The Paris Agreement: Is The World’s Climate Action Plan on Track?

The following content is sponsored by MSCI.

Keeping Tabs on the World’s Climate Action Plan

When the Paris Agreement came into force in 2016, it was considered by many to be a step forward in the world’s climate action plan. In the five years that have followed, more and more countries have established carbon neutrality targets.

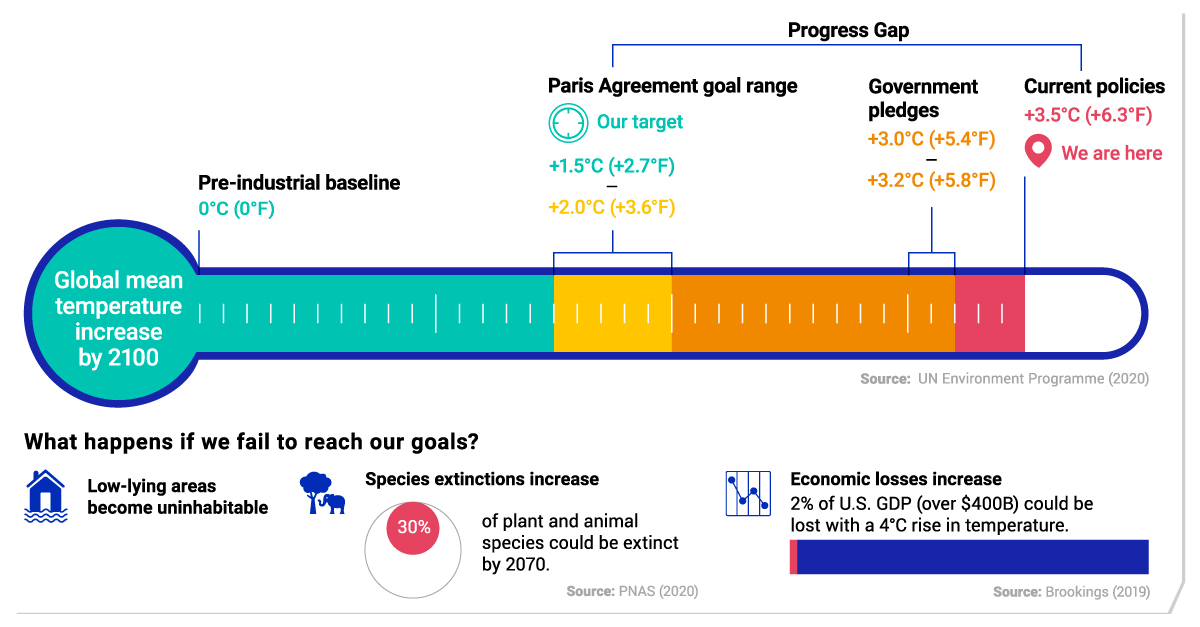

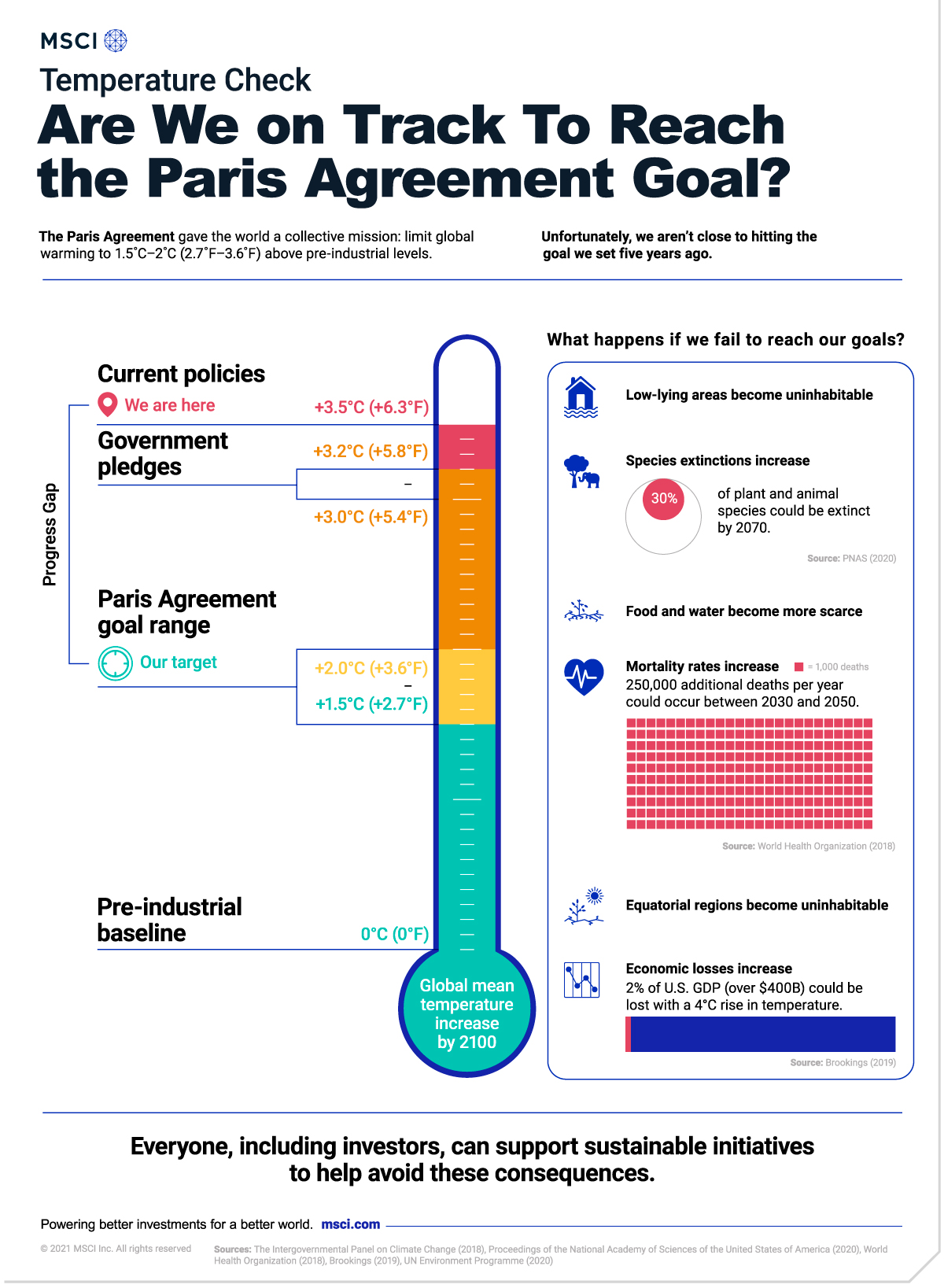

Has it been enough to keep us on track? This graphic from MSCI shows where we are in relation to the Paris Agreement goal, and what may happen if we fail to reach it.

What is the Paris Agreement?

The Paris Agreement is a legally binding international treaty that lays out a climate action plan. Its goal is to limit global warming to well below 2 degrees Celsius (3.6 degrees Fahrenheit), and preferably to 1.5 degrees Celsius (2.7 degrees Fahrenheit), compared to pre-industrial levels.

A total of 191 countries have solidified their support with formal approval.

Tracking Our Progress

To date, signing nations are not close to hitting the goal set five years ago.

| Scenario | Global Mean Temperature Increase by 2100 |

|---|---|

| Pre-industrial baseline | 0℃ (0℉) |

| Paris Agreement goal range | 1.5-2.0℃ (2.7-3.6℉) |

| Government pledges | 3.0-3.2℃ (5.4-5.8℉) |

| Current policies | 3.5℃ (6.3℉) |

Source: UN Environment Programme

Based on policies currently in effect, we are on track for 3.5 degrees Celsius global warming by 2100—far beyond the maximum warming goal of 2 degrees. Even if we take government pledges into account, which is the amount by which countries intend to reduce their emissions, we are still far from achieving the Paris Agreement goal.

What about the impact of reduced emissions due to COVID-19 lockdowns? The temporary dip is expected to translate into an insignificant 0.01 degree Celsius reduction of global warming by 2050. Without significant policy action that pursues a more sustainable recovery, the UN Environment Programme projects that we will continue on a dangerous trajectory.

“The pandemic is a warning that we must urgently shift from our destructive development path, which is driving the three planetary crises of climate change, nature loss and pollution.”

—Inger Andersen, Executive Director, United Nations Environment Programme

The World Economic Forum agrees with this viewpoint, and identified climate action failure as one of the most likely and impactful risks of 2021.

The Potential Consequences

If we fall short of the climate action plan, our planet may see numerous negative effects.

- Reduced livable land area: Due to rising sea levels and increased heat stress, low-lying areas and equatorial regions could become uninhabitable.

- Scarce food and water: Global warming may increase water and food scarcity. In particular, fisheries and aquafarming face increasing risks from ocean warming and acidification.

- Loss of life: The World Health Organization projects that climate change will cause 250,000 additional deaths per year between 2030 and 2050.

- Less biodiversity: About 30% of plant and animal species could be extinct by 2070, primarily due to increases in maximum annual temperature.

- Economic losses: At 4 degree celsius warming by 2080-2099, the U.S. could suffer annual losses amounting to 2% of GDP (about $400B). If global warming is limited to 2 degrees, losses would likely drop to 0.5% of GDP.

What steps can we take to reduce these risks?

Advancing Our Climate Action Plan

Everyone, including investors, can support green initiatives to help avoid these consequences. For example, investors may consider company ESG ratings when building a portfolio, and invest in businesses that are contributing to a more sustainable future.

In Part 2 of our Paris Agreement series, we’ll explain how investors can align their portfolio with the Paris Agreement goals.

-

Sponsored3 years ago

Sponsored3 years agoMore Than Precious: Silver’s Role in the New Energy Era (Part 3 of 3)

Long known as a precious metal, silver in solar and EV technologies will redefine its role and importance to a greener economy.

-

Sponsored7 years ago

Sponsored7 years agoThe History and Evolution of the Video Games Market

Everything from Pong to the rise of mobile gaming and AR/VR. Learn about the $100 billion video games market in this giant infographic.

-

Sponsored8 years ago

Sponsored8 years agoThe Extraordinary Raw Materials in an iPhone 6s

Over 700 million iPhones have now been sold, but the iPhone would not exist if it were not for the raw materials that make the technology...

-

Sponsored8 years ago

Sponsored8 years agoThe Industrial Internet, and How It’s Revolutionizing Mining

The convergence of the global industrial sector with big data and the internet of things, or the Industrial Internet, will revolutionize how mining works.