Politics

The Pension Time Bomb: $400 Trillion by 2050

View a high resolution version of this graphic

The Pension Time Bomb: $400 Trillion by 2050

View the high resolution version of today’s graphic by clicking here.

Are governments making promises about pensions that they might not be able to keep?

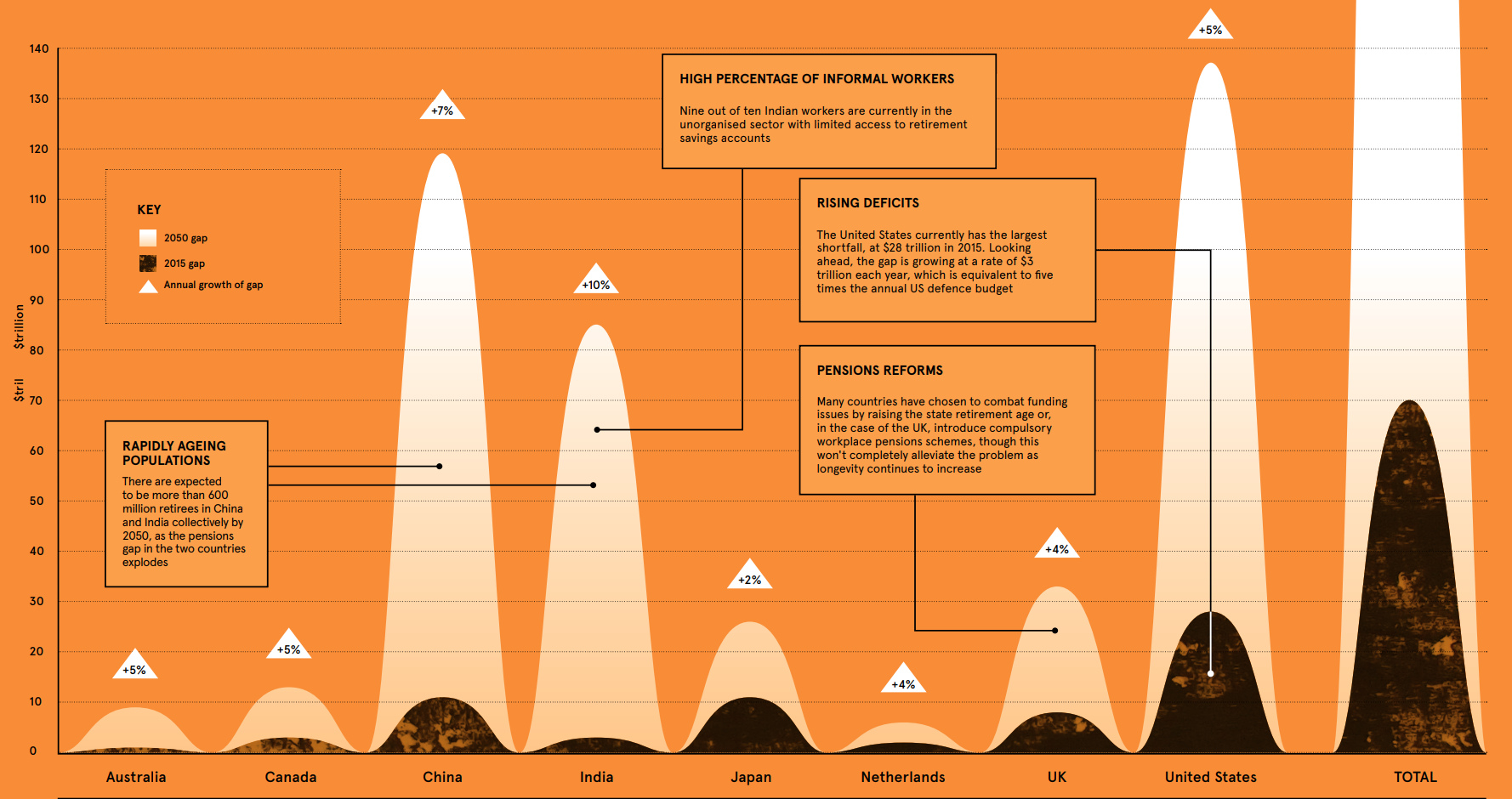

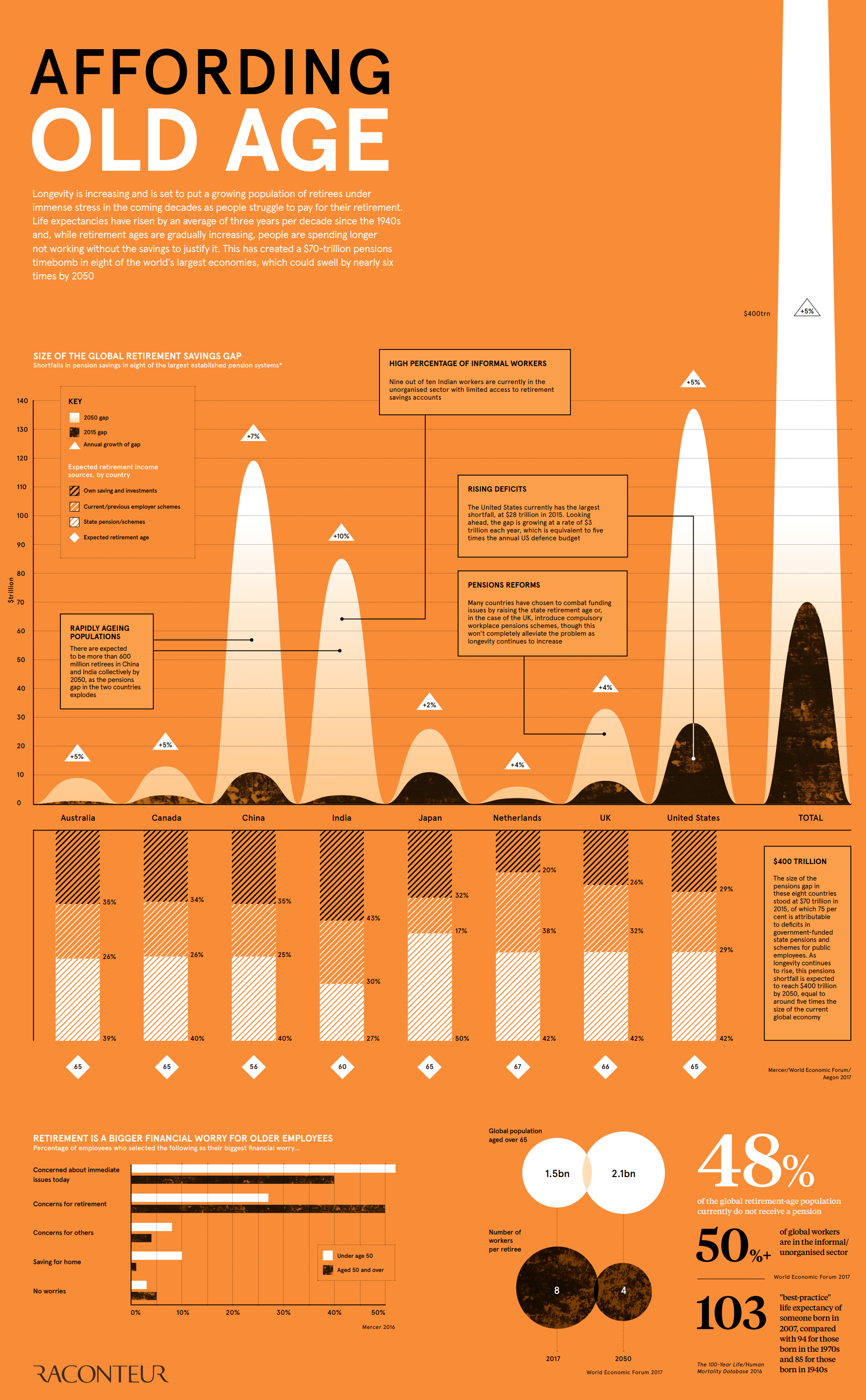

According to an analysis by the World Economic Forum (WEF), there was a combined retirement savings gap in excess of $70 trillion in 2015, spread between eight major economies..

The WEF says the deficit is growing by $28 billion every 24 hours – and if nothing is done to slow the growth rate, the deficit will reach $400 trillion by 2050, or about five times the size of the global economy today.

The group of economies studied: Canada, Australia, Netherlands, Japan, India, China, the United Kingdom, and the United States.

Mind the Gap

Today’s infographic comes to us from Raconteur, and it illuminates a growing problem attached to an aging population (and those that will be supporting it).

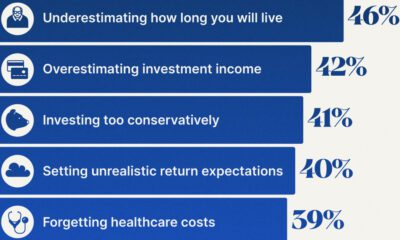

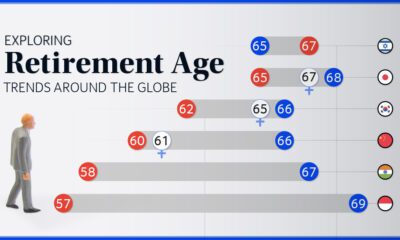

Since social security programs were initially developed, the circumstances around work and retirement have shifted considerably. Life expectancy has risen by three years per decade since the 1940s, and older people are having increasingly long life spans. With the retirement age hardly changing in most economies, this longevity means that people are spending longer not working without the savings to justify it.

This problem is amplified by the size of generations and fertility rates. The population of retirees globally is expected to grow from 1.5 billion to 2.1 billion between 2017-2050, while the number of workers for each retiree is expected to halve from eight to four over the same timeframe.

The WEF has made clear that the situation is not trivial, likening the scenario to “financial climate change”:

The anticipated increase in longevity and resulting ageing populations is the financial equivalent of climate change

Michael Drexler, Head of Financial and Infrastructure Systems, WEF

Like climate change, some of the early signs of this retirement savings gap can be “sandbagged” for the time being – but if not handled properly in the medium and long term, the adverse effects could be overwhelming.

Future Proofing

While implementing various system reforms like raising the retirement age will help, ultimately the money in the system has to come from somewhere. Social security programs will need to cut benefits, increase taxes, or borrow from somewhere else in the government’s budget to make up for the coming shortfalls.

In the United States specifically, it is expected that the Social Security trust fund will run out by 2034. At that point, there will only be enough revenue coming in to pay out approximately 77% of benefits.

War

Visualized: Top 15 Global Tank Fleets

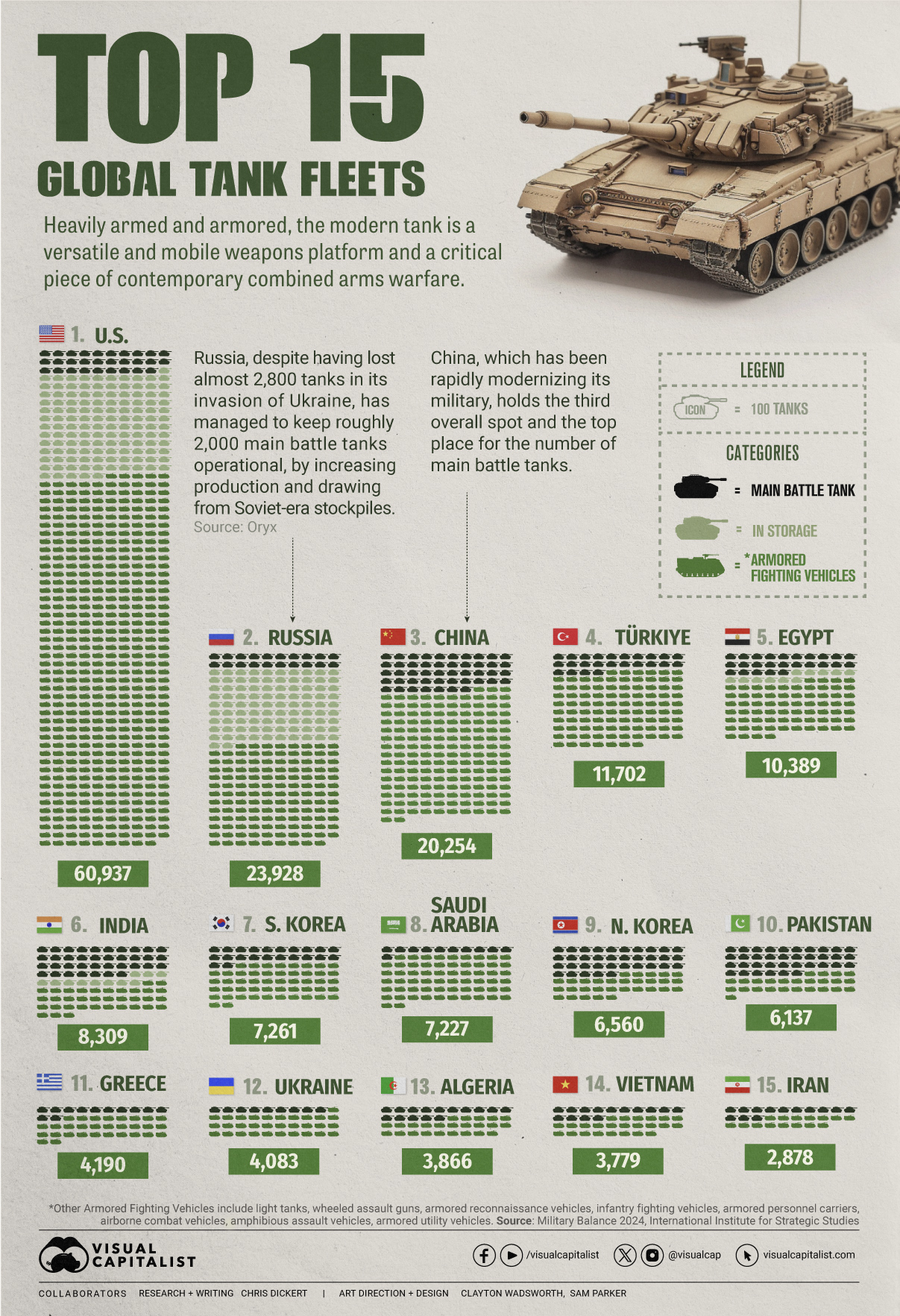

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

The Top 15 Global Tank Fleets

This was originally posted on our Voronoi app. Download the app for free on iOS or Android and discover incredible data-driven charts from a variety of trusted sources.

Heavily armed and armored, the modern tank is a versatile and mobile weapons platform, and a critical piece of contemporary warfare.

This visualization shows the top 15 global tank fleets, using data from the 2024 Military Balance report from the International Institute for Strategic Studies (IISS).

Let’s take an in-depth look at the top three fleets:

1. United States

As the world’s pre-eminent military power, it’s perhaps no surprise that the United States also has the largest tank fleet, by a wide margin.

In total, they have just over 45,000 armored fighting vehicles in operation, along with 2,640 main battle tanks (MBTs), and 12,800 vehicles in storage, of which 2,000 are main battle tanks.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 2,640 | 4 |

| Armored reconnaissance | 1,745 | 1 |

| Infantry fighting vehicles | 3,262 | 3 |

| Armored personnel carriers | 10,644 | 1 |

| Amphibious assault vehicles | 1,401 | 1 |

| Armored utility vehicles | 28,445 | 1 |

| Storage | 12,800 | 1 |

| Total | 60,937 | 1 |

The U.S. is internalizing the lessons from the ongoing invasion of Ukraine, where Western-supplied anti-tank weapons and massed Ukrainian artillery have been cutting Russian tanks to pieces. As a result, the U.S. recently canceled an upgrade of the M1 Abrams in favor of a more ambitious upgrade.

Meanwhile, the U.S. is nervously eyeing a more confident China and a potential clash over Taiwan, where air and naval forces will be critical. However, a recent war game showed that Taiwanese mechanized ground forces, kitted out with American-made tanks and armored fighting vehicles, were critical in keeping the island autonomous.

2. Russia

According to Oryx, a Dutch open-source intelligence defense website, at time of writing, Russia has lost almost 2,800 main battle tanks since invading Ukraine. Considering that in the 2022 edition of the Military Balance, Russia was estimated to have 2,927 MBTs in operation, those are some hefty losses.

Russia has been able to maintain about 2,000 MBTs in the field, in part, by increasing domestic production. Many defense plants have been taken over by state-owned Rostec and now operate around the clock. Russia is also now spending a full third of their budget on defense, equivalent to about 7.5% of GDP.

At the same time, they’ve also been drawing down their Soviet-era stockpiles, which are modernized before being sent to the front. Just how long they can keep this up is an open question; their stockpiles are large, but not limitless. Here is what their storage levels look like:

| Category | 2023 | 2024 | YOY change |

|---|---|---|---|

| Main battle tanks | 5,000 | 4,000 | -20.0% |

| Armored reconnaissance | 1,000 | 100 | -90.0% |

| Infantry fighting vehicles | 4,000 | 2,800 | -30.0% |

| Armored personnel carriers | 6,000 | 2,300 | -61.7% |

| Total | 16,000 | 9,200 | -42.5% |

3. China

China holds the third overall spot and top place globally for the number of main battle tanks in operation. Untypically, the People’s Liberation Army has no armored vehicles in storage, which perhaps isn’t surprising when you consider that China has been rapidly modernizing its military and that stockpiles usually contain older models.

China also has one of the world’s largest fleets of armored fighting vehicles, second only to the United States. Breaking down that headline number, we can also see that they have the largest number of light tanks, wheeled guns, and infantry fighting vehicles.

| Category | Vehicles | Global rank |

|---|---|---|

| Main battle tanks | 4,700 | 1 |

| Light tanks | 1,330 | 1 |

| Wheeled guns | 1,250 | 1 |

| Infantry fighting vehicles | 8,200 | 1 |

| Armored personnel carriers | 3,604 | 5 |

| Airborne combat vehicles | 180 | 2 |

| Amphibious assault vehicles | 990 | 2 |

| Total | 20,254 | 3 |

This is equipment that would be integral if China were to make an attempt to reunify Taiwan with the mainland by force, where lightly armored mechanized units need to move with speed to occupy the island before Western allies can enter the fray. It’s worth noting that China also has one of the world’s largest fleets of amphibious assault vehicles.

End of the Tank?

Many commentators at the outset of Russia’s invasion of Ukraine, were quick to predict the end of the tank, however, to paraphrase Mark Twain, reports of the tank’s demise are greatly exaggerated.

With the U.S. and China both developing remote and autonomous armored vehicles, tanks could be quite different in the future, but there is nothing else that matches them for firepower, mobility, and survivability on the modern battlefield today.

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes

-

Technology1 week ago

Technology1 week agoRanked: Semiconductor Companies by Industry Revenue Share

-

Money1 week ago

Money1 week agoWhich States Have the Highest Minimum Wage in America?

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc2 weeks ago

Misc2 weeks agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?