Business

Pandemic Recovery: Have North American Downtowns Bounced Back?

Pandemic Recovery: Have Downtowns Bounced Back?

As we continue on our journey towards recovery from the impacts of the pandemic, North American offices that sat empty for months have started to welcome back in-person workers.

This small step towards normalcy has sparked questions around the future of office life—will office culture eventually bounce back to pre-pandemic levels, or is remote work here to stay?

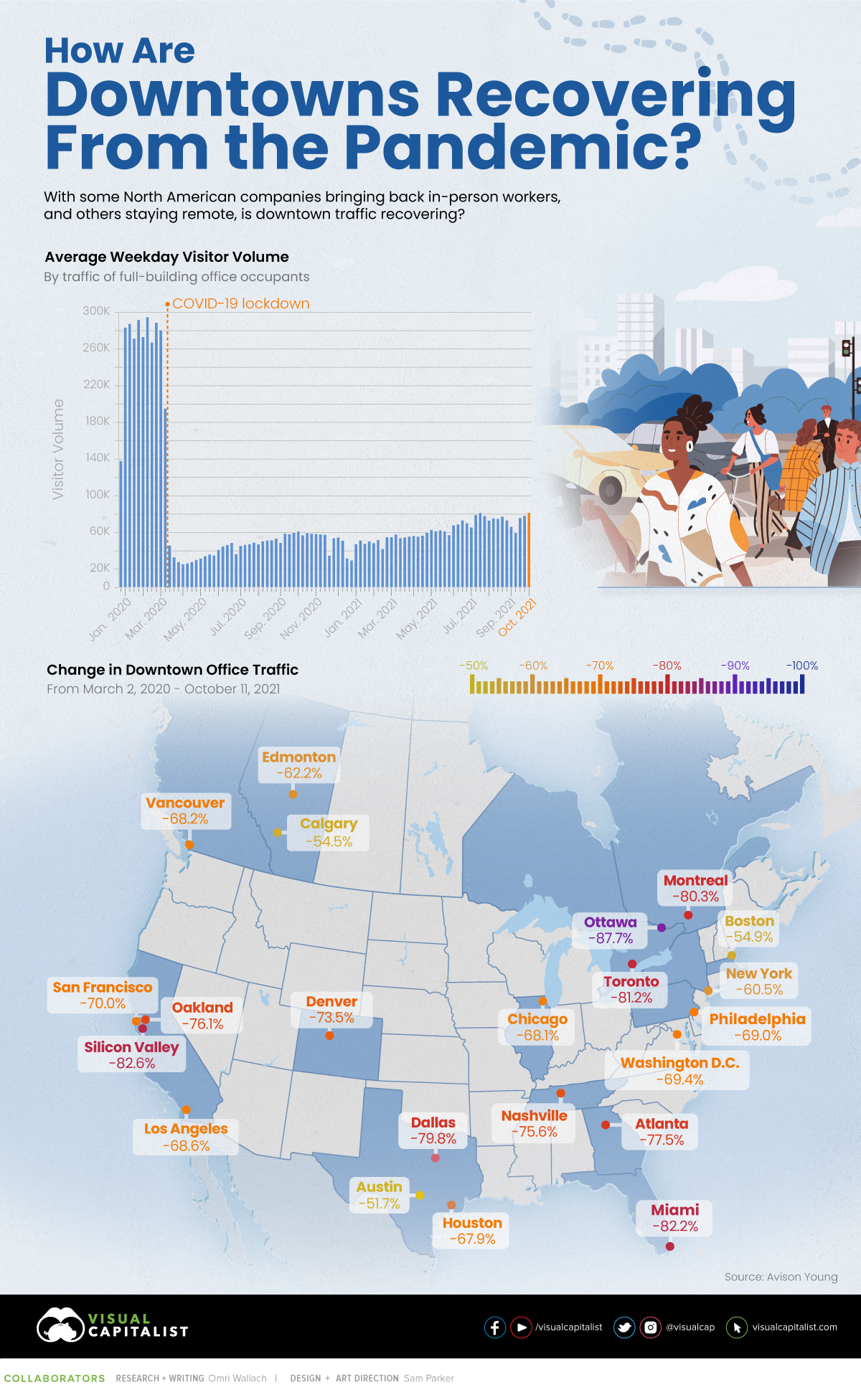

It’s impossible to predict the future, but one way to gauge the current state of office life is by looking at foot traffic across city centers in North America. This graphic measures just that, using data from Avison Young.

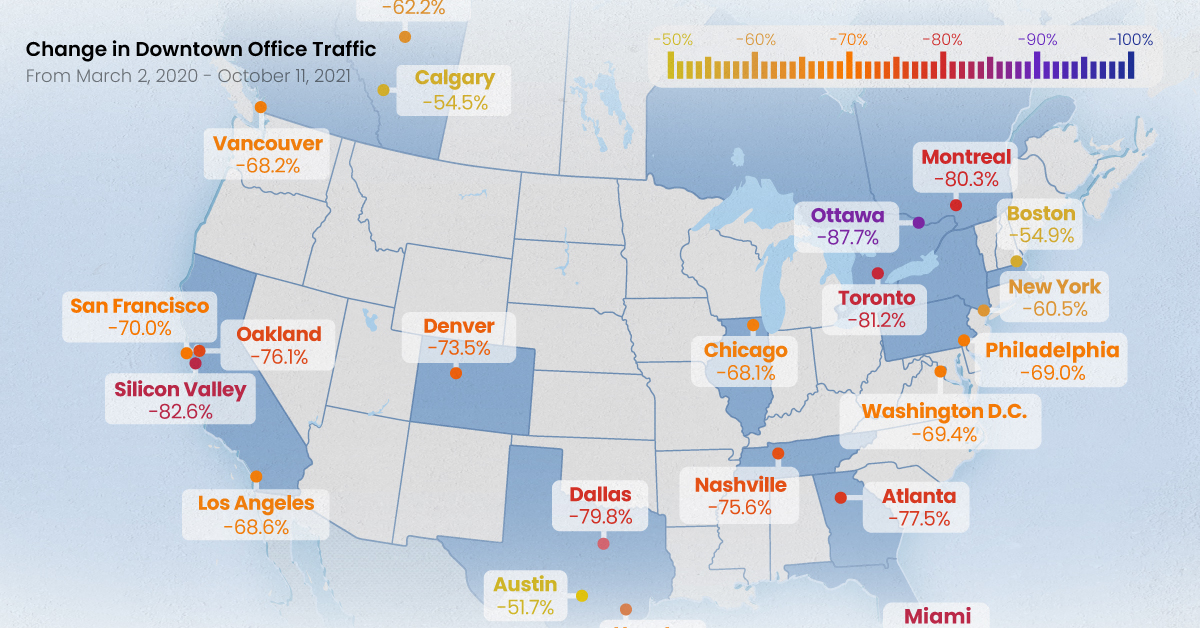

Change in Downtown Office Traffic

According to the data, which measures foot traffic in major office buildings in 23 different metropolitan hubs across North America, remains drastically below pre-pandemic levels.

Across all major cities included in the index, average weekday visitor volume has fallen by 73.7% since the early months of 2020. Here’s a look at each individual city’s change in foot traffic, from March 2, 2020 to Oct 11, 2021:

| City | Country | Change in Foot Traffic |

|---|---|---|

| Austin | 🇺🇸 | -51.70% |

| Calgary | 🇨🇦 | -54.50% |

| Boston | 🇺🇸 | -54.90% |

| New York | 🇺🇸 | -60.50% |

| San Francisco | 🇺🇸 | -60.80% |

| Edmonton | 🇨🇦 | -62.20% |

| Houston | 🇺🇸 | -67.90% |

| Chicago | 🇺🇸 | -68.10% |

| Vancouver | 🇨🇦 | -68.20% |

| Los Angeles | 🇺🇸 | -68.60% |

| Philadelphia | 🇺🇸 | -69.00% |

| Washington, DC | 🇺🇸 | -69.40% |

| San Francisco Peninsula | 🇺🇸 | -70.00% |

| Denver | 🇺🇸 | -73.50% |

| Nashville | 🇺🇸 | -75.60% |

| East Bay/Oakland | 🇺🇸 | -76.10% |

| Atlanta | 🇺🇸 | -77.50% |

| Dallas | 🇺🇸 | -79.80% |

| Montreal | 🇨🇦 | -80.30% |

| Toronto | 🇨🇦 | -81.20% |

| Miami | 🇺🇸 | -82.20% |

| Silicon Valley | 🇺🇸 | -82.60% |

| Ottawa | 🇨🇦 | -87.70% |

The Canadian city of Calgary is a somewhat unique case. On one hand, foot traffic has bounced back stronger than many other downtowns across North America. On the other hand, the city has one of the highest commercial vacancy rates in North America, and there are existential questions about what comes next for the city.

Interestingly, a number of cities with a high proportion of tech jobs, such as Austin, Boston, and San Francisco bounced back the strongest post-pandemic. Of course, there is one noteworthy exception to that rule.

A Tale of Two Cities

Silicon Valley has experienced one of the most significant drops in foot traffic, at -82.6%. Tech as an industry has seen one of the largest increases in remote work, as Bay Area workers look to escape high commuter traffic and high living expenses. A recent survey found that 53% of tech workers in the region said they are considering moving, with housing costs being the primary reason most respondents cited.

Meanwhile, in a very different part of North America, another city is experienced a sluggish rebound in foot traffic, but for very different reasons. Ottawa, Canada’s capital, is facing empty streets and struggling small businesses that rely on the droves of government workers that used to commute to downtown offices. Unlike Silicon Valley, where tech workers are taking advantage of flexible work options, many federal workers in Ottawa are still working from home without a clear plan on returning to the workplace.

It’s also worth noting that these two cities are home to a lot of single-occupant office buildings, which is a focus of this data set.

Some Businesses Remain Hopeful

Despite a slow return to office life, some employers are snapping up commercial office space in preparation for a potential mass return to the office.

Back in March 2021, Google announced it was planning to spend over $7 billion on U.S. office space and data centers. The tech giant held true to its promise—in September, Google purchased a Manhattan commercial building for $2.1 billion.

Other tech companies like Alphabet and Facebook have also been growing their office spaces throughout the pandemic. In August 2021, Amazon leased new office space in six major U.S. cities, and in September 2020, Facebook bought a 400,000 square foot complex in Bellevue, Washington.

Will More Employees Return or Stay Remote?

It’s important to note that we’re still in the midst of pandemic recovery, which means the jury’s still out on what our post-pandemic world will look like.

Will different cities and industries eventually recover in different ways, or are we approaching the realities of “new normal” foot traffic in North American city centers?

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Sports1 week ago

Sports1 week agoThe Highest Earning Athletes in Seven Professional Sports

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)