Technology

Electronic Health Records as a GPS for Healthcare

Electronic Health Records as a GPS for Healthcare

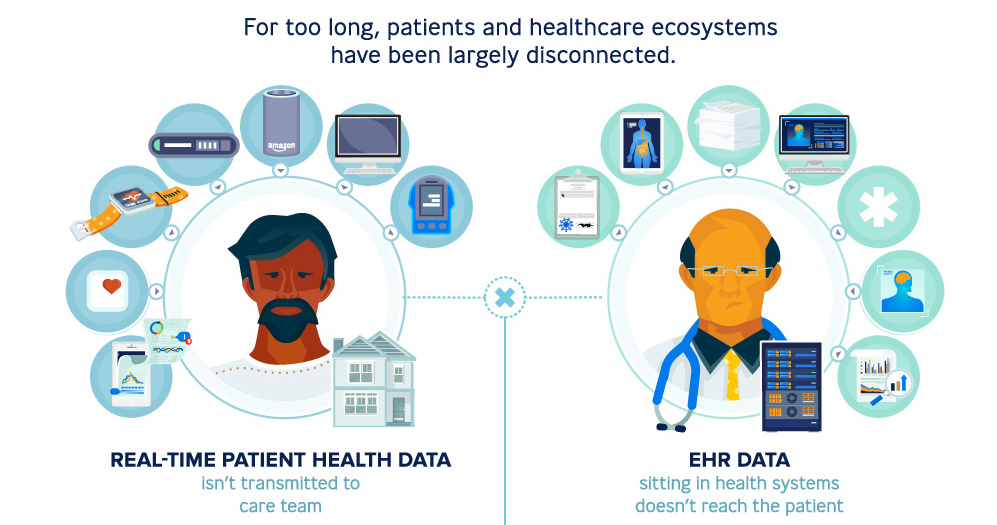

As patients are bombarded with more choice and information than ever, the burdened health system seems to lack the appropriate support to manage increasing demands for personalized and convenient care.

Today’s infographic comes to us from Publicis Health, and it demonstrates how electronic health records are an important piece in the puzzle to improve experiences for patients and providers alike.

At a Crossroads

As it stands, the current healthcare industry faces several challenges. Patients today have more complex needs and wants, while physicians are struggling to keep up.

- 25% of Americans have multiple chronic conditions.

- 63% of patients forget to adhere to medications.

- 40% of doctors feel that their work pace is chaotic.

- 60% of doctors feel that visits are too short to treat patients effectively.

Adding to these challenges, the healthcare industry is grappling with significant amounts of technological change, while also trying to keep costs in check. Between 2015 and 2017, hospitals lost $6.8 billion in operating income – that’s an average decline of nearly 40% in just two years.

A New Direction for Patient Care

Enter electronic health records (EHRs) – platforms used to conveniently store a patient’s health information and offer all sorts of services, from scheduling appointments and consultations to identifying patients at risk and guiding care decisions.

An improvement on physical paper charts, EHRs allow a patient’s medical history to be shared securely and instantly across different settings.

First conceived in 2009 under the Obama administration’s Health Information Technology for Economic and Clinical Health (HITECH) act, EHRs have rapidly evolved as they’ve been implemented in the industry, with 87% office-based doctors nationwide relying on the system.

Today, EHRs are a massive industry: the global market was worth $23.6 billion in 2016, and it’s expected to reach close to $33.3 billion by 2023. It’s clear their real capabilities are still just at the tip of the iceberg.

As technology progresses to incorporate artificial intelligence and big data into healthcare, the point of care for patients will likely extend beyond the four walls of a doctor’s office and out into the world. In other words, EHR systems act like a GPS, helping doctors and care teams navigate patient care more efficiently. This improves patient-doctor interactions, resulting in better outcomes.

Of course, there are always challenges to overcome. Here are a few key considerations for EHRs:

| What’s the Problem? | The Solve | Benefits |

|---|---|---|

| Apps aren’t for all ages | Conversational AI platforms | - All age groups are familiar with chat platforms - Streamline user interactions - Increases engagement |

| Expensive professional health system resources | AI-powered virtual assistance | - Concierge services for patients - Access accurate patient information - Increases engagement and adherence |

| Generic, one-way content | Personalized content | - Educational and relevant content, based on individual needs |

| Missed appointments or medication | Reminder services | - Supports optimal care - Improves adherence |

| Accessibility issues | Telemedicine or transportation services | - Enables patients with transportation challenges to receive the care they need |

Thinking Beyond EHR Systems

Capturing real world data and patient-reported outcomes will be important for wider applications, towards:

- A deeper understanding of patient journeys

- Informing clinical trial design and execution

- Better characterizing patient demographics

- Evaluating treatment options for sub-populations

In the future, healthcare and pharma companies could potentially use EHRs as one part of an entire suite of solutions to improve their workflow – and extend the point of care everywhere.

This is part six of a seven part series. Stay tuned for the final piece by subscribing to Visual Capitalist for free, as we wrap up the major transformative forces shaping the future of healthcare.

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Science1 week ago

Science1 week agoVisualizing the Average Lifespans of Mammals

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

-

Maps2 weeks ago

Maps2 weeks agoThe Largest Earthquakes in the New York Area (1970-2024)

-

Green2 weeks ago

Green2 weeks agoRanked: The Countries With the Most Air Pollution in 2023