Economy

The 20 Fastest Growing Jobs in the Next Decade

How is the Job Market Shifting Over the Next Decade?

The employment landscape is constantly shifting. While agricultural jobs played a big role in the 19th century, a large portion of U.S. jobs today are in administration, sales, or transportation. So how can job seekers identify the fastest growing jobs of the future?

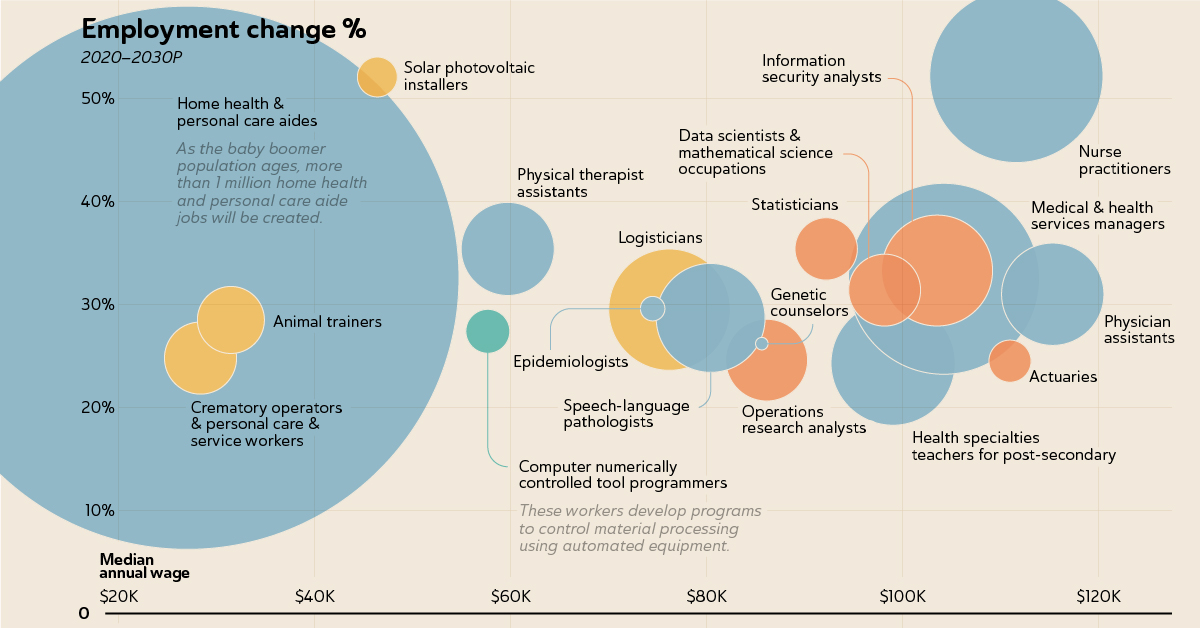

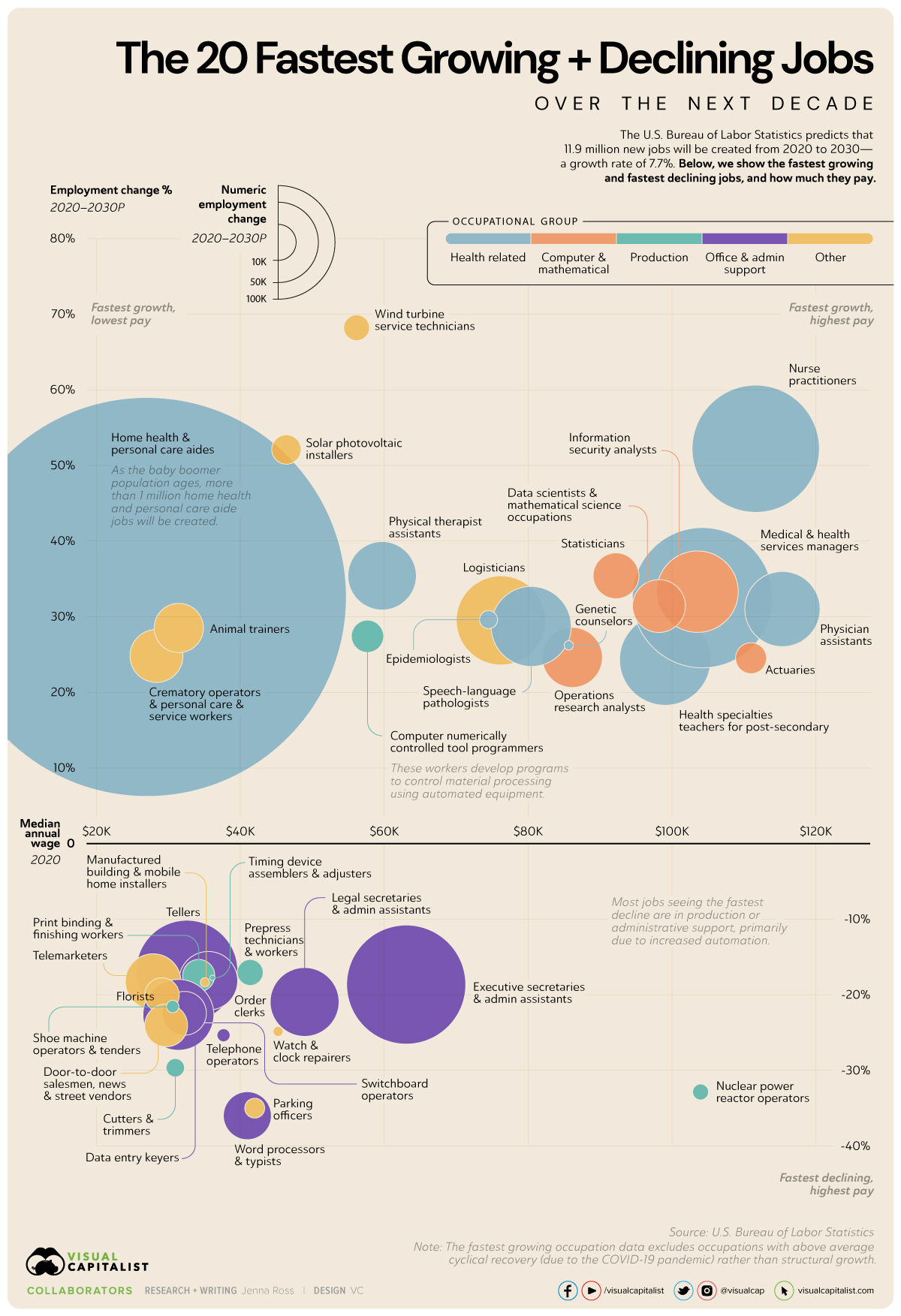

The U.S. Bureau of Labor Statistics (BLS) projects there will be 11.9 million new jobs created from 2020 to 2030, an overall growth rate of 7.7%. However, some jobs have a growth rate that far exceeds this level. In this graphic, we use BLS data to show the fastest growing jobs—and fastest declining jobs—and how much they each pay.

The Top 20 Fastest Growing Jobs

We used the dataset that excludes occupations with above average cyclical recovery from the COVID-19 pandemic. For example, jobs such as motion picture projectionists, ticket takers, and restaurant cooks were removed. Once these exclusions were made, the resulting list reflects long-term structural growth.

Here are the fastest growing jobs from 2020 to 2030, along with the number of jobs that will be created and the median pay for the position.

| Occupation | Percent employment change, 2020–2030P | Numeric employment change, 2020-2030P | Median annual wage, 2020 |

|---|---|---|---|

| Wind turbine service technicians | 68.2% | 4,700 | $56,230 |

| Nurse practitioners | 52.2% | 114,900 | $111,680 |

| Solar photovoltaic installers | 52.1% | 6,100 | $46,470 |

| Statisticians | 35.4% | 14,900 | $92,270 |

| Physical therapist assistants | 35.4% | 33,200 | $59,770 |

| Information security analysts | 33.3% | 47,100 | $103,590 |

| Home health and personal care aides | 32.6% | 1,129,900 | $27,080 |

| Medical and health services managers | 32.5% | 139,600 | $104,280 |

| Data scientists and mathematical science occupations, all other | 31.4% | 19,800 | $98,230 |

| Physician assistants | 31.0% | 40,100 | $115,390 |

| Epidemiologists | 29.6% | 2,300 | $74,560 |

| Logisticians | 29.5% | 56,400 | $76,270 |

| Speech-language pathologists | 28.7% | 45,400 | $80,480 |

| Animal trainers | 28.5% | 17,200 | $31,520 |

| Computer numerically controlled tool programmers | 27.4% | 7,400 | $57,740 |

| Genetic counselors | 26.2% | 600 | $85,700 |

| Crematory operators and personal care and service workers, all other | 24.8% | 19,900 | $28,420 |

| Operations research analysts | 24.6% | 25,600 | $86,200 |

| Actuaries | 24.5% | 6,800 | $111,030 |

| Health specialties teachers, post-secondary | 24.3% | 58,900 | $99,090 |

Wind turbine service technicians have the fastest growth rate, with solar photovoltaic (solar panel) installers taking the third slot. The rapid growth is driven by demand for renewable energy. However, because these are relatively small occupations, the two roles will account for about 11,000 new jobs collectively.

Nine of the top 20 fastest growing jobs are in healthcare or related fields, as the baby boomer population ages and chronic conditions are on the rise. Home health and personal care aides, who assist with routine healthcare tasks such as bathing and feeding, will account for over one million new jobs in the next decade. This will be almost 10% of all new jobs created between 2020 and 2030. Unfortunately, these workers are the lowest paid on the list.

Computer and math-related jobs are also expected to see high growth. The BLS expects strong demand for IT security and software development, partly because of the increase in people that are working from home.

The Top 20 Fastest Declining Jobs

Structural changes in the economy will cause some jobs to decline quite quickly. Here are the top 20 jobs where employment is expected to decline the fastest over the next decade.

| Occupation | Percent employment change, 2020–2030P | Numeric employment change, 2020-2030P | Median annual wage, 2020 |

|---|---|---|---|

| Word processors and typists | -36.0% | -16,300 | $41,050 |

| Parking enforcement workers | -35.0% | -2,800 | $42,070 |

| Nuclear power reactor operators | -32.9% | -1,800 | $104,040 |

| Cutters and trimmers, hand | -29.7% | -2,400 | $31,630 |

| Telephone operators | -25.4% | -1,200 | $37,710 |

| Watch and clock repairers | -24.9% | -700 | $45,290 |

| Door-to-door sales workers, news and street vendors, and related workers | -24.1% | -13,000 | $29,730 |

| Switchboard operators, including answering service | -22.7% | -13,600 | $31,430 |

| Data entry keyers | -22.5% | -35,600 | $34,440 |

| Shoe machine operators and tenders | -21.6% | -1,100 | $30,630 |

| Legal secretaries and administrative assistants | -21.0% | -33,600 | $48,980 |

| Floral designers | -20.1% | -8,500 | $29,140 |

| Executive secretaries and executive administrative assistants | -18.7% | -100,600 | $63,110 |

| Manufactured building and mobile home installers | -18.4% | -600 | $35,120 |

| Telemarketers | -18.3% | -21,900 | $27,920 |

| Order clerks | -18.2% | -24,400 | $35,590 |

| Timing device assemblers and adjusters | -17.8% | -200 | $36,170 |

| Print binding and finishing workers | -17.5% | -7,300 | $34,260 |

| Prepress technicians and workers | -17.1% | -4,800 | $41,410 |

| Tellers | -16.9% | -73,100 | $32,620 |

Eight of the top 20 declining jobs are in office and administrative support. This could be cause for concern, given this category currently makes up almost 13% of employment in the U.S.—the largest of any major category. Jobs involved in the production of goods and services, as well as sales jobs, are also seeing declines.

In all cases, automation is likely the biggest culprit. For example, software that automatically converts audio to text will reduce the need for typists.

While the fastest declining jobs typically fall within the lower salary range, there is one outlier. Nuclear power reactor operators, who earn a salary of over $100,000, will see employment decline at a steep rate of -33%. No new nuclear plants have opened since the 1990s, and nuclear power faces steep competition from renewable energy sources.

Warning: Education Required

As the composition of employment shifts, it eliminates some jobs and creates others. For instance, while production jobs are declining, new opportunities exist for “computer numerically controlled tool programmers.” These workers develop programs to control the automated equipment that processes materials.

However, while many of the fastest growing jobs are higher paying, they typically also require advanced education.

| Top 20 Fastest Growing Jobs | Top 20 Fastest Declining Jobs | |

|---|---|---|

| # with median salary > $41,950 | 17 | 5 |

| # with post-secondary education required | 16 | 0 |

Seventeen of the top 20 fastest growing jobs have a median salary higher than $41,950, which is the median salary for all jobs in total. Most also require post-secondary schooling. These opportunities are replacing jobs that only required a high school diploma.

With tuition costs soaring relative to inflation, this could create challenges for displaced workers or young people entering the workforce.

Economy

Economic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

G7 & BRICS Real GDP Growth Forecasts for 2024

The International Monetary Fund’s (IMF) has released its real gross domestic product (GDP) growth forecasts for 2024, and while global growth is projected to stay steady at 3.2%, various major nations are seeing declining forecasts.

This chart visualizes the 2024 real GDP growth forecasts using data from the IMF’s 2024 World Economic Outlook for G7 and BRICS member nations along with Saudi Arabia, which is still considering an invitation to join the bloc.

Get the Key Insights of the IMF’s World Economic Outlook

Want a visual breakdown of the insights from the IMF’s 2024 World Economic Outlook report?

This visual is part of a special dispatch of the key takeaways exclusively for VC+ members.

Get the full dispatch of charts by signing up to VC+.

Mixed Economic Growth Prospects for Major Nations in 2024

Economic growth projections by the IMF for major nations are mixed, with the majority of G7 and BRICS countries forecasted to have slower growth in 2024 compared to 2023.

Only three BRICS-invited or member countries, Saudi Arabia, the UAE, and South Africa, have higher projected real GDP growth rates in 2024 than last year.

| Group | Country | Real GDP Growth (2023) | Real GDP Growth (2024P) |

|---|---|---|---|

| G7 | 🇺🇸 U.S. | 2.5% | 2.7% |

| G7 | 🇨🇦 Canada | 1.1% | 1.2% |

| G7 | 🇯🇵 Japan | 1.9% | 0.9% |

| G7 | 🇫🇷 France | 0.9% | 0.7% |

| G7 | 🇮🇹 Italy | 0.9% | 0.7% |

| G7 | 🇬🇧 UK | 0.1% | 0.5% |

| G7 | 🇩🇪 Germany | -0.3% | 0.2% |

| BRICS | 🇮🇳 India | 7.8% | 6.8% |

| BRICS | 🇨🇳 China | 5.2% | 4.6% |

| BRICS | 🇦🇪 UAE | 3.4% | 3.5% |

| BRICS | 🇮🇷 Iran | 4.7% | 3.3% |

| BRICS | 🇷🇺 Russia | 3.6% | 3.2% |

| BRICS | 🇪🇬 Egypt | 3.8% | 3.0% |

| BRICS-invited | 🇸🇦 Saudi Arabia | -0.8% | 2.6% |

| BRICS | 🇧🇷 Brazil | 2.9% | 2.2% |

| BRICS | 🇿🇦 South Africa | 0.6% | 0.9% |

| BRICS | 🇪🇹 Ethiopia | 7.2% | 6.2% |

| 🌍 World | 3.2% | 3.2% |

China and India are forecasted to maintain relatively high growth rates in 2024 at 4.6% and 6.8% respectively, but compared to the previous year, China is growing 0.6 percentage points slower while India is an entire percentage point slower.

On the other hand, four G7 nations are set to grow faster than last year, which includes Germany making its comeback from its negative real GDP growth of -0.3% in 2023.

Faster Growth for BRICS than G7 Nations

Despite mostly lower growth forecasts in 2024 compared to 2023, BRICS nations still have a significantly higher average growth forecast at 3.6% compared to the G7 average of 1%.

While the G7 countries’ combined GDP is around $15 trillion greater than the BRICS nations, with continued higher growth rates and the potential to add more members, BRICS looks likely to overtake the G7 in economic size within two decades.

BRICS Expansion Stutters Before October 2024 Summit

BRICS’ recent expansion has stuttered slightly, as Argentina’s newly-elected president Javier Milei declined its invitation and Saudi Arabia clarified that the country is still considering its invitation and has not joined BRICS yet.

Even with these initial growing pains, South Africa’s Foreign Minister Naledi Pandor told reporters in February that 34 different countries have submitted applications to join the growing BRICS bloc.

Any changes to the group are likely to be announced leading up to or at the 2024 BRICS summit which takes place October 22-24 in Kazan, Russia.

Get the Full Analysis of the IMF’s Outlook on VC+

This visual is part of an exclusive special dispatch for VC+ members which breaks down the key takeaways from the IMF’s 2024 World Economic Outlook.

For the full set of charts and analysis, sign up for VC+.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries