Datastream

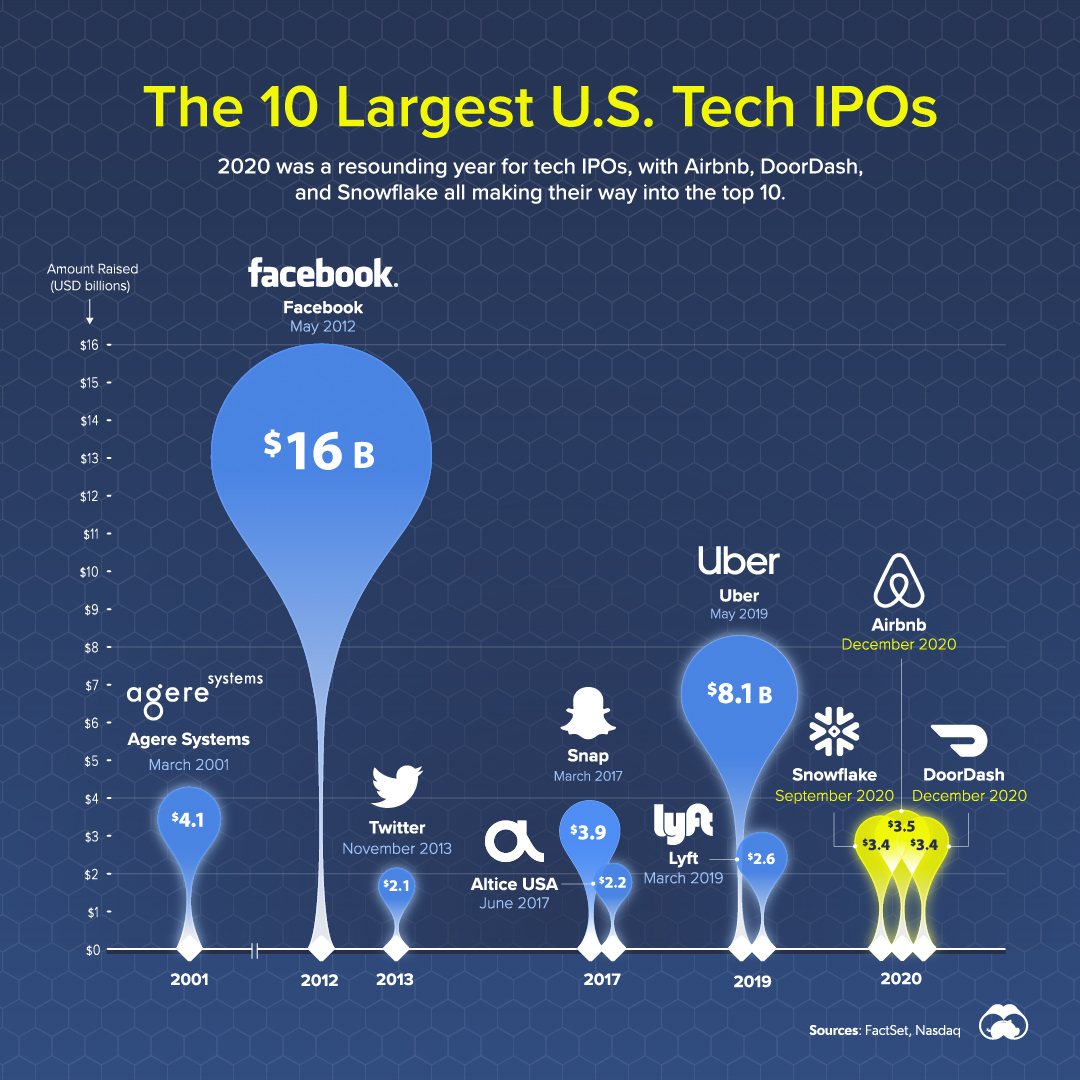

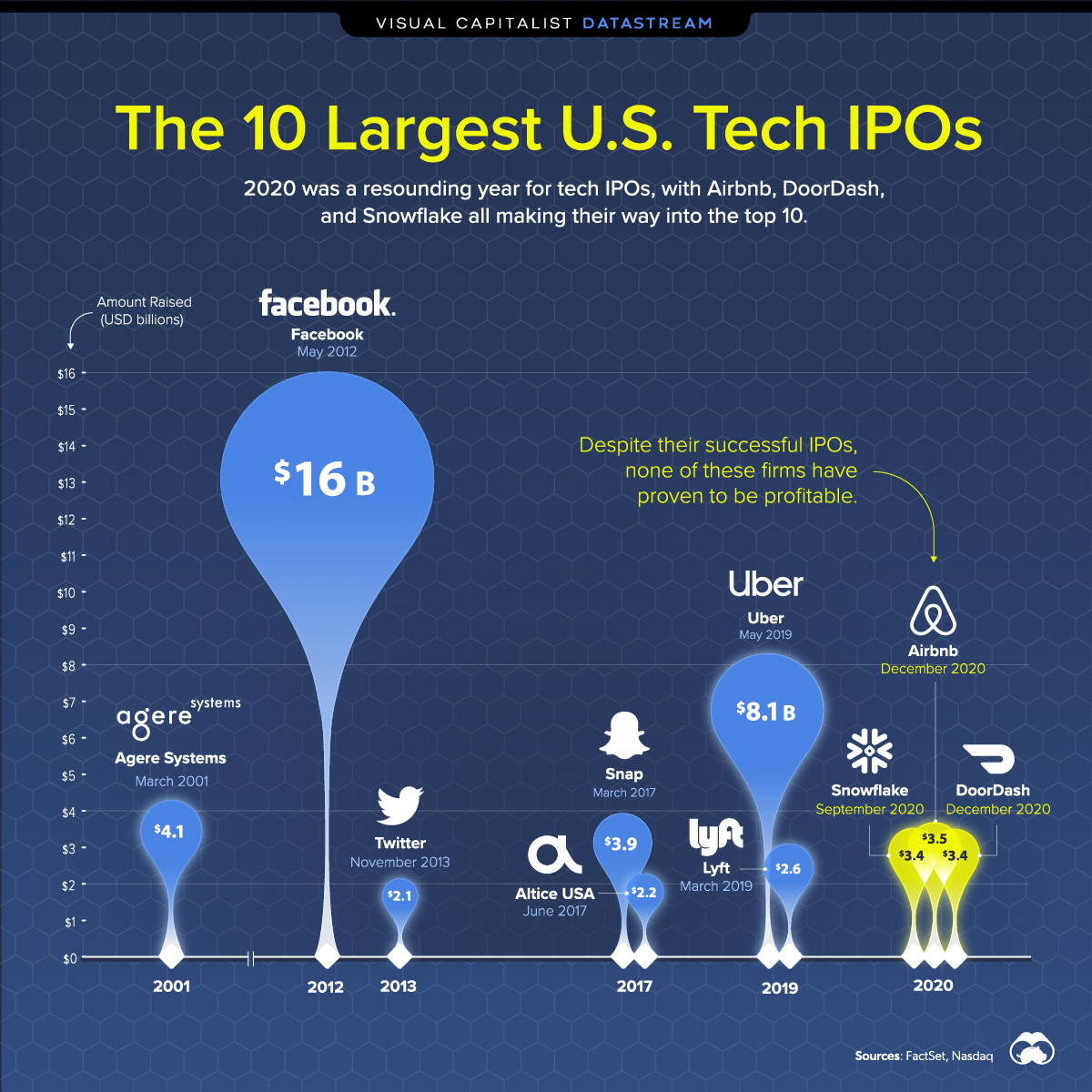

The 10 Largest U.S. Tech IPOs in History

The Briefing

- The IPOs of Airbnb, DoorDash, and Snowflake raised over $3 billion each

- This secures their spot among the 10 largest U.S. tech IPOs in history

U.S. Tech IPOs: Three Stocks from 2020 Break into the Top Ten

2020 was an eventful year for IPOs despite the economic hardships caused by COVID-19. Over $300 billion was raised in U.S. equity markets, with companies from the tech sector generating a significant amount of hype.

Among these companies were Airbnb, DoorDash, and Snowflake, all of which raised over $3 billion. To put this into perspective, let’s look at the 10 biggest U.S. tech IPOs of all time.

The Top 10 U.S. Tech IPOs

Airbnb, DoorDash, and Snowflake muscled their way into the top 10, raising a combined $10.3 billion dollars in the second half of 2020.

| Rank | Company | IPO Date | Amount Raised (USD billions) |

|---|---|---|---|

| 1 | May 2012 | $16.0 | |

| 2 | Uber | May 2019 | $8.1 |

| 3 | Agere Systems | March 2001 | $4.1 |

| 4 | Snap | March 2017 | $3.9 |

| 5 | Airbnb | December 2020 | $3.5 |

| 6 | Snowflake | September 2020 | $3.4 |

| 7 | DoorDash | December 2020 | $3.4 |

| 8 | Lyft | March 2019 | $2.6 |

| 9 | Altice USA | June 2017 | $2.2 |

| 10 | November 2013 | $2.1 |

Not adjusted for inflation.

More than eight years after going public, Facebook maintains a sizable lead over industry peers. The $16.0 billion IPO by the social networking company is also the second largest in U.S. business history, falling only shy of the $17.9 billion raised by Visa in March 2008.

The Airbnb IPO

Airbnb is an online vacation marketplace that connects vacationers with “hosts” who offer accommodations for short-term booking. Since its creation in 2008, Airbnb has grown in size and influence, disrupting the hotel industry in the process.

Airbnb’s IPO raised $3.5 billion by selling 51.5 million Class A shares at $68 each. Airbnb shares closed 112% higher after their first day of trading on December 10, a sign of strong investor optimism.

The Snowflake IPO

Snowflake is a data-warehousing company that provides its customers with cloud-based data storage services. Noteworthy clients of Snowflake include CapitalOne, Logitech, and the University of Notre Dame.

Snowflake’s IPO raised $3.4 billion by selling 28 million Class A shares at $120 each. Similar to Airbnb, shares of Snowflake made an impressive climb on their first day of trading, even surpassing the $300 mark. With this achievement, Snowflake became the largest company to double its market cap on opening day.

The DoorDash IPO

DoorDash is a food delivery platform similar in concept to Uber Eats and Grubhub. The business was well-positioned to take advantage of COVID-19 lockdowns which had led to a surge in food delivery orders.

DoorDash’s IPO raised $3.4 billion by selling roughly 33 million Class A shares at $102 each. Like its peers, DoorDash rose on its first day of trading, closing at $189.51 a share.

Investor Optimism Outweighs Traditional Thinking

A common factor among each of these tech IPOs is that none of the companies have turned a profit. This has drawn criticism from members of the investment industry, especially regarding DoorDash’s IPO.

This is Silicon Valley selling public markets an asset at a huge premium…and I think a lot of individual investors rushing into this are going to lose a lot of money.

—David Trainer, CEO, New Constructs

Regardless, DoorDash investors remain bullish. As of February 3, 2021, the company’s shares have climbed 27% year to date (YTD).

»If you found this article interesting, you might enjoy this post on the world’s largest IPOs.

Where does this data come from?

Source: FactSet, Nasdaq

Details: Retrieved on Jan. 26, 2020. Not adjusted for inflation.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Wealth6 days ago

Wealth6 days agoCharted: Which City Has the Most Billionaires in 2024?

-

Mining2 weeks ago

Mining2 weeks agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Uranium2 weeks ago

Uranium2 weeks agoThe World’s Biggest Nuclear Energy Producers

-

Education2 weeks ago

Education2 weeks agoHow Hard Is It to Get Into an Ivy League School?

-

Debt2 weeks ago

Debt2 weeks agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Sports2 weeks ago

Sports2 weeks agoThe Highest Earning Athletes in Seven Professional Sports

-

Science2 weeks ago

Science2 weeks agoVisualizing the Average Lifespans of Mammals

-

Brands1 week ago

Brands1 week agoHow Tech Logos Have Evolved Over Time