Energy

Visualizing EV Production in the U.S. by Brand

Visualizing EV Production in the U.S. by Brand

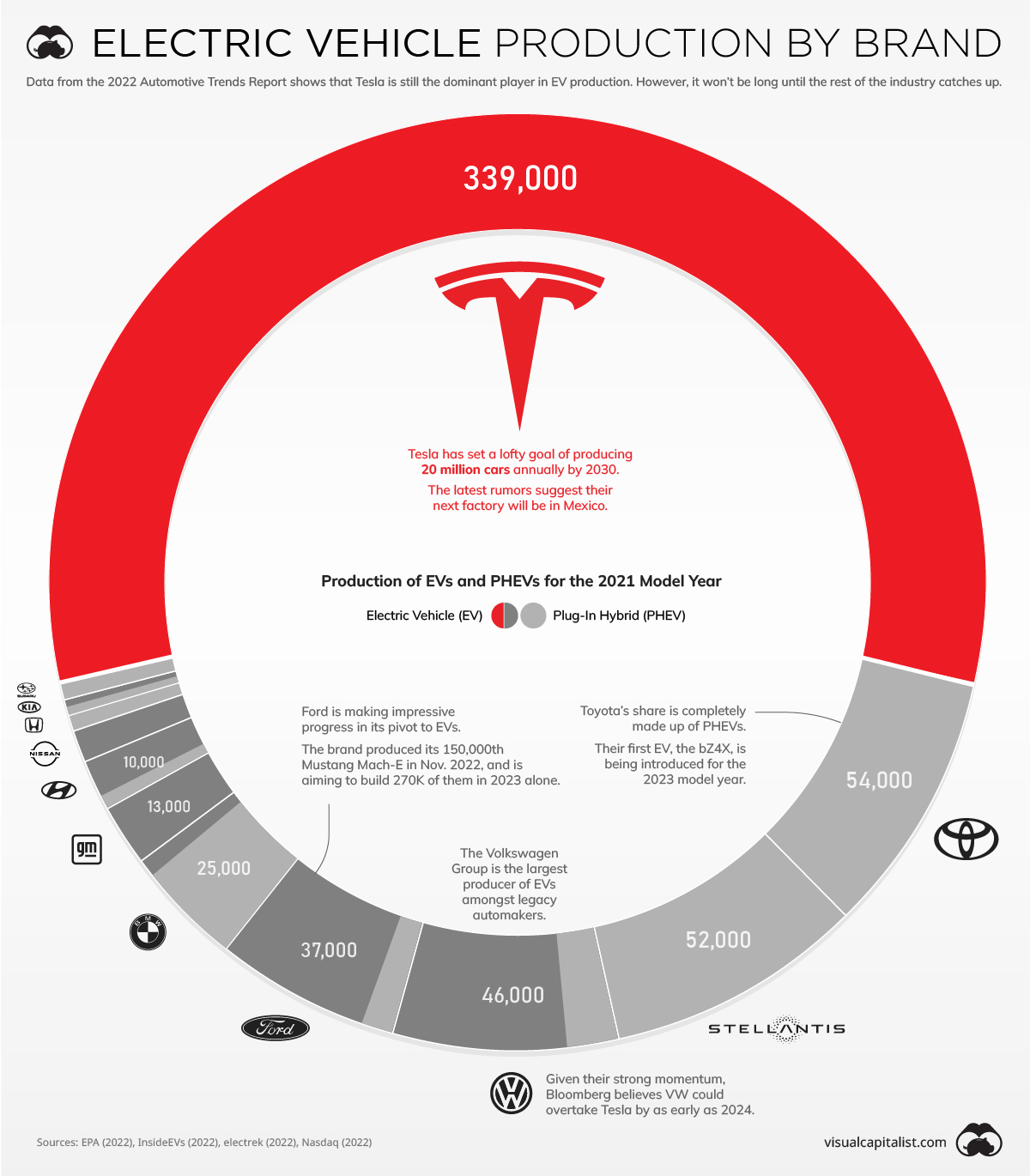

How long will Tesla hold onto its dominant electric vehicle (EV) market share?

This is one of the biggest questions facing the U.S. automotive industry. On one hand, Tesla has a very strong brand and loyal customer base (similar to Apple). The company also has a headstart in EV production and spends more on R&D per car than its competitors.

On the other hand, legacy automakers such as Volkswagen are eager to overtake Tesla. As the incumbents, they have decades more experience in building cars and are investing billions of dollars to catch up.

To keep you up to date on this evolving story, we’ve visualized data from the EPA’s 2022 Automotive Trends Report.

Data for the 2021 Model Year

Although it comes from a 2022 report, the comprehensive production data used in this infographic is for the 2021 model year.

The table below breaks out total production by EV and PHEV (plug-in hybrid electric vehicle).

| Manufacturer | EV Production | PHEV Production | Combined Production |

|---|---|---|---|

| GM | 13,000 | 0 | 13,000 |

| Toyota | 0 | 54,000 | 54,000 |

| VW | 37,000 | 9,000 | 46,000 |

| BMW | 2,000 | 22,000 | 25,000 |

| Honda | 0 | 2,000 | 2,000 |

| Tesla | 339,000 | 0 | 339,000 |

| Mazda | 0 | 0 | 0 |

| Hyundai | 8,000 | 2,000 | 10,000 |

| Subaru | 0 | 2,000 | 2,000 |

| Mercedes | 0 | 0 | 0 |

| Stellantis | 0 | 52,000 | 52,000 |

| Kia | 1,000 | 1,000 | 2,000 |

| Nissan | 6,000 | 0 | 6,000 |

| Ford | 32,000 | 5,000 | 37,000 |

| Total* | 438,000 | 149,000 | 588,000 |

*Rounded to nearest 1,000. Numbers may not add up due to rounding. Includes top 14 manufacturers with U.S. footprint

Toyota and Stellantis are the two biggest legacy automakers in this dataset, though it’s worth pointing out that they only produced PHEVs. Toyota’s first EV, the bZ4X, isn’t slated for release until 2023.

Stellantis appears to be even further behind, though the company has plenty of untapped potential with brands like Jeep and Ram. In a recent interview, Stellantis CEO Carlos Tavares revealed that the company has set aside $36 billion for electrification and software.

Legacy Brands with the Most Momentum

When it comes to building EVs, some legacy brands have moved quicker than others.

Among these legacy brands is Volkswagen, which has made a major commitment to EVs in the fallout of its Dieselgate scandal. The group aims to produce 22 million EVs by 2028, and is rolling out various models including the ID.3 hatchback, the ID.4 SUV, and the ID. Buzz (an electric revival of the classic Microbus).

Ford is also showing good pace, announcing $22 billion in EV investment between 2021 and 2025. The brand produced its 150,000th Mustang Mach-E in Nov. 2022, and is aiming to build 270,000 of them in 2023 alone.

Ford’s highly anticipated F-150 Lightning has also received over 200,000 reservations. Production of the Lightning is expected to be 15,000 in 2022, 55,000 in 2023, and 80,000 in 2024. Rivian, Ford’s primary rival in the electric pickup truck segment, is on track to reach 25,000 vehicles in 2022.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium5 days ago

Lithium5 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue