Energy

Our Energy Problem: Putting the Battery in Context

The Battery Series

Part 2: Our Energy Problem: Putting the Battery in Context

The Battery Series is a five-part infographic series that explores what investors need to know about modern battery technology, including raw material supply, demand, and future applications.

Presented by: Nevada Energy Metals, eCobalt Solutions Inc., and Great Lakes Graphite

Our Energy Problem: Putting the Battery in Context

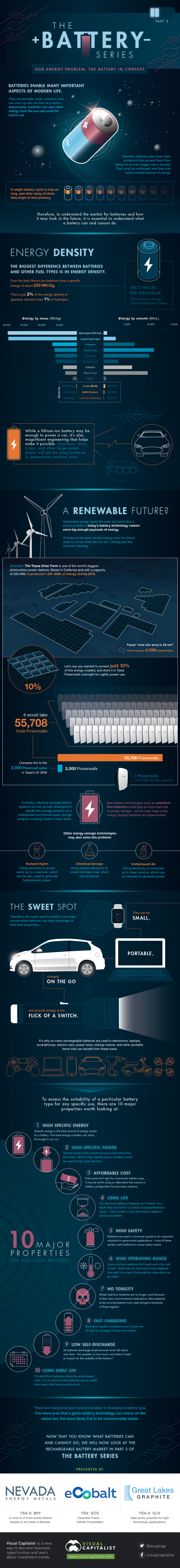

In Part 1, we examined the evolution of battery technology. In this part, we examine what batteries can and cannot do, and the energy problem that humans hope that batteries can help solve.

Batteries enable many important aspects of modern life.

They are portable, quiet, compact, and can start-up with the flick of a switch. Importantly, batteries can also store energy from the sun and wind for future use.

However, batteries also have many limitations that prevent them from taking on an even bigger role in society. They must be recharged, and they hold a limited amount of energy. A single battery cycle is only so long, and after many of them they begin to lose potency.

Therefore, to understand the market for batteries and how it may look in the future, it is essential to understand what a battery can and cannot do.

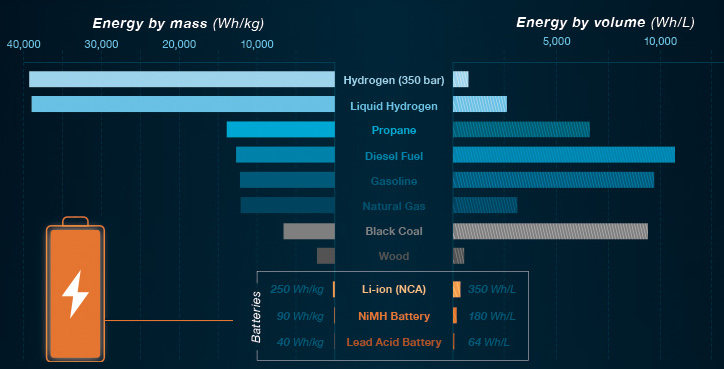

Energy Density

The biggest difference between batteries and other fuel types is in energy density.

Even the best lithium-ion batteries have a specific energy of about 250 Wh/kg. That is just 2% of the energy density of gasoline, and less than 1% of hydrogen.

While it may be enough to power a car, it’s also magnificent engineering that helps makes this possible. Airplanes, ships, trains, and other large power drains will not be using batteries in powertrains anytime soon.

A Renewable Future?

Renewable energy sources like solar and wind face a similar problem – today’s battery technology cannot store big enough payloads of energy. To balance the load, excess energy must be stored somehow to be used when the sun isn’t shining and the wind isn’t blowing.

Currently, industrial-strength battery systems are not yet fully developed to handle this storage problem on a widespread commercial basis, though progress is being made in many areas. New technologies such as vanadium flow batteries could play an important role in energy storage in the future. But for now, large-scale energy storage batteries are experimental.

Other energy storage technologies may also solve this problem:

- Chemical storage: Using excess electricity to create hydrogen fuel, which can be stored.

- Pumped hydro: Using electricity to pump water up to a reservoir, which can be later used to generate hydroelectric power.

- Compressed air: Using electricity to compress air in deep caverns, which can be released to generate power.

Solving this energy storage problem will pave the way for more use of renewables in the future on a grander scale.

The Sweet Spot

Therefore, the sweet spot for battery use today comes when batteries can take advantage of their best properties. Batteries can be small, portable, charged on the go, and provide energy at the flick of a switch.

It’s why so many rechargeable batteries are used in: electronics, laptops, smartphones, electric cars, power tools, startup motors, and other portable items that can benefit from these traits.

To assess the suitability of a particular type for any specific use, there are 10 major properties worth looking at:

- High Specific Energy: Specific energy is the total amount of energy stored by a battery. The more energy a battery can store, the longer it can run.

- High Specific Power: Specific power is the amount of load current drawn from the battery. Without high specific power, a battery cannot be used for the high-drain activities we need

- Affordable Cost: If the price isn’t right for a particular battery type, it may be worth using an alternative fuel source or battery configuration for economic reasons

- Long Life: The chemical makeup of batteries isn’t perfect. As a result, they only last for a number of charge/discharge cycles – if that number is low, that means a battery’s use may be limited.

- High Safety: Batteries are used in consumer goods or for important industrial or government applications – none of these parties want batteries to cause safety issues.

- Wide Operating Range: Some chemical reactions don’t work well in the cold or heat – that’s why it’s important to have batteries that work in a range of temperatures where it can be useful.

- No Toxicity: Nickel cadmium batteries are no longer used because of their toxic environmental implications. New batteries to be commercialized must meet stringent standards in these regards.

- Fast Charging: What good would a smartphone be if it took two full days to recharge? Charge time matters.

- Low Self-Discharge: All batteries discharge small amounts when left alone over time – the question is how much, and does it make an impact on the usability of the battery?

- Long Shelf Life: The shelf life of batteries affects the whole supply chain, so it is important that batteries can be usable many years after being manufactured.

There are many pros and cons to consider in choosing a battery type. The more pros that a given battery technology can check off the above list, the more likely it is to be commercially viable.

Now that you know what batteries can and cannot do, we will now look at the rechargeable battery market in Part 3 of the Battery Series.

Energy

Charted: 4 Reasons Why Lithium Could Be the Next Gold Rush

Visual Capitalist has partnered with EnergyX to show why drops in prices and growing demand may make now the right time to invest in lithium.

4 Reasons Why You Should Invest in Lithium

Lithium’s importance in powering EVs makes it a linchpin of the clean energy transition and one of the world’s most precious minerals.

In this graphic, Visual Capitalist partnered with EnergyX to explore why now may be the time to invest in lithium.

1. Lithium Prices Have Dropped

One of the most critical aspects of evaluating an investment is ensuring that the asset’s value is higher than its price would indicate. Lithium is integral to powering EVs, and, prices have fallen fast over the last year:

| Date | LiOH·H₂O* | Li₂CO₃** |

|---|---|---|

| Feb 2023 | $76 | $71 |

| March 2023 | $71 | $61 |

| Apr 2023 | $43 | $33 |

| May 2023 | $43 | $33 |

| June 2023 | $47 | $45 |

| July 2023 | $44 | $40 |

| Aug 2023 | $35 | $35 |

| Sept 2023 | $28 | $27 |

| Oct 2023 | $24 | $23 |

| Nov 2023 | $21 | $21 |

| Dec 2023 | $17 | $16 |

| Jan 2024 | $14 | $15 |

| Feb 2024 | $13 | $14 |

Note: Monthly spot prices were taken as close to the 14th of each month as possible.

*Lithium hydroxide monohydrate MB-LI-0033

**Lithium carbonate MB-LI-0029

2. Lithium-Ion Battery Prices Are Also Falling

The drop in lithium prices is just one reason to invest in the metal. Increasing economies of scale, coupled with low commodity prices, have caused the cost of lithium-ion batteries to drop significantly as well.

In fact, BNEF reports that between 2013 and 2023, the price of a Li-ion battery dropped by 82%.

| Year | Price per KWh |

|---|---|

| 2023 | $139 |

| 2022 | $161 |

| 2021 | $150 |

| 2020 | $160 |

| 2019 | $183 |

| 2018 | $211 |

| 2017 | $258 |

| 2016 | $345 |

| 2015 | $448 |

| 2014 | $692 |

| 2013 | $780 |

3. EV Adoption is Sustainable

One of the best reasons to invest in lithium is that EVs, one of the main drivers behind the demand for lithium, have reached a price point similar to that of traditional vehicle.

According to the Kelly Blue Book, Tesla’s average transaction price dropped by 25% between 2022 and 2023, bringing it in line with many other major manufacturers and showing that EVs are a realistic transport option from a consumer price perspective.

| Manufacturer | September 2022 | September 2023 |

|---|---|---|

| BMW | $69,000 | $72,000 |

| Ford | $54,000 | $56,000 |

| Volkswagon | $54,000 | $56,000 |

| General Motors | $52,000 | $53,000 |

| Tesla | $68,000 | $51,000 |

4. Electricity Demand in Transport is Growing

As EVs become an accessible transport option, there’s an investment opportunity in lithium. But possibly the best reason to invest in lithium is that the IEA reports global demand for the electricity in transport could grow dramatically by 2030:

| Transport Type | 2022 | 2025 | 2030 |

|---|---|---|---|

| Buses 🚌 | 23,000 GWh | 50,000 GWh | 130,000 GWh |

| Cars 🚙 | 65,000 GWh | 200,000 GWh | 570,000 GWh |

| Trucks 🛻 | 4,000 GWh | 15,000 GWh | 94,000 GWh |

| Vans 🚐 | 6,000 GWh | 16,000 GWh | 72,000 GWh |

The Lithium Investment Opportunity

Lithium presents a potentially classic investment opportunity. Lithium and battery prices have dropped significantly, and recently, EVs have reached a price point similar to other vehicles. By 2030, the demand for clean energy, especially in transport, will grow dramatically.

With prices dropping and demand skyrocketing, now is the time to invest in lithium.

EnergyX is poised to exploit lithium demand with cutting-edge lithium extraction technology capable of extracting 300% more lithium than current processes.

-

Lithium5 days ago

Lithium5 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Energy1 week ago

Energy1 week agoThe World’s Biggest Nuclear Energy Producers

China has grown its nuclear capacity over the last decade, now ranking second on the list of top nuclear energy producers.

-

Energy1 month ago

Energy1 month agoThe World’s Biggest Oil Producers in 2023

Just three countries accounted for 40% of global oil production last year.

-

Energy1 month ago

Energy1 month agoHow Much Does the U.S. Depend on Russian Uranium?

Currently, Russia is the largest foreign supplier of nuclear power fuel to the U.S.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy3 months ago

Energy3 months agoVisualizing the Rise of the U.S. as Top Crude Oil Producer

Over the last decade, the United States has established itself as the world’s top producer of crude oil, surpassing Saudi Arabia and Russia.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees