Politics

Mapping the Global Flow of Foreign Aid

Mapping the Global Flow of Foreign Aid

Billions of dollars routinely flow between countries for a number of reasons that go beyond simply helping people in less wealthy nations.

Extending foreign aid can be a tool to help strengthen relationships with allies, to help bolster a military presence in a key area, or even to project a positive image at home and abroad. Of course, aid also helps less wealthy nations do all kinds of things, from constructing new infrastructure to recovering from humanitarian crises or natural disasters.

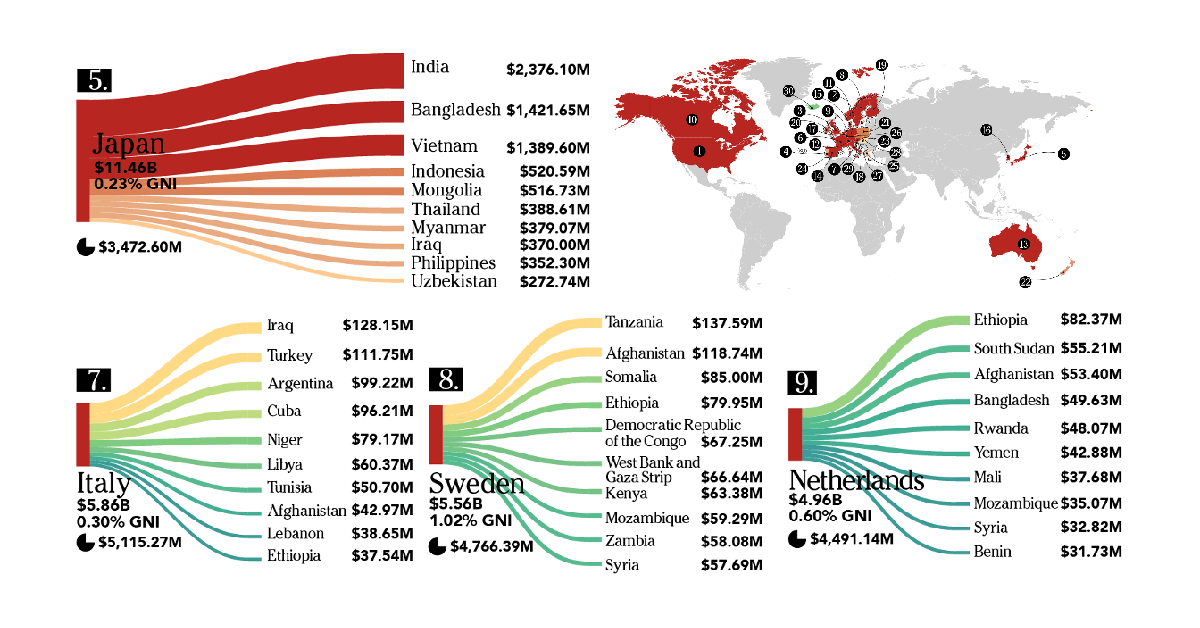

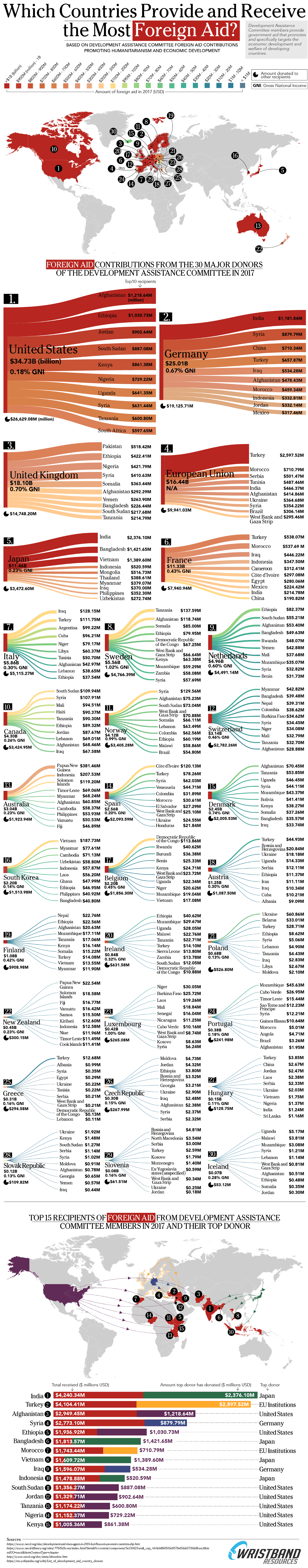

Today’s infographic, from Wristband Resources, is a comprehensive look at the flow of foreign aid funds around the world in 2017.

