Chart of the Week

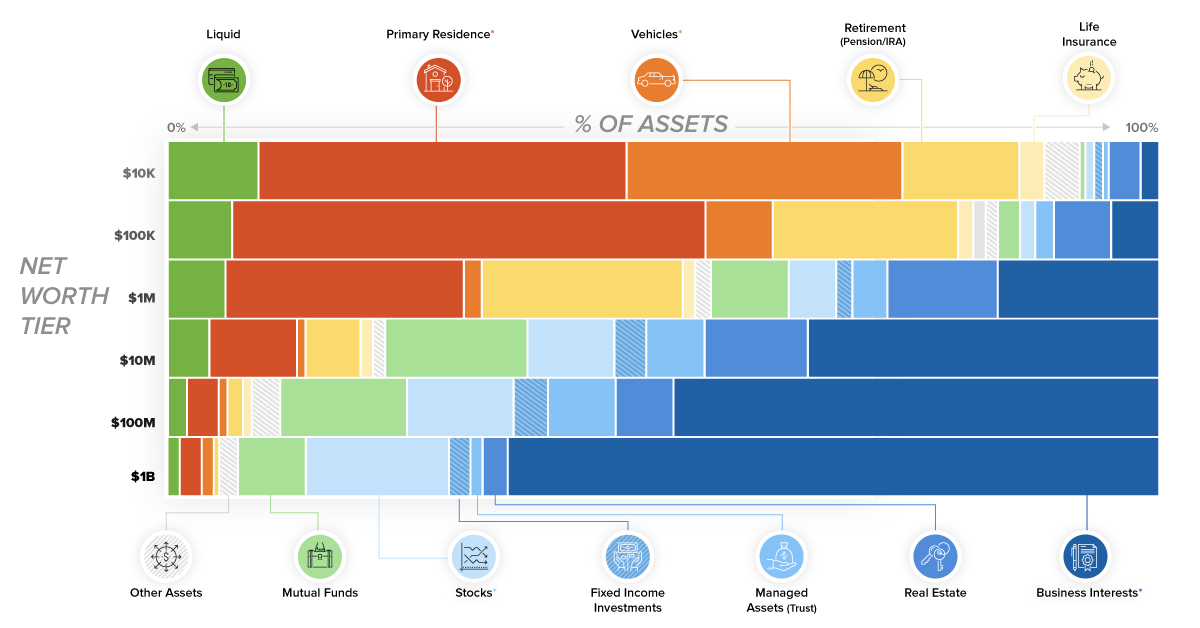

Chart: What Assets Make Up Wealth?

Chart: What Assets Make Up Wealth?

A look at asset distributions, based on net worth tiers

The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

A person’s wealth can be made up of many different assets.

Net worth, the measure we use to gauge wealth, is actually the sum of all of a person’s assets after subtracting liabilities (such as loans). Therefore, net worth can be comprised of liquid savings, stocks, mutual funds, bonds, real estate, vehicles, retirement accounts (IRAs, pensions), and many other types of assets.

But how does the composition of net worth differ for a person with $100k in net worth, versus that of a billionaire?

Today’s chart uses data from the Federal Reserve Survey of Consumer Finances from 2016 to find out.

Simplifying the Data

Based on this original work done by Ben Weber of Windfall Data, we’ve since taken the data and tried to clean up the categories to make it more digestible.

For example, residential real estate and non-residential real estate were combined into a single category, and bonds, savings bonds, and certificates of deposit were merged into a single fixed income investment category.

The end result is a net worth composition for each of the six different wealth brackets, which are each grouped based on size. For example, in the $10k bracket, all five-figure net worths ($10k-$99k) are grouped together, and so on.

Different Makeups

The composition of wealth ends up varying considerably between lower and higher net worths:

Primary Residence:

This is by far the most important asset class for all net worth tiers up to $1 million.

Vehicle:

For the $10k net worth tier, the value of a vehicle is more than investments such as pensions, IRAs, mutual funds, stocks, etc.

Stocks:

The proportion of directly-held stock increases up the tiers, and billionaires hold a significant portion of wealth in stocks.

Business Interests:

Most multi-millionaires or billionaires are not liquid, and have most of their wealth in business interests.

Chart of the Week

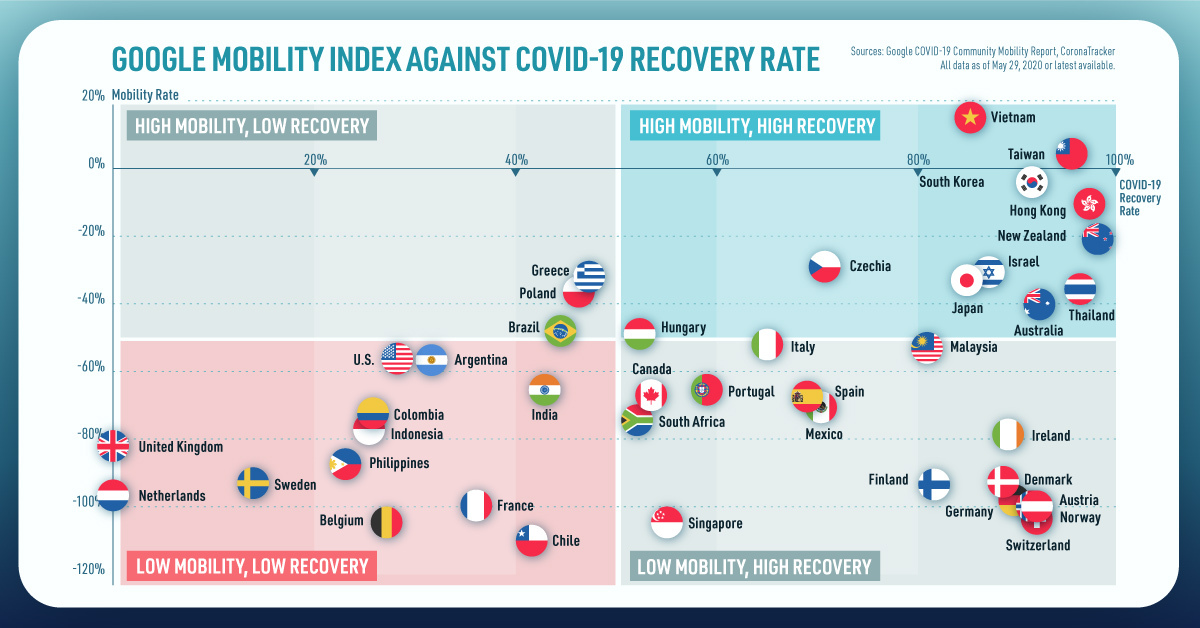

The Road to Recovery: Which Economies are Reopening?

We look at mobility rates as well as COVID-19 recovery rates for 41 economies, to see which countries are reopening for business.

The Road to Recovery: Which Economies are Reopening?

COVID-19 has brought the world to a halt—but after months of uncertainty, it seems that the situation is slowly taking a turn for the better.

Today’s chart measures the extent to which 41 major economies are reopening, by plotting two metrics for each country: the mobility rate and the COVID-19 recovery rate:

- Mobility Index

This refers to the change in activity around workplaces, subtracting activity around residences, measured as a percentage deviation from the baseline. - COVID-19 Recovery Rate

The number of recovered cases in a country is measured as the percentage of total cases.

Data for the first measure comes from Google’s COVID-19 Community Mobility Reports, which relies on aggregated, anonymous location history data from individuals. Note that China does not show up in the graphic as the government bans Google services.

COVID-19 recovery rates rely on values from CoronaTracker, using aggregated information from multiple global and governmental databases such as WHO and CDC.

Reopening Economies, One Step at a Time

In general, the higher the mobility rate, the more economic activity this signifies. In most cases, mobility rate also correlates with a higher rate of recovered people in the population.

Here’s how these countries fare based on the above metrics.

| Country | Mobility Rate | Recovery Rate | Total Cases | Total Recovered |

|---|---|---|---|---|

| Argentina | -56% | 31.40% | 14,702 | 4,617 |

| Australia | -41% | 92.03% | 7,150 | 6,580 |

| Austria | -100% | 91.93% | 16,628 | 15,286 |

| Belgium | -105% | 26.92% | 57,849 | 15,572 |

| Brazil | -48% | 44.02% | 438,812 | 193,181 |

| Canada | -67% | 52.91% | 88,512 | 46,831 |

| Chile | -110% | 41.58% | 86,943 | 36,150 |

| Colombia | -73% | 26.28% | 25,366 | 6,665 |

| Czechia | -29% | 70.68% | 9,140 | 6,460 |

| Denmark | -93% | 88.43% | 11,512 | 10,180 |

| Finland | -93% | 81.57% | 6,743 | 5,500 |

| France | -100% | 36.08% | 186,238 | 67,191 |

| Germany | -99% | 89.45% | 182,452 | 163,200 |

| Greece | -32% | 47.28% | 2,906 | 1,374 |

| Hong Kong | -10% | 97.00% | 1,067 | 1,035 |

| Hungary | -49% | 52.31% | 3,816 | 1,996 |

| India | -65% | 42.88% | 165,386 | 70,920 |

| Indonesia | -77% | 25.43% | 24,538 | 6,240 |

| Ireland | -79% | 88.92% | 24,841 | 22,089 |

| Israel | -31% | 87.00% | 16,872 | 14,679 |

| Italy | -52% | 64.99% | 231,732 | 150,604 |

| Japan | -33% | 84.80% | 16,683 | 14,147 |

| Malaysia | -53% | 80.86% | 7,629 | 6,169 |

| Mexico | -69% | 69.70% | 78,023 | 54,383 |

| Netherlands | -97% | 0.01% | 45,950 | 3 |

| New Zealand | -21% | 98.01% | 1,504 | 1,474 |

| Norway | -100% | 91.87% | 8,411 | 7,727 |

| Philippines | -87% | 23.08% | 15,588 | 3,598 |

| Poland | -36% | 46.27% | 22,825 | 10,560 |

| Portugal | -65% | 58.99% | 31,596 | 18,637 |

| Singapore | -105% | 55.02% | 33,249 | 18,294 |

| South Africa | -74% | 52.44% | 27,403 | 14,370 |

| South Korea | -4% | 91.15% | 11,344 | 10,340 |

| Spain | -67% | 69.11% | 284,986 | 196,958 |

| Sweden | -93% | 13.91% | 35,727 | 4,971 |

| Switzerland | -101% | 91.90% | 30,796 | 28,300 |

| Taiwan | 4% | 95.24% | 441 | 420 |

| Thailand | -36% | 96.08% | 3,065 | 2,945 |

| U.S. | -56% | 28.20% | 1,768,346 | 498,720 |

| United Kingdom | -82% | 0.05% | 269,127 | 135 |

| Vietnam | 15% | 85.02% | 327 | 278 |

Mobility data as of May 21, 2020 (Latest available). COVID-19 case data as of May 29, 2020.

In the main scatterplot visualization, we’ve taken things a step further, assigning these countries into four distinct quadrants:

1. High Mobility, High Recovery

High recovery rates are resulting in lifted restrictions for countries in this quadrant, and people are steadily returning to work.

New Zealand has earned praise for its early and effective pandemic response, allowing it to curtail the total number of cases. This has resulted in a 98% recovery rate, the highest of all countries. After almost 50 days of lockdown, the government is recommending a flexible four-day work week to boost the economy back up.

2. High Mobility, Low Recovery

Despite low COVID-19 related recoveries, mobility rates of countries in this quadrant remain higher than average. Some countries have loosened lockdown measures, while others did not have strict measures in place to begin with.

Brazil is an interesting case study to consider here. After deferring lockdown decisions to state and local levels, the country is now averaging the highest number of daily cases out of any country. On May 28th, for example, the country had 24,151 new cases and 1,067 new deaths.

3. Low Mobility, High Recovery

Countries in this quadrant are playing it safe, and holding off on reopening their economies until the population has fully recovered.

Italy, the once-epicenter for the crisis in Europe is understandably wary of cases rising back up to critical levels. As a result, it has opted to keep its activity to a minimum to try and boost the 65% recovery rate, even as it slowly emerges from over 10 weeks of lockdown.

4. Low Mobility, Low Recovery

Last but not least, people in these countries are cautiously remaining indoors as their governments continue to work on crisis response.

With a low 0.05% recovery rate, the United Kingdom has no immediate plans to reopen. A two-week lag time in reporting discharged patients from NHS services may also be contributing to this low number. Although new cases are leveling off, the country has the highest coronavirus-caused death toll across Europe.

The U.S. also sits in this quadrant with over 1.7 million cases and counting. Recently, some states have opted to ease restrictions on social and business activity, which could potentially result in case numbers climbing back up.

Over in Sweden, a controversial herd immunity strategy meant that the country continued business as usual amid the rest of Europe’s heightened regulations. Sweden’s COVID-19 recovery rate sits at only 13.9%, and the country’s -93% mobility rate implies that people have been taking their own precautions.

COVID-19’s Impact on the Future

It’s important to note that a “second wave” of new cases could upend plans to reopen economies. As countries reckon with these competing risks of health and economic activity, there is no clear answer around the right path to take.

COVID-19 is a catalyst for an entirely different future, but interestingly, it’s one that has been in the works for a while.

Without being melodramatic, COVID-19 is like the last nail in the coffin of globalization…The 2008-2009 crisis gave globalization a big hit, as did Brexit, as did the U.S.-China trade war, but COVID is taking it to a new level.

—Carmen Reinhart, incoming Chief Economist for the World Bank

Will there be any chance of returning to “normal” as we know it?

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001