Economy

Visualizing China’s $18 Trillion Economy in One Chart

Visualizing China’s $18 Trillion Economy in 2021

China is the world’s second largest economy after the U.S., and it is expected to eventually climb into the number one position in the coming decades.

While China’s economy has had a much rockier start this year due to zero-tolerance COVID-19 lockdowns and supply chain issues, our visualization covers a full year of data for 2021—a year in which most economies recovered after the initial chaos of the pandemic.

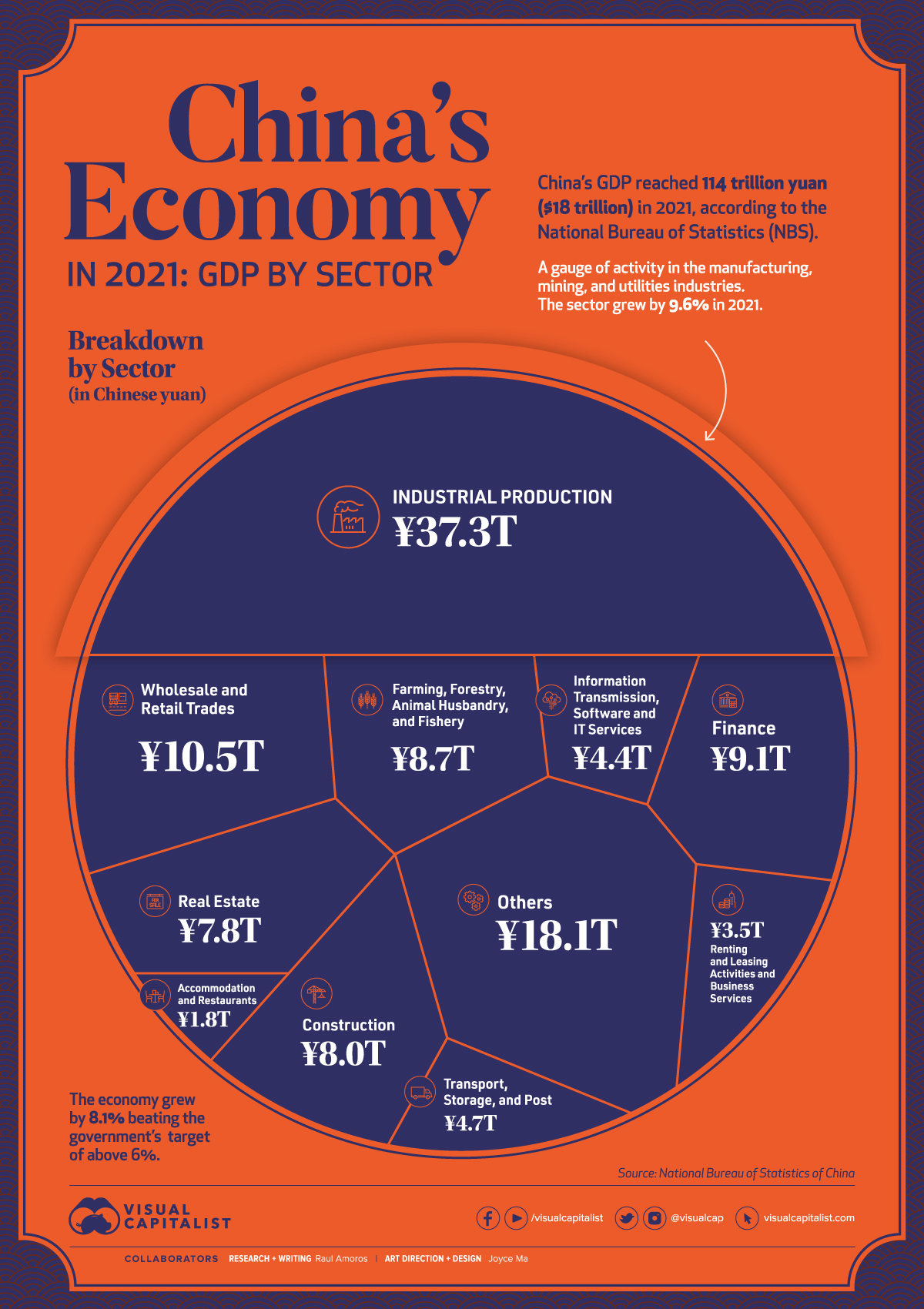

In 2021, China’s Gross Domestic Product (GDP) reached ¥114 trillion ($18 trillion in USD), according to the National Bureau of Statistics. The country’s economy outperformed government targets of 6% growth, with the overall economy growing by 8.1%.

Let’s take a look at what powers China’s modern economy.

Breaking Down China’s Economy By Sector

| Sector | 2021 Total GDP (Yuan) | 2021 Total GDP (USD) | % Share |

|---|---|---|---|

| Industry | ¥37.3T | $5.9T | 32.6% |

| Wholesale and Retail Trades | ¥10.5T | $1.7T | 9.2% |

| Finance | ¥9.1T | $1.4T | 8.0% |

| Farming, Forestry, Animal Husbandry, and Fishery | ¥8.7T | $1.4T | 7.6% |

| Construction | ¥8.0T | $1.3T | 7.0% |

| Real Estate | ¥7.8T | $1.2T | 6.9% |

| Transport, Storage, and Post | ¥4.7T | $0.7T | 4.1% |

| Information Transmission, Software and IT Services | ¥4.4T | $0.7T | 3.9% |

| Renting & Leasing Activities and Business Services | ¥3.5T | $0.6T | 3.1% |

| Accommodation and Restaurants | ¥1.8T | $0.3T | 1.6% |

| Others | ¥18.1T | $2.8T | 15.9% |

| Total | ¥114T | ¥18T | 100.0% |

Industrial production—activity in the manufacturing, mining, and utilities sectors—is by far the leading driver of China’s economy. In 2021, the sector generated ¥37.3 trillion, or one-third of the country’s total economic activity.

Despite a slowdown in December, wholesale and retail trades also performed strongly in 2021. As the main gauge of consumption, it was affected by lockdown measures and the spread of the COVID-19 Omicron variant towards the end of the year, but still rose by double digits, reaching a total of ¥10.5 trillion*.

“Other services”, which includes everything from scientific research and development to education and social services, generated 16% of China’s total economy in 2021, or ¥18.1 trillion.

*Editor’s note: At time of publishing, China’s government seems to have since adjusted this number to ¥11.0 trillion, which is not consistent with the original data set provided, but worth noting.

Where is China’s GDP Headed?

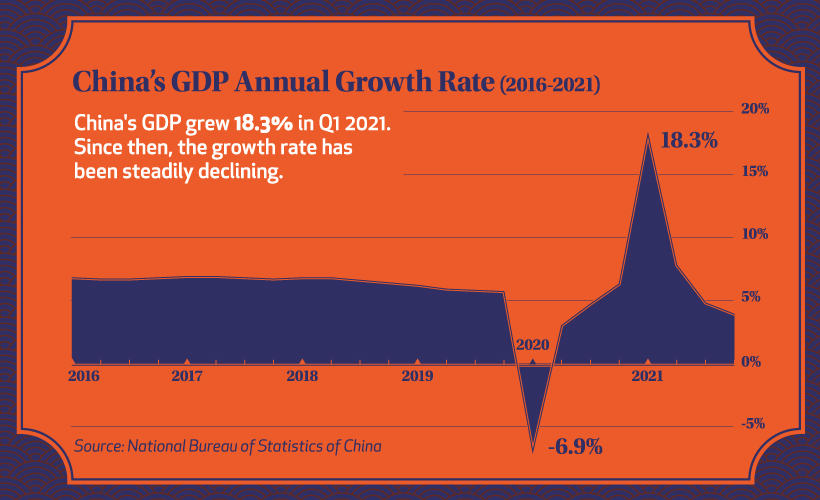

China’s economy recovered noticeably faster than most major economies last year, and as the overall trend below shows, the country has grown consistently in the years prior.

Before the pandemic hit, China’s quarterly GDP growth had been quite stable at just above 5%.

After the initial onset of COVID-19, the country’s economy faltered, mirroring economies around the globe. But after a strong recovery into 2021, resurging cases caused a new series of crackdowns on the private sector, slowing down GDP growth considerably.

With the slowdown continuing into early 2022, China’s economic horizon still looks uncertain. The lockdown in Shanghai is expected to continue all the way to June 1st, and over recent months there have been hundreds of ships stuck outside of Shanghai’s port as a part of ongoing supply chain challenges.

China’s Zero-COVID Policy: Good or Bad for the Economy?

While every country reacted to the COVID-19 pandemic differently, China adopted a zero-COVID policy of strict lockdowns to control cases and outbreaks.

For most of 2021, the policy didn’t deter GDP growth. Despite some major cities fully or partially locked down to control regional outbreaks, the country’s economy still paced well ahead of many other major economies.

But the policy faced a challenge with the emergence of the Omicron variant. Despite lockdowns and an 88% vaccination rate nationally, seven out of China’s 31 provinces and all of the biggest cities have reported Omicron cases.

And China’s zero-COVID policy has not affected all sectors equally. Industrial production rose by more than 10% in the first 11 months of 2021, despite city lockdowns around the country. That’s because many factories in China are in suburban industrial parks outside the cities, and employees often live nearby.

But many sectors like hotels and restaurants have been more severely affected by city lockdowns. Many global economies are starting to transition to living with COVID, with China remaining as one of the last countries to follow a zero-COVID policy. Does that ensure the country’s economy will continue to slow in 2022, or will China manage to recover and maintain one of the world’s fastest growing economies?

Politics

Charted: What Southeast Asia Thinks About China & the U.S.

A significant share of respondents from an ASEAN-focused survey are not happy about rising American and Chinese influence in the region.

What Southeast Asia Thinks About China & the U.S.

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

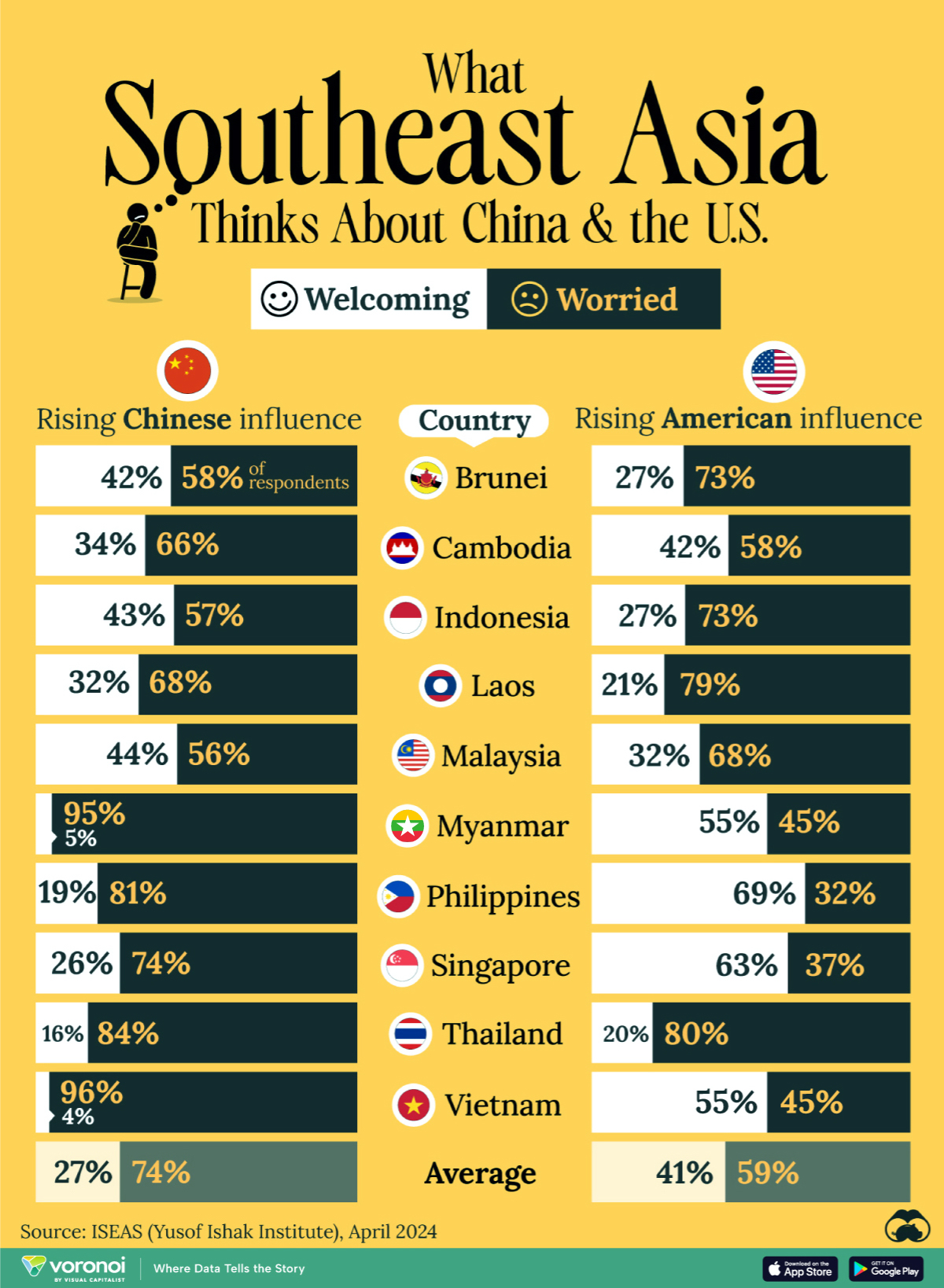

This chart visualizes the results of a 2024 survey conducted by the ASEAN Studies Centre at the ISEAS-Yusof Ishak Institute. Nearly 2,000 respondents were asked if they were worried or welcoming of rising Chinese and American geopolitical influence in their country.

The countries surveyed all belong to the Association of Southeast Asian Nations (ASEAN), a political and economic union of 10 states in Southeast Asia.

Feelings Towards China

On average, a significant share of respondents from all 10 countries are worried about rising influence from both the U.S. and China.

However, overall skepticism is higher for China, at 74% (versus 59% for U.S.).

| Country | Worried About Growing 🇨🇳 Influence | Welcome Growing 🇨🇳 Influence |

|---|---|---|

| 🇧🇳 Brunei | 58% | 42% |

| 🇰🇭 Cambodia | 66% | 34% |

| 🇮🇩 Indonesia | 57% | 43% |

| 🇱🇦 Laos | 68% | 32% |

| 🇲🇾 Malaysia | 56% | 44% |

| 🇲🇲 Myanmar | 95% | 5% |

| 🇵🇭 Philippines | 81% | 19% |

| 🇸🇬 Singapore | 74% | 26% |

| 🇹🇭 Thailand | 84% | 16% |

| 🇻🇳 Vietnam | 96% | 4% |

| Average | 74% | 27% |

The recently-cooled but still active territorial concerns over the South China Sea may play a significant role in these responses, especially in countries which are also claimants over the sea.

For example, in Vietnam over 95% of respondents said they were worried about China’s growing influence.

Feelings Towards America

Conversely, rising American influence is welcomed in two countries with competing claims in the South China Sea, the Philippines (69%) and Vietnam (55%).

| Country | Worried About Growing 🇺🇸 Influence | Welcome Growing 🇺🇸 Influence |

|---|---|---|

| 🇧🇳 Brunei | 73% | 27% |

| 🇰🇭 Cambodia | 58% | 42% |

| 🇮🇩 Indonesia | 73% | 27% |

| 🇱🇦 Laos | 79% | 21% |

| 🇲🇾 Malaysia | 68% | 32% |

| 🇲🇲 Myanmar | 45% | 55% |

| 🇵🇭 Philippines | 32% | 69% |

| 🇸🇬 Singapore | 37% | 63% |

| 🇹🇭 Thailand | 80% | 20% |

| 🇻🇳 Vietnam | 45% | 55% |

| Average | 59% | 41% |

Despite this, on a regional average, more respondents worry about growing American influence (59%) than they welcome it (41%).

Interestingly, it seems almost every ASEAN nation has a clear preference for one superpower over the other.

The only exception is Thailand, where those surveyed were not a fan of either option, with 84% worried about China, and 80% worried about the U.S.

-

Culture6 days ago

Culture6 days agoThe World’s Top Media Franchises by All-Time Revenue

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands2 weeks ago

Brands2 weeks agoHow Tech Logos Have Evolved Over Time

-

Energy2 weeks ago

Energy2 weeks agoRanked: The Top 10 EV Battery Manufacturers in 2023

-

Countries2 weeks ago

Countries2 weeks agoCountries With the Largest Happiness Gains Since 2010

-

Economy2 weeks ago

Economy2 weeks agoVC+: Get Our Key Takeaways From the IMF’s World Economic Outlook

-

Demographics1 week ago

Demographics1 week agoThe Countries That Have Become Sadder Since 2010

-

Money1 week ago

Money1 week agoCharted: Who Has Savings in This Economy?