Politics

Explained by Graphics: Tension in the South China Sea

Explained by Graphics: Tension in the South China Sea

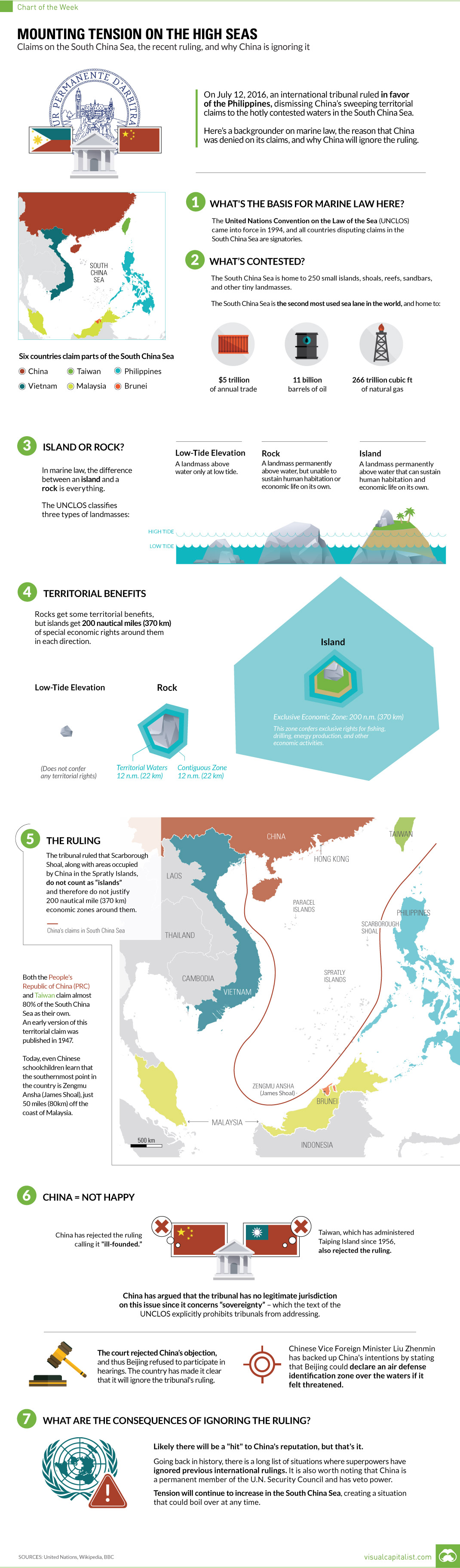

Claims on the South China Sea, the recent ruling, and why China is ignoring it

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Tension in the South China Sea reached a potential inflection point this week.

Days ago, an international tribunal ruled in favor of the Philippines, dismissing China’s sweeping territorial claims to the hotly contested waters in the South China Sea.

Since then, it has become clear that China plans to ignore the ruling, while Chinese Vice-Foreign Minister Liu Zhenmin has threatened to declare an air defense identification zone over the waters to help protect the country’s interests.

But how did we get to this point? How was this ruling determined, and what does it mean moving forwards?

Why the South China Sea matters

The South China Sea is home to 250 small islands, shoals, reefs, sandbars, and other tiny landmasses.

The South China Sea is the second most used sea lane in the world, and home to:

- $5 trillion of annual trade

- 11 billion barrels of oil

- 266 trillion cubic ft of natural gas

Six countries claim parts of the South China Sea as their own: China, Taiwan, Philippines, Vietnam, Malaysia, and Brunei.

However, China has the boldest claim, insisting that over 80% of the sea is their territory based on historical maps.

Island or Rock?

The ruling in the Philippines vs. China hearing is based on the provisions of the United Nations Convention on the Law of the Sea (UNCLOS), which came into force in 1994. All countries disputing claims in the South China Sea are signatories.

UNCLOS defines three types of landmasses, and whether something is a “rock” or an “island” has huge implications for territorial claims.

- Low-tide elevation: A landmass above water only at low tide.

- Rock: A landmass permanently above water, but unable to sustain human habitation or economic life on its own.

- Island: A landmass permanently above water that can sustain human habitation and economic life on its own.

Rocks get some territorial benefits, but islands get 200 nautical miles (370 km) of special economic rights around them in each direction.

- Low-tide elevation: Not entitled to any separate maritime zone.

- Rock: Entitled to territorial sea and contiguous zone. Each are up to 12 nautical miles (22 km) from base line.

- Island: Entitled to territorial sea and contiguous zone, but also entitled to an exclusive economic zone of 200 nautical miles (370 km), and continental shelf rights.

The economic zone confers rights for fishing, drilling, energy production, and other economic activities.

The Ruling

The tribunal ruled that Scarborough Shoal, along with areas occupied by China in the Spratly Islands do not count as “islands”, and therefore do not justify 200 nautical mile (370 km) economic zones around them.

China has rejected the ruling calling it “ill-founded”. Taiwan, which has administered Taiping Island since 1956, also rejected the ruling.

China has argued that the tribunal has no legitimate jurisdiction on this issue since it concerns “sovereignty” – which the text of the UNCLOS explicitly prohibits tribunals from addressing.

What are the consequences?

If China continues to ignore the ruling, likely there will be a “hit” to China’s reputation, but that’s it.

Going back in history, there is a long list of situations where superpowers have ignored international rulings. It is also worth noting that China is a permanent member of the U.N. Security Council and has veto power.

Tension will continue to increase in the South China Sea, creating a situation that could boil over at any time.

War

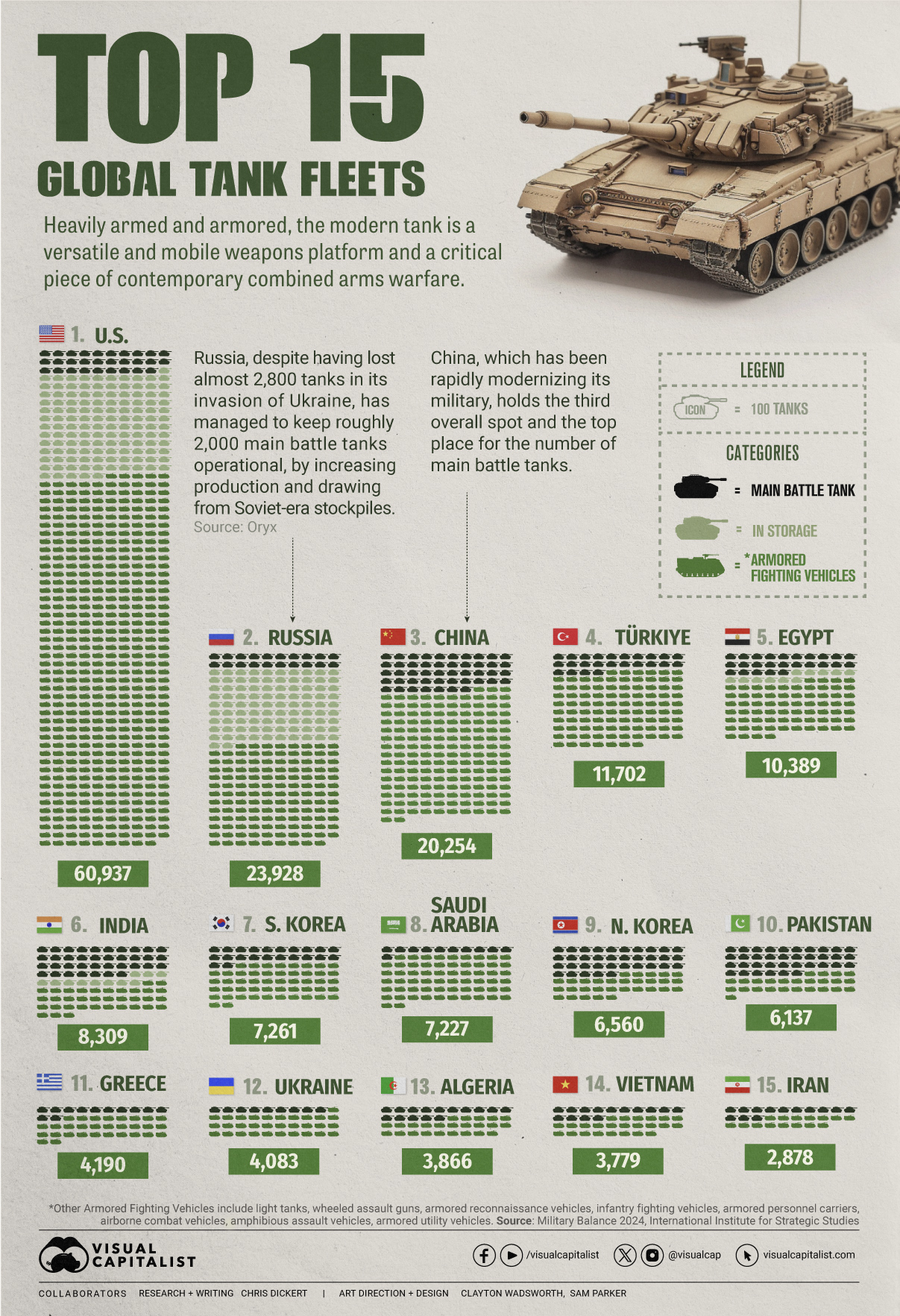

Visualized: Top 15 Global Tank Fleets

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

The Top 15 Global Tank Fleets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

This visualization shows the top 15 global tank fleets, using data from the 2024 Military Balance report from the International Institute for Strategic Studies (IISS).

Let’s take an in-depth look at the top three fleets:

1. United States

As the world’s pre-eminent military power, it’s perhaps no surprise that the United States also has the largest tank fleet, by a wide margin.

In total, they have just over 45,000 armored fighting vehicles in operation, along with 2,640 main battle tanks (MBTs), and 12,800 vehicles in storage, of which 2,000 are main battle tanks.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 2,640 | 4 |

| Armored reconnaissance | 1,745 | 1 |

| Infantry fighting vehicles | 3,262 | 3 |

| Armored personnel carriers | 10,644 | 1 |

| Amphibious assault vehicles | 1,401 | 1 |

| Armored utility vehicles | 28,445 | 1 |

| Storage | 12,800 | 1 |

| Total | 60,937 | 1 |

The U.S. is internalizing the lessons from the ongoing invasion of Ukraine, where Western-supplied anti-tank weapons and massed Ukrainian artillery have been cutting Russian tanks to pieces. As a result, the U.S. recently canceled an upgrade of the M1 Abrams in favor of a more ambitious upgrade.

Meanwhile, the U.S. is nervously eyeing a more confident China and a potential clash over Taiwan, where air and naval forces will be critical. However, a recent war game showed that Taiwanese mechanized ground forces, kitted out with American-made tanks and armored fighting vehicles, were critical in keeping the island autonomous.

2. Russia

According to Oryx, a Dutch open-source intelligence defense website, at time of writing, Russia has lost almost 2,800 main battle tanks since invading Ukraine. Considering that in the 2022 edition of the Military Balance, Russia was estimated to have 2,927 MBTs in operation, those are some hefty losses.

Russia has been able to maintain about 2,000 MBTs in the field, in part, by increasing domestic production. Many defense plants have been taken over by state-owned Rostec and now operate around the clock. Russia is also now spending a full third of their budget on defense, equivalent to about 7.5% of GDP.

At the same time, they’ve also been drawing down their Soviet-era stockpiles, which are modernized before being sent to the front. Just how long they can keep this up is an open question; their stockpiles are large, but not limitless. Here is what their storage levels look like:

| Category | 2023 | 2024 | YOY change |

|---|---|---|---|

| Main battle tanks | 5,000 | 4,000 | -20.0% |

| Armored reconnaissance | 1,000 | 100 | -90.0% |

| Infantry fighting vehicles | 4,000 | 2,800 | -30.0% |

| Armored personnel carriers | 6,000 | 2,300 | -61.7% |

| Total | 16,000 | 9,200 | -42.5% |

3. China

China holds the third overall spot and top place globally for the number of main battle tanks in operation. Untypically, the People’s Liberation Army has no armored vehicles in storage, which perhaps isn’t surprising when you consider that China has been rapidly modernizing its military and that stockpiles usually contain older models.

China also has one of the world’s largest fleets of armored fighting vehicles, second only to the United States. Breaking down that headline number, we can also see that they have the largest number of light tanks, wheeled guns, and infantry fighting vehicles.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 4,700 | 1 |

| Light tanks | 1,330 | 1 |

| Wheeled guns | 1,250 | 1 |

| Infantry fighting vehicles | 8,200 | 1 |

| Armored personnel carriers | 3,604 | 5 |

| Airborne combat vehicles | 180 | 2 |

| Amphibious assault vehicles | 990 | 2 |

| Total | 20,254 | 3 |

This is equipment that would be integral if China were to make an attempt to reunify Taiwan with the mainland by force, where lightly armored mechanized units need to move with speed to occupy the island before Western allies can enter the fray. It’s worth noting that China also has one of the world’s largest fleets of amphibious assault vehicles.

End of the Tank?

Many commentators at the outset of Russia’s invasion of Ukraine, were quick to predict the end of the tank, however, to paraphrase Mark Twain, reports of the tank’s demise are greatly exaggerated.

With the U.S. and China both developing remote and autonomous armored vehicles, tanks could be quite different in the future, but there is nothing else that matches them for firepower, mobility, and survivability on the modern battlefield today.

-

Markets1 week ago

Markets1 week agoRanked: The Largest U.S. Corporations by Number of Employees

-

Green3 weeks ago

Green3 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Automotive2 weeks ago

Automotive2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

AI2 weeks ago

AI2 weeks agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Markets2 weeks ago

Markets2 weeks agoCharted: Big Four Market Share by S&P 500 Audits

-

Real Estate2 weeks ago

Real Estate2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?