The visualization raises a number of questions. For example:

- Why does Japan send so much foreign aid to places like India and Vietnam?

- Why does Turkey—one of the top 20 economies in the world—receive so much foreign aid?

- And why did Ethiopia receive over $1 billion in aid from the United States?

Below we’ll answer key questions about foreign aid, while examining some of the more interesting relationships in detail.

What Constitutes Foreign Aid?

In simple terms, foreign aid is the voluntary transfer of resources from one country to another country—typically capital. Here are the six types of foreign aid:

Note: The graphic above measures official development assistance (ODA), as defined by the OECD. ODA excludes military aid and the “promotion of donors’ security interests” as well as transactions that have primarily commercial objectives.

Which Countries Give the Most Foreign Aid?

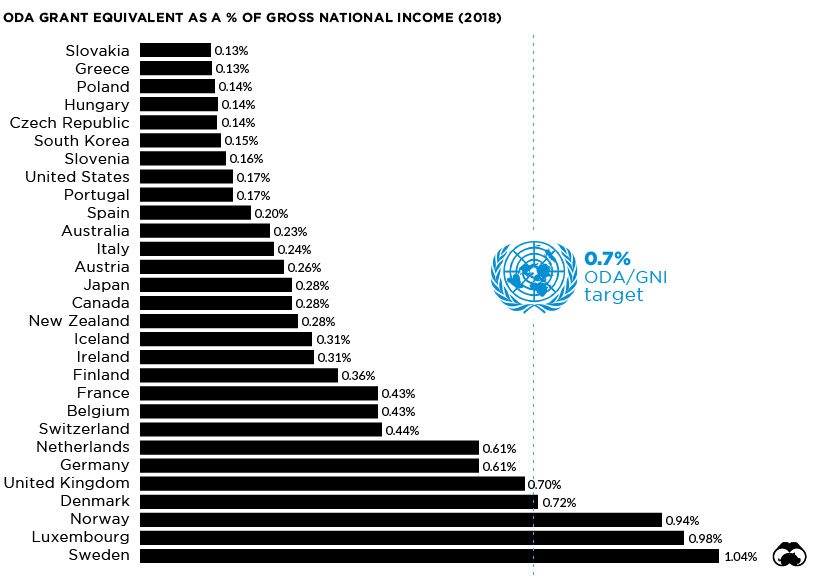

Every country’s budget is different, and priorities can change as the economic and political cycles progress. As of 2018, here are the countries that contributed the most foreign aid as a portion of their Gross National Income (GNI).

In a 1970 resolution, the UN challenged countries to spend 0.7% of their GNI on foreign aid. Today, only four countries—Sweden, Luxembourg, Norway, and Denmark—surpassed the United Nations’ official development assistance target.

Using this measure, all top 10 countries are located in Europe. That said, in absolute terms, countries like Japan and the United States are still major contributors of aid around the world.

Below are a few real world examples of foreign aid flow, and more context around why money is flowing between the countries.

Japan → India

India is the top recipient of foreign aid, with the majority of funds coming from Japan. The country received close to $2.4 billion from Japan in 2017.

In recent years, the growth of Japan-India relations is viewed as a counter to China’s expanding economic and political influence across the Asian continent. As China’s national banks continue to fund megaprojects around the world, Japan is helping to fill a similar role in India.

One major project currently under construction is the Mumbai–Ahmedabad High Speed Rail Corridor. To move the $22 billion project forward, Japan offered India a 50-year loan at a 0.1% interest rate, covering 80% of the project cost.

European Union → Turkey

European institutions contributed nearly $2.6 billion to Turkey in 2017. On the surface this may seem confusing, as Turkey is more developed than most nations receiving foreign aid—however, much of this funding stems from the migration crisis. In 2016, the EU struck a deal with Turkey to reroute any migrant arriving in Europe via the Aegean Sea back to Turkey. In exchange, the EU agreed to fast-track Turkey’s EU membership bid.

Turkey has been bearing the brunt of caring for refugees, and the EU has contributed significant funds to the effort. For example, funding for the Emergency Social Safety Net (ESSN) program in Turkey has reached $1.2 billion.

In 2019, EU-Turkey relations took a chilly turn as European Parliament voted to suspend Turkey’s EU membership bid, expressing concern over creeping authoritarianism and human rights violations.

United States → Ethiopia

In 2017, Ethiopia was under a state of emergency as the African country faced a third straight year of drought, and security forces and anti-government protesters clashed in the streets. Though the U.S. does provide plenty of military and security-oriented aid, this is an example of humanitarian aid in the face of a crisis.

The United States was also the top source by far for aid flowing into other countries in the region, including Kenya, Tanzania, and South Sudan.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy1 month ago

Economy1 month agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy1 month ago

Economy1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees