Technology

AIoT: When Artificial Intelligence Meets the Internet of Things

AIoT: When AI Meets the Internet of Things

The Internet of Things (IoT) is a technology helping us to reimagine daily life, but artificial intelligence (AI) is the real driving force behind the IoT’s full potential.

From its most basic applications of tracking our fitness levels, to its wide-reaching potential across industries and urban planning, the growing partnership between AI and the IoT means that a smarter future could occur sooner than we think.

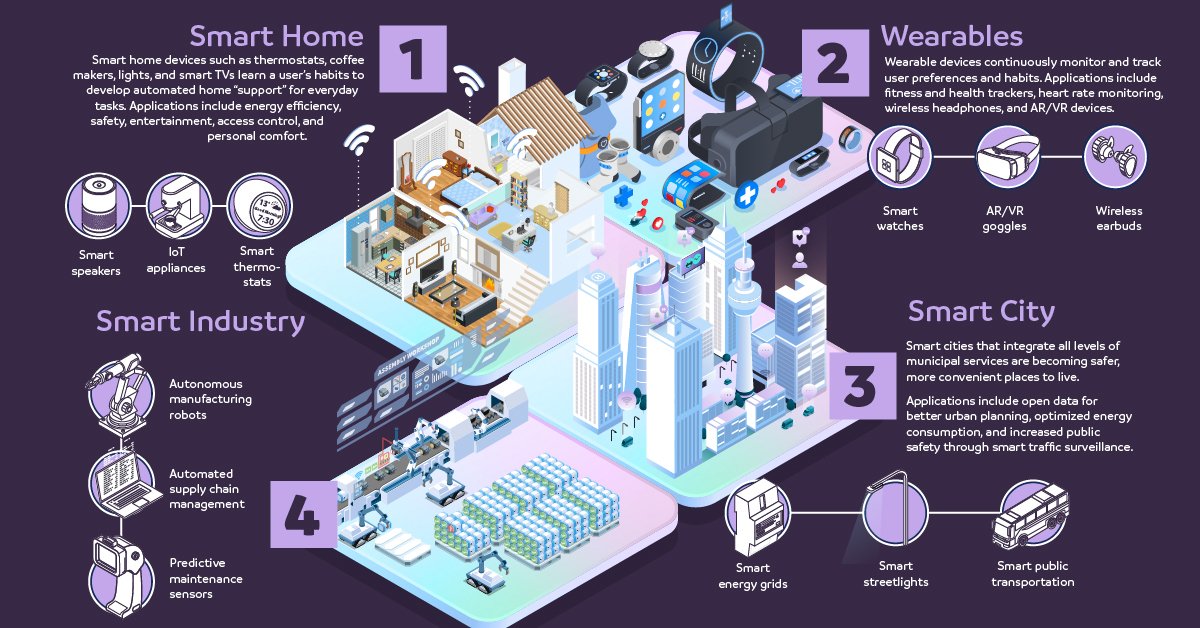

This infographic by TSMC highlights the breakthrough technologies and trends making that shift possible, and how we’re continuing to push the boundaries.

AI + IoT = Superpowers of Innovation

IoT devices use the internet to communicate, collect, and exchange information about our online activities. Every day, they generate 1 billion GB of data.

By 2025, there’s projected to be 42 billion IoT-connected devices globally. It’s only natural that as these device numbers grow, the swaths of data will too. That’s where AI steps in—lending its learning capabilities to the connectivity of the IoT.

The IoT is empowered by three key emerging technologies:

- Artificial Intelligence (AI)

Programmable functions and systems that enable devices to learn, reason, and process information like humans. - 5G Networks

Fifth generation mobile networks with high-speed, near-zero lag for real time data processing. - Big Data

Enormous volumes of data processed from numerous internet-connected sources.

Together, these interconnected devices are transforming the way we interact with our devices at home and at work, creating the AIoT (“Artificial Intelligence of Things”) in the process.

The Major AIoT Segments

So where are AI and the IoT headed together?

There are four major segments in which the AIoT is making an impact: wearables, smart home, smart city, and smart industry:

1. Wearables

Wearable devices such as smartwatches continuously monitor and track user preferences and habits. Not only has this led to impactful applications in the healthtech sector, it also works well for sports and fitness. According to leading tech research firm Gartner, the global wearable device market is estimated to see more than $87 billion in revenue by 2023.

2. Smart Home

Houses that respond to your every request are no longer restricted to science fiction. Smart homes are able to leverage appliances, lighting, electronic devices and more, learning a homeowner’s habits and developing automated “support.”

This seamless access also brings about additional perks of improved energy efficiency. As a result, the smart home market could see a compound annual growth rate (CAGR) of 25% between 2020-2025, to reach $246 billion.

3. Smart City

As more and more people flock from rural to urban areas, cities are evolving into safer, more convenient places to live. Smart city innovations are keeping pace, with investments going towards improving public safety, transport, and energy efficiency.

The practical applications of AI in traffic control are already becoming clear. In New Delhi, home to some of the world’s most traffic-congested roads, an Intelligent Transport Management System (ITMS) is in use to make ‘real time dynamic decisions on traffic flows’.

4. Smart Industry

Last but not least, industries from manufacturing to mining rely on digital transformation to become more efficient and reduce human error.

From real-time data analytics to supply-chain sensors, smart devices help prevent costly errors in industry. In fact, Gartner also estimates that over 80% of enterprise IoT projects will incorporate AI by 2022.

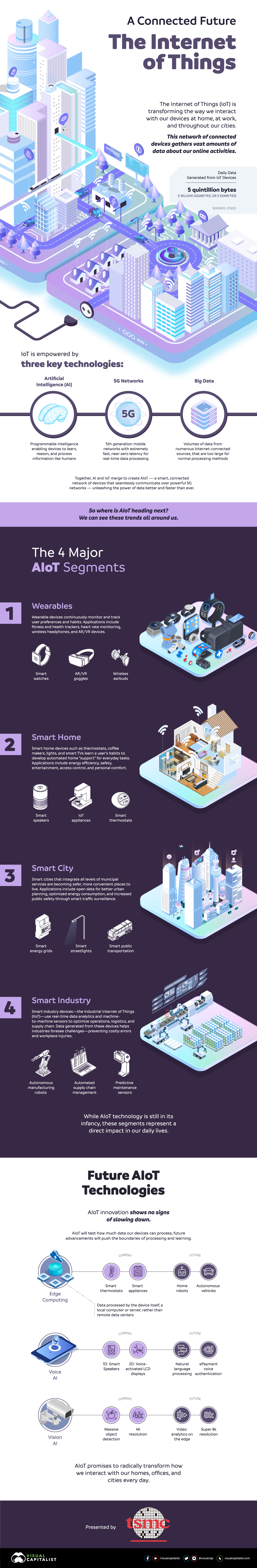

The Untapped Potential of AI & IoT

AIoT innovation is only accelerating, and promises to lead us into a more connected future.

| Category | Today | Tomorrow |

|---|---|---|

| Edge computing | Smart thermostats Smart appliances | Home robots Autonomous vehicles |

| Voice AI | Smart speakers | Natural language processing (NLP) ePayment voice authentication |

| Vision AI | Massive object detection | Video analytics on the edge Super 8K resolution |

The AIoT fusion is increasingly becoming more mainstream, as it continues to push the boundaries of data processing and intelligent learning for years to come.

Just like any company that blissfully ignored the Internet at the turn of the century, the ones that dismiss the Internet of Things risk getting left behind.

—Jared Newman, Technology Analyst

Technology

All of the Grants Given by the U.S. CHIPS Act

Intel, TSMC, and more have received billions in subsidies from the U.S. CHIPS Act in 2024.

All of the Grants Given by the U.S. CHIPS Act

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

This visualization shows which companies are receiving grants from the U.S. CHIPS Act, as of April 25, 2024. The CHIPS Act is a federal statute signed into law by President Joe Biden that authorizes $280 billion in new funding to boost domestic research and manufacturing of semiconductors.

The grant amounts visualized in this graphic are intended to accelerate the production of semiconductor fabrication plants (fabs) across the United States.

Data and Company Highlights

The figures we used to create this graphic were collected from a variety of public news sources. The Semiconductor Industry Association (SIA) also maintains a tracker for CHIPS Act recipients, though at the time of writing it does not have the latest details for Micron.

| Company | Federal Grant Amount | Anticipated Investment From Company |

|---|---|---|

| 🇺🇸 Intel | $8,500,000,000 | $100,000,000,000 |

| 🇹🇼 TSMC | $6,600,000,000 | $65,000,000,000 |

| 🇰🇷 Samsung | $6,400,000,000 | $45,000,000,000 |

| 🇺🇸 Micron | $6,100,000,000 | $50,000,000,000 |

| 🇺🇸 GlobalFoundries | $1,500,000,000 | $12,000,000,000 |

| 🇺🇸 Microchip | $162,000,000 | N/A |

| 🇬🇧 BAE Systems | $35,000,000 | N/A |

BAE Systems was not included in the graphic due to size limitations

Intel’s Massive Plans

Intel is receiving the largest share of the pie, with $8.5 billion in grants (plus an additional $11 billion in government loans). This grant accounts for 22% of the CHIPS Act’s total subsidies for chip production.

From Intel’s side, the company is expected to invest $100 billion to construct new fabs in Arizona and Ohio, while modernizing and/or expanding existing fabs in Oregon and New Mexico. Intel could also claim another $25 billion in credits through the U.S. Treasury Department’s Investment Tax Credit.

TSMC Expands its U.S. Presence

TSMC, the world’s largest semiconductor foundry company, is receiving a hefty $6.6 billion to construct a new chip plant with three fabs in Arizona. The Taiwanese chipmaker is expected to invest $65 billion into the project.

The plant’s first fab will be up and running in the first half of 2025, leveraging 4 nm (nanometer) technology. According to TrendForce, the other fabs will produce chips on more advanced 3 nm and 2 nm processes.

The Latest Grant Goes to Micron

Micron, the only U.S.-based manufacturer of memory chips, is set to receive $6.1 billion in grants to support its plans of investing $50 billion through 2030. This investment will be used to construct new fabs in Idaho and New York.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001