Green

Net-Zero Emissions: The Steps Companies and Investors Can Consider

The Steps to Net-Zero Emissions

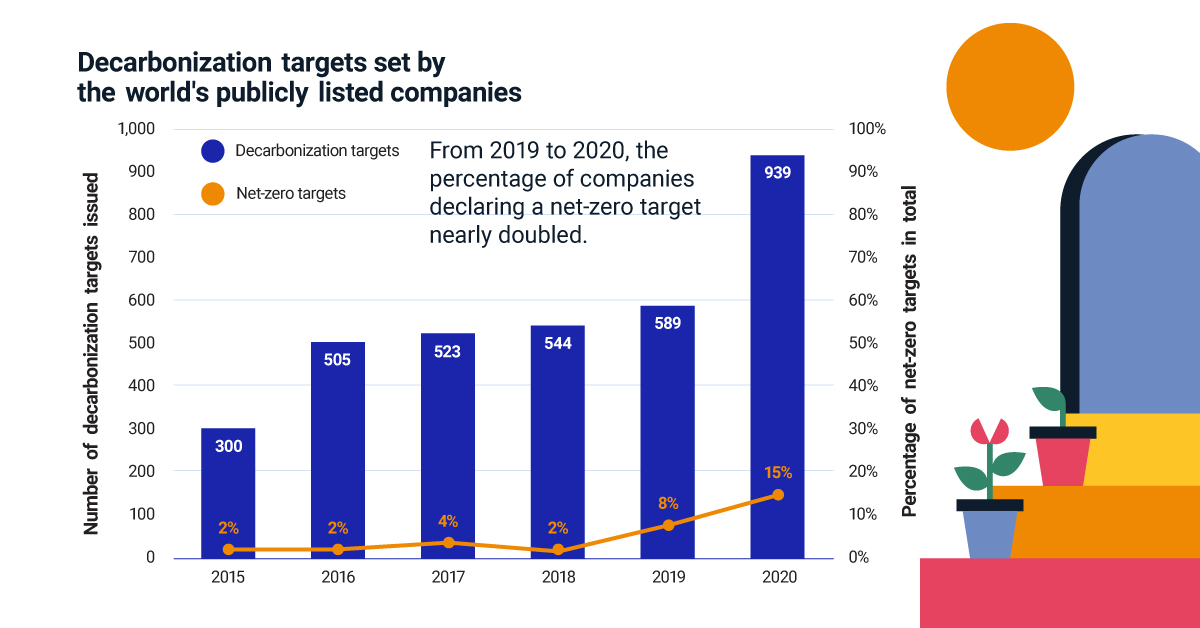

To help prevent the worst effects of climate change, a growing number of companies are pledging to achieve net-zero emissions by 2050. In fact, the percentage of companies declaring a net-zero target nearly doubled from 2019 to 2020.

With urgency building, how can companies and investors approach net-zero emissions? The above infographic from MSCI highlights the steps these two groups can take, from defining a strategy to reporting progress.

Net-Zero Emissions: A Clear Process

Setting a net-zero emissions target means reducing carbon emissions to the greatest extent possible, and compensating for the remaining unavoidable emissions via removal.

Companies and investors can take four broad steps to move toward their targets.

1. Define Strategy

To begin, companies can measure current emissions and identify priority areas where emissions can be reduced. For example, ABC chemical company determines that its greenhouse gas (GHG) emissions far exceed those of its competitors. In response, ABC chemical company prioritizes reducing GHG emissions during material processing.

Similarly, wealth and asset managers can assess climate risks:

- Risks of transitioning to a net-zero economy

- Risks of extreme weather events

They can then map out a strategy to curb climate risk. For example, XYZ asset manager determines that 33% of its portfolio may be vulnerable to asset stranding or some level of transition risk. XYZ decides to lower its transition risk by aligning with a 1.5 degrees Celsius (2.7 degrees Fahrenheit) warming scenario.

2. Set Target

With a strategy set, companies can pledge their net-zero emissions commitment and set interim goals. They can also specify how their pledge will be achieved. For example, ABC chemical company could set a net-zero emissions target by 2050. To increase short-term accountability, they set an interim target to halve carbon emissions by 2035.

Wealth and asset managers can also set targets and interim goals, as they apply to their portfolios. For instance, XYZ asset manager could set a goal to decarbonize its portfolio 5% by 2025, and 10% by 2030. This means that the companies within the portfolio are reducing their carbon emissions at this rate.

| Scenario | Warming Potential |

|---|---|

| Business as usual | 3.6℃ (6.5℉) |

| 10% decarbonization | 1.5℃ (2.7℉) |

As shown above, a 10% year-on-year decarbonization will align XYZ asset manager’s model portfolio with a 1.5 degrees Celsius warming scenario.

3. Implement

ABC chemical company takes immediate action consistent with its interim targets. For instance, the company can start by reducing the carbon footprint of its processes. This approach carries the lowest risks and costs. But to take larger strides toward its net-zero emissions goal, ABC could draw on renewable energy together with carbon-removal technologies as they are developed.

In the same vein, XYZ asset manager can move toward its decarbonization targets by adopting a benchmark index and reallocating capital. This could include:

- Increasing investment in clean technologies

- Re-weighting securities or selecting those that are “best in class” for ESG metrics

- Reducing risk exposure and targeting companies for shareholder engagement

- Selling holdings in companies with the greatest exposure

All of these actions will help XYZ become better aligned with its investment strategy.

4. Track and Publish Progress

Here, the actions for companies and investors converge. Both groups can measure and monitor progress, disclose results, and adjust as necessary.

For example, XYZ asset manager shares the following year-end results of its decarbonization strategy. The results compare the portfolio and its benchmark on their implied temperature rise and exposure to low-carbon transition categories.

| Portfolio | Benchmark | Difference (Portfolio - Benchmark) |

|

|---|---|---|---|

| Implied temperature rise | 3.2℃ (5.8℉) | 3.4℃ (6.1℉) | -0.2℃ (-0.4℉) |

| Exposure to companies classified as: | |||

| Asset stranding | 0.0% | 0.5% | -0.5% |

| Product transition | 6.1% | 8.1% | -2.0% |

| Operational transition | 5.2% | 7.0% | -1.8% |

| Neutral | 77.6% | 77.8% | -0.2% |

| Solutions | 11.1% | 6.6% | +4.5% |

Asset stranding is the potential for an asset to lose its value well ahead of its anticipated useful life because of the low carbon transition. Companies with product transition risk may suffer from reduced demand for carbon-intensive products and services, while companies with operational transition risk may have increased operational or capital costs due to the low carbon transition.

XYZ asset manager’s portfolio has less risk than the benchmark. XYZ has also significantly reduced its exposure to transition risk to 11.3%, down from 33% in step 1. However, with an implied temperature rise of 3.2 degrees Celsius, the portfolio is far from meeting its 1.5 degrees Celsius warming goal. In response, XYZ begins to intensify pressure on portfolio companies to cut their GHG emissions by at least 10% every year.

A Climate Revolution for Net-Zero Emissions

The time to drive the transition to net-zero emissions is now. By the end of this century, the world is on track to be up to 3.5 degrees Celsius warmer. This could lead to catastrophic flooding, harm to human health, and increased rates of mortality.

As of July 2021, just 10% of the world’s publicly listed companies have aligned with global temperature goals. Preventing the worst effects of climate change will demand the largest economic transformation since the Industrial Revolution. Companies, investors and other capital-market participants can drive this change.

Green

How Carbon Credits Can Help Close the Climate Funding Gap

To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030, and carbon credits could help close the gap.

How Carbon Credits Can Help Close the Climate Funding Gap

Governments around the world have committed to the goals of the Paris Agreement, but their climate pledges are insufficient. To keep a 1.5℃ world within reach, global emissions need to fall by as much as 45% by 2030.

Bold and immediate action is essential, but so are resources that will make it happen.

In this graphic, we have partnered with Carbon Streaming to look at the role that the voluntary carbon market and carbon credits can play in closing that gap.

More Funds are Needed for Climate Finance

According to data from the Climate Policy Initiative, climate finance, which includes funds for both adaptation and mitigation, needs to increase at least five-fold, from $1.3T in 2021/2022, to an average $8.6T annually until 2030, and then to just over $10T in the two decades leading up to 2050.

That adds up to a very large number, but consider that in 2022, $7.0T went to fossil fuel subsidies, which almost covers the annual estimated outlay. And the world has shown that when pressed, governments can come up with the money, if the global pandemic is any indication.

Mobilizing Carbon Finance to the Developing World

But the same cannot be said of the developing world, where debt, inequality, and poverty reduce the ability of governments to act. And this is where carbon credits can play an important role. According to analyses from Ecosystem Marketplace, carbon credits help move capital from developed countries, to where funds are needed in the developing world.

For example, in 2019, 69.2% of the carbon credits by volume in the voluntary carbon market were purchased by buyers in Europe, and nearly a third from North America. Compare that to over 90% of the volume of carbon credits sold in the voluntary carbon market in 2022 came from projects that were located outside of those two regions.

Carbon Credits Can Complement Decarbonization Efforts

Carbon credits can also complement decarbonization efforts in the corporate world, where more and more companies have been signing up to reduce emissions. According to the 2022 monitoring report from the Science Based Targets initiative, 4,230 companies around the world had approved targets and commitments, which represented an 88% increase from the prior year. However, as of year end 2022, combined scope 1 and 2 emissions covered by science-based targets totaled approximately 2 GtCO2e, which represents just a fraction of global emissions.

The fine print is that this is just scope 1 and 2 emissions, and doesn’t include scope 3 emissions, which can account for more than 70% of a company’s total emissions. And as these emissions come under greater and greater scrutiny the closer we get to 2030 and beyond, the voluntary carbon credit market could expand exponentially to help meet the need to compensate for these emissions.

Potential Carbon Credit Market Size in 2030

OK, but how big? In 2022, the voluntary carbon credit market was around $2B, but some analysts predict that it could grow to between $5–250 billion by 2030.

| Firm | Low Estimate | High Estimate |

|---|---|---|

| Bain & Company | $15B | $30B |

| Barclays | N/A | $250B |

| Citigroup | $5B | $50B |

| McKinsey & Company | $5B | $50B |

| Morgan Stanley | N/A | $100B |

| Shell / Boston Consulting Group | $10B | $40B |

Morgan Stanley and Barclays were the most bullish on the size of the voluntary carbon credit market in 2030, but the latter firm was even more optimistic about 2050, and predicted that the voluntary carbon credit market could grow to a colossal $1.5 trillion.

Carbon Streaming is Focused on Carbon Credit Integrity

Ultimately, carbon credits could have an important role to play in marshaling the resources needed to keep the world on track to net zero by 2050, and avoiding the worst consequences of a warming world.

Carbon Streaming uses streaming transactions, a proven and flexible funding model, to scale high-integrity carbon credit projects to advance global climate action and UN Sustainable Development Goals.

Learn more at www.carbonstreaming.com.

-

Green1 week ago

Green1 week agoRanking the Top 15 Countries by Carbon Tax Revenue

This graphic highlights France and Canada as the global leaders when it comes to generating carbon tax revenue.

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

South Asian nations are the global hotspot for pollution. In this graphic, we rank the world’s most polluted countries according to IQAir.

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001

One country is taking reforestation very seriously, registering more than 400,000 square km of forest growth in two decades.

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

The country with the most forest loss since 2001 lost as much forest cover as the next four countries combined.

-

Markets2 months ago

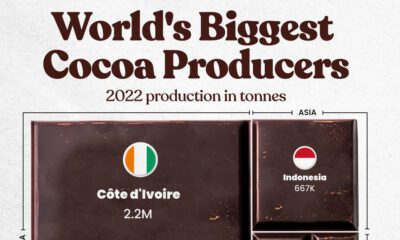

Markets2 months agoThe World’s Top Cocoa Producing Countries

Here are the largest cocoa producing countries globally—from Côte d’Ivoire to Brazil—as cocoa prices hit record highs.

-

Environment2 months ago

Environment2 months agoCharted: Share of World Forests by Country

We visualize which countries have the biggest share of world forests by area—and while country size plays a factor, so too, does the environment.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries