Energy

The Critical Ingredients Needed to Fuel the Battery Boom

The Battery Series

Part 4: Critical Ingredients Needed to Fuel the Battery Boom

The Battery Series is a five-part infographic series that explores what investors need to know about modern battery technology, including raw material supply, demand, and future applications.

Presented by: Nevada Energy Metals, eCobalt Solutions Inc., and Great Lakes Graphite

The Critical Ingredients Needed to Fuel the Battery Boom

We’ve already looked at the evolution of battery technology and how lithium-ion technology will dominate battery market share over the coming years. Part 4 of the Battery Series breaks down the raw materials that will be needed for this battery boom.

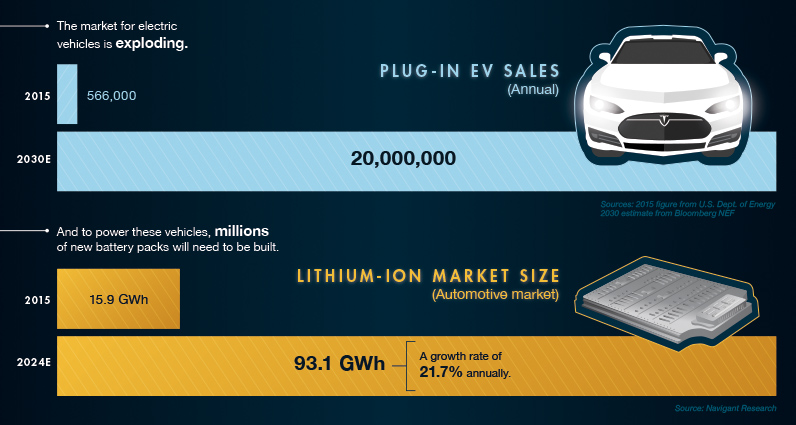

Batteries are more powerful and reliable than ever, and costs have come down dramatically over years. As a result, the market for electric vehicles is expected to explode to 20 million plug-in EV sales per year by 2030.

To power these vehicles, millions of new battery packs will need to be built. The lithium-ion battery market is expected to grow at a 21.7% rate annually in terms of the actual energy capacity required. It was 15.9 GWh in 2015, but will be a whopping 93.1 GWh by 2024.

Dissecting the Lithium-Ion

While there are many exciting battery technologies out there, we will focus on the innards of lithium-ion batteries as they are expected to make up the vast majority of the total rechargeable battery market for the near future.

Each lithium-ion cell contains three major parts:

1) Anode (natural or synthetic graphite)

2) Electrolyte (lithium salts

3) Cathode (differing formulations)

While the anode and electrolytes are pretty straightforward as far as lithium-ion technology goes, it is the cathode where most developments are being made.

Lithium isn’t the only metal that goes into the cathode – other metals like cobalt, manganese, aluminum, and nickel are also used in different formulations. Here’s four cathode chemistries, the metal proportions (excluding lithium), and an example of what they are used for:

| Cathode Type | Chemistry | Example Metal Portions | Example Use |

|---|---|---|---|

| NCA | LiNiCoAlO2 | 80% Nickel, 15% Cobalt, 5% Aluminum | Tesla Model S |

| LCO | LiCoO2 | 100% Cobalt | Apple iPhone |

| LMO | LiMn2O4 | 100% Manganese | Nissan Leaf |

| NMC | LiNiMnCoO2 | Nickel 33.3%, Manganese 33.3%, Cobalt 33.3% | Tesla Powerwall |

| LFP | LiFePO4 | 100% Iron | Starter batteries |

While manganese and aluminum are important for lithium-ion cathodes, they are also cheaper metals with giant markets. This makes them fairly easy to procure for battery manufacturers.

Lithium, graphite, and cobalt, are all much smaller and less-established markets – and each has supply concerns that remain unanswered:

- South America: The countries in the “Lithium Triangle” host a whopping 75% of the world’s lithium resources: Argentina, Chile, and Bolivia.

- China: 65% of flake graphite is mined in China. With poor environmental and labor practices, China’s graphite industry has been under particular scrutiny – and some mines have even been shut down.

- Indonesia: Price swings of nickel can impact battery makers. In 2014, Indonesia banned exports of nickel, which caused the price to soar nearly 50%.

- DRC: 65% of all cobalt production comes from the DRC, a country that is extremely politically unstable with deeply-rooted corruption.

- North America: Yet, companies such as Tesla have stated that they want to source 100% of raw materials sustainably and ethically from North America. The problem? Only nickel sees significant supply come from the continent.

Cobalt hasn’t been mined in the United States for 40 years, and the country produced zero tonnes of graphite in 2015. There is one lithium operation near the Tesla Gigafactory 1 site but it only produces 1,000 tonnes of lithium hydroxide per year. That’s not nearly enough to fuel a battery boom of this size.

To meet its goal of a 100% North American raw materials supply chain, Tesla needs new resources to be discovered and extracted from the U.S., Canada, or Mexico.

Raw Material Demand

While all sorts of supply questions exist for these energy metals, the demand situation is much more straightforward.

Consumers are demanding more batteries, and each battery is made up of raw materials like cobalt, graphite, and lithium.

Cobalt:

Today, about 40% of cobalt is used to make rechargeable batteries. By 2019, it’s expected that 55% of total cobalt demand will go to the cause.

In fact, many analysts see an upcoming bull market in cobalt.

- Battery demand is rising fast

- Production is being cut from the Congo

- A supply deficit is starting to emerge

“In many ways, the cobalt industry has the most fragile supply structure of all battery raw materials.” – Andrew Miller, Benchmark Mineral Intelligence

Graphite:

There is 54kg of graphite in every battery anode of a Tesla Model S (85kWh).

Benchmark Mineral Intelligence forecasts that the battery anode market for graphite (natural and synthetic) will at least triple in size from 80,000 tonnes in 2015 to at least 250,000 tonnes by the end of 2020.

Lithium:

Goldman Sachs estimates that a Tesla Model S with a 70kWh battery uses 63 kilograms of lithium carbonate equivalent (LCE) – more than the amount of lithium in 10,000 cell phones.

Further, for every 1% increase in battery electric vehicle (BEV) market penetration, there is an increase in lithium demand by around 70,000 tonnes LCE/year.

Lithium prices have recently spiked, but they may begin sliding in 2019 if more supply comes online.

The Future of Battery Tech

Sourcing the raw materials for lithium-ion batteries will be critical for our energy mix.

But, the future is also bright for many other battery technologies that could help in solving our most pressing energy issues.

Part 5 of The Battery Series will look at the newest technologies in the battery sector.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium5 days ago

Lithium5 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees