Money

Mapped: Countries With a Shrinking Consumer Class by 2030

![]() See this visualization first on the Voronoi app.

See this visualization first on the Voronoi app.

Visualizing Countries With a Shrinking Consumer Class by 2030

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

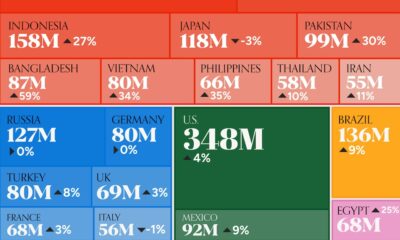

Over 100 million people are expected to be added to the consumer class worldwide just in 2024.

Despite this, some countries are actually predicted to see a decline in their number of consumers over the coming years.

In this visualization, we list key countries that are losing consumers, using data from 2023 from the World Data Lab.

Demographic Changes Impacting Consumption

Under the definition used here, a consumer is classified as someone who spends at least $12 per day. Currently, more than half of the world’s population is considered to be in the consumer class—about 4 billion people in 2023.

According to World Data Lab research, demographic changes are the major factor driving increases and reductions in the number of consumers globally.

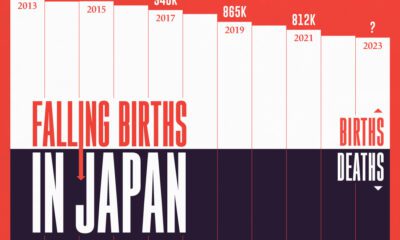

In Japan, where the most significant anticipated decline in consumer numbers is expected by 2030, the diminishing workforce and decreasing consumer base are mostly the consequence of the country’s low birth rate.

| Country | Decrease in Consumer Class Size by 2030 |

|---|---|

| 🇹🇼 Taiwan | -124,000 |

| 🇧🇬 Bulgaria | -135,000 |

| 🇩🇪 Germany | -152,000 |

| 🇵🇹 Portugal | -178,000 |

| 🇮🇹 Italy | -480,000 |

| 🇯🇵 Japan | -3,600,000 |

Currently, more than half of all municipalities in Japan are designated as depopulated districts, with schools shutting down and over 1.2 million small businesses owned by older individuals or families lacking successors.

In Europe as well, a decline in both birth rates and an aging population is impacting consumption. Italy is expected to lose almost half a million consumers by the end of the decade. Births in Italy dropped to a historic low below 400,000 in 2022, and Italy’s dearth of babies is considered a national emergency.

The emigration of working-age individuals can also shrink a country’s consumer class. For instance, between 2019 and 2022, Taiwan’s population shrank by roughly 300,000.

As the age of the average consumer grows, the demand for healthcare services, leisure activities, and retirement-related offerings will increase.

Money

Charted: Which City Has the Most Billionaires in 2024?

Just two countries account for half of the top 20 cities with the most billionaires. And the majority of the other half are found in Asia.

Charted: Which Country Has the Most Billionaires in 2024?

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Some cities seem to attract the rich. Take New York City for example, which has 340,000 high-net-worth residents with investable assets of more than $1 million.

But there’s a vast difference between being a millionaire and a billionaire. So where do the richest of them all live?

Using data from the Hurun Global Rich List 2024, we rank the top 20 cities with the highest number of billionaires in 2024.

A caveat to these rich lists: sources often vary on figures and exact rankings. For example, in last year’s reports, Forbes had New York as the city with the most billionaires, while the Hurun Global Rich List placed Beijing at the top spot.

Ranked: Top 20 Cities with the Most Billionaires in 2024

The Chinese economy’s doldrums over the course of the past year have affected its ultra-wealthy residents in key cities.

Beijing, the city with the most billionaires in 2023, has not only ceded its spot to New York, but has dropped to #4, overtaken by London and Mumbai.

| Rank | City | Billionaires | Rank Change YoY |

|---|---|---|---|

| 1 | 🇺🇸 New York | 119 | +1 |

| 2 | 🇬🇧 London | 97 | +3 |

| 3 | 🇮🇳 Mumbai | 92 | +4 |

| 4 | 🇨🇳 Beijing | 91 | -3 |

| 5 | 🇨🇳 Shanghai | 87 | -2 |

| 6 | 🇨🇳 Shenzhen | 84 | -2 |

| 7 | 🇭🇰 Hong Kong | 65 | -1 |

| 8 | 🇷🇺 Moscow | 59 | No Change |

| 9 | 🇮🇳 New Delhi | 57 | +6 |

| 10 | 🇺🇸 San Francisco | 52 | No Change |

| 11 | 🇹🇭 Bangkok | 49 | +2 |

| 12 | 🇹🇼 Taipei | 45 | +2 |

| 13 | 🇫🇷 Paris | 44 | -2 |

| 14 | 🇨🇳 Hangzhou | 43 | -5 |

| 15 | 🇸🇬 Singapore | 42 | New to Top 20 |

| 16 | 🇨🇳 Guangzhou | 39 | -4 |

| 17T | 🇮🇩 Jakarta | 37 | +1 |

| 17T | 🇧🇷 Sao Paulo | 37 | No Change |

| 19T | 🇺🇸 Los Angeles | 31 | No Change |

| 19T | 🇰🇷 Seoul | 31 | -3 |

In fact all Chinese cities on the top 20 list have lost billionaires between 2023–24. Consequently, they’ve all lost ranking spots as well, with Hangzhou seeing the biggest slide (-5) in the top 20.

Where China lost, all other Asian cities—except Seoul—in the top 20 have gained ranks. Indian cities lead the way, with New Delhi (+6) and Mumbai (+3) having climbed the most.

At a country level, China and the U.S combine to make up half of the cities in the top 20. They are also home to about half of the world’s 3,200 billionaire population.

In other news of note: Hurun officially counts Taylor Swift as a billionaire, estimating her net worth at $1.2 billion.

-

Debt1 week ago

Debt1 week agoHow Debt-to-GDP Ratios Have Changed Since 2000

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Green2 weeks ago

Green2 weeks agoTop Countries By Forest Growth Since 2001

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees