Ranking the Credit Ratings of Major Economies

Ranking the Credit Ratings of Major Economies

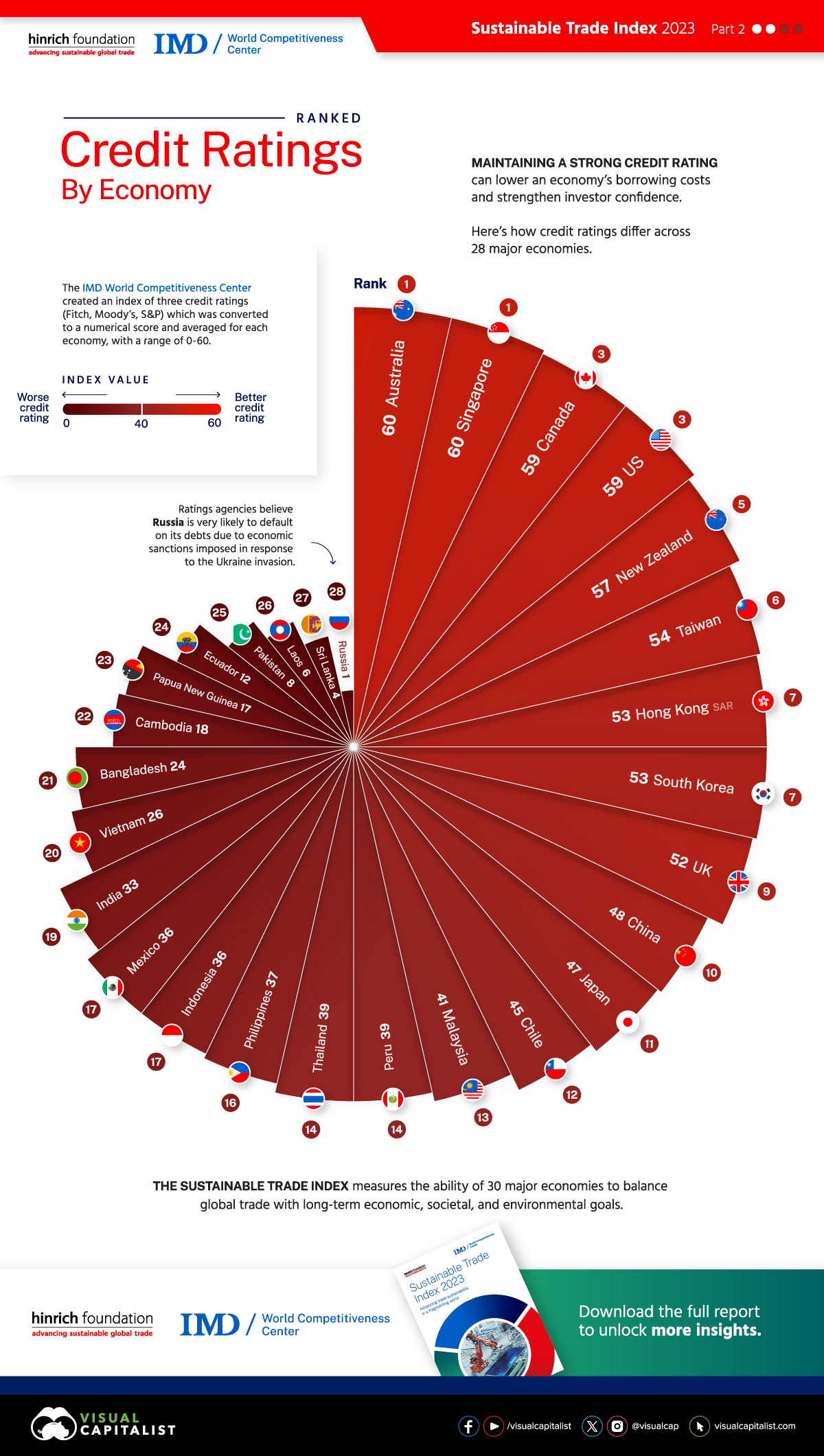

Country credit ratings assess the likelihood that a country will default on its debts, and are determined by international rating agencies like Standard & Poor’s (S&P), Moody’s, and Fitch Ratings.

Generally speaking, a higher rating results in lower borrowing costs for the country, while lower ratings can increase costs or even limit access to capital.

This graphic from The Hinrich Foundation shows the credit worthiness of 28 major economies, using an index of ratings from the three agencies mentioned above (S&P, Moody’s, Fitch).

The analysis comes from the 2023 Sustainable Trade Index (STI), which the Hinrich Foundation produced in collaboration with the IMD World Competitiveness Center.

Data Overview

To produce the STI’s credit rating metric, ratings from S&P, Moody’s, and Fitch were converted to a numerical score and averaged for each economy, with a range of 0-60 (60 being the highest). All data are as of 2022.

| Rank | Economy | Index Value |

|---|---|---|

| 1 | 🇦🇺 Australia | 60 |

| 1 | 🇸🇬 Singapore | 60 |

| 3 | 🇨🇦 Canada | 59 |

| 3 | 🇺🇸 United States | 59 |

| 5 | 🇳🇿 New Zealand | 57 |

| 6 | 🇹🇼 Taiwan | 54 |

| 7 | 🇭🇰 Hong Kong | 53 |

| 7 | 🇰🇷 South Korea | 53 |

| 9 | 🇬🇧 United Kingdom | 52 |

| 10 | 🇨🇳 China | 48 |

| 11 | 🇯🇵 Japan | 47 |

| 12 | 🇨🇱 Chile | 45 |

| 13 | 🇲🇾 Malaysia | 41 |

| 14 | 🇵🇪 Peru | 39 |

| 14 | 🇹🇭 Thailand | 39 |

| 16 | 🇵🇭 Philippines | 37 |

| 17 | 🇮🇩 Indonesia | 36 |

| 17 | 🇲🇽 Mexico | 36 |

| 19 | 🇮🇳 India | 33 |

| 20 | 🇻🇳 Vietnam | 26 |

| 21 | 🇧🇩 Bangladesh | 24 |

| 22 | 🇰🇭 Cambodia | 18 |

| 23 | 🇵🇬 Papua New Guinea | 17 |

| 24 | 🇪🇨 Ecuador | 12 |

| 25 | 🇵🇰 Pakistan | 8 |

| 26 | 🇱🇦 Laos | 6 |

| 27 | 🇱🇰 Sri Lanka | 4 |

| 28 | 🇷🇺 Russia | 1 |

Countries with advanced economies and stable political structures typically receive the highest credit ratings, but this is always subject to change. For example, in August 2023, Fitch Ratings announced it had downgraded the U.S. to an AA+ from AAA (the highest possible).

From Fitch’s press release:

The rating downgrade of the U.S. reflects the expected fiscal deterioration over the next three years, a high and growing general government debt burden, and the erosion of governance relative to ‘AA’ and ‘AAA’ rated peers over the last two decades that has manifested in repeated debt limit standoffs and last-minute resolutions.

Speaking of downgrades, one country that has received numerous in recent years is Russia, due to sanctions it faces as a result of the prolonged invasion of Ukraine. For example, S&P reduced Russia’s sovereign credit rating to a CCC-, which implies a default is imminent in the near future.

Explore the Sustainable Trade Index

This infographic was just a preview of what the Sustainable Trade Index has to offer. To learn more, visit The Hinrich Foundation, where you can download additional resources including the entire report for free.

-

Money2 days ago

Money2 days agoCharted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

-

Money4 days ago

Money4 days agoCharted: Who Has Savings in This Economy?

Older, better-educated adults are winning the savings game, reveals a January survey by the National Opinion Research Center at the University of Chicago.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

See how much the debt-to-GDP ratios of advanced economies have grown (or shrank) since the year 2000.

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

Which OECD countries have the smallest gender wage gaps? We look at the 10 countries with gaps lower than the average.

-

Money3 weeks ago

Money3 weeks agoWhich States Have the Highest Minimum Wage in America?

Here’s where workers earn the highest minimum wage in America as 22 states implement wage increases in 2024.

-

Money3 weeks ago

Money3 weeks agoWhere Does One U.S. Tax Dollar Go?

Listing the many programs—health, defense, veterans benefits—that U.S. federal taxes fund, in the form of a single federal tax dollar.