Datastream

Visualizing the Five Drivers of Forest Loss

The following content is sponsored by Carbon Streaming Corporation.

The Briefing

- On average, the world loses more than 20 million hectares of forests annually.

- Agriculture and commodity-driven deforestation each account for approximately a quarter of annual forest loss.

Visualizing the Five Drivers of Forest Loss

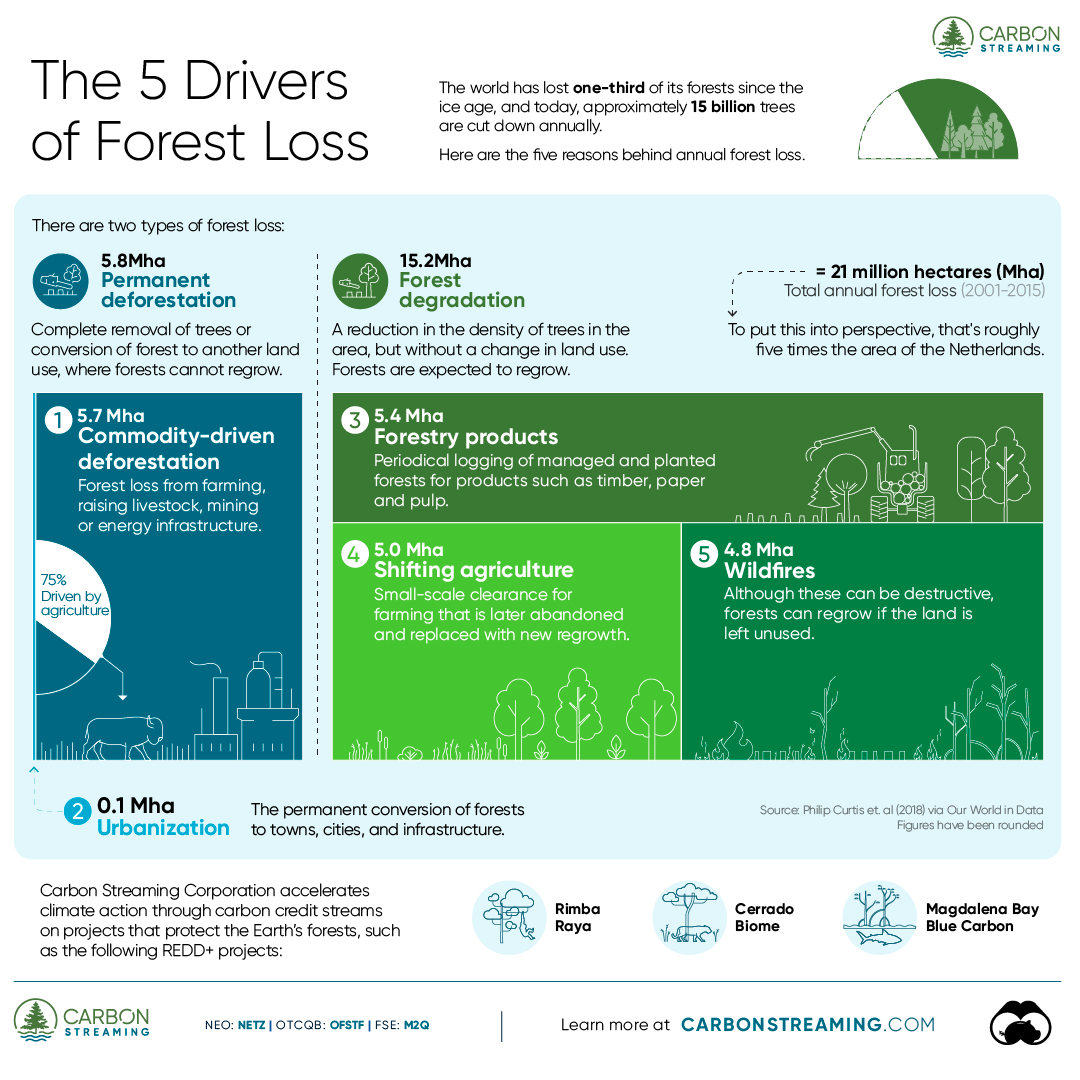

The world has lost one-third of its forests since the ice age, and today, approximately 15 billion trees are cut down annually.

Forests are wellsprings of biodiversity and an essential buffer against climate change, absorbing billions of tonnes of carbon dioxide emissions every year. Yet, forest loss continues to grow.

The above infographic sponsored by Carbon Streaming Corporation highlights the five primary drivers behind forest loss.

Deforestation vs. Degradation

‘Forest loss’ is a broad term that captures the impacts of both permanent deforestation and forest degradation. There is an important distinction between the two:

- Permanent deforestation: Refers to the complete removal of trees or conversion of forests to another land use (like buildings), where forests cannot regrow.

- Forest degradation: Refers to a reduction in the density of trees in the area without a change in land use. Forests are expected to regrow.

Forest degradation accounts for over 70% or 15 million hectares of annual forest loss. The other 30% of lost forests are permanently deforested.

| Driving factor | Category | Average annual forest loss (2001-2015, million hectares) |

|---|---|---|

| Commodity-driven deforestation | Permanent deforestation | 5.7 |

| Urbanization | Permanent deforestation | 0.1 |

| Forestry products | Forest degradation | 5.4 |

| Shifting agriculture | Forest degradation | 5 |

| Wildfires | Forest degradation | 4.8 |

| Total | N/A | 21 |

Commodity-driven deforestation, which includes removal of forests for farming and mining, is the largest driver of forest loss. Agriculture alone accounts for three-fourths of all commodity-driven deforestation, where forests are often converted into land for cattle ranches and plantations.

The harvesting of forestry products like timber, paper, pulp, and rubber accounts for the largest share of forest loss from degradation. This process is often managed and planned so that forests can regrow after the harvest.

Shifting agriculture and wildfires each account for around 5 million hectares or one-fourth of annual forest loss. In both cases, forests can replenish if the land is left unused.

Urbanization—the conversion of forests into land for cities and infrastructure—is by far the smallest contributor, accounting for less than 1% of annual forest loss.

How Much Carbon Do Forests Absorb?

The world’s forests absorbed nearly twice as much carbon dioxide (CO2) as they emitted between 2001 and 2019, according to research published in Nature.

On a net basis, forests sequester 7.6 billion tonnes of CO2 equivalent (CO2e) annually, which equates to around 15% of global CO2e emissions. As the impacts of climate change intensify, protecting forests from deforestation and degradation is increasingly critical.

Carbon Streaming Corporation accelerates climate action through carbon credit streams on REDD+ projects that protect the Earth’s forests. Click here to learn more now.

Where does this data come from?

Source: Our World in Data

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001