Technology

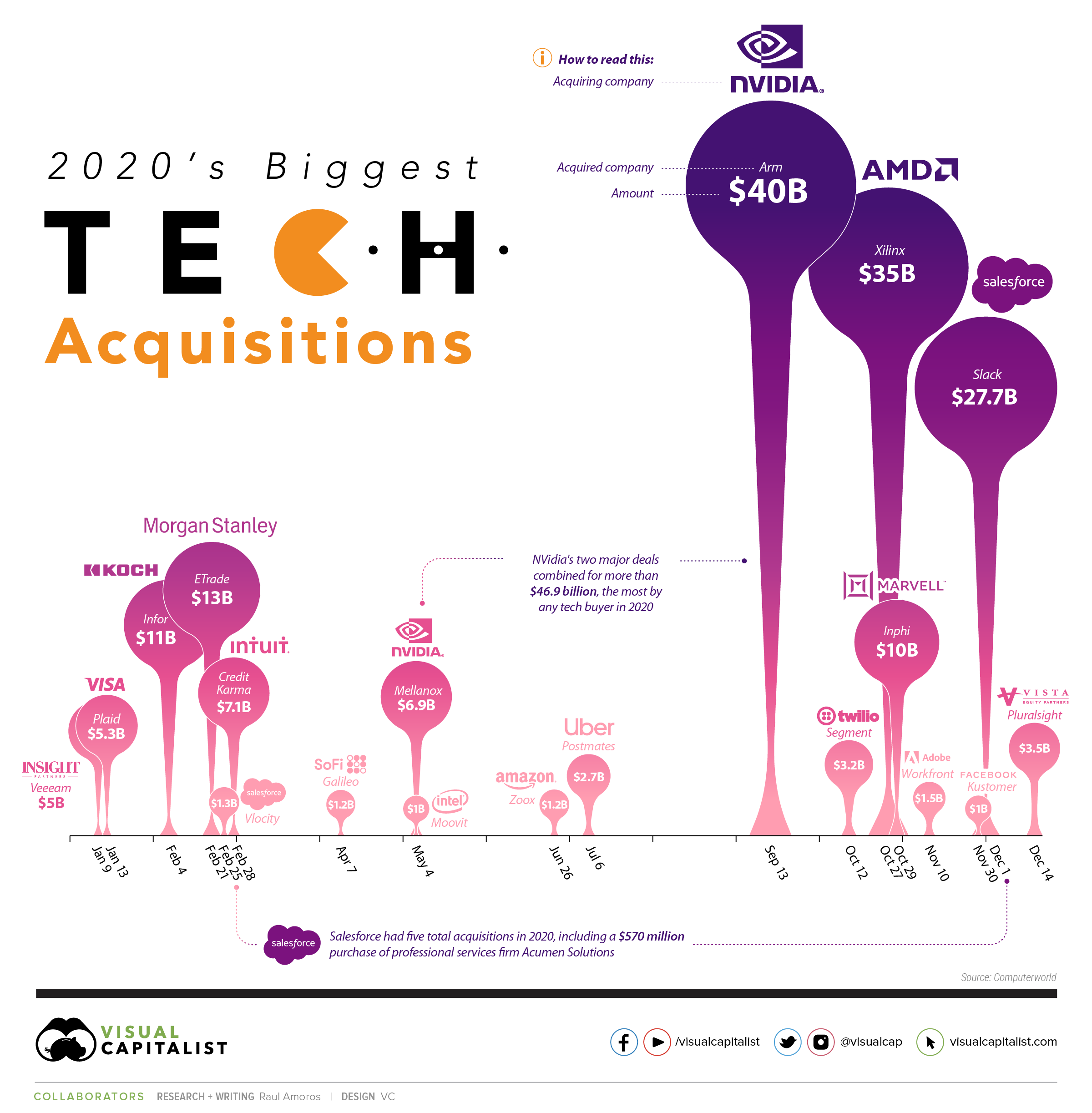

Visualizing the Biggest Tech Mergers and Acquisitions of 2020

The Biggest Tech Mergers and Acquisitions of 2020

For most businesses around the world, 2020 was a year of difficulties, lost business, and economic hardship. For Big Tech, it was a boon.

After COVID-19 hit hard in March, tech companies started to see their customer bases and revenues grow at an increased rate as people were stuck at home and utilizing their services.

Since down markets are the perfect time to consolidate, 2020 also saw big tech companies take the opportunity to grow their business with major mergers and acquisitions (M&A). After a quieter year in 2019 that saw tech investment activity dip, it was a resurgence to expected form.

In this graphic, we visualize the year’s biggest tech deals above $1 billion using data from Computerworld, which tracked the year’s biggest acquisitions.

Deal Activity from the Get-Go

Though 2020 was all about COVID-19 and its impact on the market, the tech sector had major deal flow even before the pandemic began.

By the end of February, six of the 19 biggest tech mergers and acquisitions of the year had already occurred—and the month of February alone saw the most major deals of any month with four.

The first deals of the year were also some of the biggest. Morgan Stanley’s purchase of online brokerage E*TRADE for $13 billion and Koch Industries’ $11 billion completed takeover of software company Infor were the 4th and 5th biggest tech acquisitions of 2020.

Other big moves included purchases from tech and payments firms Salesforce, Visa, and Intuit, as well as private equity firm Insight Partners.

The Biggest 2020 Deals Were Saved for Last

After a quiet March, only a few large deals occurred from April to the summer.

Nvidia’s $6.9 billion purchase of network chip producer Mellanox Technologies in May was more than a year in the making, and Uber’s $2.65 billion acquisition of food delivery rival Postmates in July significantly consolidated the U.S. food delivery scene.

As it turned out, the biggest deals of 2020 were back-loaded for the end of the year. Just under half of 2020’s billion-dollar tech M&As happened from September‒December, including the year’s three largest tech acquisitions:

| Date | Purchaser | Acquired Company | Amount (Billions) |

|---|---|---|---|

| 2020-09-13 | Nvidia | Arm | $40.0 |

| 2020-10-27 | AMD | Xilinx | $35.0 |

| 2020-12-01 | Salesforce | Slack | $27.7 |

| 2020-02-21 | Morgan Stanley | ETrade | $13.0 |

| 2020-02-04 | Koch Industries | Infor | $11.0 |

| 2020-10-29 | Marvell Techonology | Inphi | $10.0 |

| 2020-02-28 | Intuit | Credit Karma | $7.1 |

| 2020-05-04 | Nvidia | Mellanox | $6.9 |

| 2020-01-13 | Visa | Plaid | $5.3 |

| 2020-01-09 | Insight Partners | Veeeam | $5.0 |

| 2020-12-14 | Vista Equity Partners | Pluralsight | $3.5 |

| 2020-10-12 | Twilio | Segment | $3.2 |

| 2020-07-06 | Uber | Postmates | $2.7 |

| 2020-11-10 | Adobe | Workfront | $1.5 |

| 2020-02-25 | Salesforce | Vlocity | $1.3 |

| 2020-04-07 | SoFI | Galileo | $1.2 |

| 2020-06-26 | Amazon | Zoox | $1.2 |

| 2020-05-04 | Intel | Moovit | $1.0 |

| 2020-11-30 | Kustomer | $1.0 |

Of the 19 deals over $1 billion tracked above, Salesforce and Nvidia were the only companies to make multiple major acquisitions. And although tech saw gains across the sector, most of the major M&A activity was centered around semiconductors.

As 2020 winds down, the market focus on tech is expected to last into 2021. However, the markets and the world at large continue to deal with COVID-19.

The rollout of vaccines has put the world on a timeline to reach a post-COVID era. How will the tech landscape be affected?

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees