Precious Metals

The 5 Biggest Market Risks That Billionaires are Hedging Against

If you’ve studied the history of markets, you know that sentiment can turn on a dime.

Whether it is an unexpected wake-up call like the collapse of Lehman Brothers, or simply the popping of a bubble that’s blown too big, the tides can shift in a matter of hours or days.

No one knows this better than the world’s most elite investors – and that’s why billionaires like Warren Buffett, Ray Dalio, Bill Gross, Paul Tudor Jones II, and Carl Icahn take the necessary precautions available to protect themselves from these big and unexpected market swings.

5 Risks That Keep Billionaires Up at Night

Today’s infographic comes to us from Sprott Physical Bullion Trusts and it highlights some of the potential market risks that could move markets, as well as how these elite investors are hedging to protect their fortunes.

While these are all market risks that billionaires are concerned about, it’s worth mentioning that these kinds of events are almost impossible to predict or forecast.

Despite the unlikelihood of them occurring, they all have the potential to impact markets – and that’s why elite investors are always active in hedging their investments.

A Note on Net Worth

Why are billionaires so concerned – after all, don’t they have lots of cash to protect themselves?

It’s worth noting that on a relative basis, billionaires often aren’t very liquid at all. In fact, the majority of their net worth is usually tied up in business interests or other investments, and the value of these assets fluctuate with the market.

That means a big market movement could wipe out millions or billions of dollars in the span of hours. For an extreme example of this, just look at Mark Zuckerberg, who saw his net worth plunge $6 billion in just one day in the wake of his company’s most recent privacy crisis.

The 5 Big Market Risks

Here are the risks keeping the world’s most elite investors up at night:

1. The Return of Inflation

Have central banks mastered monetary policy- or is there a chance that inflation could come back with a vengeance? After trending down for decades, billionaire Carl Icahn says that creeping inflation could lead to higher interest rates, which he thinks would be “difficult to deal with for the market”.

2. Record High Debt

The most recent number for global debt is at $233 trillion, and about $63 trillion of that is central government debt.

Bill Gross, the “Bond King”, says that our system is dependent on leverage, and the critical values that affect this are debt levels, availability, and the cost of leverage. He said in a recent interview that “When one or more of these factors deteriorates, the probability of the model’s success and stability go down”.

3. Bond Market Worries

Last year, 84% of investors said that the corporate bond market was overvalued – and 82% said that the government bond market was overvalued.

In a recent interview, hedge fund billionaire Paul Tudor Jones II predicted a price plunge, saying that “Bonds are the most expensive they’ve ever been by virtually any metric. They’re overvalued and over-owned.”

4. Geopolitical Black Swans

Elite investors continue to worry about geopolitical surprises that could impact markets, such as a trade war with China. We looked at this broad topic in depth in our previous infographic on geopolitical black swans.

5. Overzealous Central Banks

Lastly, many world-class investors are also concerned about the unintended aftereffects of massive central bank programs in recent years. With $13 trillion in total QE pumped into global markets since 2008, investors are worried about how much room that central banks have left to maneuver in a situation where the central bank “tool kit” is needed.

Mining

Visualizing the New Era of Gold Mining

This infographic highlights the need for new gold mining projects and shows the next generation of America’s gold deposits.

Visualizing the New Era of Gold Mining

Between 2011 and 2020, the number of major gold discoveries fell by 70% relative to 2001-2010.

The lack of discoveries, alongside stagnating gold production, has cast a shadow of doubt on the future of gold supply.

This infographic sponsored by NOVAGOLD highlights the need for new gold mining projects with a focus on the company’s Donlin Gold project in Alaska.

The Current State of Gold Production

Between 2010 and 2019, gold production increased steadily, though this growth has stagnated over the past few years.

| Year | Gold Production, tonnes | YoY % Change |

|---|---|---|

| 2010 | 2,560 | - |

| 2011 | 2,660 | 3.9% |

| 2012 | 2,690 | 1.1% |

| 2013 | 2,800 | 4.1% |

| 2014 | 2,990 | 6.8% |

| 2015 | 3,100 | 3.7% |

| 2016 | 3,110 | 0.3% |

| 2017 | 3,230 | 3.9% |

| 2018 | 3,300 | 2.2% |

| 2019 | 3,300 | 0.0% |

| 2020 | 3,030 | -8.2% |

| 2021 | 3,090 | 2.0% |

| 2022 | 3,100 | 0.3% |

Along with a small decrease in gold production in 2020, there were no new major gold discoveries in 2021.

The fall in production and long-term lack of gold discoveries point towards a possible imbalance in gold supply and demand. This calls for the introduction of new gold development projects that can fill the supply-demand gap in the future.

Sustaining Supply: Gold for the Future

Jurisdictions play an important role when looking for projects that could sustain gold production well into the future.

From political stability to trustworthy legal systems, the characteristics of a jurisdiction can make or break mining projects. Amid ongoing market uncertainty, political turmoil, and resource nationalism, projects in safe jurisdictions offer a better investment opportunity for investors and mining companies.

Today, 10 of the top 15 mining jurisdictions for investment are located in North America, according to the Fraser Institute report published in 2023.

A Golden Opportunity

Located in Alaska, one of the world’s safest mining jurisdictions, NOVAGOLD’s 50% owned Donlin Gold project has the highest average grade of gold among major development projects in the Americas. For every tonne of ore, Donlin Gold offers 2.24 grams of gold, which is more than twice the global average grade of 1.04g/t.

Additionally, Donlin Gold is the second-largest gold-focused development project in the Americas, with over 39 million ounces of gold in M&I resources inclusive of reserves.

NOVAGOLD is focused on the Donlin Gold project in equal partnership with Barrick Gold.

Learn more about Donlin Gold .

-

Lithium3 days ago

Lithium3 days agoRanked: The Top 10 EV Battery Manufacturers in 2023

Asia dominates this ranking of the world’s largest EV battery manufacturers in 2023.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

-

Mining3 weeks ago

Mining3 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

While the price of gold has reached new record highs in 2024, gold mining stocks are still far from their 2011 peaks.

-

Uranium2 months ago

Uranium2 months agoCharted: Global Uranium Reserves, by Country

We visualize the distribution of the world’s uranium reserves by country, with 3 countries accounting for more than half of total reserves.

-

Energy4 months ago

Energy4 months agoThe Periodic Table of Commodity Returns (2014-2023)

Commodity returns in 2023 took a hit. This graphic shows the performance of commodities like gold, oil, nickel, and corn over the last decade.

-

Mining4 months ago

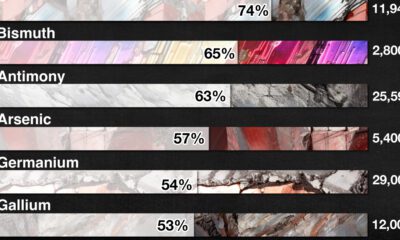

Mining4 months agoChina Dominates the Supply of U.S. Critical Minerals List

The U.S. Geological Survey estimates that in 2022, China was the world’s leading producer of 30 out of 50 entries on the U.S. critical minerals list.

-

Mining1 week ago

Mining1 week agoGold vs. S&P 500: Which Has Grown More Over Five Years?

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

-

Money2 weeks ago

Money2 weeks agoWhich States Have the Highest Minimum Wage in America?

-

AI2 weeks ago

AI2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Countries2 weeks ago

Countries2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries