United States

Where are Immigrant Founders of U.S. Unicorns From?

Where are Immigrant Founders of U.S. Unicorns From?

The majority of U.S. unicorns—private startups worth more than $1 billion—have at least one immigrant founder, according to the National Foundation for American Policy (NFAP).

While some of the companies and founders are well known, like SpaceX from South Africa’s Elon Musk, hundreds of lesser-known unicorns have been founded from the top talent of just a handful of countries.

This visual using NFAP data lays out the countries which are home to the most U.S. billion-dollar startup founders as of May 2022.

Note: These rankings are based on unicorn valuations as of May 2022. As valuations regularly fluctuate, some companies may have gained or lost unicorn status since that time.

Countries with the Most U.S. Unicorn Founders

Here’s a look at the countries that these immigrant founders come from.

The 382 founders accounted for below have combined to start 319 of 582 U.S.-based unicorns.

| Rank | Country | # Founders of U.S. Unicorns |

|---|---|---|

| 1 | 🇮🇳 India | 66 |

| 2 | 🇮🇱 Israel | 54 |

| 3 | 🇬🇧 United Kingdom | 27 |

| 4 | 🇨🇦 Canada | 22 |

| 5 | 🇨🇳 China | 21 |

| 6 | 🇫🇷 France | 18 |

| 7 | 🇩🇪 Germany | 15 |

| 8 | 🇷🇺 Russia | 11 |

| 9 | 🇺🇦 Ukraine | 10 |

| 10 | 🇮🇷 Iran | 8 |

| 11 | 🇦🇺 Australia | 7 |

| T12 | 🇮🇹 Italy | 6 |

| T12 | 🇳🇬 Nigeria | 6 |

| T12 | 🇵🇱 Poland | 6 |

| T12 | 🇷🇴 Romania | 6 |

| T16 | 🇦🇷 Argentina | 5 |

| T16 | 🇧🇷 Brazil | 5 |

| T16 | 🇳🇿 New Zealand | 5 |

| T16 | 🇵🇰 Pakistan | 5 |

| T16 | 🇰🇷 South Korea | 5 |

| T21 | 🇩🇰 Denmark | 4 |

| T21 | 🇵🇹 Portugal | 4 |

| T21 | 🇪🇸 Spain | 4 |

| T24 | 🇧🇾 Belarus | 3 |

| T24 | 🇧🇬 Bulgaria | 3 |

| T24 | 🇮🇪 Ireland | 3 |

| T24 | 🇰🇪 Kenya | 3 |

| T24 | 🇱🇧 Lebanon | 3 |

| T24 | 🇵🇭 Philippines | 3 |

| T24 | 🇿🇦 South Africa | 3 |

| T24 | 🇹🇼 Taiwan | 3 |

| T24 | 🇹🇷 Turkey | 3 |

| T33 | 🇦🇲 Armenia | 2 |

| T33 | 🇨🇿 Czech Republic | 2 |

| T33 | 🇬🇷 Greece | 2 |

| T33 | 🇲🇽 Mexico | 2 |

| T33 | 🇸🇦 Saudi Arabia | 2 |

| T33 | 🇸🇬 Singapore | 2 |

| T33 | 🇨🇭 Switzerland | 2 |

| T33 | 🇺🇿 Uzbekistan | 2 |

| T41 | 🇦🇹 Austria | 1 |

| T41 | 🇧🇩 Bangladesh | 1 |

| T41 | 🇧🇧 Barbados | 1 |

| T41 | 🇨🇴 Colombia | 1 |

| T41 | 🇩🇴 Dominican Republic | 1 |

| T41 | 🇪🇬 Egypt | 1 |

| T33 | 🇬🇪 Georgia | 1 |

| T41 | 🇮🇶 Iraq | 1 |

| T41 | 🇯🇴 Jordan | 1 |

| T41 | 🇱🇻 Latvia | 1 |

| T41 | 🇱🇹 Lithuania | 1 |

| T41 | 🇲🇹 Malta | 1 |

| T41 | 🇲🇦 Morocco | 1 |

| T41 | 🇳🇱 Netherlands | 1 |

| T41 | 🇳🇴 Norway | 1 |

| T41 | 🇵🇪 Peru | 1 |

| T41 | 🇶🇦 Qatar | 1 |

| T41 | 🇸🇮 Slovenia | 1 |

| T41 | 🇻🇪 Venezuela | 1 |

Far in the lead is India with 66 startup founders and Israel with 54 startup founders. Together, they account for 31% of all unicorn founders listed. In fact, more than half of the immigrant unicorn founders came from just six countries: India, Israel, the UK, Canada, China, and France.

These immigrant founders have helped found many of the world’s biggest startups:

- Stripe was co-founded by Irish brothers Patrick and John Collison

- Instacart’s founder and former CEO, Apoorva Mehta, was born in India, then moved to Libya and Canada as a child.

- Big data startup Databricks was founded by a group of seven computer scientists from the University of California, including five immigrants from Iran, Romania, and China.

Immigration and Entrepreneurship

Though some of these founders came to the U.S. as successful business leaders, the report noted that many immigrated as children or international students.

In addition, there are another 51 founders (not included in the above statistics) that were not immigrants themselves but are first-generation Americans born to immigrant parents. Data from the report also shows that 80% of unicorns have an immigrant in some key role, whether it’s as a founder, a C-level executive, or some other crucial position.

Even historically, some of the biggest companies in the U.S. were not founded by Americans. For example, the founders of Procter & Gamble emigrated from England and Ireland in the early 1800s. And today, one of the biggest companies in the U.S. is NVIDIA, which recently broached a trillion dollar market cap and whose founder is from Taiwan.

The Ever-Changing Unicorn Landscape

While this dataset is from mid-2022, it should be noted that the startup ecosystem has shifted drastically in just the last year.

Rapidly rising interest rates and a slowdown in venture capital have conspired to create a more precarious fundraising environment, leading to down rounds and stagnation for some of these billion-dollar companies.

In Q1 2023, unicorn births declined 89%, suggesting that in upcoming years the unicorn list—and the number of immigrant founders—may be subject to change.

United States

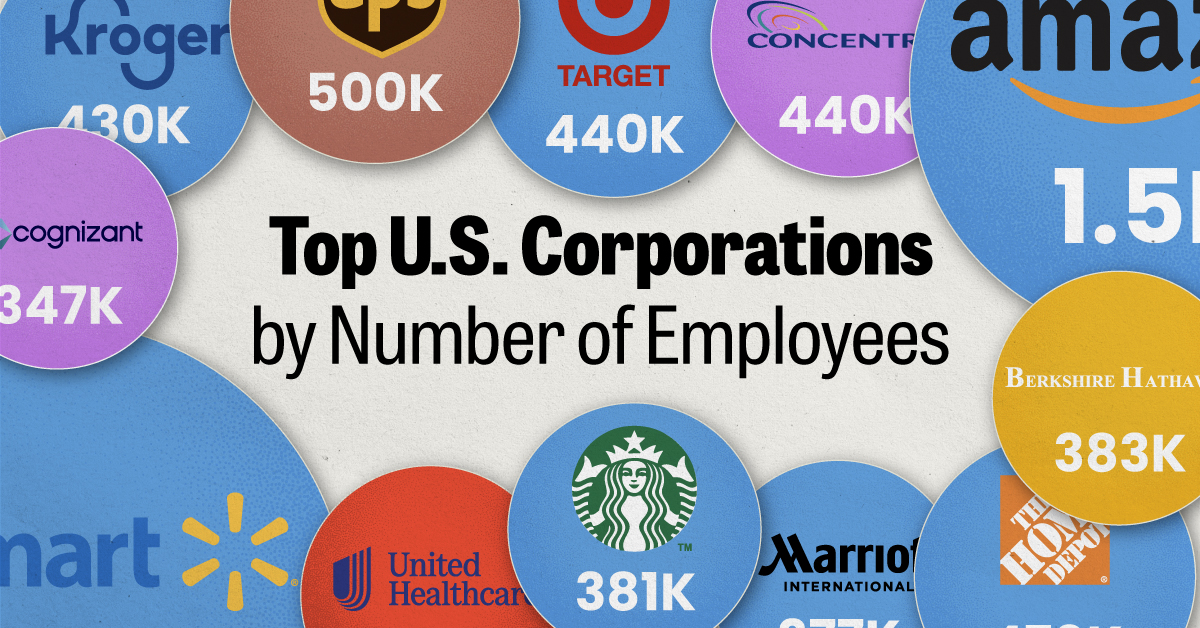

Ranked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

The Largest U.S. Corporations by Number of Employees

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Revenue and profit are common measures for measuring the size of a business, but what about employee headcount?

To see how big companies have become from a human perspective, we’ve visualized the top U.S. companies by employees. These figures come from companiesmarketcap.com, and were accessed in March 2024. Note that this ranking includes publicly-traded companies only.

Data and Highlights

The data we used to create this list of largest U.S. corporations by number of employees can be found in the table below.

| Company | Sector | Number of Employees |

|---|---|---|

| Walmart | Consumer Staples | 2,100,000 |

| Amazon | Consumer Discretionary | 1,500,000 |

| UPS | Industrials | 500,000 |

| Home Depot | Consumer Discretionary | 470,000 |

| Concentrix | Information Technology | 440,000 |

| Target | Consumer Staples | 440,000 |

| Kroger | Consumer Staples | 430,000 |

| UnitedHealth | Health Care | 400,000 |

| Berkshire Hathaway | Financials | 383,000 |

| Starbucks | Consumer Discretionary | 381,000 |

| Marriott International | Consumer Discretionary | 377,000 |

| Cognizant | Information Technology | 346,600 |

Retail and Logistics Top the List

Companies like Walmart, Target, and Kroger have a massive headcount due to having many locations spread across the country, which require everything from cashiers to IT professionals.

Moving goods around the world is also highly labor intensive, explaining why UPS has half a million employees globally.

Below the Radar?

Two companies that rank among the largest U.S. corporations by employees which may be less familiar to the public include Concentrix and Cognizant. Both of these companies are B2B brands, meaning they primarily work with other companies rather than consumers. This contrasts with brands like Amazon or Home Depot, which are much more visible among average consumers.

A Note on Berkshire Hathaway

Warren Buffett’s company doesn’t directly employ 383,000 people. This headcount actually includes the employees of the firm’s many subsidiaries, such as GEICO (insurance), Dairy Queen (retail), and Duracell (batteries).

If you’re curious to see how Buffett’s empire has grown over the years, check out this animated graphic that visualizes the growth of Berkshire Hathaway’s portfolio from 1994 to 2022.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001