Datastream

Ranked: Top 10 Foreign Policy Concerns of Americans

The Briefing

- Political leanings aside, terrorism remains a top issue of concern for Americans

- Previous top issues, such as disinformation and U.S.–China relations, now rank lower

In the United States, there is a distinct difference on top foreign policy concerns between Democrats and Republicans.

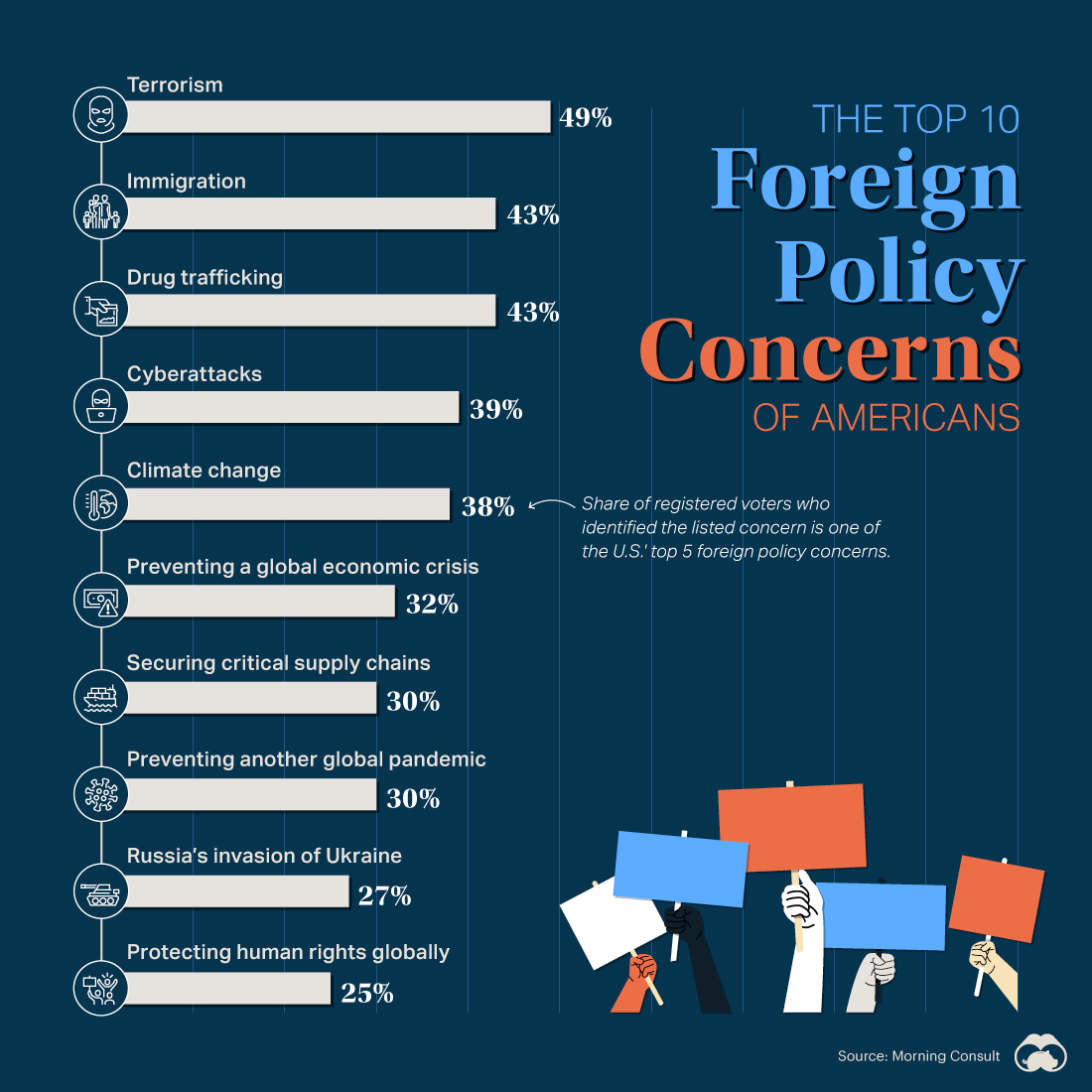

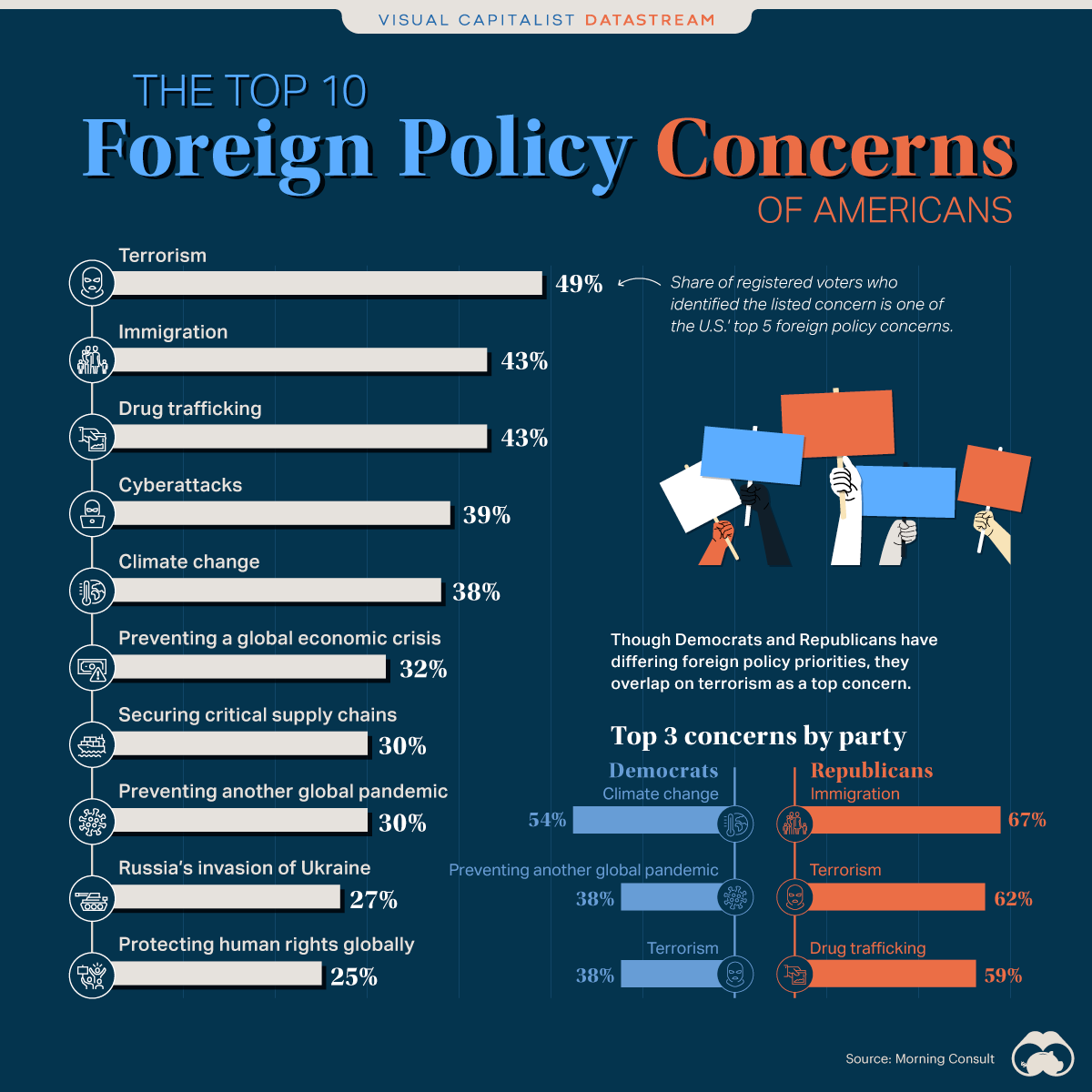

This chart uses data from Morning Consult to assess the top policy concerns of Americans.

The Top Concerns

Overall, the average American is most concerned about terrorism, immigration, and drug trafficking. Interestingly, this list corresponds with the concerns of the average Republican, though falling in a different order.

Meanwhile, Democrats are chiefly worried about climate change, another global pandemic, and terrorism.

Here’s a breakdown of the policy concerns at large and across political parties.

| Overall Rank with Americans | Foreign Policy Concern | Share of Voters Listing it as a Top Concern | Share of Democrats Listing it as a Top Concern | Share of Republicans Listing it as a Top Concern |

|---|---|---|---|---|

| #1 | Terrorism | 49% | 38% | 62% |

| #2 | Immigration | 43% | 22% | 67% |

| #3 | Drug trafficking | 43% | 30% | 59% |

| #4 | Cyberattacks | 39% | 35% | 40% |

| #5 | Climate change | 38% | 54% | 17% |

| #6 | Preventing a global economic crisis | 32% | 33% | 31% |

| #7 | Securing critical supply chains | 30% | 27% | 34% |

| #8 | Preventing another global pandemic | 30% | 38% | 22% |

| #9 | Russia's invasion of Ukraine | 27% | 33% | 21% |

| #10 | Protecting human rights globally | 25% | 31% | 18% |

| #11 | Preventing disinformation | 24% | 29% | 21% |

| #12 | U.S.-China relations | 24% | 19% | 31% |

| #13 | Iran nuclear deal | 21% | 19% | 24% |

| #14 | Upholding democracy globally | 15% | 22% | 8% |

Notably, the concern around U.S.-China relations ranks considerably low, as does preventing disinformation. Upholding democracy worldwide ranks extremely low with Republicans.

America’s Foreign Policy

Along party lines, the results are not surprising. Democrats skew towards multilateralism and want to engage with foreign bodies and other countries to tackle global issues. Republicans are generally more concerned with what’s happening at home.

Looking at the country as a whole and its relations with other nations, however, Americans lean more towards an America-first focus. According to Morning Consult, 39% of registered voters want to decrease U.S. involvement in other countries’ affairs, whereas 20% want to increase it; 30% want to keep the status quo.

Here’s a closer look at Americans’ desire to get involved in a variety of foreign policy initiatives:

| Issue | Increase Efforts | Decrease Efforts | Neither |

|---|---|---|---|

| Overseas Troop Deployment | 21% | 37% | 30% |

| Trade and Tariffs | 41% | 15% | 29% |

| Involvement with International Organizations | 35% | 21% | 32% |

| Resolution of Military Disputes | 38% | 16% | 33% |

| Resolution of Economic Disputes | 43% | 13% | 31% |

As of October 2022

The U.S. Midterm Elections

With midterm elections underway, America’s foreign policy may not be the most important factor for voters. Pew Research Center found that in these congressional elections, foreign policy only ranked 12th among other key issues considered “very important” by registered voters.

The top five concerns of voters in these midterms are:

- The economy

- The future of democracy within the U.S.

- Education

- Healthcare

- Energy policy

Regardless, the U.S. has a massive impact in foreign affairs and the results of the country’s midterm elections will likely cause a ripple effect globally. If Republicans win the House—which is looking extremely likely—and the Senate, President Biden’s foreign policy initiatives and priorities could be drastically restricted.

Where does this data come from?

Source: Morning Consult

Data notes: This ranking is made using the share of registered U.S. voters who identified the given issue as a top 5 concern for the country. For example, only 30% of registered voters said securing critical supply chains was a top 5 concern which is why it’s #7, whereas 43% said immigration was a top concern, ranking it at #2.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Culture1 week ago

Culture1 week agoThe Highest Earning Athletes in Seven Professional Sports

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)