Demographics

The Problem of an Aging Global Population, Shown by Country

The Implications of an Aging Population

The world is experiencing a seismic demographic shift—and no country is immune to the consequences.

While increasing life expectancy and declining birth rates are considered major achievements in modern science and healthcare, they will have a significant impact on future generations.

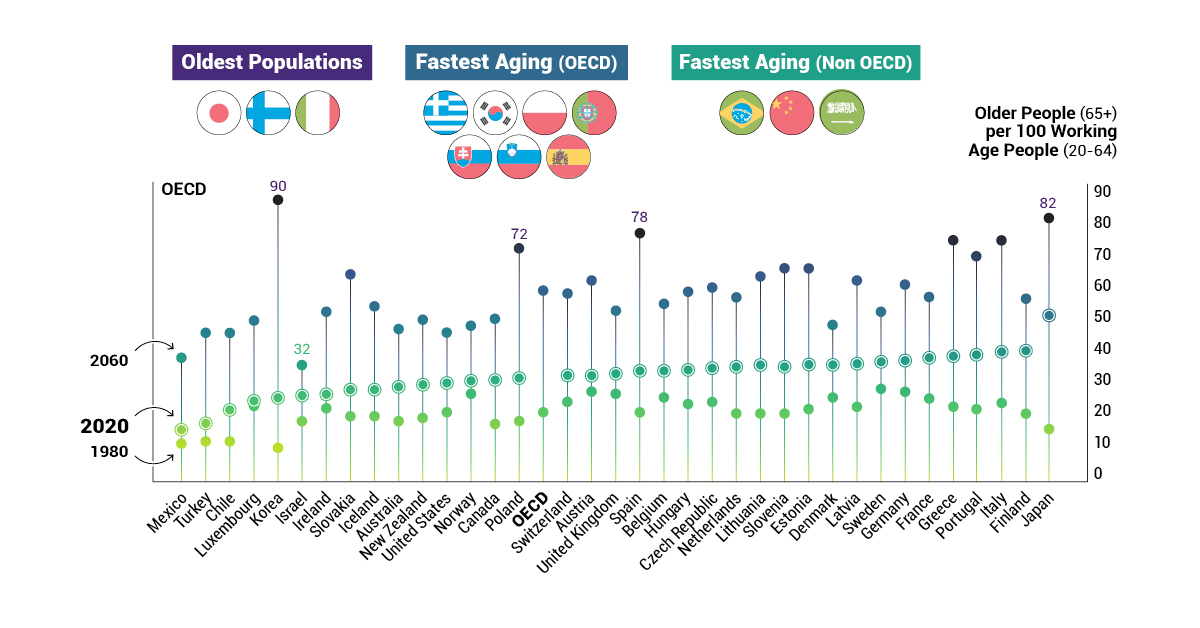

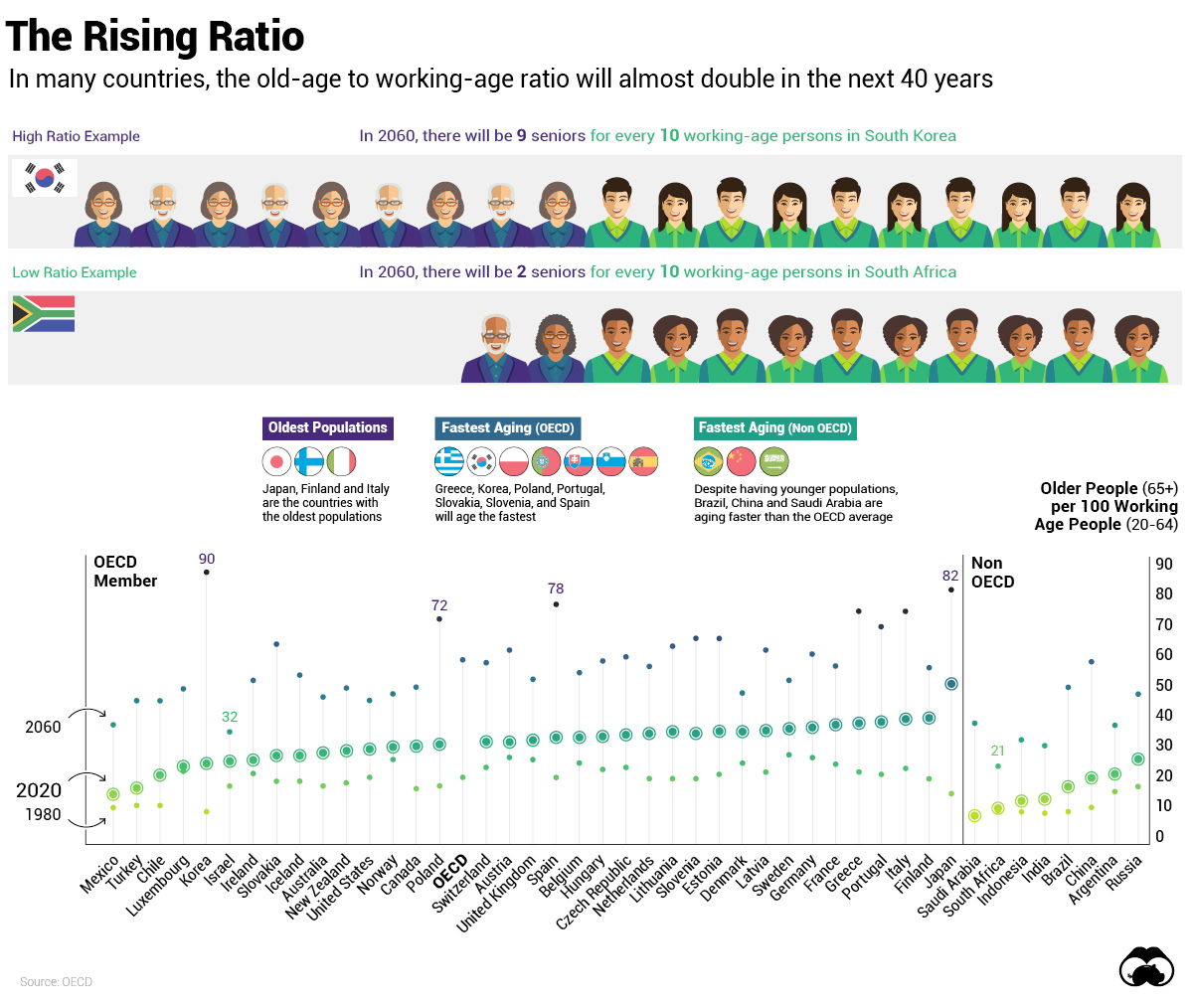

Today’s graphic relies on OECD data to demonstrate how the old-age to working-age ratio will change by 2060, highlighting some of the world’s fastest aging countries.

The Demographic Debacle

By 2050, there will be 10 billion people on earth, compared to 7.7 billion today—and many of them will be living longer. As a result, the number of elderly people per 100 working-age people will nearly triple—from 20 in 1980, to 58 in 2060.

