Datastream

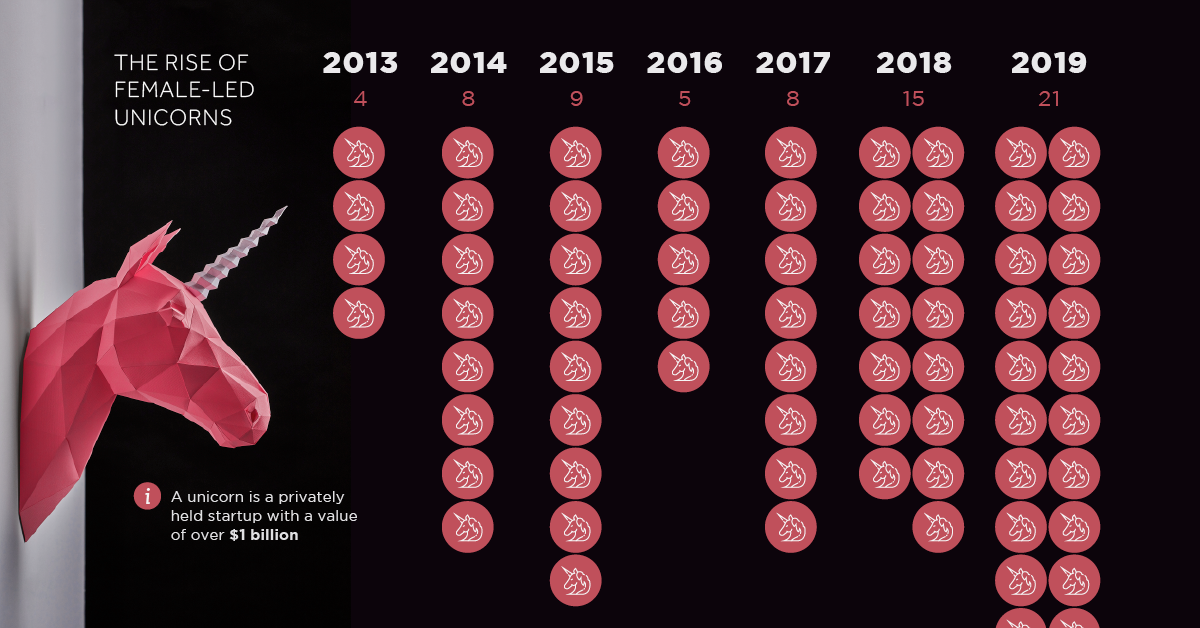

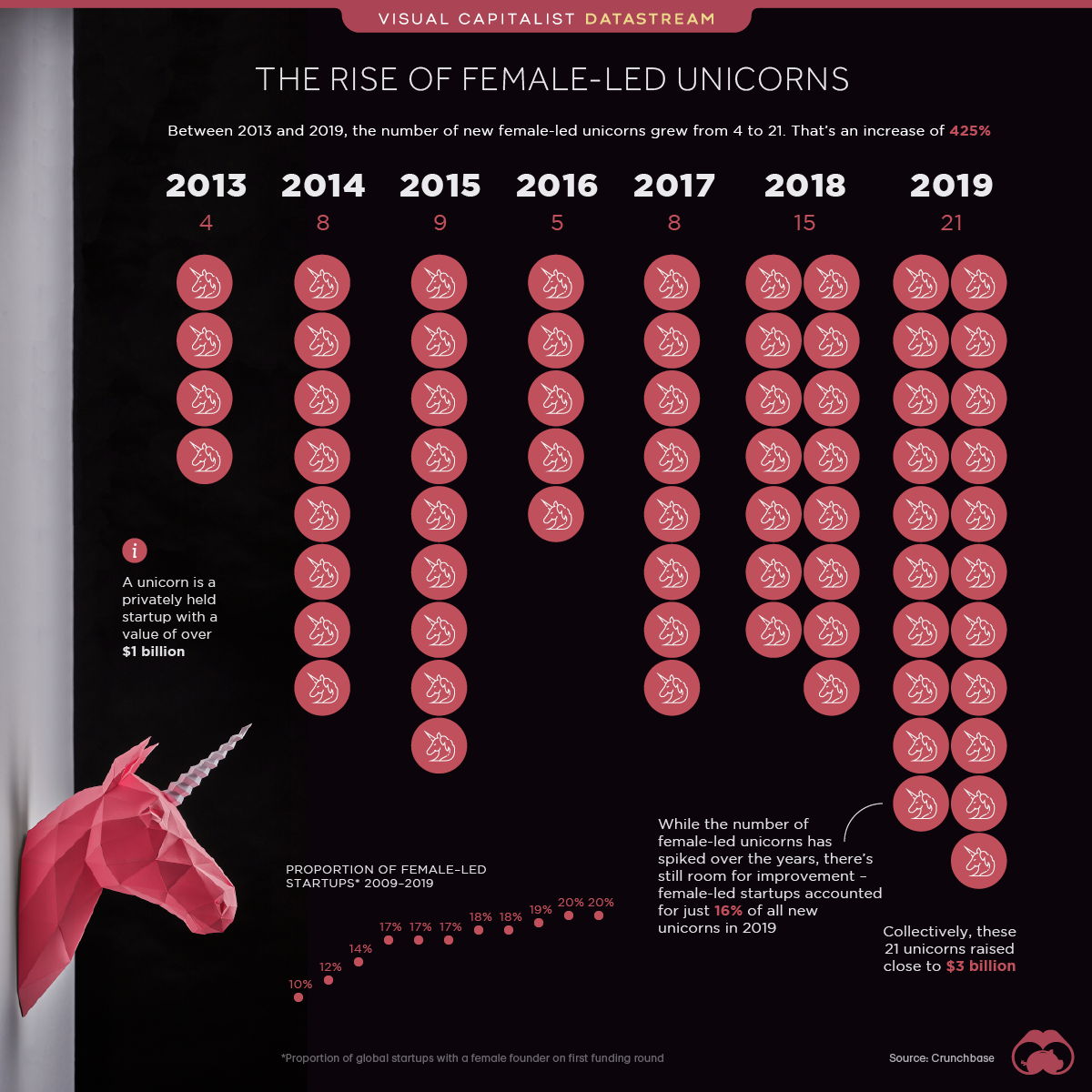

On the Rise: 2019 Set a Record for New Female-Led Unicorns

The Briefing

- In 2019, just 9% of total VC investment dollars went to startups with at least one female founder

- While there’s still a long way to go to narrow the gender gap in VC funding, progress is being made—last year, 21 female-led businesses achieved unicorn status, compared to just 4 in 2013

On the Rise: 2019 Set a Record for New Female-Led Unicorns

In 2019, more female-led start-ups achieved unicorn status than ever before.

A unicorn is a privately held company that’s valued at $1 billion or more. Last year, 21 new female-led companies hit that valuation mark—a 40% increase compared to 2018.

Within the last decade, the number of female-led unicorns has grown steadily:

| Year | Unicorns with at least one female founder |

|---|---|

| 2013 | 4 |

| 2014 | 8 |

| 2015 | 9 |

| 2016 | 5 |

| 2017 | 8 |

| 2018 | 15 |

| 2019 | 21 |

One of the startups to achieve unicorn status in 2019 was Away, a travel and lifestyle brand based in New York. After launching in 2016, Away made $12 million in sales in its first 12 months, and in 2019, the company closed $100 million in Series D funding.

Glossier, a direct-to-consumer beauty company, also made the new unicorn list in 2019. Like Away, the New York-based beauty brand raised $100 million in Series D funding—almost double the amount garnered in its $52 million Series C round.

There’s Still Work to Do

While it’s clear that the number of female-led unicorns is increasing, there’s still a wide gender gap in the venture capital and startup landscape.

In 2019, only 9% of VC investment dollars went to companies with at least one female founder. And this proportion of dollars to female/male co-founded companies hasn’t changed much over the years:

| Year | Proportion |

|---|---|

| 2013 | 8% |

| 2014 | 8% |

| 2015 | 9% |

| 2016 | 8% |

| 2017 | 10% |

| 2018 | 9% |

| 2019 | 9% |

Why does this gap persist? One reason could be the lack of female representation in venture capital leadership. As of 2019, less than 10% of decision-makers at U.S. venture capital firms are women.

In short—things are looking up, but there’s still a ton of progress to be made.

»Interested in learning more about female founders and the VC landscape? Read our full article on The Top Female Founder in Each Country

Where does this data come from?

Source: Crunchbase report, titled “Funding to the Female Founders”.

Notes: The analysis was based on announced funding to companies with founders associated. Crunchbase included private company fundings from seed through latestage venture; excluding private equity rounds.

Datastream

Can You Calculate Your Daily Carbon Footprint?

Discover how the average person’s carbon footprint impacts the environment and learn how carbon credits can offset your carbon footprint.

The Briefing

- A person’s carbon footprint is substantial, with activities such as food consumption creating as much as 4,500 g of CO₂ emissions daily.

- By purchasing carbon credits from Carbon Streaming Corporation, you can offset your own emissions and fund positive climate action.

Your Everyday Carbon Footprint

While many large businesses and countries have committed to net-zero goals, it is essential to acknowledge that your everyday activities also contribute to global emissions.

In this graphic, sponsored by Carbon Streaming Corporation, we will explore how the choices we make and the products we use have a profound impact on our carbon footprint.

Carbon Emissions by Activity

Here are some of the daily activities and products of the average person and their carbon footprint, according to Clever Carbon.

| Household Activities & Products | CO2 Emissions (g) |

|---|---|

| 💡 Standard Light Bulb (100 watts, four hours) | 172 g |

| 📱 Mobile Phone Use (195 minutes per day)* | 189 g |

| 👕 Washing Machine (0.63 kWh) | 275 g |

| 🔥 Electric Oven (1.56 kWh) | 675 g |

| ♨️ Tumble Dryer (2.5 kWh) | 1,000 g |

| 🧻 Toilet Roll (2 ply) | 1,300 g |

| 🚿 Hot Shower (10 mins) | 2,000 g |

| 🚙 Daily Commute (one hour, by car) | 3,360 g |

| 🍽️ Average Daily Food Consumption (three meals of 600 calories) | 4,500 g |

| *Phone use based on yearly use of 69kg per the source, Reboxed | |

Your choice of transportation plays a crucial role in determining your carbon footprint. For instance, a 15 km daily commute to work on public transport generates an average of 1,464 g of CO₂ emissions. Compared to 3,360 g—twice the volume for a journey the same length by car.

By opting for more sustainable modes of transport, such as cycling, walking, or public transportation, you can significantly reduce your carbon footprint.

Addressing Your Carbon Footprint

One way to compensate for your emissions is by purchasing high-quality carbon credits.

Carbon credits are used to help fund projects that avoid, reduce or remove CO₂ emissions. This includes nature-based solutions such as reforestation and improved forest management, or technology-based solutions such as the production of biochar and carbon capture and storage (CCS).

While carbon credits offer a potential solution for individuals to help reduce global emissions, public awareness remains a significant challenge. A BCG-Patch survey revealed that only 34% of U.S. consumers are familiar with carbon credits, and only 3% have purchased them in the past.

About Carbon Streaming

By financing the creation or expansion of carbon projects, Carbon Streaming Corporation secures the rights to future carbon credits generated by these sustainable projects. You can then purchase these carbon credits to help fund climate solutions around the world and compensate for your own emissions.

Ready to get involved?

>> Learn more about purchasing carbon credits at Carbon Streaming

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries