Datastream

The Rising Cost of College in the U.S.

The Briefing

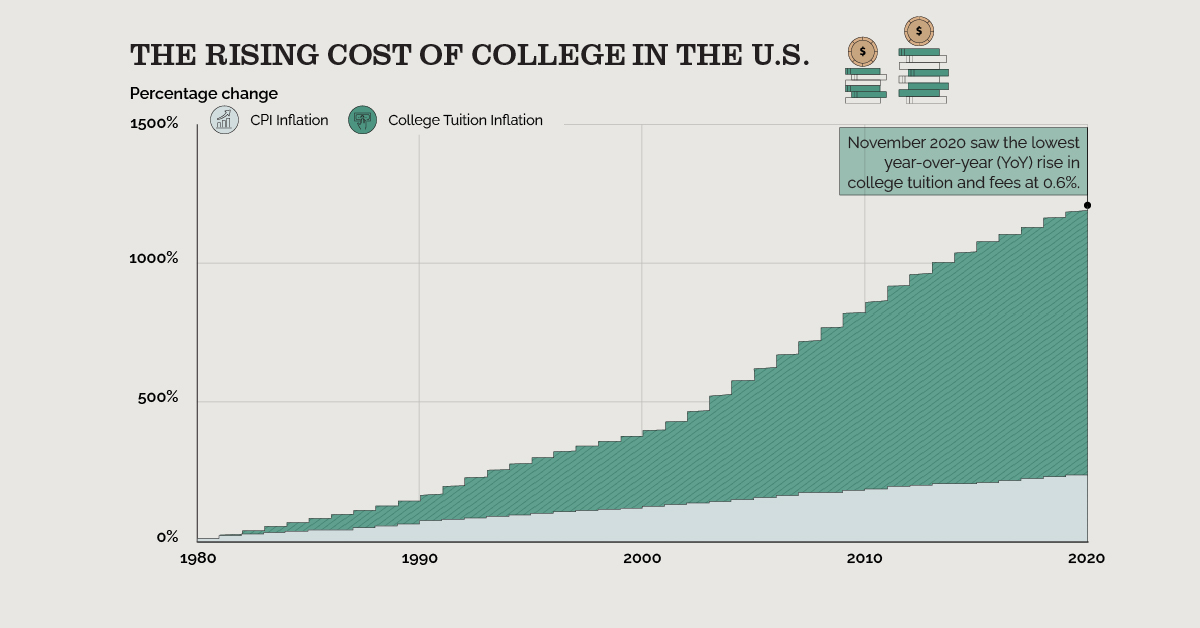

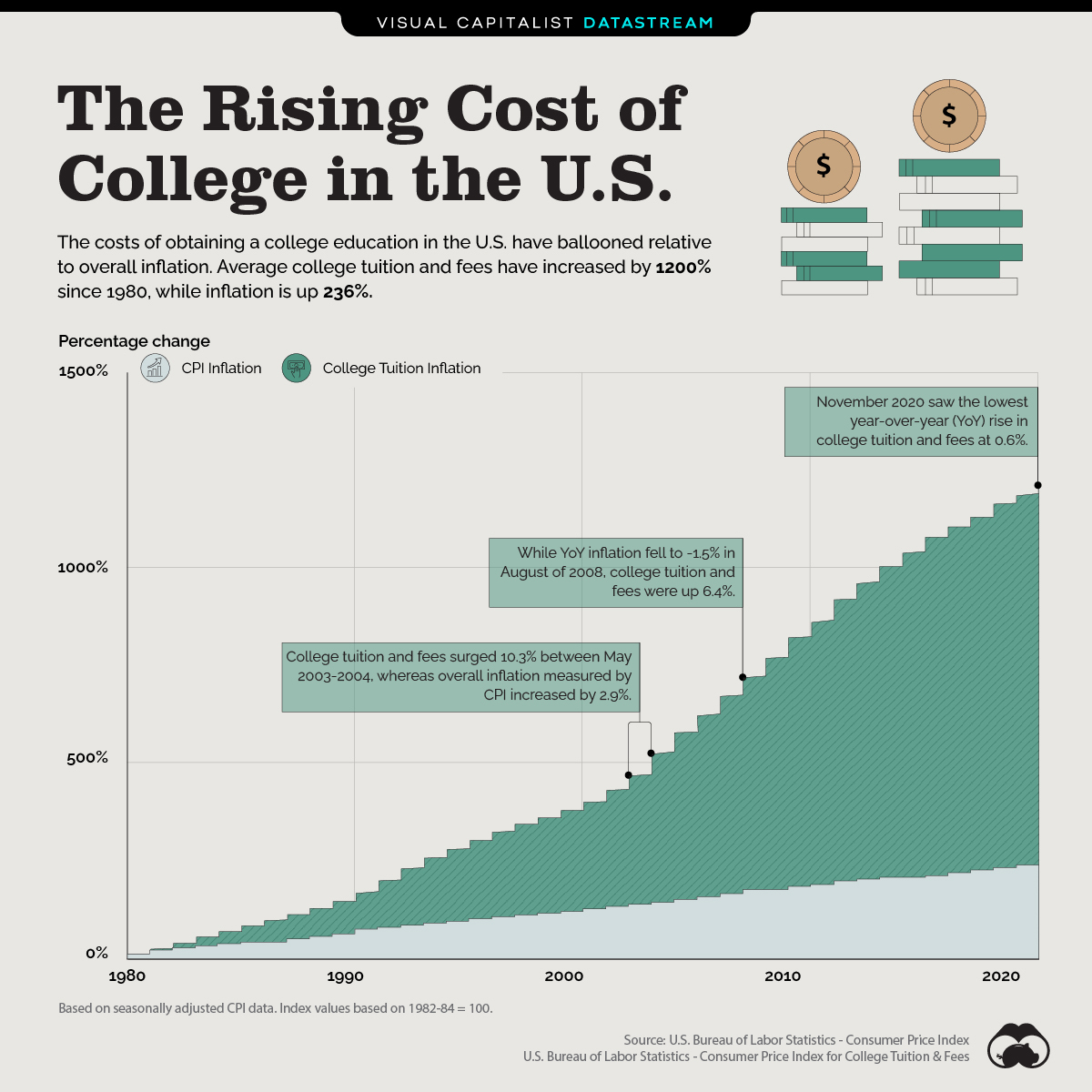

- Since 1980, college tuition and fees in the U.S. have increased by 1,200%

- Because of the shift to online classes, 2020 saw the lowest tuition increase in the last four decades

The Rising Cost of College in America

The average cost of getting a college degree has soared relative to overall inflation over the last few decades.

Since 1980, college tuition and fees are up 1,200%, while the Consumer Price Index (CPI) for all items has risen by only 236%.

The Average Cost of College Over Time

Back in 1980, it cost $1,856 to attend a degree-granting public school in the U.S., and $10,227 to attend a private school after adjusting for inflation.

Since then, the figures have skyrocketed. Here’s how college tuition and the CPI have both changed since 1980:

| Year | Avg. Undergrad Tuition and Fees (Public) | Avg. Undergrad Tuition and Fees (Private) | CPI % Change (College Tuition and Fees) | CPI % Change (All Items) |

|---|---|---|---|---|

| 1980 | $1,856 | $10,227 | 0% | 0% |

| 1990 | $2,750 | $16,590 | 150.2% | 63.5% |

| 2000 | $3,706 | $21,698 | 382.5% | 117% |

| 2010 | $5,814 | $25,250 | 828.6% | 178.8% |

| 2020 | $9,403 | $34,059 | 1198.9% | 231.82% |

Source: National Center for Education Statistics, U.S. News

Note: Tuition and fees are in constant 2018-19 dollars. For public schools, in-state tuition and fees are used. All CPI % change values calculated for the month of January.

According to the Bureau of Labor Statistics, the highest year-over-year change in college tuition and fees was recorded in June 1982 at 14.2%— and over that same time period, overall inflation was up 6.6%.

