Markets

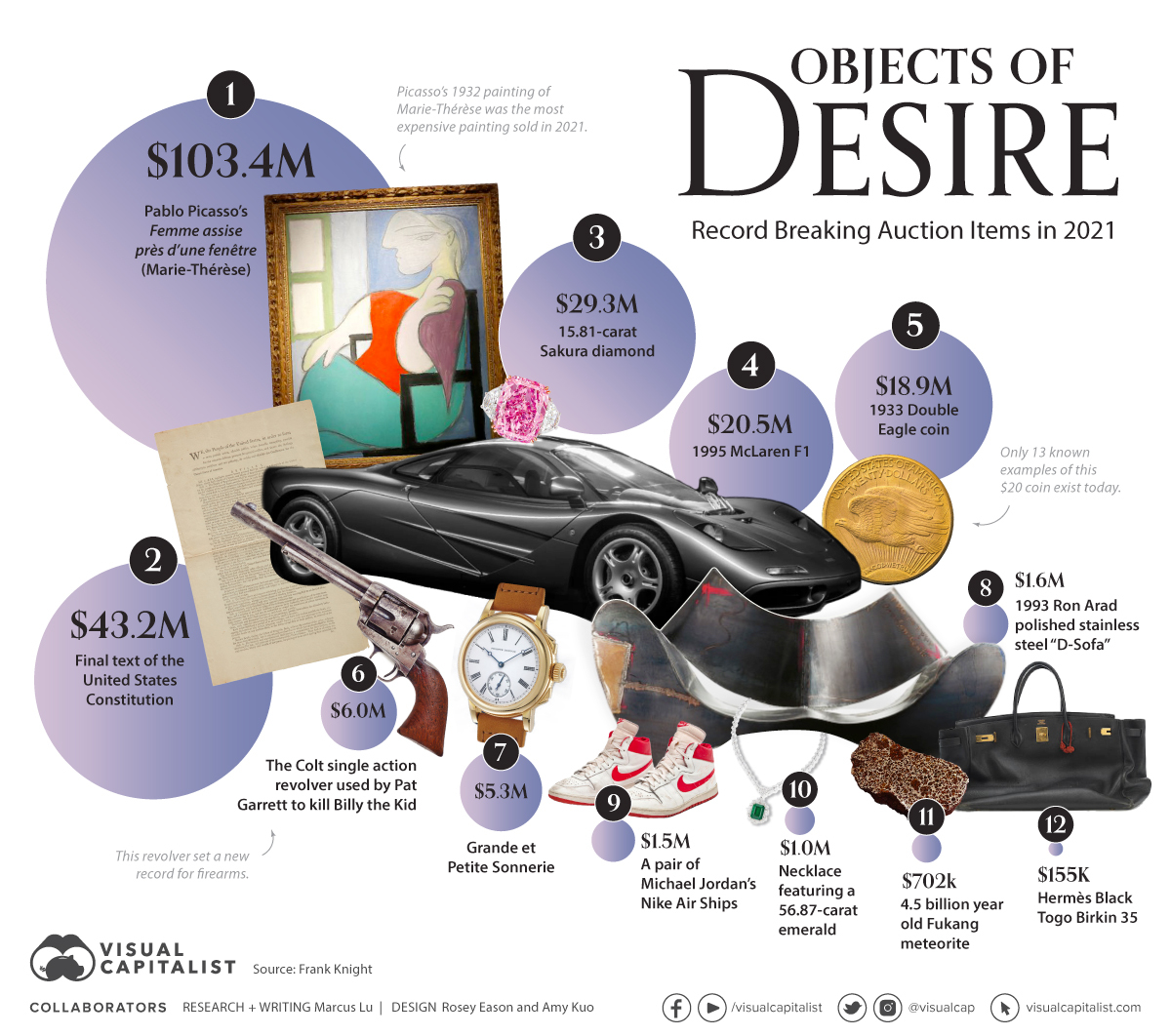

Objects of Desire: Record Breaking Auction Sales in 2021

Record Breaking Auction Sales in 2021

2021 may have been the year of the NFT, but wealthy collectors still dropped plenty of cash on physical objects. This included the usual items like paintings and cars, as well as some more obscure ones like meteorites.

To gain insight into the world of rare collectibles, this infographic summarizes the biggest auction sales of 2021, spread across 12 different item categories.

The Numbers

The key details of these sales are listed below in tabular format. Some broke all-time records, while others set the record for 2021 specifically.

| Object | Category | Sale Price (USD) | Auction House |

|---|---|---|---|

| Pablo Picasso’s Femme assise près d’une fenêtre | Paintings | $103.4M | Christie’s |

| Final text of the United States Constitution | Printed texts | $43.2M | Sotheby’s |

| 15.81-carat Sakura diamond | Purple-pink diamonds | $29.3M | Christie’s |

| 1995 McLaren F1 | Automobiles | $20.5M | Gooding & Company |

| 1933 Double Eagle coin | Coins | $18.9M | Sotheby’s |

| The revolver used to kill Billy the Kid | Firearms | $6.0M | Bonhams |

| Grande et Petite Sonnerie | Watches | $5.3M | Phillips |

| 1993 Ron Arad “D-Sofa” | Furniture | $1.6M | Phillips |

| Pair of Michael Jordan’s Nike Air Ships | Shoes | $1.5M | Sotheby’s |

| Necklace featuring a 56.87-carat emerald | Emeralds | $1.0M | Phillips |

| 4.5B year old Fukang meteorite | Meteorites | $702K | Christie’s |

| Hermès Black Togo Birkin 35 | Handbags | $155K | Bonhams |

The Details

Here are some interesting facts and details about these rare collectibles, starting with:

Pablo Picasso’s Femme assise près d’une fenêtre (Marie-Thérèse)

This 1932 painting is a depiction of Picasso’s lover, Marie-Thérèse Walter (1909-1977). Walter is believed to have had a significant impact on Picasso’s work, and the pair had a child out-of-wedlock in 1935.

He loved the blondeness of her hair, her luminous complexion, her sculptural body.

– Brassaï

Sold by Christie’s in New York, this was the first painting to auction for over $100 million in nearly two years. The all-time record holder is Leonardo da Vinci’s Salvator Mundi, which sold for $450 million in 2016 to Mohammed Bin Salman, the Crown Prince of Saudi Arabia.

1995 McLaren F1

Produced between 1992 and 1998, the McLaren F1 is widely regarded as one of the most desirable supercars in the world. It features many innovations that are still rare in modern road cars, including a carbon fiber monocoque (the main structure of the car), active aerodynamics on the underbody, and a centered driving position.

The F1’s legacy is cemented by the fact that only 106 were ever produced, many of which have been owned by celebrities. That includes Elon Musk, who famously crashed his F1 in 2000 without insurance.

The specific car highlighted above was sold by Gooding & Company, a classic car auction company. It has just 242 miles (390 km) on the clock, which translates to an average of 9.3 miles (15 km) being driven on the road per year.

1933 Double Eagle Coin

The 1933 Double Eagle is one of the last $20 gold coins ever produced in the United States. It dates back to an era when the U.S. dollar’s value was tied to gold, which is a system known as the gold standard. The coins were melted down when the U.S. transitioned to fiat money, and only 13 examples are known to exist today.

After selling for $18.9 million, this Double Eagle holds the title as the most valuable rare coin in the world.

The Revolver Used to Kill Billy the Kid

The Colt single-action revolver that was used to kill Billy the Kid is now the most expensive firearm ever sold at an auction. It belonged to Sheriff Pat Garrett, who killed Billy in 1881.

Billy is one of the most notorious figures from America’s wild west era and was responsible for the deaths of eight men, including two sheriff’s deputies during an escape from jail.

Because of Billy’s legacy, this revolver is lauded as one of the most desirable Western firearms in existence. Surprisingly, it was the gun’s first appearance in a public auction.

Final Text of the United States Constitution

This first-edition copy of the U.S. constitution is an incredibly rare and historically significant artifact. The story of how it sold is equally as impressive.

Bidding came down to two parties, one of which was Ken Griffin, billionaire CEO of Citadel. If you’re an investor, that name may sound familiar—Citadel was a hedge fund involved in the r/wallstreetbets saga of 2021.

The other party was ConstitutionDAO, a group of 17,000+ crypto investors who pooled together $47 million worth of Ethereum. The term “DAO” refers to a decentralized autonomous organization, which is an online entity that’s collectively owned by its members without centralized leadership—and that takes action based on transparent rules set on a public blockchain.

In the end, the copy was sold to Griffin for a total of $43.2 million. Organizers of ConstitutionDAO could not place a higher bid because they wouldn’t have had enough money to insure, store, and transport the document.

About Those NFTs…

NFTs only exist in the digital realm, but they’ve quickly become some of the world’s most valuable collectibles. How valuable, you may ask?

For starters, consider the $7.6 million sale of CryptoPunk #3100, a profile picture (PFP) NFT that depicts a blue zombie. Then there’s The Merge, a digital artwork comprised of 312,686 pieces. In December 2021, it was sold to a collective of 28,983 buyers who, altogether, paid $91.8 million.

All of this hype has led some of the world’s oldest auction houses to begin selling NFTs through online events. This includes Christie’s (founded in 1766), which surpassed $100 million in NFT auction sales in less than a year.

Whether this momentum can carry forward is questionable. Interest in NFTs has plummeted, and crypto markets remain incredibly volatile.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001