Technology

Virtual and Augmented Reality: The Players and the Game

Virtual and Augmented Reality: The Players and the Game

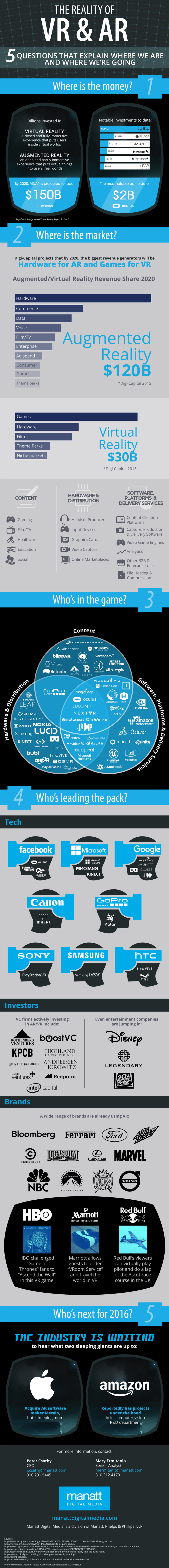

Virtual reality has been exiled to the dreaded trough of disillusionment for years, but it is finally on the path to escape. Products such as Oculus Rift and the HTC Vive are continuously wowing both users and investors, and these technologies will clearly play a significant role in the future of movies and gaming.

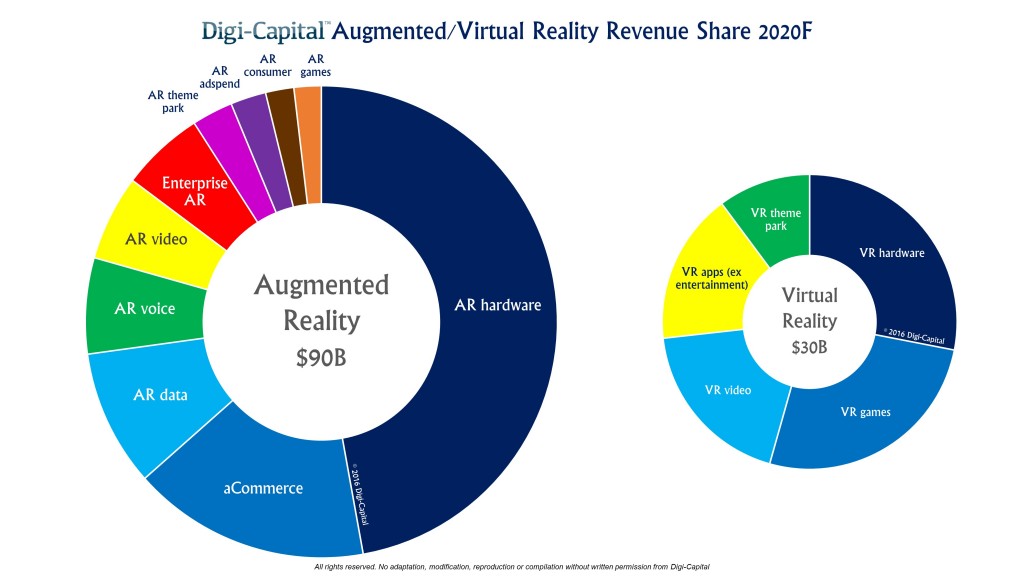

Despite this emergence, it is another related technology that has shown even more potential. The market for augmented reality will be worth 3x as much as the market for virtual reality in the coming years, according to a recently updated estimate from AR/VR advisory firm Digi-Capital.

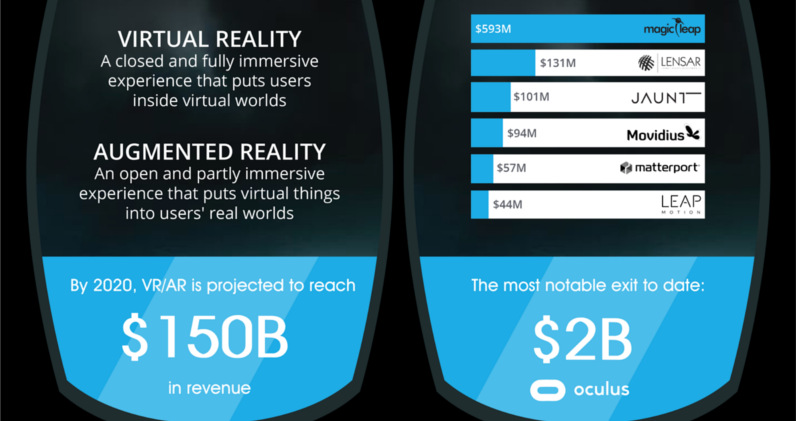

What’s the difference between the two?

Virtual reality offers a closed and fully immersive experience for users inside a virtual world.

Augmented reality offers an open and partly immersive experience that makes virtual elements visible in the real world.

The Players

While devices such as smartphones can offer some basic aspects of augmented or virtual reality, there are now several companies in both fields that are on the verge of bringing game-changing products to the mass market.

Facebook made an early bet buy purchasing Oculus Rift for $2 billion in 2014, which is now considered the leader in virtual reality. Phone and game console manufactures have also anted up with Sony, HTC, and Samsung all actively developing products in the ecosystem.

On the augmented side, it’s the Google-backed Magic Leap as well as the Microsoft’s HoloLens that are considered key players for hardware. Apple has also acquired AR software maker Metaio, but has kept plans under wraps.

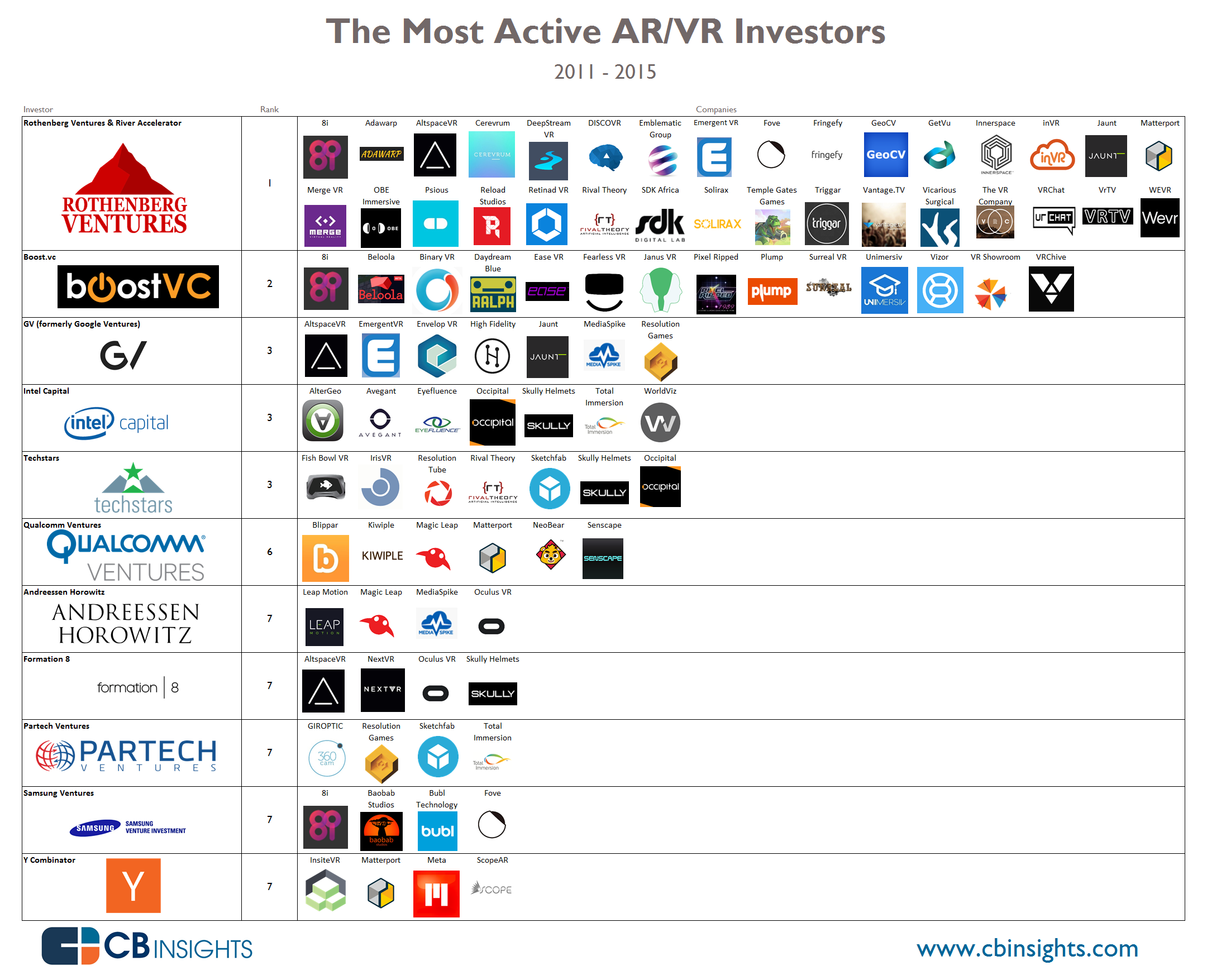

Aside from the big companies involved, there are also plenty of smaller startups in virtual and augmented reality. CB Insights has created a list of venture capital investments, sorted by firm, in these technologies: (click to expand)

What’s Ahead in 2016?

This year is expected to be a big one for virtual and augmented reality technologies. The TED Conference in Vancouver, BC was littered with VR/AR experiences, and the technology has become the primary focus of the CES event in Las Vegas.

Oculus Rift, HTC Vive, and Sony are expected to bring early VR headsets to market. Meanwhile, the low-cost Google Cardboard will continue to whet everyone’s appetite for more immersive virtual reality experiences in the meantime.

The mystery surrounding Magic Leap will continue to grow, and many expect a reveal from the secretive Florida startup in 2016. The sleeping giants, Apple and Amazon, could also wake up this year after keeping their VR and AR efforts highly-veiled thus far.

Original graphics by: Manatt Digital Media, CB Insights

Technology

Visualizing AI Patents by Country

See which countries have been granted the most AI patents each year, from 2012 to 2022.

Visualizing AI Patents by Country

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

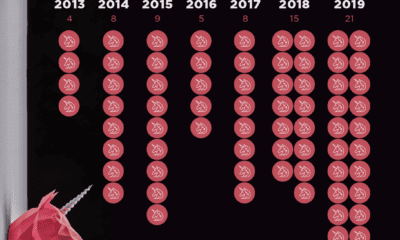

This infographic shows the number of AI-related patents granted each year from 2010 to 2022 (latest data available). These figures come from the Center for Security and Emerging Technology (CSET), accessed via Stanford University’s 2024 AI Index Report.

From this data, we can see that China first overtook the U.S. in 2013. Since then, the country has seen enormous growth in the number of AI patents granted each year.

| Year | China | EU and UK | U.S. | RoW | Global Total |

|---|---|---|---|---|---|

| 2010 | 307 | 137 | 984 | 571 | 1,999 |

| 2011 | 516 | 129 | 980 | 581 | 2,206 |

| 2012 | 926 | 112 | 950 | 660 | 2,648 |

| 2013 | 1,035 | 91 | 970 | 627 | 2,723 |

| 2014 | 1,278 | 97 | 1,078 | 667 | 3,120 |

| 2015 | 1,721 | 110 | 1,135 | 539 | 3,505 |

| 2016 | 1,621 | 128 | 1,298 | 714 | 3,761 |

| 2017 | 2,428 | 144 | 1,489 | 1,075 | 5,136 |

| 2018 | 4,741 | 155 | 1,674 | 1,574 | 8,144 |

| 2019 | 9,530 | 322 | 3,211 | 2,720 | 15,783 |

| 2020 | 13,071 | 406 | 5,441 | 4,455 | 23,373 |

| 2021 | 21,907 | 623 | 8,219 | 7,519 | 38,268 |

| 2022 | 35,315 | 1,173 | 12,077 | 13,699 | 62,264 |

In 2022, China was granted more patents than every other country combined.

While this suggests that the country is very active in researching the field of artificial intelligence, it doesn’t necessarily mean that China is the farthest in terms of capability.

Key Facts About AI Patents

According to CSET, AI patents relate to mathematical relationships and algorithms, which are considered abstract ideas under patent law. They can also have different meaning, depending on where they are filed.

In the U.S., AI patenting is concentrated amongst large companies including IBM, Microsoft, and Google. On the other hand, AI patenting in China is more distributed across government organizations, universities, and tech firms (e.g. Tencent).

In terms of focus area, China’s patents are typically related to computer vision, a field of AI that enables computers and systems to interpret visual data and inputs. Meanwhile America’s efforts are more evenly distributed across research fields.

Learn More About AI From Visual Capitalist

If you want to see more data visualizations on artificial intelligence, check out this graphic that shows which job departments will be impacted by AI the most.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries