Personal Finance

How Money is Spent by Different Income Groups

How Money is Spent by Different Income Groups

If you started making twice the amount of money that you do today, how would your spending habits change?

Consider if the tables were turned, and you instead were reduced to half of your current income. Where would you likely make cuts to spending?

The reality is that the money you have coming in has big implications on how expenses get prioritized – and so it’s interesting to see how people in different income brackets allocate what they have.

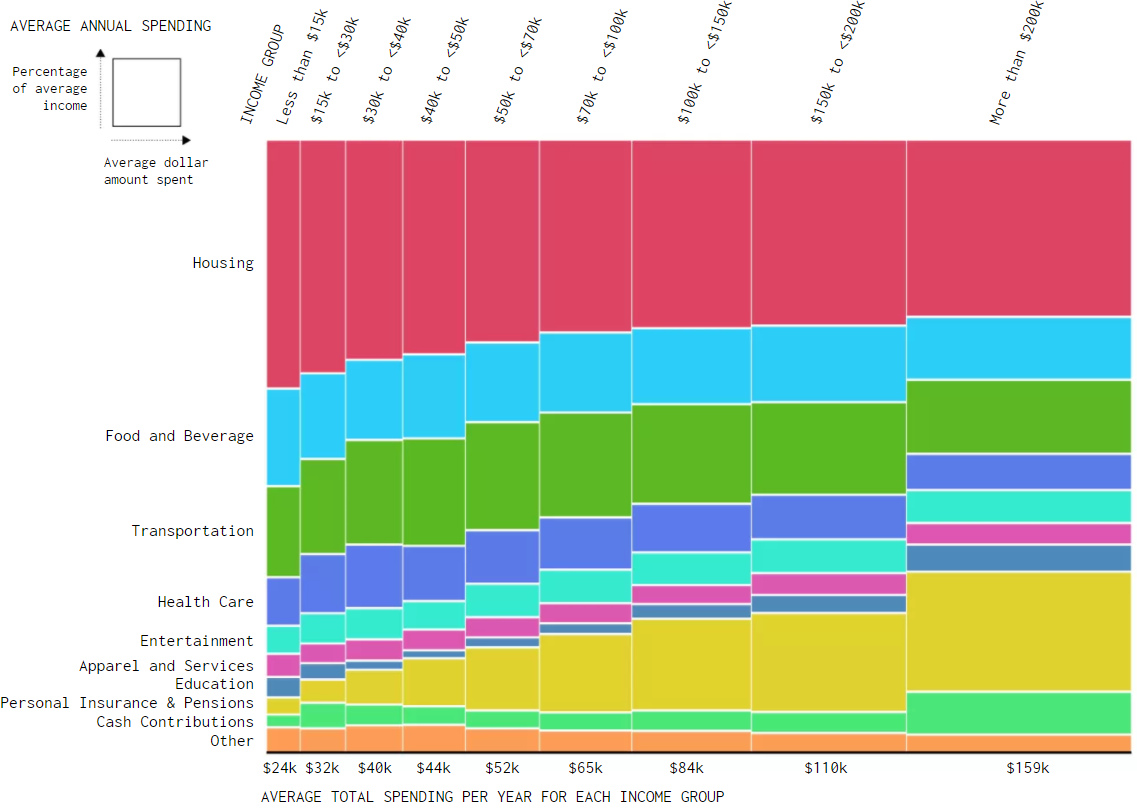

Visualizing Spending

Today’s series of graphics come to us from data visualization expert Nathan Yau at FlowingData, and they show how money is being spent by different income groups.

It uses data from the 2016 Consumer Expenditure Survey, an annual survey by the Bureau of Labor Statistics. Meanwhile, embedded words in the graphics come from Yau, as he makes observations on the data.

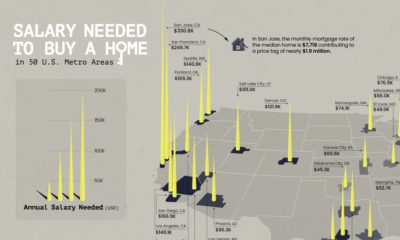

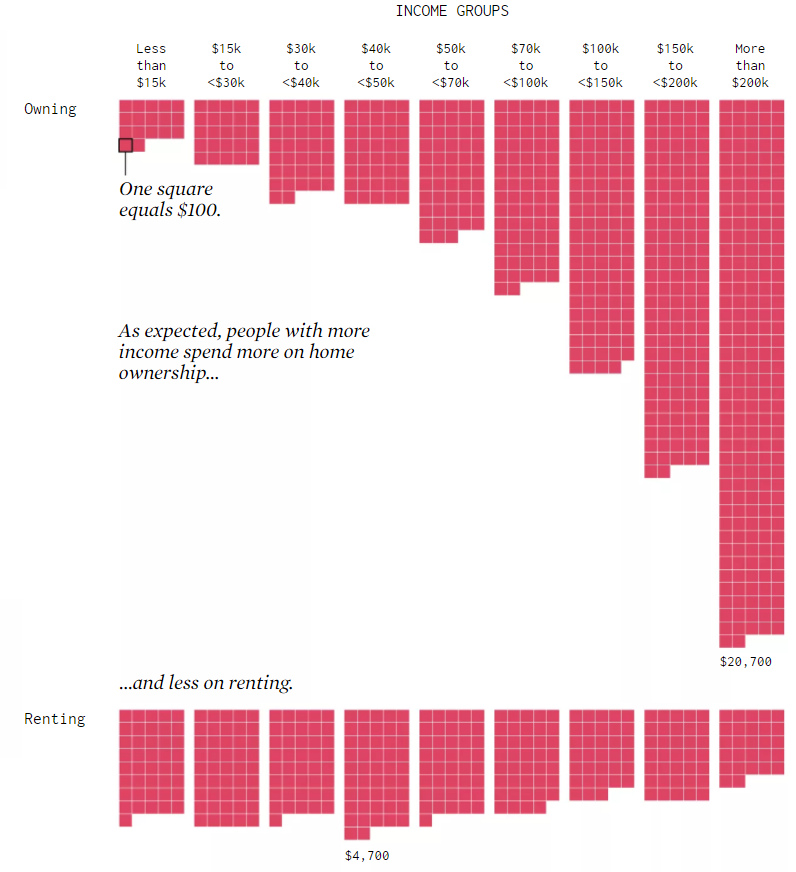

To Buy or Rent a House?

How do income groups differ in spending for housing?

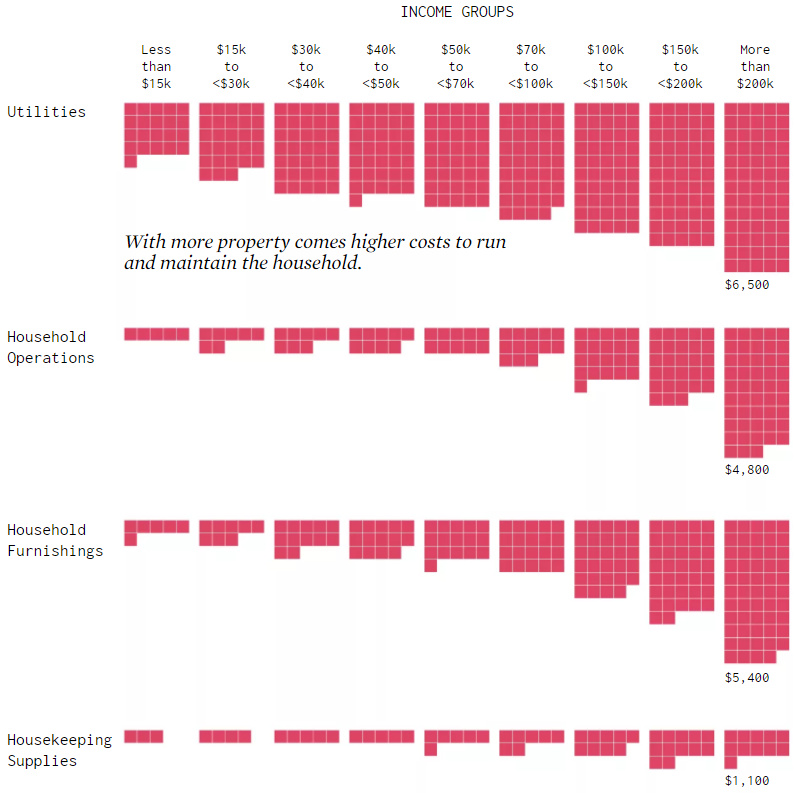

Housing Expenses

How is money spent on utilities, furniture, and other household expenses?

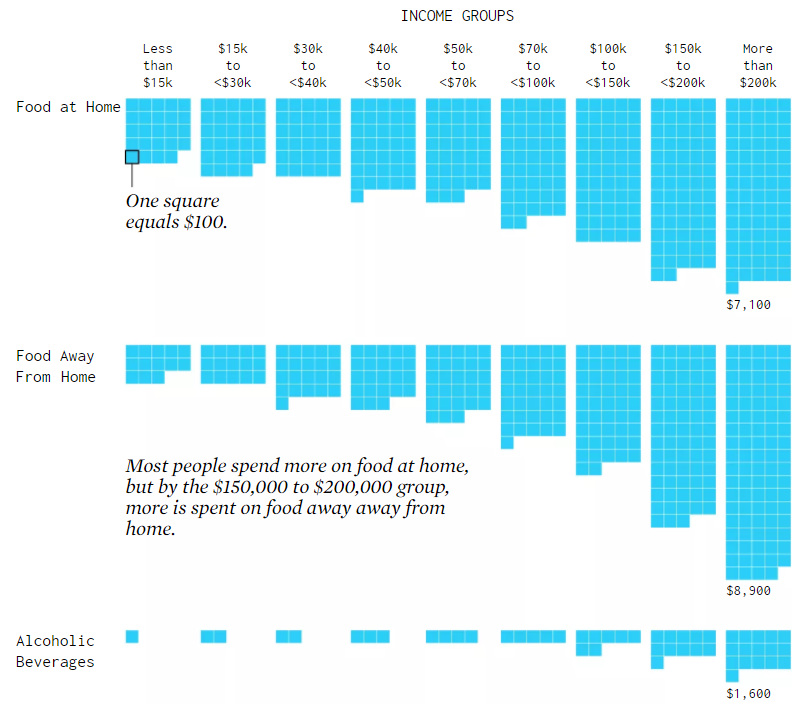

Food Expenses

Do income groups spend more eating at home, or eating out?

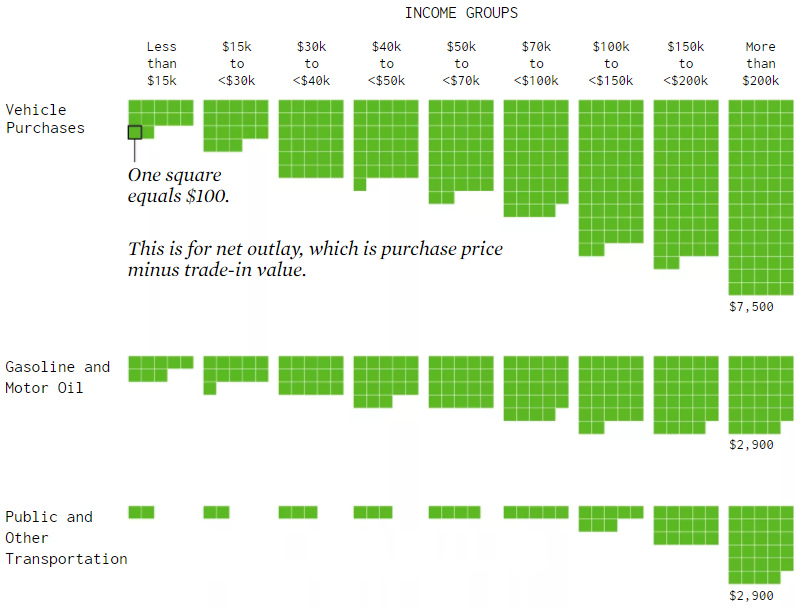

Travel and Transportation

The cost of vehicles, gas, and other travel expenses.

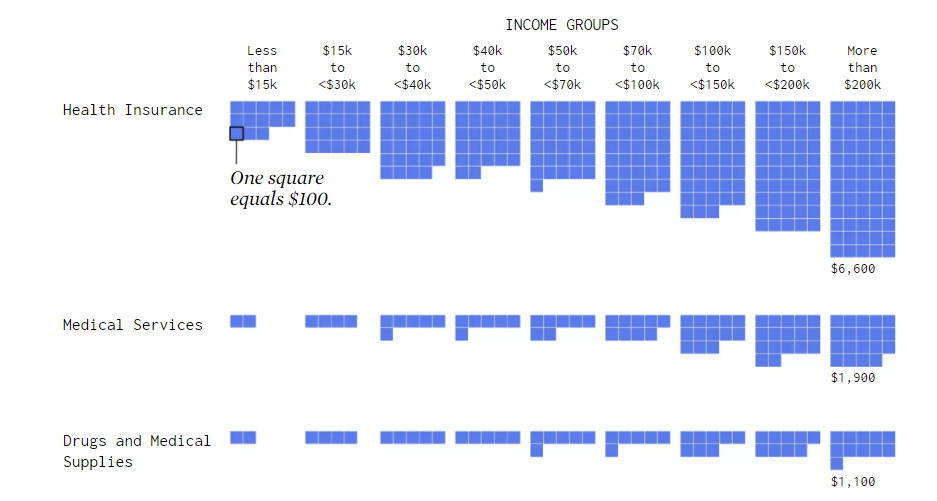

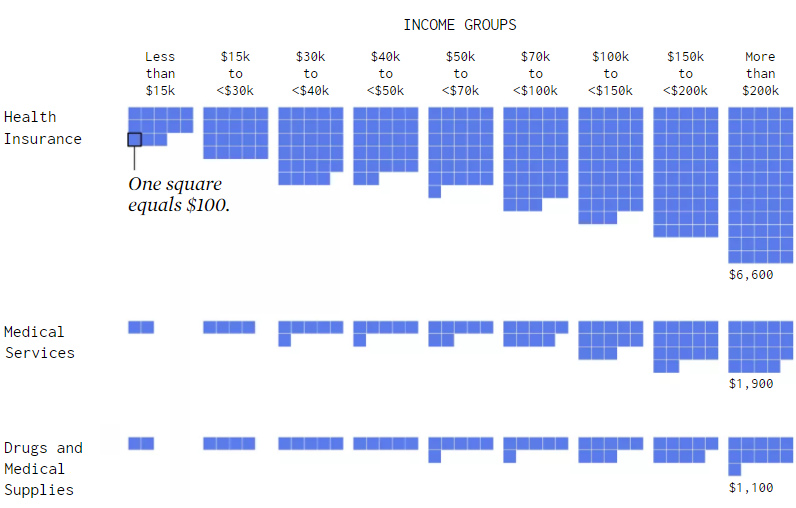

Health Expenditures

What about money spent on health insurance, services, or drugs?

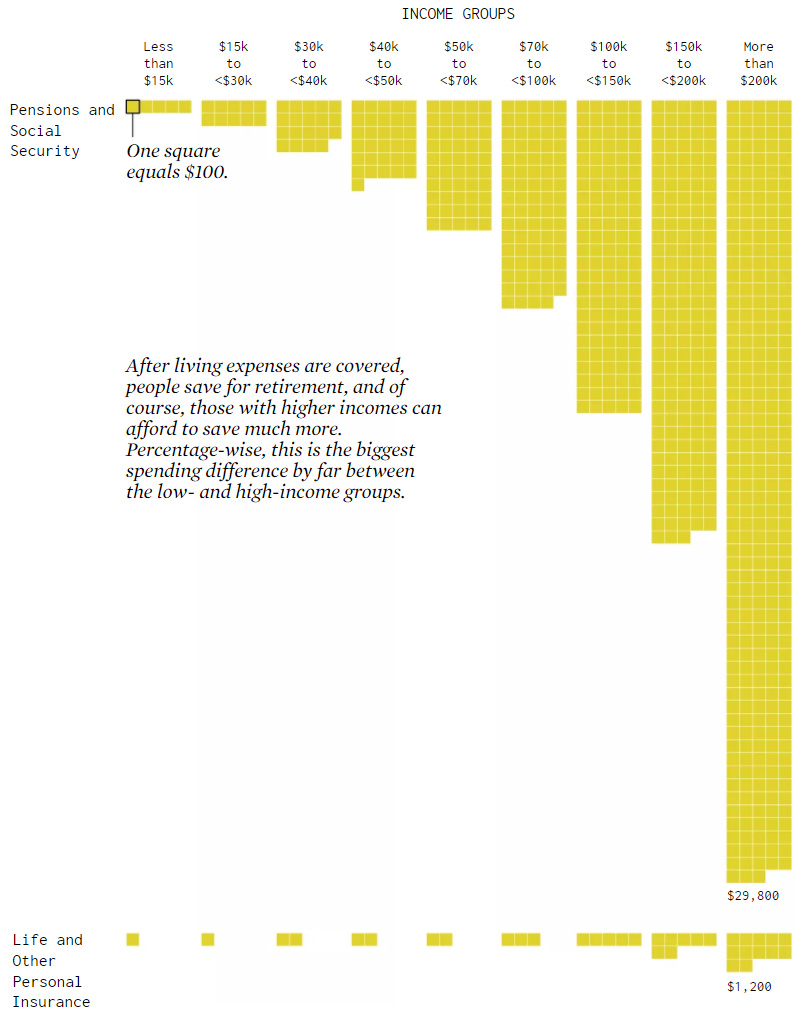

Pensions and Social Security

Lastly, the money going to retirement, pension, social security, and insurance plans.

For more data analysis, as well as many other great visualizations on income, we highly recommend checking out FlowingData.

Personal Finance

Chart: The Declining Value of the U.S. Federal Minimum Wage

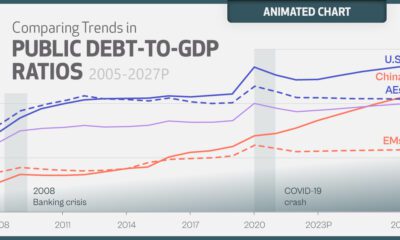

This graphic compares the nominal vs. inflation-adjusted value of the U.S. minimum wage, from 1940 to 2023.

The Declining Value of the U.S. Federal Minimum Wage

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This graphic illustrates the history of the U.S. federal minimum wage using data compiled by Statista, in both nominal and real (inflation-adjusted) terms. The federal minimum wage was raised to $7.25 per hour in July 2009, where it has remained ever since.

Nominal vs. Real Value

The data we used to create this graphic can be found in the table below.

| Year | Nominal value ($/hour) | Real value ($/hour) |

|---|---|---|

| 1940 | 0.3 | 6.5 |

| 1945 | 0.4 | 6.82 |

| 1950 | 0.75 | 9.64 |

| 1955 | 0.75 | 8.52 |

| 1960 | 1 | 10.28 |

| 1965 | 1.25 | 12.08 |

| 1970 | 1.6 | 12.61 |

| 1975 | 2.1 | 12.04 |

| 1980 | 3.1 | 11.61 |

| 1985 | 3.35 | 9.51 |

| 1990 | 3.8 | 8.94 |

| 1995 | 4.25 | 8.49 |

| 2000 | 5.15 | 9.12 |

| 2005 | 5.15 | 8.03 |

| 2010 | 7.25 | 10.09 |

| 2015 | 7.25 | 9.3 |

| 2018 | 7.25 | 8.78 |

| 2019 | 7.25 | 8.61 |

| 2020 | 7.25 | 8.58 |

| 2021 | 7.25 | 8.24 |

| 2022 | 7.25 | 7.61 |

| 2023 | 7.25 | 7.25 |

What our graphic shows is how inflation has eroded the real value of the U.S. minimum wage over time, despite nominal increases.

For instance, consider the year 1960, when the federal minimum wage was $1 per hour. After accounting for inflation, this would be worth around $10.28 today!

The two lines converge at 2023 because the nominal and real value are identical in present day terms.

Many States Have Their Own Minimum Wage

According to the National Conference of State Legislatures (NCSL), 30 states and Washington, D.C. have implemented a minimum wage that is higher than $7.25.

The following states have adopted the federal minimum: Georgia, Idaho, Indiana, Iowa, Kansas, Kentucky, New Hampshire, North Carolina, North Dakota, Oklahoma, Pennsylvania, Texas, Utah, Wisconsin, and Wyoming.

Meanwhile, the states of Alabama, Louisiana, Mississippi, South Carolina, and Tennessee have no wage minimums, but have to follow the federal minimum.

How Does the U.S. Minimum Wage Rank Globally?

If you found this topic interesting, check out Mapped: Minimum Wage Around the World to see which countries have the highest minimum wage in monthly terms, as of January 2023.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023