Technology

What is Extended Reality (XR)?

What is Extended Reality (XR)?

It’s the year 2030, and you have a busy day scheduled. You need to check on your production lines in China, visit Mars during your lunch break, and attend a business meeting in Brazil – all from the comfort of your office in New York.

While it might sound far-fetched now, this future might be within our grasp thanks to advancements in Extended Reality (XR). Today’s infographic from Raconteur illustrates the growth of XR technology, and its potential to transform business across industries.

Understanding Extended Reality

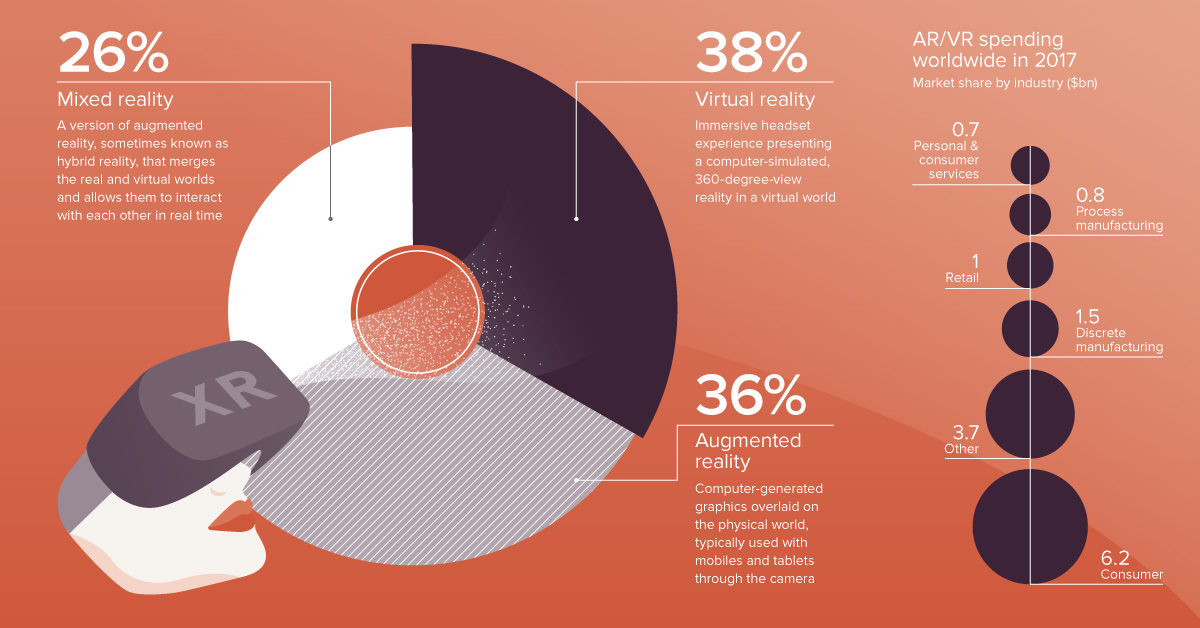

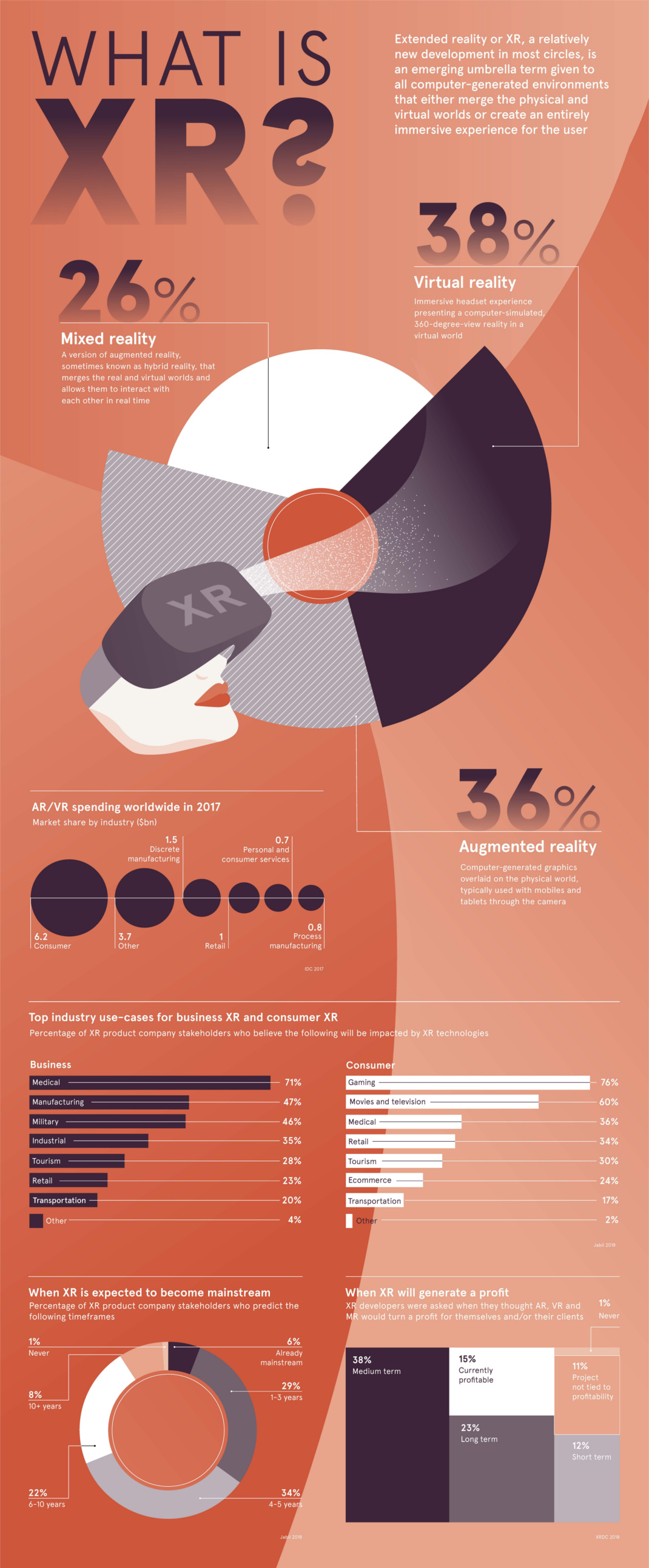

To understand Extended Reality (XR), we’ll begin by defining three of its main components: virtual, augmented, and mixed reality.

Virtual Reality

Virtual Reality (VR) applications use headsets to fully immerse users in a computer-simulated reality. These headsets generate realistic sounds and images, engaging all five senses to create an interactive virtual world.

Augmented Reality

Augmented Reality (AR) is not a new reality, but a layer on top of your existing one. Rather than immersing users, AR relies on a device – usually the camera in your phone or tablet – to overlay digital graphics and sounds into a real-world environment. Pokémon Go and Snapchat filters are commonplace examples of this kind of technology.

Mixed Reality

Mixed Reality (MR) lies somewhere in between VR and AR. It blends real and virtual worlds to create complex environments where physical and digital elements can interact in real time. Like AR, it overlays synthetic content in a real-world environment; and like VR, this content is interactive, and users can manipulate the digital objects in their physical space.

With their Spectator View, Microsoft has used MR as a complement to their HoloLens AR product. The Spectator View app offers users a third-party perspective of a HoloLens user and their AR content in real time.

Extended Reality

Extended Reality (XR) is the umbrella term used for VR, AR, and MR, as well as all future realities such technology might bring. XR covers the full spectrum of real and virtual environments.

