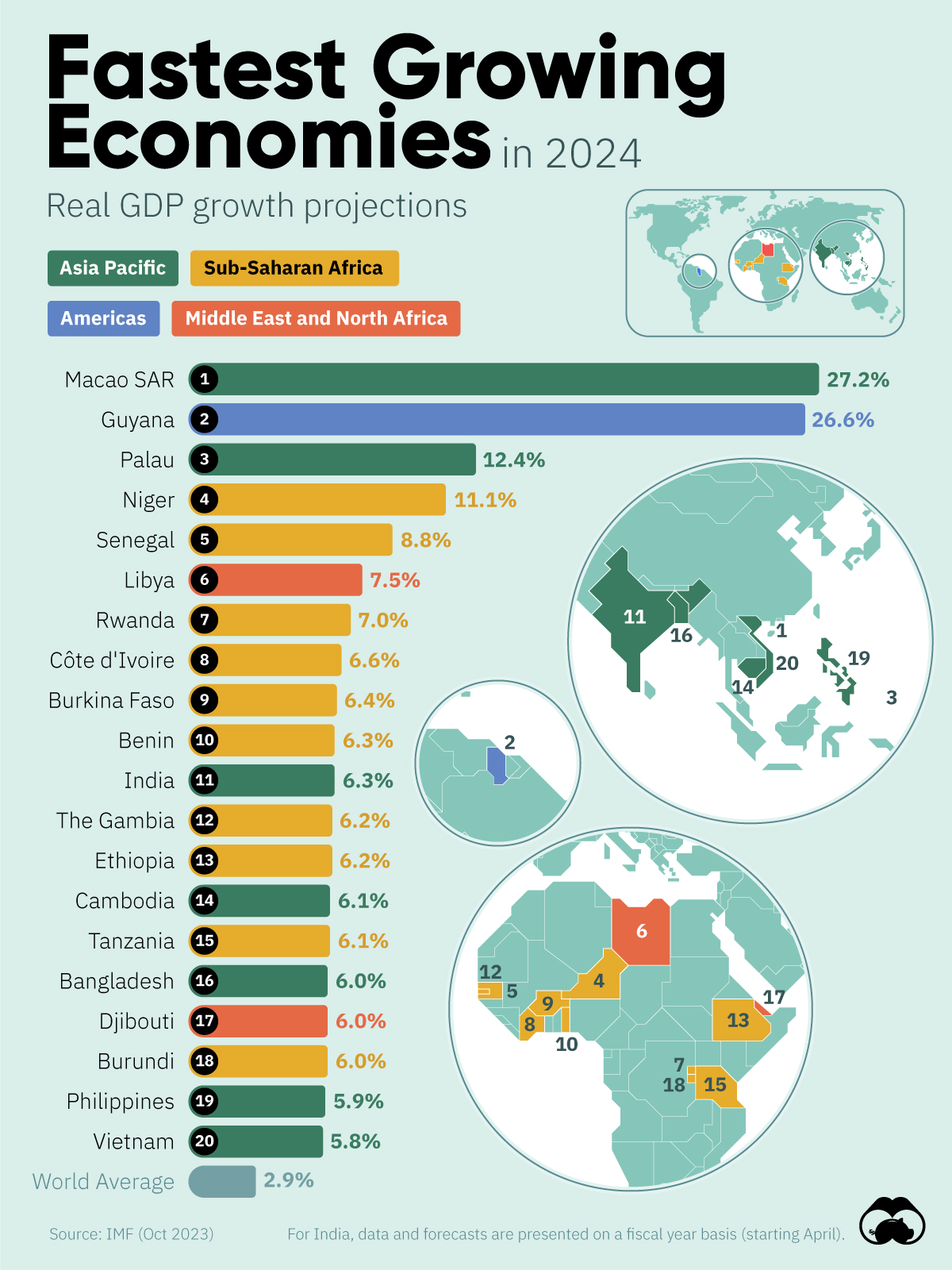

Ranked: The Fastest Growing Economies In 2024

IMF Projections: The Fastest Growing Economies in 2024

Which countries will see the most economic growth in 2024?

To answer this question, we’ve visualized GDP growth forecasts from the IMF’s October 2023 World Economic Outlook. Unsurprisingly, many of these countries are located in Asia and Sub-Saharan Africa—two of the world’s fastest growing regions.

| Country | Region | GDP Growth 2024 (%) |

|---|---|---|

| 🇲🇴 Macao SAR | Asia Pacific | 27.2 |

| 🇬🇾 Guyana | Americas | 26.6 |

| 🇵🇼 Palau | Asia Pacific | 12.4 |

| 🇳🇪 Niger | Sub-Saharan Africa | 11.1 |

| 🇸🇳 Senegal | Sub-Saharan Africa | 8.8 |

| 🇱🇾 Libya | Middle East and North Africa | 7.5 |

| 🇷🇼 Rwanda | Sub-Saharan Africa | 7.0 |

| 🇨🇮 Côte d'Ivoire | Sub-Saharan Africa | 6.6 |

| 🇧🇫 Burkina Faso | Sub-Saharan Africa | 6.4 |

| 🇧🇯 Benin | Sub-Saharan Africa | 6.3 |

| 🇮🇳 India | Asia Pacific | 6.3 |

| 🇬🇲 The Gambia | Sub-Saharan Africa | 6.2 |

| 🇪🇹 Ethiopia | Sub-Saharan Africa | 6.2 |

| 🇰🇭 Cambodia | Asia Pacific | 6.1 |

| 🇹🇿 Tanzania | Sub-Saharan Africa | 6.1 |

| 🇧🇩 Bangladesh | Asia Pacific | 6.0 |

| 🇩🇯 Djibouti | Middle East and North Africa | 6.0 |

| 🇧🇮 Burundi | Sub-Saharan Africa | 6.0 |

| 🇵🇭 Philippines | Asia Pacific | 5.9 |

| 🇻🇳 Vietnam | Asia Pacific | 5.8 |

| 🌍 World Average | -- | 2.9 |

For India, data and forecasts are presented on a fiscal year basis (starting April). Continue reading below for additional context on these figures.

Highlights: Asia Pacific

The fastest growing economies in Asia are forecasted to be Macao (+27.2%), Palau (+12.4%), and India (+6.3%).

- The economy of Macao is heavily reliant on tourism, an industry that represents over 60% of the region’s jobs, as well as roughly 70% of its GDP.

- Palau is a tiny country consisting of 340 islands, representing an overall land area of 180 square miles (466 square kilometers). According to the U.S. State Department, tourism represents approximately 40% of Palau’s GDP.

- India, which recently became the world’s largest country by population, is expected to reach a peak of 1.7 billion people by 2064.

Highlights: Sub-Saharan Africa

Sub-Saharan Africa accounts for half of the top 20 list, with Niger (+11.1%) and Senegal (+8.8%) leading.

- A recent military coup could have serious implications on Niger’s future economic growth. The country’s Agadem oil field, which is majority owned by China National Petroleum Corporation (CNPC), could see its exports disrupted as a result of global sanctions.

- Senegal’s economy is also linked to the oil industry, meaning its growth could fluctuate in the years to come.

Oil Drives Growth for Guyana

Guyana (+26.6%), with a population of only 815,000, is expected to be the second fastest growing economy in 2024. Interestingly, it was the world’s fastest growing economy last year, with a 62% increase in GDP, and is likely to claim that title again in 2023 with expected growth of 37%.

This growth is largely driven by rising oil exports from Stabroek Block, an offshore oil field being developed by an Exxon Mobil-led consortium. According to BBC, Guyana has over 11 billion barrels in oil reserves.

Economy

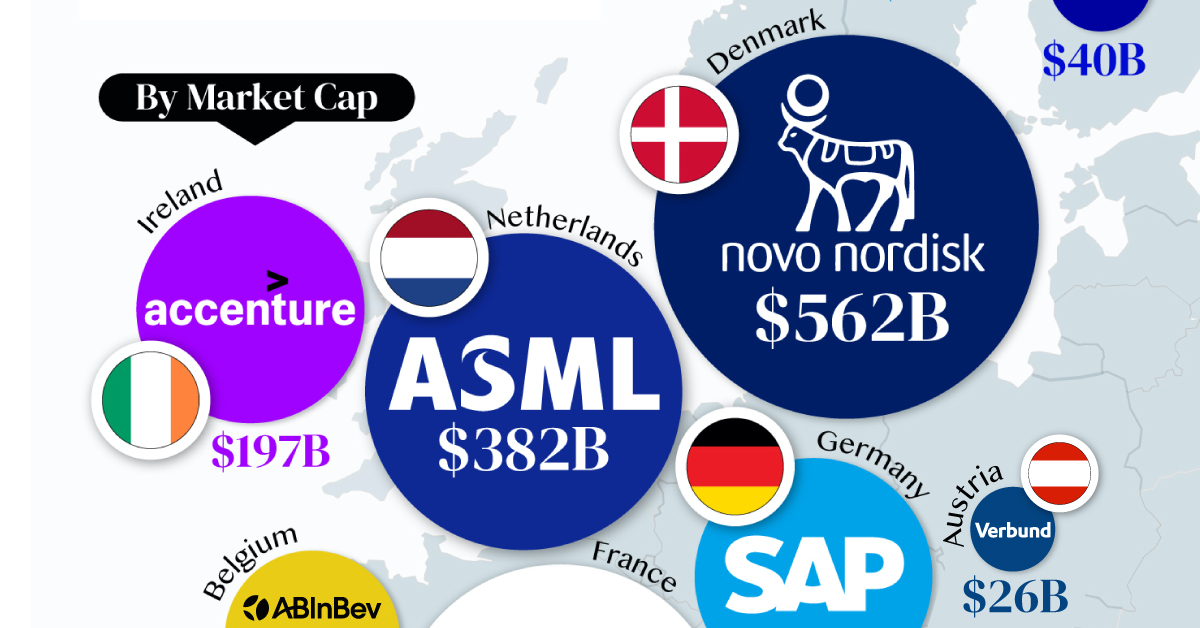

The Most Valuable Companies in Major EU Economies

From semiconductor equipment manufacturers to supercar makers, the EU’s most valuable companies run the gamut of industries.

Most Valuable Companies in the EU, by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

In this graphic, we mapped out the most valuable corporations in 11 major EU economies, based on their market capitalizations as of April 15th, 2024. All figures are in USD, and were sourced from Companiesmarketcap.com.

Novo Nordisk is currently worth more than $550 billion, making it Europe’s most valuable company by a wide margin. The pharmaceutical giant specializes in diabetes and weight-loss drugs. Demand for two of them, Ozempic and Wegovy, has surged due to their weight-loss capabilities, even causing nationwide shortages in the United States.

The following table includes an expanded list of the most valuable publicly-traded company in larger EU economies. Many of these were not included in the graphic due to space limitations.

| Country | Company | Sector | Market Cap |

|---|---|---|---|

| 🇩🇰 Denmark | 💊 Novo Nordisk | Pharmaceuticals | $562B |

| 🇫🇷 France | 👜 LVMH | Luxury Goods | $422B |

| 🇳🇱 Netherlands | 🔧 ASML | Semiconductor Equipment | $382B |

| 🇩🇪 Germany | 💼 SAP | Enterprise Software | $214B |

| 🇮🇪 Ireland | 🖥️ Accenture | IT Services | $197B |

| 🇪🇸 Spain | 👗 Inditex | Retail | $147B |

| 🇧🇪 Belgium | 🍻 Anheuser-Busch InBev | Beverages | $116B |

| 🇸🇪 Sweden | 🛠️ Atlas Copco | Industrial Equipment | $80B |

| 🇮🇹 Italy | 🏎️ Ferrari | Automotive | $76B |

| 🇫🇮 Finland | 🏦 Nordea Bank | Banking | $40B |

| 🇦🇹 Austria | 🔌 Verbund AG | Energy | $26B |

| 🇱🇺 Luxembourg | 🏗️ Tenaris | Oil & Gas Equipment | $22B |

| 🇨🇿 Czech Republic | 💡 CEZ Group | Energy | $20B |

| 🇵🇱 Poland | ⛽ PKN Orlen | Energy | $20B |

| 🇵🇹 Portugal | 🔌 EDP Group | Energy | $16B |

| 🇬🇷 Greece | 🏦 Eurobank | Banking | $7B |

| 🇭🇺 Hungary | ⛽ MOL Group | Energy | $7B |

| 🇭🇷 Croatia | 🏦 Zagrebacka Banka | Banking | $6B |

| 🇷🇴 Romania | ⛽ Romgaz | Energy | $4B |

| 🇸🇮 Slovenia | 💊 Krka | Pharmaceuticals | $4B |

Note: Figures are rounded and last updated on April 15th, 2024. Countries with top publicly-traded companies worth under $4 billion are excluded.

Luxury supergiant LVMH—which owns brands like Tiffany, Christian Dior, and TAG Heuer to name a few—is Europe’s second largest company by market cap, at $420 billion.

Rounding out the top three is ASML, which produces equipment crucial to chip manufacturers, worth $380 billion.

When looking at the region, there is a vast disparity between EU member states and their most valuable companies.

For example, as mentioned earlier, Denmark’s Novo Nordisk and France’s LVMH are worth between $400-550 billion each. Meanwhile, some countries don’t even have a single publicly-listed company that is worth over $1 billion.

In fact, only 12 EU countries (less than half of the union) are home to the top 100 most valuable companies within the bloc. An additional four countries are represented if you look at the list of the top 200 companies.

-

Wealth6 days ago

Wealth6 days agoCharted: Which City Has the Most Billionaires in 2024?

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time