Culture

Mapped: The Top Podcasts on Spotify Across Countries

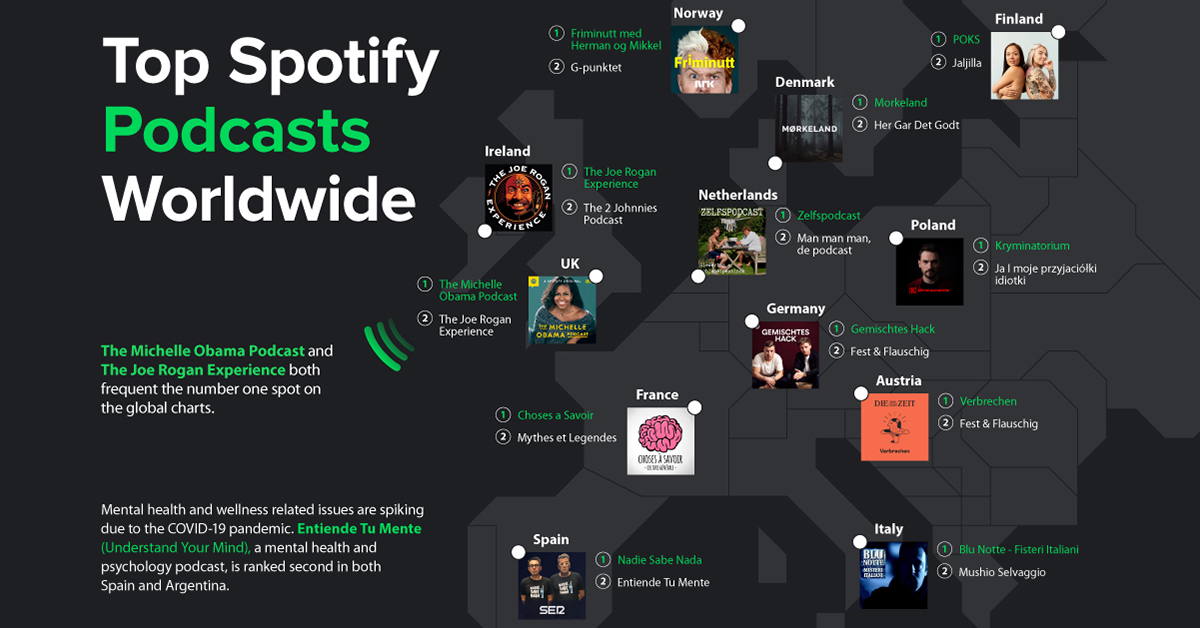

The Top Spotify Podcast Across Countries

We are amidst the breakout era of podcasts. Since the beginning of the smartphone revolution, the digital audio format has picked up serious traction with audiences all over. In the U.S. alone, it’s estimated that there will be 132 million podcast listeners by 2022.

Today, there are 850,000 active podcasts available in 100 languages, with over 30 million episodes to tap into—perfect if you have an afternoon to yourself.

Worldwide Podcast Chart-Toppers

The data in this infographic comes from Spotify, the top global streaming service in the industry by paid users. How do the top podcasts fare on a per country basis?

| Country | Top Podcast | Honorable Mention (Second Highest) |

|---|---|---|

| Canada | The Joe Rogan Experience | Call Her Daddy |

| France | Choses a Savoir | Mythes et Legendes |

| UK | The Michelle Obama Podcast | The Joe Rogan Experience |

| Germany | Gemischtes Hack | Fest & Flauschig |

| Italy | Blu Notte - Fisteri Italiani | Mushio Selvaggio |

| U.S. | The Michelle Obama Podcast | Call Her Daddy |

| Japan | kemioの耳そうじクラブ | Hapa英会話 Podcast |

| Australia | From The Newsroom | The Joe Rogan Experience |

| India | The Michelle Obama Podcast | Purijagannadh |

| Ireland | The Joe Rogan Experience | The 2 Johnnies Podcast |

| Mexico | Leyendas Legendarias | La Cotorrisa |

| New Zealand | The Joe Rogan Experience | Call Her Daddy |

| Argentina | Concha Podcast | Entiende Tu Mente |

| Austria | Verbrechen | Fest & Flauschig |

| Brazil | NerdCast | Café da Manha |

| Chile | Tomas Va A Morir | Matriarcalmente Hablando |

| Colombia | DianaUribe.fm | Dani 3Palacios Podcast |

| Denmark | Morkeland | Her Gar Det Godt |

| Finland | POKS | Jaliila |

| Indonesia | Rintik Sedu | PODKESMAS |

| Norway | Friminutt med Herman og Mikkel | G-punktet |

| Philippines | Sleeping Pill with Inka | Adulting With Joyce Pring |

| Poland | Kryminatorium | Ja I moje przyjaciółki idiotki |

| Spain | Nadie Sabe Nada | Entiende Tu Mente |

| Sweden | P3 Dokumentar | Sommar & Vinter i P1 |

| Netherlands | Zelfspodcast | Man man man, de podcast |

Many of the top shows around the world follow a familiar interview or conversational format, but there are trends that deviate from that formula. In particular, there are a number of podcasts focused on health and wellness as well as current events.

The early beginnings of podcasting were dominated by upstart content creators, but as the market has matured, big media outlets and A-list personalities have been vying for listeners’ attention in an increasingly crowded field. As it stands now, two podcasts from America carry a large presence in foreign markets, and the two big personalities—Michelle Obama and Joe Rogan—stand a notch above the rest.

The Rogan-Obama tug of war in the podcast realm has had its back and forths. Obama pulled ahead in many countries in August, but in September the pendulum swung in favor of Rogan.

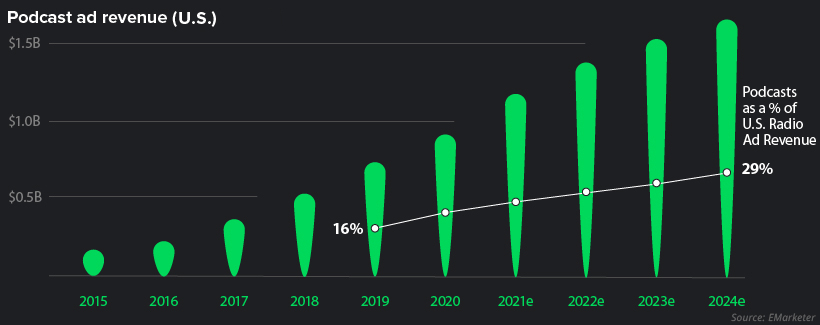

Follow The Money

In 2015, ad revenue in the podcast industry was a minuscule $69 million across the board. It’s expected to reach over $1 billion by 2021, and to grow further from there.

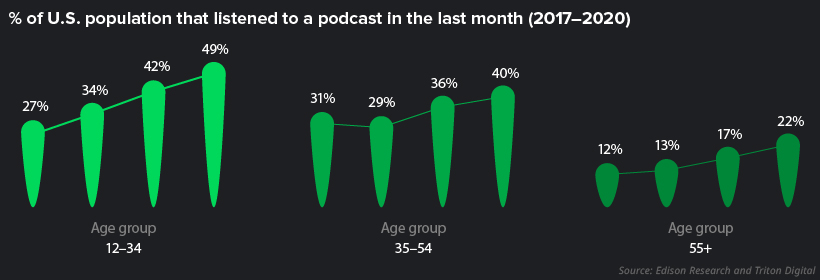

The podcast boom is powered by younger generations, and both millennials and Gen Z represent a sizable portion of the total podcast audience globally. In particular, demographic listenership numbers experience a big drop after the 35-54 age bracket.

Flexibility and variety are key features that are helping fuel the growth of the medium. One can keep up with serious world affairs or listen to Call Her Daddy—a podcast on sex and relationships by Barstool Sports, another podcast that frequently tops the charts.