The use of an umbrella term speaks to the future of XR as a fundamental shift in the way people interact with media. In the future, instead of saying “I’m using AR to attend a business meeting” – it will just be another day at the office. People will interact with the real and virtual worlds in seamless ways, without mention of extended reality’s distinct categories and their underpinning technology.

To use an umbrella term is to recognize the intersection of these technologies, and the many ways they will work together to disrupt our everyday tasks.

XR for Business

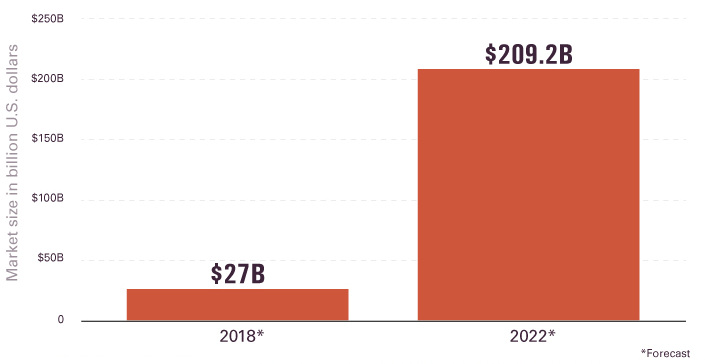

Extended reality is changing the landscape in a number of industries. It’s expected to grow eightfold, reaching an estimated market size of more than $209 billion by 2022.

A glance at current use cases shows the potential for XR across industries:

- Entertainment

XR brings immersive experiences to the entertainment world, and offers consumers an opportunity to virtually experience live music and sporting events from the comfort of their VR headset. While a majority of market share leans heavily towards entertainment, it’s not the only one gearing up for a virtual expansion. - Marketing

Virtual realities have opened new ways for brands to engage with consumers, offering immersive ways to interact with new products. - Training

Extended reality opens new avenues for training and education. People who work in high-risk conditions – like chemists and pilots – can train in safety from a more conventional classroom setting. Medical students, meanwhile, can get hands-on practice on virtual patients. - Real Estate

Property managers can streamline the rental process by allowing potential tenants to view properties virtually, while architects and interior designers can leverage XR to bring their designs to life. - Remote Work

XR removes distance barriers, allowing remote employees to seamlessly access data from anywhere in the world.

Extended reality is not without its challenges. The spread of data presents a new layer of vulnerability for cyber attacks, while the high cost of implementation is a barrier to entry for many companies.

But even these challenges can’t slow the progress of XR, and the question remains: how will businesses define reality five years from now?

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees