Technology

Space Exploration is Taking Off

Space Exploration is Taking Off

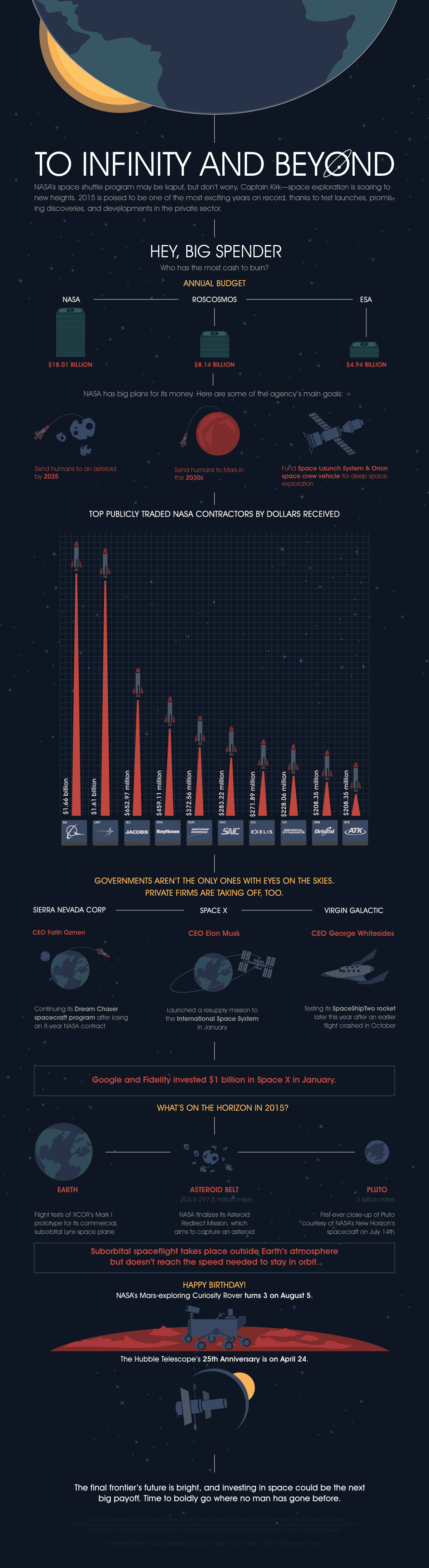

Up until recent years, the momentum associated with space exploration had more or less fizzled. While it would seem that rapid innovation is occurring in every other technology field worldwide, the hardware and business models used in space exploration have remained static aside from small, incremental improvements.

It is mind boggling that the last time humans walked on the moon was over 40 years ago.

However, since the 2010 there have been signs of great ambition in space exploration. We catalogued many of these interesting developments from the private sector just months ago, covering the endeavours of future asteroid miners, Elon Musk, Richard Branson, and many other big names.

This year is set to be one of the more exciting years on record for those interested in the last human frontier. Between SpaceX resupply missions to the ISS and Virgin Galactic test launches, there are also many other interesting events to stay tuned to in 2015.

The first high-res pictures of Pluto will be beamed back to us on July 14th and sometime later this year, NASA plans to finalize its mission to capture an asteroid. XCOR’s Mark I prototype for its commercial, sub-orbital Lynx plane will also be tested.

If all of those happenings are not exciting enough, don’t forget to check out whatever the latest controversy is with Mars One. There may be more to come.

Regardless, it is an exciting time for investors and enthusiasts to think about space exploration. Mankind is aiming to land on asteroids by 2025, visit Mars by 2030, and even fund deep space exploration in the near future.

In the coming decades, asteroids will be harvested for minerals and tourists will fly in space on regularly scheduled spaceflights. That said, finding ways for investors to profit off this last frontier will be the real undertaking.

Original graphic from: Kapitall

Space Wars: The Private Sector Strikes Back

Powering New York

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries