Wealth

The Richest People in the World in 2022

The Richest People in the World in 2022

Today, the 10 richest people in the world control $1.3 trillion in wealth.

This scale of wealth is equal to approximately 1.3% of the world economy, Amazon’s entire market cap, or spending $1 million a day over 3,000 years. In fact, it’s almost double the amount seen two years ago ($663 billion).

As billionaire wealth accumulates at a remarkable speed, we feature a snapshot of the world’s richest in 2022, based on data from the Forbes Real-Time Billionaires List.

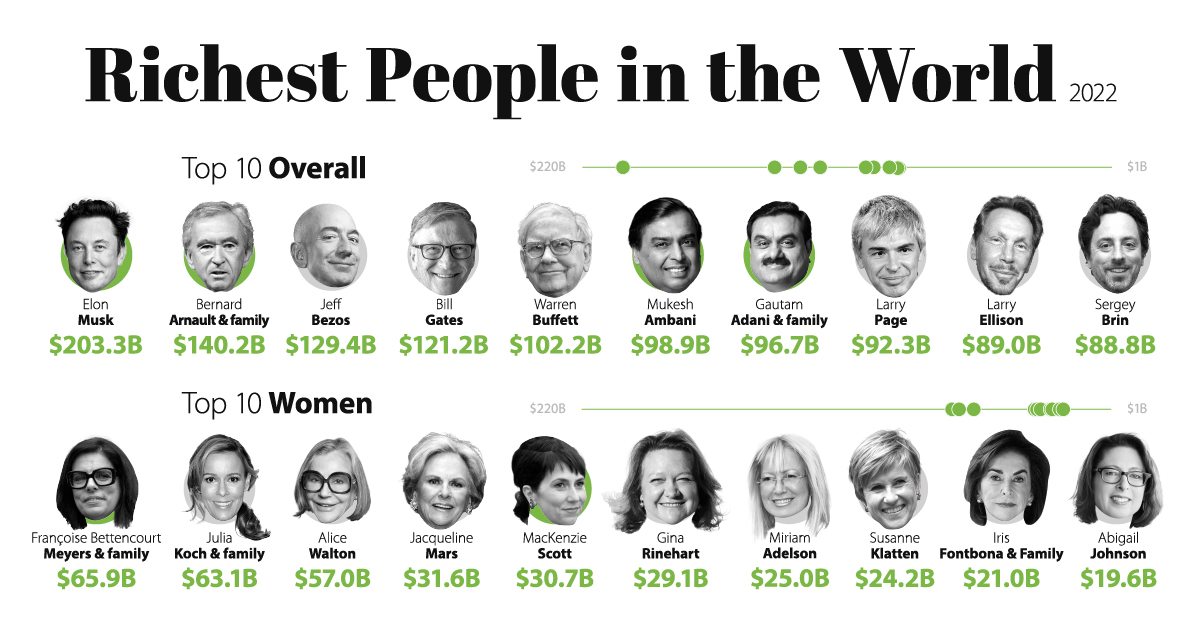

Top 10 Richest People in the World

Elon Musk, with a fortune of $266 billion, is the richest person on the planet.

Despite supply chain bottlenecks, Tesla deliveries have increased 27% since the second quarter of 2021. Musk, who is also CEO and chief engineer of SpaceX, plans to send the largest rocket ever built into orbit in 2022. It spans 119 meters tall.

Here are the richest people in the world, based on data as of September 13, 2022:

| Rank | Name | Source | Net Worth (Sep 2022) | Net Worth (Mar 2021) | Change 2021-2022 |

|---|---|---|---|---|---|

| 1 | Elon Musk | Tesla, SpaceX | $266B | $151B | $115B |

| 2 | Bernard Arnault & family | LVMH | $160B | $150B | $10B |

| 3 | Gautam Adani & family | Infrastructure, Commodities | $151B | $51B | $100B |

| 4 | Jeff Bezos | Amazon | $150B | $177B | -$27B |

| 5 | Bill Gates | Microsoft | $107B | $124B | -$17B |

| 6 | Larry Ellison | Oracle | $104B | $93B | $11B |

| 7 | Warren Buffett | Berkshire Hathaway | $97B | $96B | $1B |

| 8 | Mukesh Ambani | Diversified | $95B | $85B | $10B |

| 9 | Larry Page | $90B | $92B | -$2B | |

| 10 | Sergey Brin | $86B | $89B | -$3B |

With a net worth of $150 billion, Jeff Bezos sits in fourth place. Since last March, Amazon shares have fallen over 20% in light of inflationary price pressures and lagging retail performance.

Most notably, Mark Zuckerberg, CEO of Meta (formerly Facebook) fell off the top 10 for the first time since 2016. Meta shares plunged after reporting the first-ever drop in global daily active users since 2004.

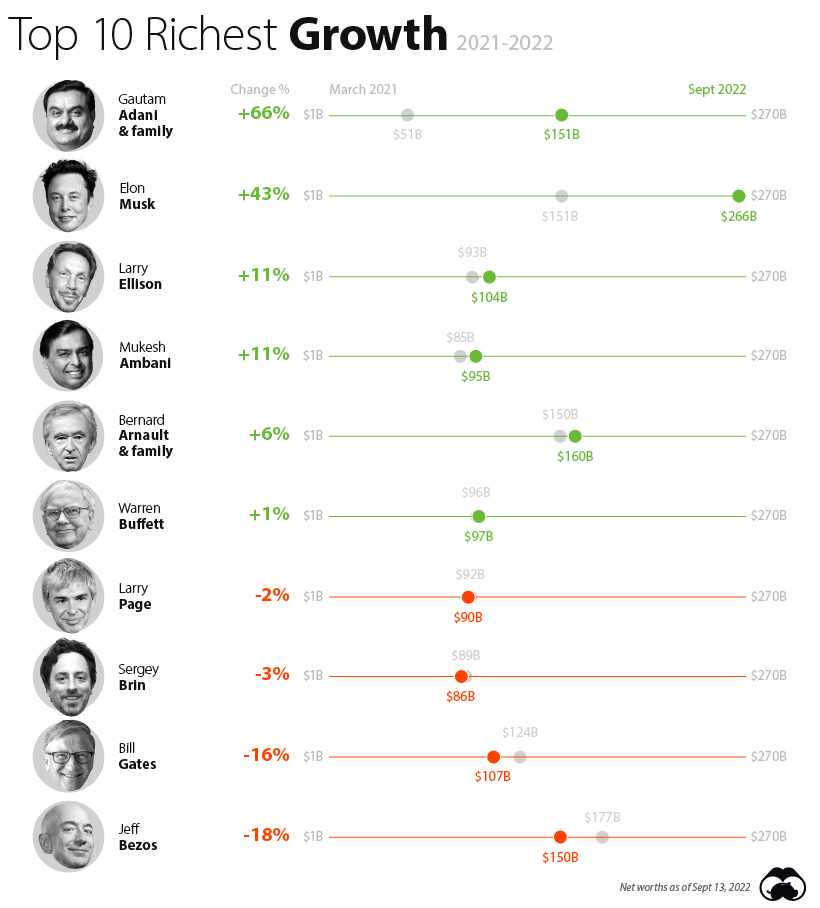

Growth Rates of the Top 10 Overall

Among the 10 richest people in the world, here’s who saw their wealth rise the fastest:

Gautam Adani saw his fortune rise more than any other in this top 10 list. Adani heads one of the three largest industrial conglomerates in India. In the coming years, Adani plans to invest $70 billion in the renewable energy sector.

Like Adani, Musk saw his wealth rise among the fastest, even as Tesla shares have declined over 30% since their peak in November.

Crypto Billionaires in 2022

Even amid the crypto winter, at least ten people worldwide have seen their wealth climb into the billions thanks to the stratospheric rise of cryptocurrencies.

Sam Bankman-Fried, founder of the FTX crypto derivatives exchange, is at the top, with a jaw-dropping $18 billion net worth. Bankman-Fried launched the exchange in 2019 when he was 27.

FTX now has one million users and a $32 billion valuation.

| Rank | Name | Net Worth | Age (as of Sep 2022) |

|---|---|---|---|

| 1 | Sam Bankman-Fried | $18B | 30 |

| 2 | Changpeng Zhao | $17B | 45 |

| 3 | Gary Wang | $5B | 29 |

| 4 | Song Chi-hyung | $3B | 43 |

| 5 | Brian Armstrong | $3B | 39 |

| 5 | Chris Larsen | $3B | 62 |

| 6 | Jed McCaleb | $3B | 47 |

| 7 | Cameron Winklevoss | $2B | 41 |

| 8 | Tyler Winklevoss | $2B | 41 |

| 9 | Barry Silbert | $2B | 46 |

Following Bankman-Fried is Changpeng Zhao, the co-founder of cryptocurrency exchange Binance. It is the largest exchange globally.

Also on the list are co-founders of Gemini cryptocurrency exchange Cameron and Tyler Winklevoss, each with a net worth of over $2 billion. Like their rival, Mark Zuckerberg, they have their sights on building a metaverse.

Larger Shifts

Will billionaire wealth continue to accumulate at record rates? As the invasion of Ukraine presses on, it will likely have broader structural outcomes.

Some argue that war is a great leveler, a force that has reduced wealth inequality, as seen in the aftermath of WWII. Others suggest that it increases wealth divergence, especially when the war is financed by public debt. Often, costs have become inflated due to war, putting pressure on low and middle-income households.

Whether or not the war will have lasting effects on wealth distribution is an open question, however, if the pandemic serves as any precedent, the effects will be far from predictable.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Brands6 days ago

Brands6 days agoHow Tech Logos Have Evolved Over Time

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023

-

Green2 weeks ago

Green2 weeks agoRanking the Top 15 Countries by Carbon Tax Revenue