On the other hand, November 2020 saw the lowest year-over-year change in the average cost of college at 0.6%, mainly as a result of the shift to online classes amid the COVID-19 pandemic. In fact, some schools are offering discounts to students, and some are even canceling scheduled tuition increases entirely in a bid to remain attractive.

Why is the Cost of College Rising?

While it’s difficult to pinpoint the exact reasons behind the rapid surge in the cost of education, a few factors could help explain why U.S. colleges hike their prices.

- Decrease in State Funding

State funding per student fell from $8,800 (2007-08) to $8,200 (2018-19), while the share of tuition in college revenues increased. - Increase in Demand

The demand for a college education has increased over time. Between 2000-2018, undergraduate enrollment in degree-granting institutions increased by 26%. - Increase in Federal Aid

According to a study from the New York Fed, every $1 in subsidized federal student loans increases college tuition by $0.60. Student loan debt has doubled since the 2008 recession.

Furthermore, the costs of providing education, known as institutional expenditures, have also escalated over time. These include spending on instruction, student services, administrative support, operations, and maintenance—all of which are critical to the student experience.

With student debt at unprecedented levels and ongoing public debates surrounding the rising costs of education, it’s uncertain how college tuition will evolve. However, given the onset of virtual classes, further hikes to college tuitions may be on hold for the foreseeable future.

Where does this data come from?

Source: U.S. Bureau of Labor Statistics

Details: Data for the average cost of college comes from the Consumer Price Index (CPI) for College Tuition and Fees. Overall inflation is measured by the CPI for all items (CPI-U). Data is seasonally adjusted and the reference base for the indices is 1982-84 = 100.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001