Technology

From Amazon to Zoom: What Happens in an Internet Minute In 2021?

From Amazon to Zoom: An Internet Minute In 2021

In our everyday lives, not much may happen in a minute. But when gauging the depth of internet activity occurring all at once, it can be extraordinary. Today, around five billion internet users exist across the globe.

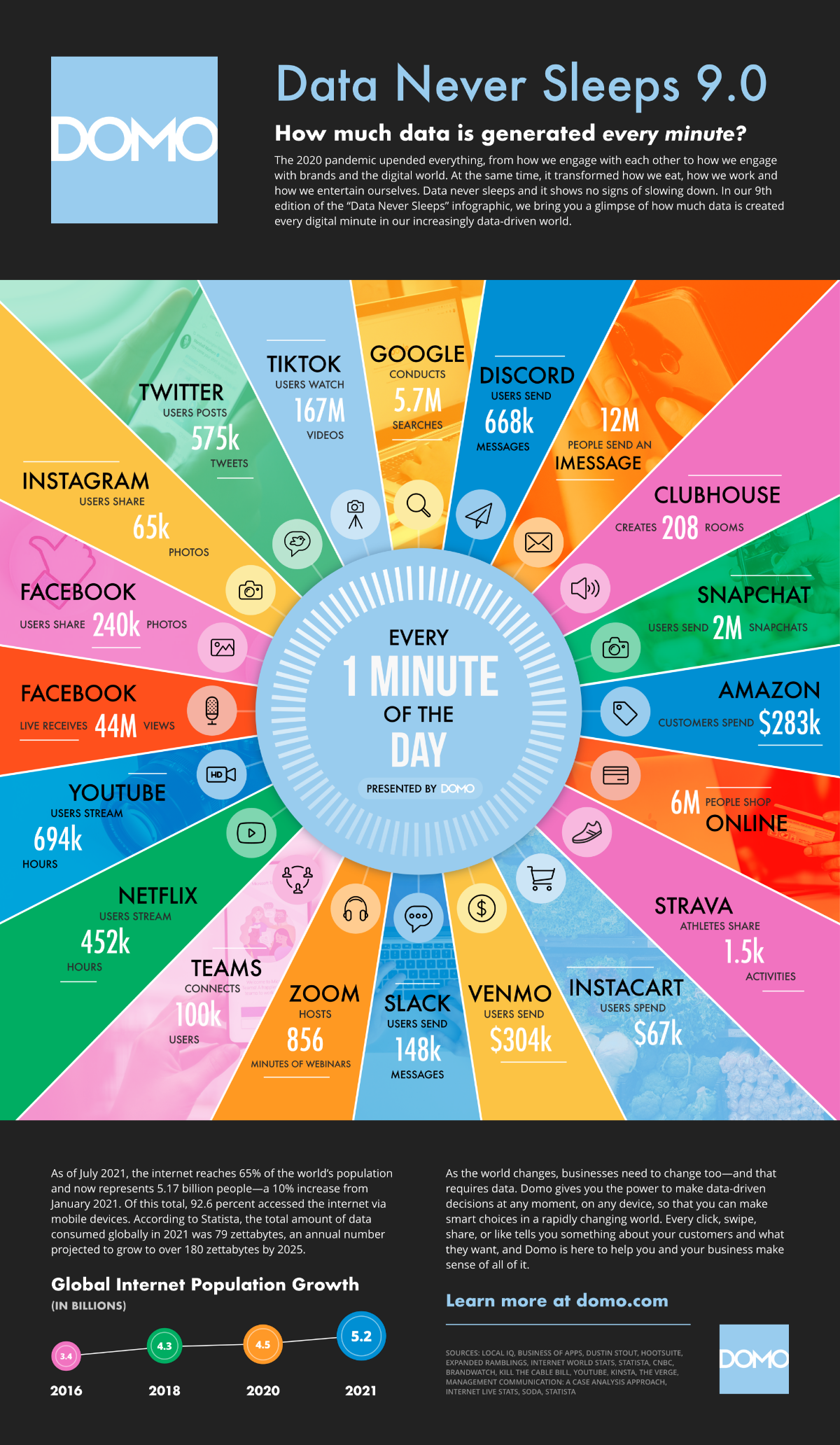

This annual infographic from Domo captures just how much activity is going on in any given minute, and the amount of data being generated by users. To put it mildly, there’s a lot.

The Internet Minute

At the heart of the world’s digital activity are the everyday services and applications that have become staples in our lives. Collectively, these produce unimaginable quantities of user activity and associated data.

Here are just some of the key figures of what happens in a minute:

- Amazon customers spend $283,000

- 12 million people send an iMessage

- 6 million people shop online

- Instacart users spend $67,000

- Slack users send 148,000 messages

- Microsoft Teams connects 100,000 users

- YouTube users stream 694,000 videos

- Facebook Live receives 44 million views

- Instagram users share 65,000 photos

- Tiktok users watch 167 million videos

As these facts show, Big Tech companies have quite the influence over our lives. That influence is becoming difficult to ignore, and draws increasing media and political attention. And some see this attention as a plausible explanation for why Facebook changed their name—to dissociate from their old one in the process.

One tangible measure of this influence is the massive amount of revenue Big Tech companies bring in. To get a better sense of this, we can look at Big Tech’s revenue generating capabilities on a per-minute basis as well:

| Company | Revenue Per Minute |

|---|---|

| Amazon | $955,517 |

| Apple | $848,090 |

| Alphabet (Google) | $433,014 |

| Microsoft | $327,823 |

| $213,628 | |

| Tesla | $81,766 |

| Netflix | $50,566 |

Much of the revenue that these elite trillion-dollar stocks generate can be traced back to all the activity on their various networks and platforms.

In other words, the 5.7 million Google searches that occur every minute is the key to their $433,014 in per minute sales.

The Internet Minute Over The Years

With the amount of data and information in the digital universe effectively doubling every two years, it’s fair to say the internet minute has gone through some changes over the years. Here are just some areas that have experienced impressive growth:

- In 2016, Snapchat users 527k photos per minute, compared to 2 million in 2021

- In 2017, Twitter saw 452k Tweets per minute, compared to 575k in 2021

- In 2018, $862,823 was spent online shopping, while 2 million people were shopping per minute in 2021

- In 2019, 4.5 million videos on YouTube were being viewed every minute, while in 2021 users were streaming 694k hours

- In 2020, Netflix users streamed 404k hours per minute, growing to 452k hours in 2021

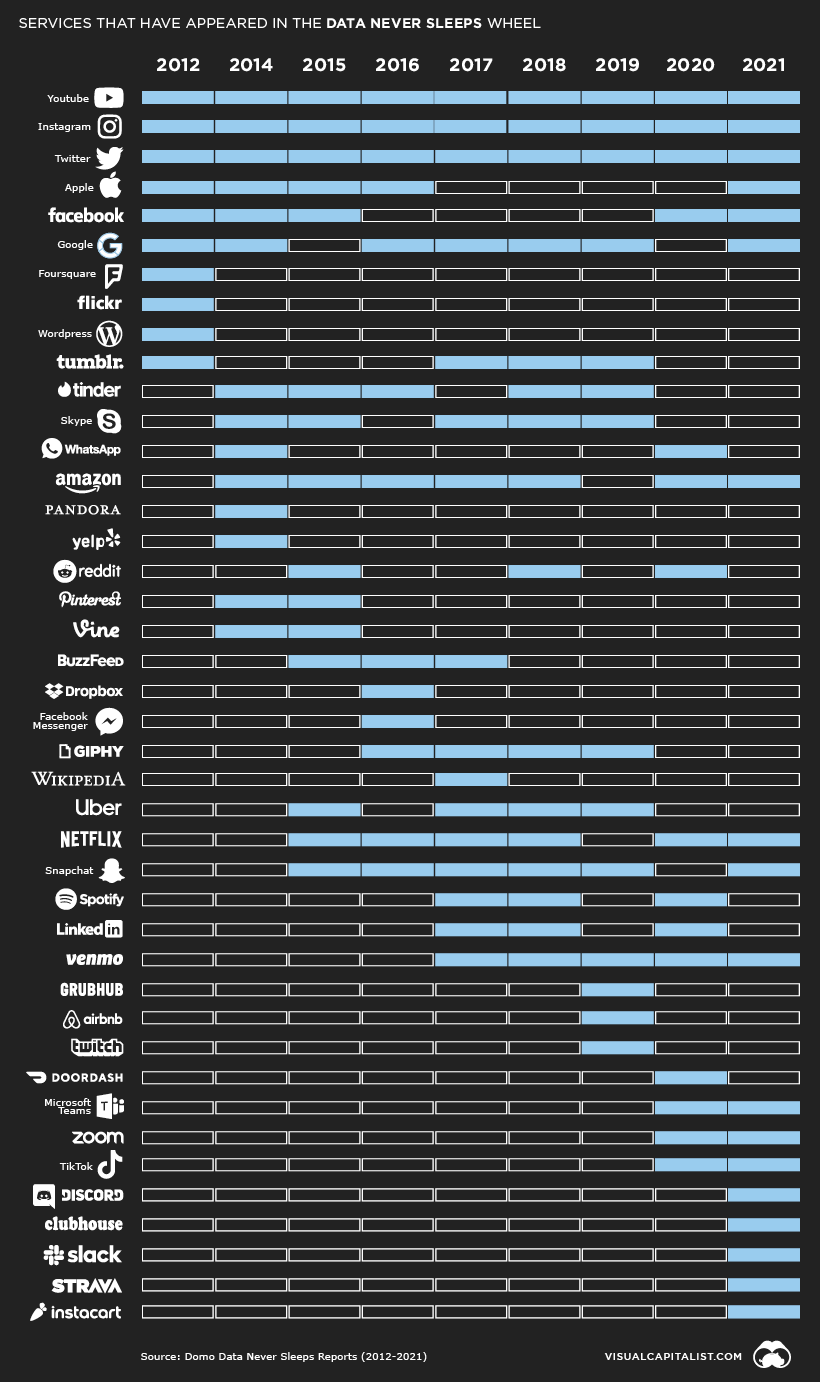

Here’s a look at the services that have been featured in the various iterations of this graphic over the years:

Twitter, Instagram, and Youtube are the only three brands to be featured every single year.

Internet Growth Perspectives

The Internet Minute wheel also helps to put the internet’s rapid rate of adoption into perspective. For instance, in 1993, there were only 14 million internet users across the globe. But today, there are over 14 million just in Chile.

That said, the total addressable market still has some room left. By some measures, the complete number of internet users grew by 500 million in 2021, a roughly 11% jump from 4.5 billion users in 2020. This comes out to an astonishing 950 new users on a per minute basis.

What’s more, in the long term, with the appropriate infrastructure in place, certain areas within emerging markets can experience buoyant growth in the number of connected citizens. Here’s where the next billion internet users may come from, based on the largest disconnected populations.

| Rank | Country / Territory | Unconnected People | % of Population |

|---|---|---|---|

| 1 | India | 685,591,071 | 50% |

| 2 | China | 582,063,733 | 41% |

| 3 | Pakistan | 142,347,735 | 65% |

| 4 | Nigeria | 118,059,925 | 58% |

| 5 | Bangladesh | 97,427,352 | 59% |

| 6 | Indonesia | 96,709,226 | 36% |

| 7 | Ethiopia | 92,385,728 | 81% |

| 8 | Democratic Republic of Congo | 71,823,319 | 81% |

| 9 | Brazil | 61,423,295 | 29% |

| 10 | Egypt | 46,626,170 | 46% |

With this growth trajectory in mind, we can expect future figures to become even more astonishing. But the human mind is known to be bad at interpreting large numbers, so in future editions, the internet minute figures may need to be stripped down to the internet second.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees