Energy

Visualizing U.S. Energy Consumption in One Chart

Visualizing U.S. Energy Consumption in One Chart

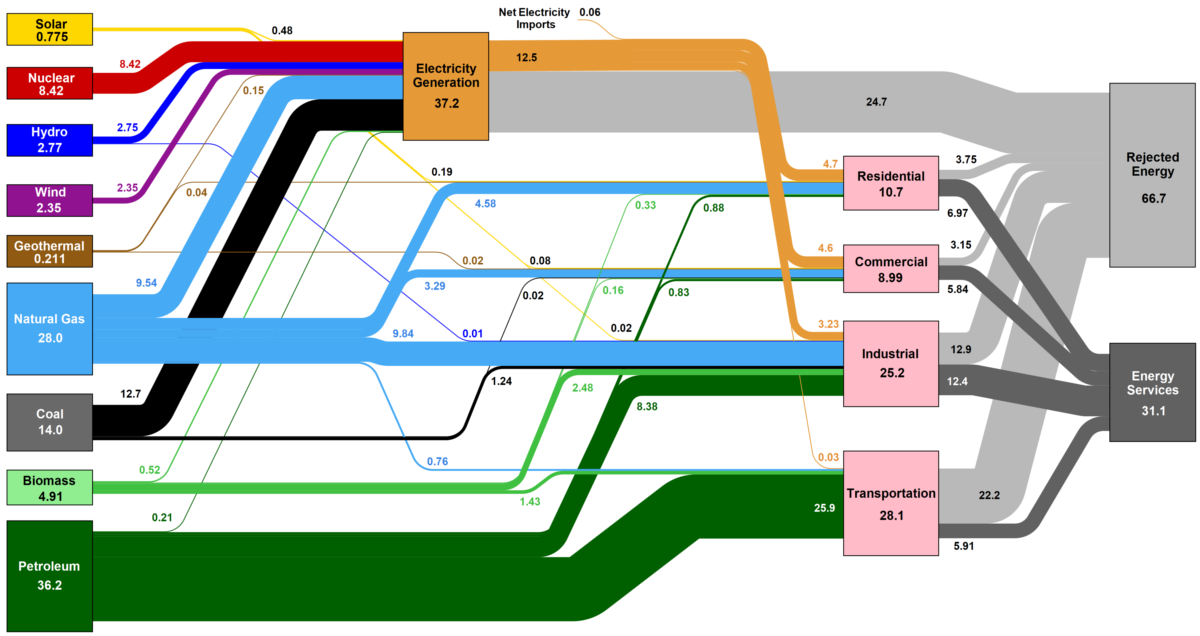

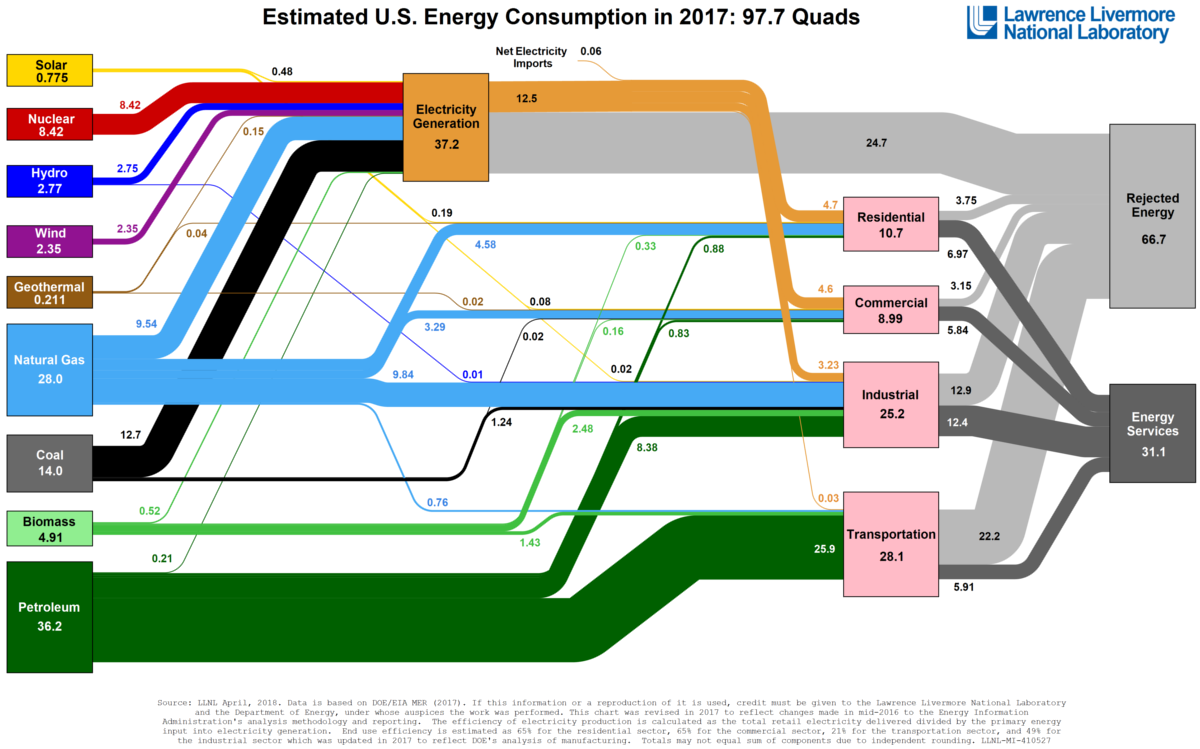

Every year, the Lawrence Livermore National Laboratory, a federal research facility funded by the Department of Energy and UC Berkeley, puts out a fascinating Sankey diagram that shows the fate of all energy that gets generated and consumed in the United States in a given year.

Today’s visualization is the summary of energy consumption for 2017, but you can see previous years going all the way back to 2010 on their website.

Dealing in Quads

The first thing you’ll notice about this Sankey is that it uses an unfamiliar unit of measurement: the quad.

Each quad is equal to a quadrillion BTUs, and it’s roughly comparable to the following:

- 8,007,000,000 gallons (US) of gasoline

- 293,071,000,000 kilowatt-hours (kWh)

- 36,000,000 tonnes of coal

- 970,434,000,000 cubic feet of natural gas

- 25,200,000 tonnes of oil

- 252,000,000 tonnes of TNT

- 13.3 tonnes of uranium-235

Put another way, a quad is a massive unit that only is useful in measuring something like national energy consumption – and in this case, the total amount of energy used by the country was 97.7 quadrillion BTUs.

Energy Wasted

On the diagram, one thing that is immediately noticeable is that a whopping 68% of all energy is actually rejected energy, or energy that gets wasted through various inefficiencies.

It’s quite eye-opening to look at this data sorted by sector:

| Sector | End-Use Efficiency | Rejected Energy (Quads) |

|---|---|---|

| Residential | 65% | 3.75 |

| Commercial | 65% | 3.15 |

| Industrial | 49% | 12.9 |

| Transportation | 21% | 22.2 |

The transportation sector used 28.1 quads of energy in 2017, about 28.8% of the total consumption. However, it wasted 22.2 quads of that energy with its poor efficiency rate, which made for more rejected energy than the other three sectors combined.

This wastage and inefficiency in the transportation sector provides an interesting lens from which to view the green energy revolution, and it also helps explain the vision that Elon Musk has for the future of Tesla.

A Ways to Go

The last time we posted a version of this visualization was for the 2015 edition of the diagram, and we noted that renewables had a ways to go as a factor in the whole energy mix.

Here are how things have changed over the last two years:

| Energy | 2015 (Quads) | 2017 (Quads) | 2-yr change |

|---|---|---|---|

| Petroleum | 35.4 | 36.2 | 2.3% |

| Natural Gas | 28.3 | 28.0 | -1.1% |

| Coal | 15.7 | 14.0 | -10.8% |

| Nuclear | 8.34 | 8.42 | 1.0% |

| Biomass | 4.72 | 4.91 | 4.0% |

| Hydro | 2.39 | 2.77 | 15.9% |

| Wind | 1.82 | 2.35 | 29.1% |

| Solar | 0.532 | 0.775 | 45.7% |

| Geothermal | 0.224 | 0.211 | -5.8% |

As you can see, solar and wind consumption are jumping considerably – but in absolute terms, our note from two years ago still remains true.

To make the desired impact, renewable energy still has a ways to go.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium5 days ago

Lithium5 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023