Space

Visualized: The Race to Invest in the Space Economy

Visualized: The Race to Invest in the Space Economy

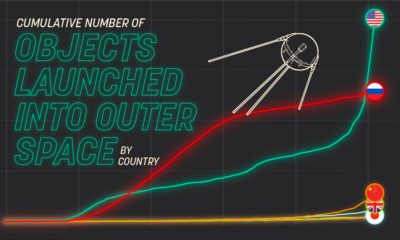

Humans have long viewed outer space as the final frontier.

Our thirst for exploration has brought whole nations together to create more advanced technologies─all in the pursuit of discovering the outer reaches of the universe.

Today’s infographic from ProcureAM highlights the exciting journey humans have taken into outer space, and the economic boom across industries as a result of this quest for discovery.

With an ever-expanding universe, how far have we gone?

Our Connection with Outer Space

Humans have been fascinated with space for millennia, using the planets and stars to navigate, keep time, and discover scientific facts about the universe.

Since the 1960s, humans have also been traveling into space and pushing the limits of our technological and physical boundaries with each excursion.

A Brief History: Humans in Space

- 1957 ─ First satellite launched: Sputnik1

- 1961 ─ First human in space: Yuri Gagarin

- 1965 ─ First human spacewalk: Aleksei Leonov

- 1969 ─ First human on the Moon: Neil Armstrong

- 1984 ─ First untethered spacewalk: Bruce McCandless

- 1998 ─ First modules launch to begin construction of the International Space Station

Nations around the world have used these trips and technological milestones to drastically improve life.

Reusable rockets and advanced satellite technology enable greater innovation on Earth through higher-quality broadband internet, 5G cellular networks, and the Internet of Things (IoT) connected devices.

The Space Economy is Ready for Lift-off

Three major sectors are dominating the global space economy today:

- Products and Services

This sector drives the majority of commercial activity in the space industry. These products and services meet specific needs in telecommunications, location-based services, and monitoring and observation. - Infrastructure

Production of space vehicles such as rockets and rovers, ground and space stations, and receivers such as satellites, receivers, and terminals for internet and TV are also booming. As the global population grows, our need to stay connected to each other evolves. - Government

Most modern government space agencies are actively monitoring and tracking space to offer better resources and services for their citizens, including geopolitical monitoring and missile tracking.

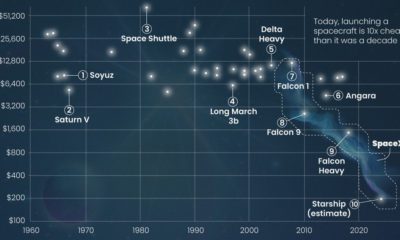

Can lower costs, new technology, and increased commercial activity make space the next trillion-dollar industry?

The Next Frontier: Investing in Space

Investments in space-related industries have shot up in recent years, rising from US$1.1 billion in 2000-2005 up to $10.2 billion between 2012-2018.

This meteoric growth is due to fewer barriers in the space industry, which was previously restricted to governments or the ultra-wealthy. Private sector companies are responsible for much of the growth. Since 2000, Goldman Sachs estimates that $13.3 billion has been invested into newly launched space startups.

These companies, backed by titans such as Jeff Bezos and Elon Musk, are pledging to support innovations from the practical to the fantastical, to boldly go where none have gone before:

- SpaceX ─ powerful satellite Internet service

- Deep Space Industries and Planetary Resources ─ first commercial mines in space

- DoubleTree Hilton ─ first company to bake cookies in space

- Blue Origin ─ deep-space exploration

And with recent technological advancements, these goals are edging closer to reality.

For example, take space tourism. While costs are still astronomical, Blue Origin and Virgin Atlantic are banking on the idea of the first space vacations taking place as early as 2020─and growing in popularity from there.

- Dennis Tito paid $20 million to become the first space tourist in 2001

- Prepaid tickets for 90-min suborbital flights in 2020 with Virgin Galactic are going for $250,000

The Future of the Space Economy

Advances in satellite and rocket technology mean that costs are declining across the entire commercial space economy.

Because of this, the global space industry may jump light years ahead in the next few decades.

For the first time since our journey to the stars began, the final frontier is well within our grasp.

Space

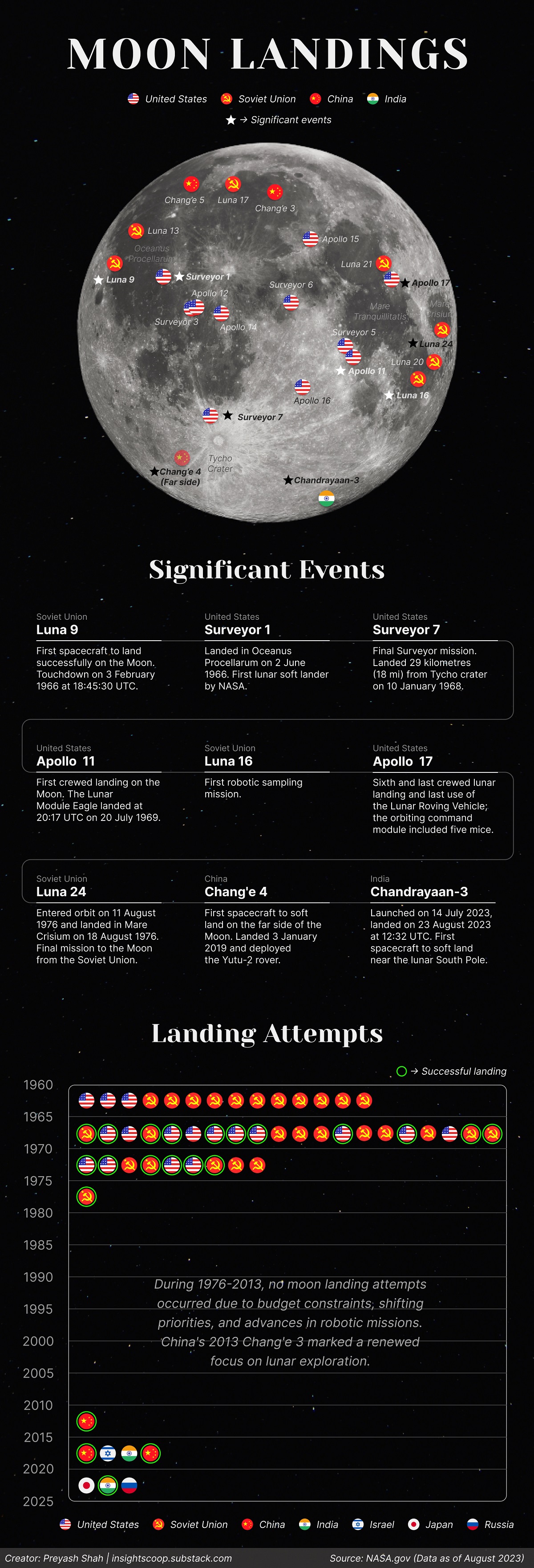

Visualizing All Attempted and Successful Moon Landings

Since the beginning of the space race, only four countries have successfully accomplished missions to the moon.

Visualizing All Attempted and Successful Moon Landings

Since before Ancient Greece and the first Chinese Dynasties, people have sought to understand and learn more about the moon.

Curiosity and centuries of study culminated in the first moon landing in the 1960s. But there have been many other attempted moon landings, both before and after.

This chart by Preyash Shah illustrates all the moon landings using NASA data since 1966 when Soviet lander Luna 9 touched down.

Race to the Moon

The 1960s and 1970s marked an era of intense competition between the U.S. and the Soviet Union as they raced to conquer the moon.

During the Cold War, space became a priority as each side sought to prove the superiority of its technology, its military firepower, and its political-economic system.

In 1961, President John F. Kennedy set a national goal to have a crewed lunar landing and return to Earth.

After several failed attempts from both sides, on July 20, 1969, the Apollo 11 mission was successful and astronauts Neil Armstrong and Buzz Aldrin became the first humans to set foot on the moon.

| Mission | Launch Date | Operator | Country | Mission Type | Outcome |

|---|---|---|---|---|---|

| Ranger 3 | 26-Jan-62 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Ranger 4 | 23-Apr-62 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Ranger 5 | 18-Oct-62 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Luna E-6 No.2 | 4-Jan-63 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Luna E-6 No.3 | 3-Feb-63 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Luna 4 | 2-Apr-63 | OKB-1 | ☭ USSR | Lander | Spacecraft failure |

| Luna E-6 No.6 | 21-Mar-64 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Luna E-6 No.5 | 20-Apr-64 | OKB-1 | ☭ USSR | Lander | Launch failure |

| Kosmos 60 | 12-Mar-65 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna E-6 No.8 | 10-Apr-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 5 | 9-May-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 6 | 8-Jun-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 7 | 4-Oct-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 8 | 3-Dec-65 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 9 | 31-Jan-66 | Lavochkin | ☭ USSR | Lander | Successful |

| Surveyor 1 | 30-May-66 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 2 | 20-Sep-66 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Luna 13 | 21-Dec-66 | Lavochkin | ☭ USSR | Lander | Successful |

| Surveyor 3 | 17-Apr-67 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 4 | 14-Jul-67 | NASA | 🇺🇸 U.S. | Lander | Spacecraft failure |

| Surveyor 5 | 8-Sep-67 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 6 | 7-Nov-67 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Surveyor 7 | 7-Jan-68 | NASA | 🇺🇸 U.S. | Lander | Successful |

| Luna E-8 No.201 | 19-Feb-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna E-8-5 No.402 | 14-Jun-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna 15 | 13-Jul-69 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Apollo 11 | 16-Jul-69 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Kosmos 300 | 23-Sep-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Kosmos 305 | 22-Oct-69 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Apollo 12 | 14-Nov-69 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Luna E-8-5 No.405 | 6-Feb-70 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Apollo 13 | 11-Apr-70 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Partial failure |

| Luna 16 | 12-Sep-70 | Lavochkin | ☭ USSR | Lander | Successful |

| Luna 17 | 10-Nov-70 | Lavochkin | ☭ USSR | Lander | Successful |

| Apollo 14 | 31-Jan-71 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Apollo 15 | 26-Jul-71 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Luna 18 | 2-Sep-71 | Lavochkin | ☭ USSR | Lander | Spacecraft failure |

| Luna 20 | 14-Feb-72 | Lavochkin | ☭ USSR | Lander | Successful |

| Apollo 16 | 16-Apr-72 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Apollo 17 | 7-Dec-72 | NASA | 🇺🇸 U.S. | Lander/ Launch Vehicle | Successful |

| Luna 21 | 8-Jan-73 | Lavochkin | ☭ USSR | Lander | Successful |

| Luna 23 | 16-Oct-75 | Lavochkin | ☭ USSR | Lander | Partial failure |

| Luna E-8-5M No.412 | 16-Oct-75 | Lavochkin | ☭ USSR | Lander | Launch failure |

| Luna 24 | 9-Aug-76 | Lavochkin | ☭ USSR | Lander | Successful |

| Chang'e 3 | 1-Dec-13 | CNSA | 🇨🇳 China | Lander | Operational |

| Chang'e 4 | 7-Dec-18 | CNSA | 🇨🇳 China | Lander | Operational |

| Beresheet | 22-Feb-19 | SpaceIL | 🇮🇱 Israel | Lander | Spacecraft failure |

| Chandrayaan-2 | 22-Jul-19 | ISRO | 🇮🇳 India | Lander | Spacecraft Failure |

| Chang'e 5 | 23-Nov-20 | CNSA | 🇨🇳 China | Lander | Successful |

| Hakuto-R Mission 1 | 11-Dec-22 | ispace | 🇯🇵 Japan | Lander | Spacecraft failure |

| Chandrayaan-3 | 14-Jul-23 | ISRO | 🇮🇳 India | Lander | Successful |

| Luna 25 | 10-Aug-23 | Roscosmos | 🇷🇺 Russia | Lander | Spacecraft failure |

After the Apollo missions, the fervor of lunar exploration waned. From 1976 to 2013, no moon landing attempts occurred due to budget constraints, shifting priorities, and advances in robotic missions.

However, a new chapter in space exploration has unfolded in recent years, with emerging players entering the cosmic arena. With its Chang’e missions, China has made significant strides, landing rovers on the moon and exploring the far side of the moon.

India, too, has asserted its presence with the Chandrayaan missions. In 2023, the country became the 4th nation to reach the moon as an unmanned spacecraft landed near the lunar south pole, advancing the country’s space ambitions to learn more about the lunar ice, potentially one of the moon’s most valuable resources.

Exploring Lunar Water

Since the 1960s, even before the historic Apollo landing, scientists had theorized the potential existence of water on the moon.

In 2008, Brown University researchers employed advanced technology to reexamine lunar samples, discovering hydrogen within beads of volcanic glass. And in 2009, a NASA instrument aboard the India’s Chandrayaan-1 probe confirmed the presence of water on the moon’s surface.

Water is deemed crucial for future space exploration. Beyond serving as a potential source of drinking water for future moon explorations, ice deposits could play a pivotal role in cooling equipment. Lunar ice could also be broken down to produce hydrogen for fuel and oxygen for breathing, essential for supporting extended space missions.

With a reinvigorated interest in exploring the moon, manned moon landings are on the horizon once again. In April 2023, NASA conducted tests for the launch of Artemis I, the first American spacecraft to aim for the moon since 1972. The agency aims to send astronauts to the moon around 2025 and build a base camp on the lunar surface.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

Creator Program

Creator Program