Top Podcast Publishers by U.S. Audience

When it comes to key participants in the industry, National Public Radio (NPR) sits on the top spot with over 26 million unique monthly audience members. In close second, iHeartRadio holds a whopping 494 shows.

| Podcast Publisher | U.S. Unique Monthly Audience | Global Downloads & Streams | Active Shows |

|---|---|---|---|

| NPR | 26,933,000 | 219,716,000 | 49 |

| iHeartRadio | 26,182,000 | 234,417,000 | 494 |

| New York Times | 13,102,000 | 145,961,000 | 15 |

| Barstool Sports | 10,228,000 | 67,569,000 | 43 |

| PRX | 9,035,000 | 82,245,000 | 87 |

| Wondery | 8,794,000 | 57,261,000 | 98 |

| ESPN/ABC | 8,472,000 | 66,685,000 | 96 |

| NBC News | 6,751,000 | 44,219,000 | 26 |

| Cumulus Media/Westwood One | 6,473,000 | 40,912,000 | 115 |

| Warner Media | 6,350,000 | 33,503,000 | 113 |

| This American Life/Serial | 5,924,000 | 22,722,000 | 2 |

| Kast Media | 5,319,000 | 30,353,000 | 46 |

| Daily Wire | 5,212,000 | 43,342,000 | 5 |

| WNYC Studios | 5,209,000 | 35,381,000 | 52 |

| All Things Comedy | 4,890,000 | 28,770,000 | 58 |

| TED | 3,739,000 | 51,696,000 | 10 |

| American Public Media | 3,362,000 | 17,997,000 | 50 |

| Fox News Radio | 2,518,000 | 13,633,000 | 34 |

| Slate | 1,951,000 | 13,812,000 | 97 |

| WBUR | 1,105,000 | 6,758,000 | 18 |

If you’re bullish on podcasts, many in the top 20 are publicly traded entities who either stand alone, or are part of a larger corporation. Notable stocks include the New York Times, ESPN as part of Disney, and Warner Media as part of AT&T.

Spotify Today and Tomorrow

Spotify’s direct listing IPO was initially met with a lack of confidence, due to Big Tech’s entry in the space, as well as the profitability and monetization concerns that typically plague the music industry as a whole. However, the company has done well in abating those concerns, especially if you consider Spotify’s stock price, which has doubled in the last year. An impressive 21% of Spotify’s monthly active users engage with podcast content.

In addition, a wealth of personalities have entered the podcasting space. These big names suggest that the competition is dialing up.

In recent months, an exclusive deal between Spotify and Joe Rogan, valued at over $100 million took the podcasting world by storm. This is quite a monumental step for the podcast timeline, and one that suggests more deals could follow as Spotify looks to lock people into their platform with exclusivity deals.

Brands

How Tech Logos Have Evolved Over Time

From complete overhauls to more subtle tweaks, these tech logos have had quite a journey. Featuring: Google, Apple, and more.

How Tech Logos Have Evolved Over Time

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

One would be hard-pressed to find a company that has never changed its logo. Granted, some brands—like Rolex, IBM, and Coca-Cola—tend to just have more minimalistic updates. But other companies undergo an entire identity change, thus necessitating a full overhaul.

In this graphic, we visualized the evolution of prominent tech companies’ logos over time. All of these brands ranked highly in a Q1 2024 YouGov study of America’s most famous tech brands. The logo changes are sourced from 1000logos.net.

How Many Times Has Google Changed Its Logo?

Google and Facebook share a 98% fame rating according to YouGov. But while Facebook’s rise was captured in The Social Network (2010), Google’s history tends to be a little less lionized in popular culture.

For example, Google was initially called “Backrub” because it analyzed “back links” to understand how important a website was. Since its founding, Google has undergone eight logo changes, finally settling on its current one in 2015.

| Company | Number of Logo Changes |

|---|---|

| 8 | |

| HP | 8 |

| Amazon | 6 |

| Microsoft | 6 |

| Samsung | 6 |

| Apple | 5* |

Note: *Includes color changes. Source: 1000Logos.net

Another fun origin story is Microsoft, which started off as Traf-O-Data, a traffic counter reading company that generated reports for traffic engineers. By 1975, the company was renamed. But it wasn’t until 2012 that Microsoft put the iconic Windows logo—still the most popular desktop operating system—alongside its name.

And then there’s Samsung, which started as a grocery trading store in 1938. Its pivot to electronics started in the 1970s with black and white television sets. For 55 years, the company kept some form of stars from its first logo, until 1993, when the iconic encircled blue Samsung logo debuted.

Finally, Apple’s first logo in 1976 featured Isaac Newton reading under a tree—moments before an apple fell on his head. Two years later, the iconic bitten apple logo would be designed at Steve Jobs’ behest, and it would take another two decades for it to go monochrome.

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001