Populations are getting older in all OECD countries, yet there are clear differences in the pace of aging. For instance, Japan holds the title for having the oldest population, with ⅓ of its citizens already over the age of 65. By 2030, the country’s workforce is expected to fall by 8 million—leading to a major potential labor shortage.

In another example, while South Korea currently boasts a younger than average population, it will age rapidly and end up with the highest old-to-young ratio among developed countries.

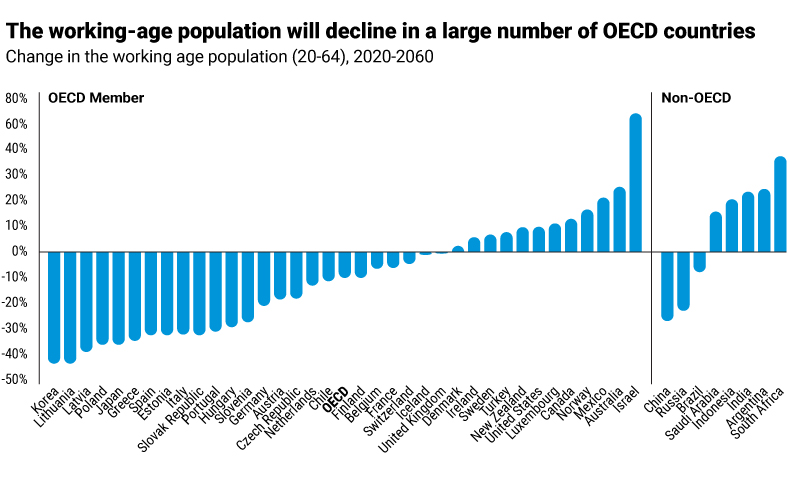

A Declining Workforce

Globally, the working-age population will see a 10% decrease by 2060. It will fall the most drastically by 35% or more in Greece, Japan, Korea, Latvia, Lithuania, and Poland. On the other end of the scale, it will increase by more than 20% in Australia, Mexico, and Israel.

Israel’s notably higher increase of 67% is due to the country’s high fertility rate, which is comparable to “baby boom” numbers seen in the U.S. following the second World War.

As countries prepare for the coming decades, workforce shortages are just one of the impacts of aging populations already being felt.

Managing the Risks

There are many other social and economic risks that we can come to expect as the global population continues to age:

- The Squeezed Middle: With more people claiming pension benefits but less people paying income taxes, the shrinking workforce may be forced to pay higher taxes.

- Rising Healthcare Costs: Longer lives do not necessarily mean healthier lives, with those over 65 more likely to have at least one chronic disease and require expensive, long-term care.

- Economic Slowdown: Changing workforces may lead capital to flow away from rapidly aging countries to younger countries, shifting the global distribution of economic power.

The strain on pension systems is perhaps the most evident sign of a drastically aging population. Although the average retirement age is gradually increasing in many countries, people are saving insufficiently for their increased life span—resulting in an estimated $400 trillion deficit by 2050.

Pensions Under Pressure

A pension is promised, but not necessarily guaranteed. Any changes made to existing government programs can alter the lives of future retirees entirely—but effective pension reforms that lessen the growing deficit are required urgently.

Towards a Better System

Certain countries are making great strides towards more sustainable pension systems, and the Global Pension Index suggests initiatives that governments can take into consideration, such as:

- Continuing to increase the age of retirement

- Increasing the level of savings—both inside and outside pension funds

- Increasing the coverage of private pensions across the labor force, including self-employed and contract employees, to provide improved integration between various pillars

- Preserving retirement funds by limiting the access to benefits before the retirement age

- Increasing the trust and confidence of all stakeholders by improving transparency of pension plans

Although 59% of employees are expecting to continue earning well into their retirement years, providing people with better incentives and options to make working at an older age easier could be crucial for ensuring continued economic growth.

Live Long and Prosper

As 2020 marks the beginning of the Decade of Healthy Ageing, the world is undoubtedly entering a pivotal period.

Countries all over the world face tremendous pressure to effectively manage their aging populations, but preparing for this demographic shift early will contribute to the economic advancement of countries, and allow populations—both young and old—to live long and prosper.

Demographics

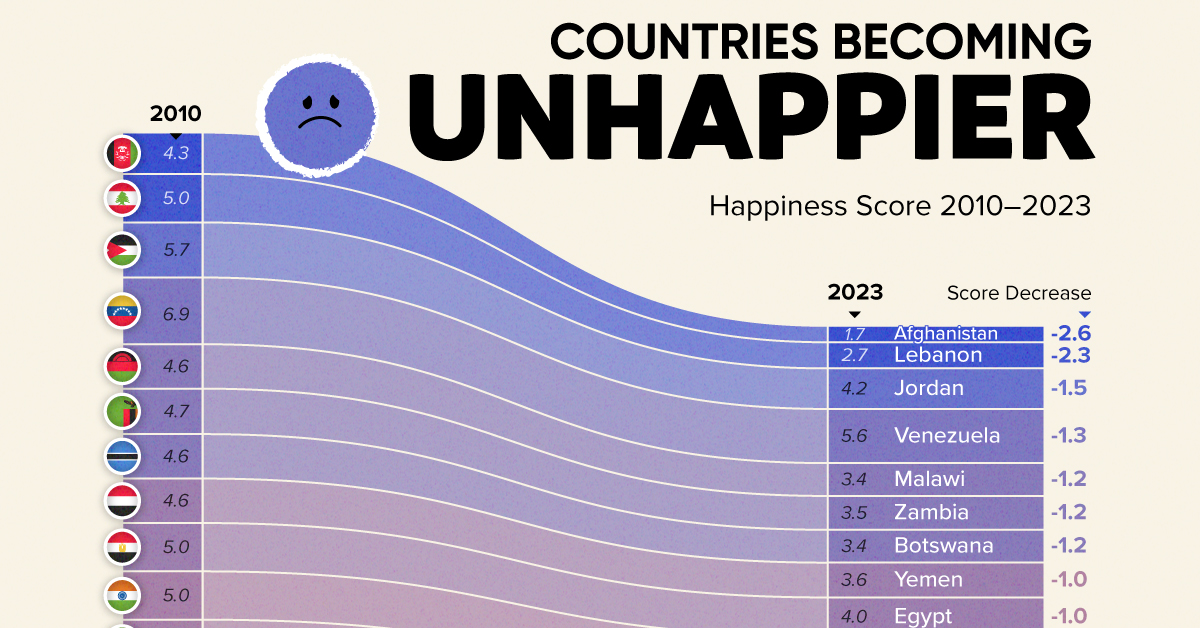

The Countries That Have Become Sadder Since 2010

Tracking Gallup survey data for more than a decade reveals some countries are witnessing big happiness declines, reflecting their shifting socio-economic conditions.

The Countries That Have Become Sadder Since 2010

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Can happiness be quantified?

Some approaches that try to answer this question make a distinction between two differing components of happiness: a daily experience part, and a more general life evaluation (which includes how people think about their life as a whole).

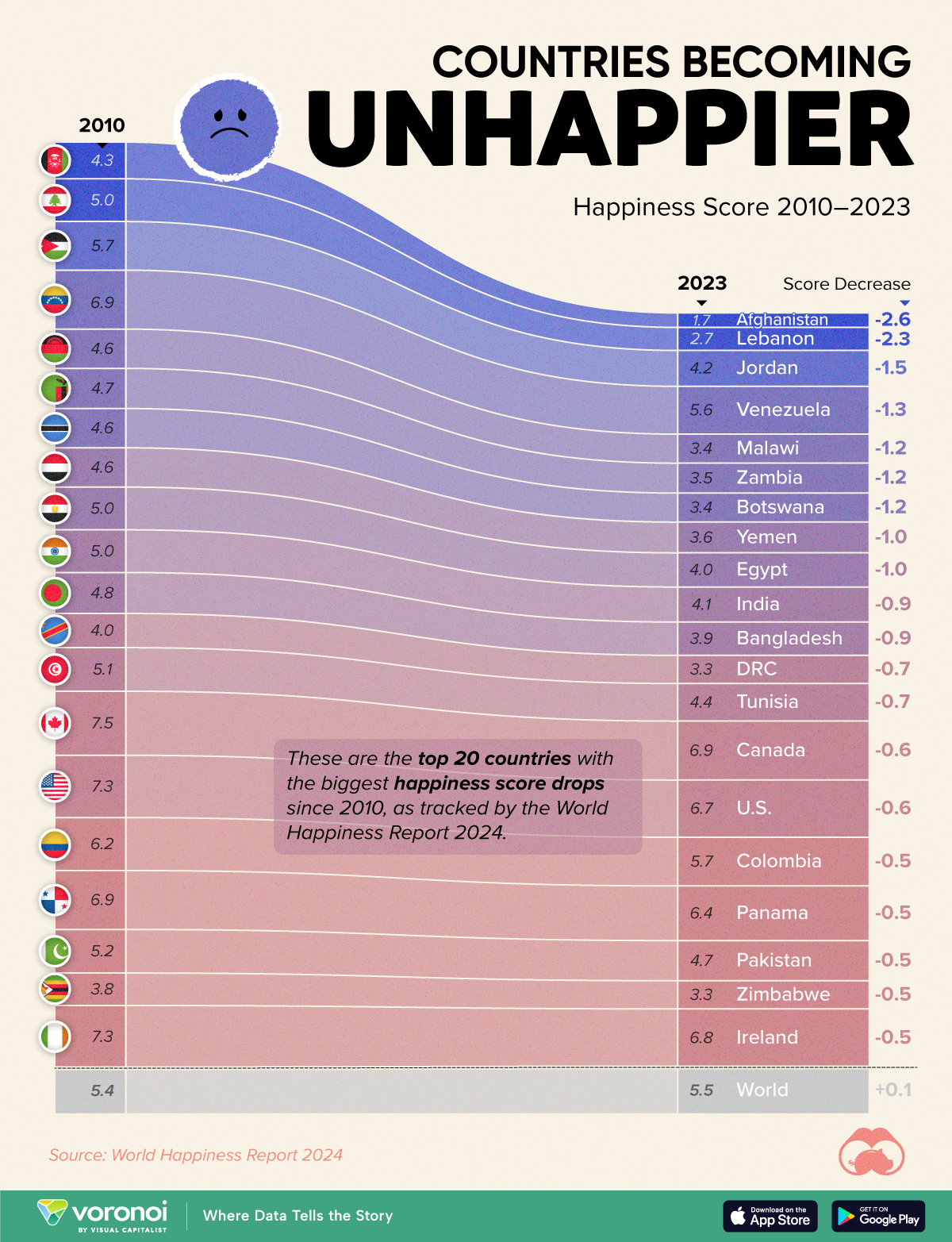

The World Happiness Report—first launched in 2012—has been making a serious go at quantifying happiness, by examining Gallup poll data that asks respondents in nearly every country to evaluate their life on a 0–10 scale. From this they extrapolate a single “happiness score” out of 10 to compare how happy (or unhappy) countries are.

More than a decade later, the 2024 World Happiness Report continues the mission. Its latest findings also include how some countries have become sadder in the intervening years.

Which Countries Have Become Unhappier Since 2010?

Afghanistan is the unhappiest country in the world right now, and is also 60% unhappier than over a decade ago, indicating how much life has worsened since 2010.

In 2021, the Taliban officially returned to power in Afghanistan, after nearly two decades of American occupation in the country. The Islamic fundamentalist group has made life harder, especially for women, who are restricted from pursuing higher education, travel, and work.

On a broader scale, the Afghan economy has suffered post-Taliban takeover, with various consequent effects: mass unemployment, a drop in income, malnutrition, and a crumbling healthcare system.

| Rank | Country | Happiness Score Loss (2010–24) | 2024 Happiness Score (out of 10) |

|---|---|---|---|

| 1 | 🇦🇫 Afghanistan | -2.6 | 1.7 |

| 2 | 🇱🇧 Lebanon | -2.3 | 2.7 |

| 3 | 🇯🇴 Jordan | -1.5 | 4.2 |

| 4 | 🇻🇪 Venezuela | -1.3 | 5.6 |

| 5 | 🇲🇼 Malawi | -1.2 | 3.4 |

| 6 | 🇿🇲 Zambia | -1.2 | 3.5 |

| 7 | 🇧🇼 Botswana | -1.2 | 3.4 |

| 8 | 🇾🇪 Yemen | -1.0 | 3.6 |

| 9 | 🇪🇬 Egypt | -1.0 | 4.0 |

| 10 | 🇮🇳 India | -0.9 | 4.1 |

| 11 | 🇧🇩 Bangladesh | -0.9 | 3.9 |

| 12 | 🇨🇩 DRC | -0.7 | 3.3 |

| 13 | 🇹🇳 Tunisia | -0.7 | 4.4 |

| 14 | 🇨🇦 Canada | -0.6 | 6.9 |

| 15 | 🇺🇸 U.S. | -0.6 | 6.7 |

| 16 | 🇨🇴 Colombia | -0.5 | 5.7 |

| 17 | 🇵🇦 Panama | -0.5 | 6.4 |

| 18 | 🇵🇰 Pakistan | -0.5 | 4.7 |

| 19 | 🇿🇼 Zimbabwe | -0.5 | 3.3 |

| 20 | 🇮🇪 Ireland | -0.5 | 6.8 |

| N/A | 🌍 World | +0.1 | 5.5 |

Nine countries in total saw their happiness score drop by a full point or more, on the 0–10 scale.

Noticeably, many of them have seen years of social and economic upheaval. Lebanon, for example, has been grappling with decades of corruption, and a severe liquidity crisis since 2019 that has resulted in a banking system collapse, sending poverty levels skyrocketing.

In Jordan, unprecedented population growth—from refugees leaving Iraq and Syria—has aggravated unemployment rates. A somewhat abrupt change in the line of succession has also raised concerns about political stability in the country.

-

Misc1 week ago

Misc1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

United States2 weeks ago

United States2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001