Politics

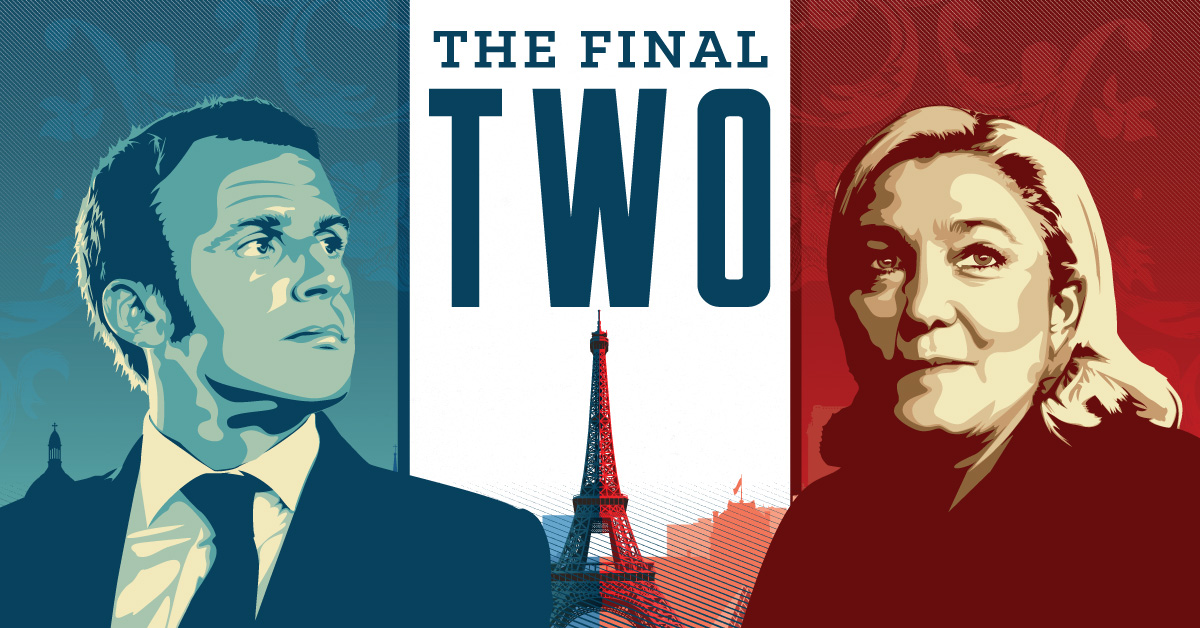

France: Macron vs. Le Pen to Decide Fate of EU

French Elections: Macron vs. Le Pen to Decide Fate of EU

The first round of the French presidential election is now complete, with only two candidates remaining:

| Candidate | % Vote (Round 1) |

|---|---|

| Emmanuel Macron | 23.9% |

| Marine Le Pen | 21.4% |

| François Fillon | 20.0% |

| Jean-Luc Mélenchon | 19.6% |

| Benoît Hamon | 6.4% |

| Nicolas Dupont-Aignan | 4.7% |

| Others | 4.0% |

Because no candidate received a majority of votes, there will be a run-off vote on May 7 in which French voters decide between Emmanuel Macron and Marine Le Pen.

While the two candidates are each considered outsiders for different reasons, their key platform differences could not be more stark. The major fundamental issue they disagree on is EU membership – and as a result, French voters potentially hold the fate of the entire EU in their hands.

Head-to-head: Macron vs. Le Pen

Today’s infographic is from Swissquote, and it compares the platforms of Macron and Le Pen head-to-head.

Here are some of the key differences between the two:

Background:

Emmanuel Macron is an investment banker that was the Minister of the Economy for François Hollande’s government. He left in 2016 to start En Marche!, a centrist political movement that describes itself as “neither right nor left”.

Marine Le Pen has been the leader of the National Front since 2011, and is a lawyer by trade. She is the youngest daughter of National Front founder Jean-Marie Le Pen, and has worked in politics since 1998. She’s also been a Member of European Parliament since 2004.

European Union:

Macron wants to remain in the European Union and to seek a common asylum policy. Meanwhile, Le Pen wants to hold a referendum on France’s EU membership, while re-instating a national currency.

Economic Policies:

Macron wants to cut government spending to 50% of GDP, to limit the wealth tax to real estate, and to cut the corporate tax rate from 33.3% to 25%.

Le Pen supports re-industrialization of France as well as “intelligent protectionism”. She wants to allow the Banque de France to print money to fund the treasury up to an annual maximum of 5% of total money supply, and also advocates a 10% cut for the lowest income tax brackets.

Security:

Macron wants to stay in the Schengen border-free zone, while Le Pen wants to exit it. Both want to hire new police officers and to add new prison spaces, though Le Pen wants to add higher amounts of each.

Le Pen also wants to cut legal immigration to France to 10,000 per year.

Military:

Both Macron and Le Pen want to re-introduce military conscription for short periods of time. Each wants to increase defense spending, as well: Macron by 2% by 2025, and Le Pen by 3% of GDP by 2022.

Labor:

Both want to keep the 35-hour work week, although with some exceptions. Macron wants to extend unemployment benefits to entrepreneurs, farmers, self-employed, and those who quit jobs voluntarily. He also wants to implement a universal pension system, and to boost training schemes for unemployed youth.

Le Pen advocates the lowering of the retirement age to 60, and for a “purchasing-power bonus” of €1,000 a year for low-wage earners and pensioners. She also wants a national plan for equal pay for women, and for overtime to be tax-free.

Environment:

Macron is opposed to the exploitation of shale gas and offshore drilling, and wants the remaining coal-fired plants in France to be closed.

Le Pen calls for a move to a “zero-carbon” economy, and to ban shale gas exploration, while setting a moratorium on windmills for power generation. Le Pen also would like to ban GMOs.

Education:

Macron says up to 5,000 new teaching jobs should be created. Le Pen wants there to be no free education for children of illegal immigrants, and to restrict the use of foreign languages in schools. She also thinks school uniforms should be mandatory.

Civil Liberties:

Macron supports same-sex marriage, while Le Pen wants to scrap the 2014 law allowing same-sex marriage and to replace it with civil unions.

Macron supports medically assisted procreation for lesbians, but opposes recourse to surrogate mothers by homosexual couples. Le Pen wants to ban surrogacy and to restrict medically-supported procreation to people with sterility problems.

Governance

Both candidates want to introduce some degree of proportional representation to the electoral system, though Le Pen wants to take it further.

Macron wants to cut 120,000 state jobs by not replacing retiring civil servants. Le Pen wants to put French flags on all public buildings, to cut the number of lawmakers in the National Assembly and Senate, and to shrink the size of local governments in half.

Economy

The Bloc Effect: International Trade with Geopolitical Allies on the Rise

Rising geopolitical tensions are shaping the future of international trade, but what is the effect on trading among G7 and BRICS countries?

The Bloc Effect: International Trade with Allies on the Rise

International trade has become increasingly fragmented over the last five years as countries have shifted to trading more with their geopolitical allies.

This graphic from The Hinrich Foundation, the first in a three-part series covering the future of trade, provides visual context to the growing divide in trade in G7 and pre-expansion BRICS countries, which are used as proxies for geopolitical blocs.

Trade Shifts in G7 and BRICS Countries

This analysis uses IMF data to examine differences in shares of exports within and between trading blocs from 2018 to 2023. For example, we looked at the percentage of China’s exports with other BRICS members as well as with G7 members to see how these proportions shifted in percentage points (pp) over time.

Countries traded nearly $270 billion more with allies in 2023 compared to 2018. This shift came at the expense of trade with rival blocs, which saw a decline of $314 billion.

Country Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

🇮🇳 India 0.0 3.9

🇷🇺 Russia 0.7 -3.8

🇮🇹 Italy 0.8 -0.7

🇨🇦 Canada 0.9 -0.7

🇫🇷 France 1.0 -1.1

🇪🇺 EU 1.1 -1.5

🇩🇪 Germany 1.4 -2.1

🇿🇦 South Africa 1.5 1.5

🇺🇸 U.S. 1.6 -0.4

🇯🇵 Japan 2.0 -1.7

🇨🇳 China 2.1 -5.2

🇧🇷 Brazil 3.7 -3.3

🇬🇧 UK 10.2 0.5

All shifts reported are in percentage points. For example, the EU saw its share of exports to G7 countries rise from 74.3% in 2018 to 75.4% in 2023, which equates to a 1.1 percentage point increase.

The UK saw the largest uptick in trading with other countries within the G7 (+10.2 percentage points), namely the EU, as the post-Brexit trade slump to the region recovered.

Meanwhile, the U.S.-China trade dispute caused China’s share of exports to the G7 to fall by 5.2 percentage points from 2018 to 2023, the largest decline in our sample set. In fact, partly as a result of the conflict, the U.S. has by far the highest number of harmful tariffs in place.

The Russia-Ukraine War and ensuing sanctions by the West contributed to Russia’s share of exports to the G7 falling by 3.8 percentage points over the same timeframe.

India, South Africa, and the UK bucked the trend and continued to witness advances in exports with the opposing bloc.

Average Trade Shifts of G7 and BRICS Blocs

Though results varied significantly on a country-by-country basis, the broader trend towards favoring geopolitical allies in international trade is clear.

Bloc Change in Exports Within Bloc (pp) Change in Exports With Other Bloc (pp)

Average 2.1 -1.1

BRICS 1.6 -1.4

G7 incl. EU 2.4 -1.0

Overall, BRICS countries saw a larger shift away from exports with the other bloc, while for G7 countries the shift within their own bloc was more pronounced. This implies that though BRICS countries are trading less with the G7, they are relying more on trade partners outside their bloc to make up for the lost G7 share.

A Global Shift in International Trade and Geopolitical Proximity

The movement towards strengthening trade relations based on geopolitical proximity is a global trend.

The United Nations categorizes countries along a scale of geopolitical proximity based on UN voting records.

According to the organization’s analysis, international trade between geopolitically close countries rose from the first quarter of 2022 (when Russia first invaded Ukraine) to the third quarter of 2023 by over 6%. Conversely, trade with geopolitically distant countries declined.

The second piece in this series will explore China’s gradual move away from using the U.S. dollar in trade settlements.

Visit the Hinrich Foundation to learn more about the future of geopolitical trade

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

We visualized product categories that saw the highest % increase in price due to U.S. inflation as of March 2024.

-

Economy1 month ago

Economy1 month agoG20 Inflation Rates: Feb 2024 vs COVID Peak

We visualize inflation rates across G20 countries as of Feb 2024, in the context of their COVID-19 pandemic peak.

-

Economy1 month ago

Economy1 month agoMapped: Unemployment Claims by State

This visual heatmap of unemployment claims by state highlights New York, California, and Alaska leading the country by a wide margin.

-

Economy2 months ago

Economy2 months agoConfidence in the Global Economy, by Country

Will the global economy be stronger in 2024 than in 2023?

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees