Venture Capital

The World’s Biggest Startups: Top Unicorns of 2021

View the full-size version of this infographic

The World’s Biggest Startups: Top Unicorns of 2021

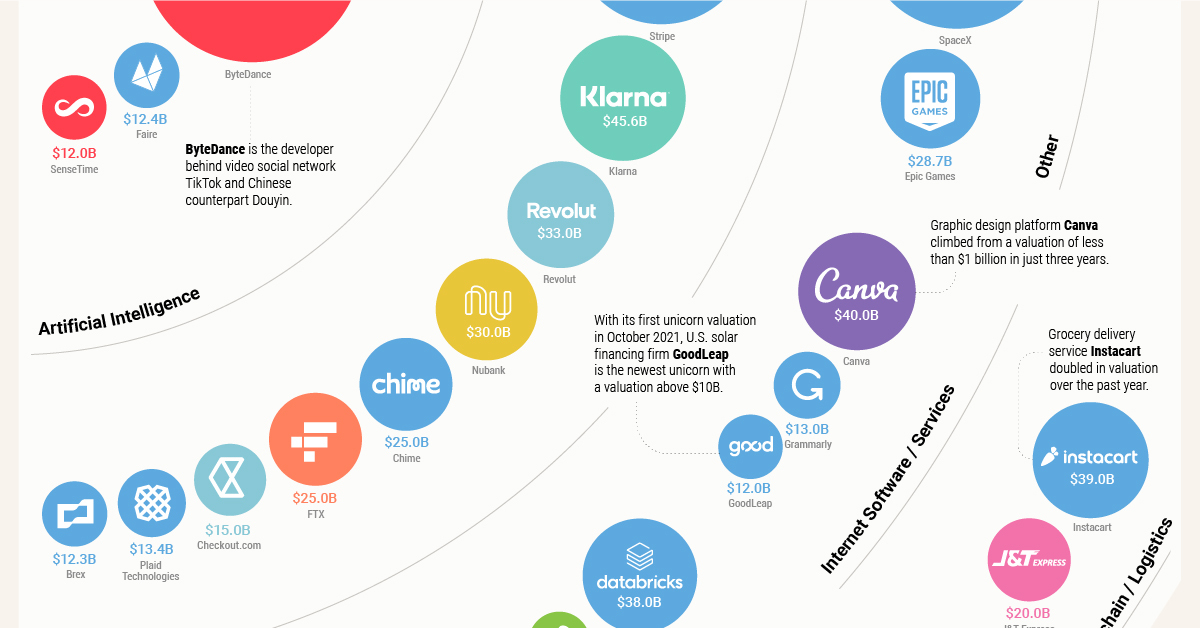

Many entrepreneurs start businesses around the world, but only the most successful new companies become “unicorns”—the biggest startups with a valuation above $1 billion.

Some unicorns are little-known companies making quiet but impactful strides in software, healthcare, automotive, and other fields. Others have already become well-known industry leaders, like aerospace manufacturer SpaceX and game developer and publisher Epic Games.

In total, there are more than 800 unicorn startups globally. That said, this visualization specifically hones in on the world’s decacorns (unicorns with valuations above $10 billion) as of December 2021 according to CB Insights.

Private Startups Valued at Over $10 Billion

The world’s most prominent unicorns constantly see their valuations change as they enter different rounds of funding or maturity.

In December 2021, there were 35 startups with a valuation above $10 billion, spread out across different countries and industries.

| Company | Valuation | Country | Category |

|---|---|---|---|

| Bytedance | $140B | China | Artificial intelligence |

| SpaceX | $100.3B | U.S. | Other |

| Stripe | $95B | U.S. | Fintech |

| Klarna | $45.6B | Sweden | Fintech |

| Canva | $40B | Australia | Internet software & services |

| Instacart | $39B | U.S. | Supply chain, logistics, & delivery |

| Databricks | $38B | U.S. | Data management & analytics |

| Revolut | $33B | UK | Fintech |

| Nubank | $30B | Brazil | Fintech |

| Epic Games | $28.7B | U.S. | Other |

| Chime | $25B | U.S. | Fintech |

| FTX | $25B | China (Hong Kong) | Fintech |

| BYJU's | $21B | India | Edtech |

| Xiaohongshu | $20B | China | E-commerce & direct-to-consumer |

| J&T Express | $20B | Indonesia | Supply chain, logistics, & delivery |

| Fanatics | $18B | U.S. | E-commerce & direct-to-consumer |

| Yuanfudao | $15.5B | China | Edtech |

| DJI Innovations | $15B | China | Hardware |

| SHEIN | $15B | China | E-commerce & direct-to-consumer |

| Checkout.com | $15B | UK | Fintech |

| goPuff | $15B | U.S. | E-commerce & direct-to-consumer |

| Plaid Technologies | $13.4B | U.S. | Fintech |

| Grammarly | $13B | U.S. | Internet software & services |

| Devoted Health | $12.6B | U.S. | Health |

| Faire | $12.4B | U.S. | Artificial intelligence |

| Brex | $12.3B | U.S. | Fintech |

| SenseTime | $12B | China | Artificial intelligence |

| Bitmain Technologies | $12B | China | Hardware |

| Biosplice Therapeutics | $12B | U.S. | Health |

| JUUL Labs | $12B | U.S. | Consumer & retail |

| GoodLeap | $12B | U.S. | Internet software & services |

| ZongMu Technology | $11.4B | China | Auto & transportation |

| Global Switch | $11.1B | UK | Hardware |

| Celonis | $11B | Germany | Data management & analytics |

| Weilong | $10.9B | China | Consumer & retail |

Many of the most valuable startups are already giants in their fields. For example, social media company Bytedance is the developer behind video network platform Douyin and its international version, TikTok, and has amassed a valuation of $140 billion.

Financial services and payment software company Stripe jumped from a valuation of $36 billion to $95 billion over the course of the COVID-19 pandemic.

Even less universally prominent names like Swedish fintech Klarna ($45.6 billion) and Australian graphic design platform Canva ($40.0 billion) are well known within their respective fields.

But private valuations don’t last forever. Many eventually go public, like electric vehicle maker and Tesla competitor Rivian, which had a valuation of $27.6 billion before listing on the NASDAQ.

The Biggest Startups by Industries and Countries

Breaking down the world’s biggest startups by industry highlights that tech is still king in most investing circles.

More than 77% of unicorns valued above $10 billion are categorized directly in tech-related fields, primarily in financial and commerce software.

| Startups Valued Above $10B By Industry | Number |

|---|---|

| Fintech | 9 |

| E-commerce & direct-to-consumer | 4 |

| Artificial intelligence | 3 |

| Hardware | 3 |

| Internet software & services | 3 |

| Consumer & retail | 2 |

| Data management & analytics | 2 |

| Edtech | 2 |

| Health | 2 |

| Other | 2 |

| Supply chain, logistics, & delivery | 2 |

| Auto & transportation | 1 |

And many of the unicorns categorized in non-tech fields are still technology companies at their core. In fact, Indonesia’s logistics and package delivery company J&T Express is one of the few unicorns not directly in tech, though it still uses automated sorting in its warehouses.

It was one of the few startups to come from somewhere other than the U.S. or China, which together accounted for over 70% of the 35 biggest startups. The UK (3) was the next most-frequently listed headquarters, while Australia, Brazil, Germany, India and Sweden each had one of these unicorns on the list.

With constantly fluctuating valuations and technological breakthroughs always around the corner, the next $10 billion unicorn could come from almost anywhere.

Finance

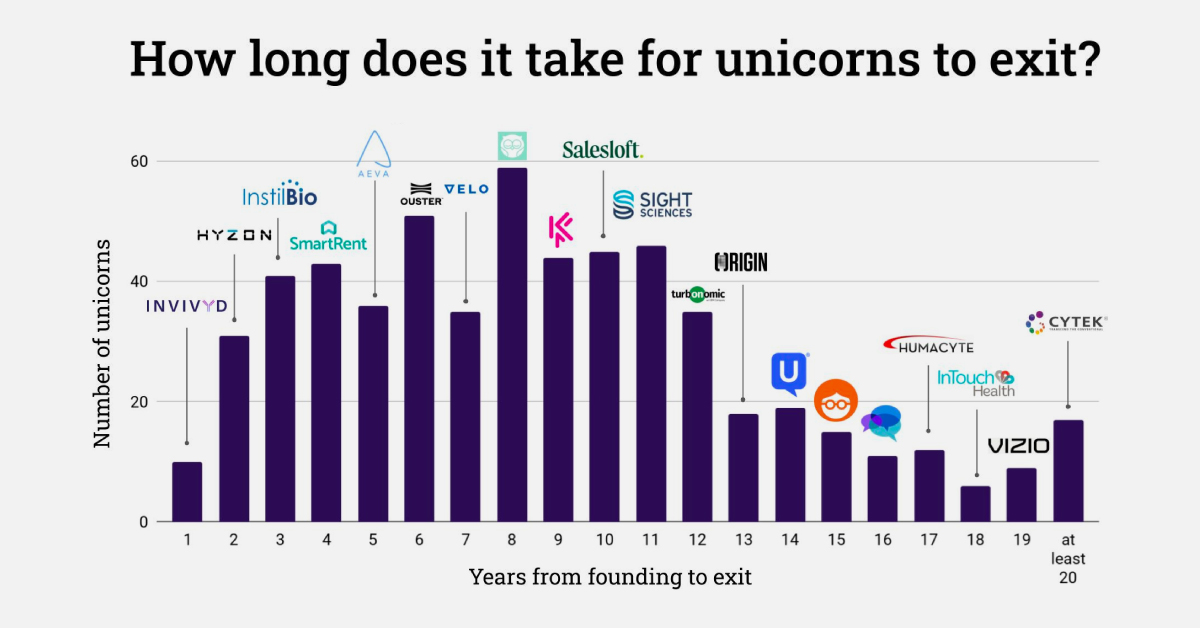

Charted: How Long Does it Take Unicorns to Exit?

There are roughly 1,400 unicorns—startups worth $1 billion or more. How many years does it take these giants to get acquired or go public?

How Long Does it Take For Unicorns to Exit?

For most unicorns—startups with a $1 billion valuation or more—it can take years to see a liquidity event.

Take Twitter, which went public seven years after its 2006 founding. Or Uber, which had an IPO after a decade of operation in 2019. After all, companies first have to succeed and build up their valuation in order to not go bankrupt or dissolve. Few are able to succeed and capitalize in a quick and tidy manner.

So when do unicorns exit, either successfully through an IPO or acquisition, or unsuccessfully through bankruptcy or liquidation? The above visualization from Ilya Strebulaev breaks down the time it took for 595 unicorns to exit from 1997 to 2022.

Unicorns: From Founding to Exit

Here’s how unicorn exits broke down over the last 25 years. Data was collected by Strebulaev at the Venture Capital Initiative in Stanford and covers exits up to October 2022:

| Years (Founding to Exit) | Unicorn Example | Number of Unicorns 1997‒2022 |

|---|---|---|

| 1 | YouTube | 10 |

| 2 | 31 | |

| 3 | Groupon | 41 |

| 4 | Zynga | 43 |

| 5 | Salesforce | 36 |

| 6 | Alphabet (Google) | 51 |

| 7 | Tesla | 35 |

| 8 | Zoom | 59 |

| 9 | Coursera | 44 |

| 10 | Uber Technologies | 45 |

| 11 | WeWork | 46 |

| 12 | Airbnb | 35 |

| 13 | Credit Karma | 18 |

| 14 | SimilarWeb | 19 |

| 15 | 23andMe | 15 |

| 16 | Sonos | 11 |

| 17 | Roblox | 12 |

| 18 | Squarespace | 6 |

| 19 | Vizio | 9 |

| >20 | Cytek | 17 |

Overall, unicorns exited after a median of eight years in business.

Companies like Facebook, LinkedIn, and Indeed are among the unicorns that exited in exactly eight years, which in total made up 10% of tracked exits. Another major example is Zoom, which launched in 2011 and went public in 2019 at a $9.2 billion valuation.

There were also many earlier exits, such as YouTube’s one-year turnaround from 2005 founding to 2006 acquisition by Google. Groupon also had an early exit just three years after its founding in 2008, after turning down an even earlier acquisition exit (also through Google).

In total, unicorn exits within 11 years or less accounted for just over three-quarters of tracked exits from 1997 to 2022. Many of the companies that took longer to exit also took longer to reach unicorn status, including website company Squarespace, which was founded in 2003 but didn’t reach a billion-dollar valuation until 2017 (and listed on the NYSE in 2021).

Unicorns, by Exit Strategy

Broadly speaking, there are three main types of exits: going public through an IPO, SPAC, or direct listing, being acquired, or liquidation/bankruptcy.

The most well-known are IPOs, or initial public offerings. These are the most common types of unicorn exits in strong market conditions, with 2021 seeing 79 unicorn IPOs globally, with $83 billion in proceeds.

| 2021 | 2022 | % Change | |

|---|---|---|---|

| # Unicorn IPOs | 79 | 13 | -84% |

| Proceeds | $82.9B | $5.3B | -94% |

But the number of IPOs drops drastically given weaker market performance, as seen above. At the end of 2022, an estimated 91% of unicorn IPOs listed since 2021 had share prices fall below their IPO price.

A less common unicorn exit is an SPAC (special purpose acquisition company), although they’ve been gaining momentum and were used by WeWork and BuzzFeed. With an SPAC, a shell company raises money in an IPO and merges with a private company to take it public.

Finally, while an IPO lists new shares to the public with an underwriter, a direct listing sells existing shares without an underwriter. Though it was historically seen as a cheaper IPO alternative, some well-known unicorns have used direct listings including Roblox and Coinbase.

And as valuations for unicorns (and their public listings) have grown, acquisitions have become less frequent. Additionally, many major firms have been buying back shares since 2022 to shore up investor confidence instead of engaging in acquisitions.

Slower Exit Activity

While the growth of unicorns has been exponential over the last decade, exit activity has virtually ground to a halt in 2023.

Investor caution and increased conservation of capital have contributed to the lack of unicorn exits. As of the second quarter of 2023, just eight unicorns in the U.S. exited. These include Mosaic ML, an artificial intelligence startup, and carbon recycling firm LanzaTech.

As exit activity declines, companies may halt listing plans and eventually slow expansion and cut costs. What’s uncertain is whether or not this lull in unicorn exits—and declining influx of private capital influx—is temporary or part of a long-term readjustment.

-

Wealth6 days ago

Wealth6 days agoCharted: Which City Has the Most Billionaires in 2024?

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time

Creator Program

Creator Program