Gold

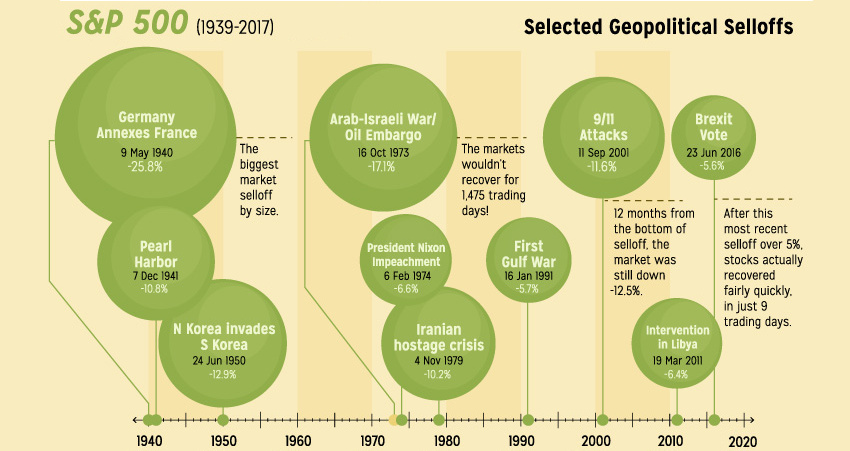

How Billionaire Investors Hedge Against Geopolitical Black Swans

Investors must always be comfortable with the idea that the market bears risk.

Sometimes this risk flies under the radar and isn’t as pronounced as it probably should be.

However, in other cases, the topic of risk can catapult to the forefront of discussion. There can be specific events or signals unfolding that give investors the jitters – and during these times, investors will make adjustments to their portfolios to avoid getting caught off guard.

How Billionaires are Hedging

In the following infographic from Sprott Physical Bullion Trusts, we explain the particular geopolitical risks that have the world’s most elite investors concerned today – and what moves they are making to protect themselves from black swans.

The world isn’t predictable at the best of times – but after unanticipated occurrences such as Brexit and the election of Trump in 2016, the geopolitical tea leaves are getting even more difficult to read.

The world is approaching a major inflection point and the intense amount of global angst we’re experiencing now stems from deep, structural forces that have been building over decades.

– Reva Goujon, VP Global Analysis of Stratfor

According to Reva Goujon, VP Global Analysis of Stratfor, we are experiencing the perfect storm of “-isms”: nationalism, nativism, protectionism, and isolationism.

As a result, the following potential geopolitical risks are at the top of the agenda for experts and top investors:

Domestic risks:

Unpredictability of the Trump administration, government inaction, a trade war with China, and NAFTA renegotiations

International risks:

Economic nationalism, further “exits” from the EU, Russia and China seeking to assert authority, terrorism, escalation of Middle East conflicts, and North Korea’s nuclear ambitions

Elite Investors Taking Action

With these risks perceived to be on the table, some of the world’s most elite investors like Ray Dalio and Warren Buffett are taking action. Here’s what they are up to:

Ray Dalio

Ray Dalio, the founder of the world’s largest hedge fund, Bridgewater Associates, had this to say:

When it comes to assessing political matters we are very humble.

-Ray Dalio, Aug 2017

Dalio’s advice: to stay liquid, stay diversified, and not be overly exposed to any particular economic outcomes. He also recommends a 5%-10% position in gold.

Warren Buffett

The Oracle of Omaha has a similar but very different perspective.

No one can tell you when these traumas will occur – not me, not Charlie, not economists, not the media.

– Warren Buffett, Feb 2017

With this in mind and with equities expensive, the seasoned value investor holds onto piles of cash to prepare for potential buying opportunities. Berkshire Hathaway now has $99.7 billion in undeployed cash, the most in the company’s history.

Bill Ackman

Billionaire hedge fund manager Bill Ackman took a position in “out of the money” call options on the VIX.

This will protect against stock market risk.

– Bill Ackman, Aug 2017

David Einhorn

The billionaire founder of Greenlight Capital says he is keeping gold as a top position.

The (Trump) administration comes with a high degree of uncertainty.

– David Einhorn, Feb 2017

Howard Marks

Lastly, the famous value investor Howard Marks warned his clients to move into lower-risk investments to protect against future losses.

The uncertainties are unusual in terms of number, scale and insolubility in areas including secular economic growth; the impact of central banks; interest rates and inflation; political dysfunction; geopolitical trouble spots; and the long-term impact of technology.

– Howard Marks, July 2017

Mining

Gold vs. S&P 500: Which Has Grown More Over Five Years?

The price of gold has set record highs in 2024, but how has this precious metal performed relative to the S&P 500?

Gold vs. S&P 500: Which Has Grown More Over Five Years?

This was originally posted on our Voronoi app. Download the app for free on Apple or Android and discover incredible data-driven charts from a variety of trusted sources.

Gold is considered a unique asset due to its enduring value, historical significance, and application in various technologies like computers, spacecraft, and communications equipment.

Commonly regarded as a “safe haven asset”, gold is something investors typically buy to protect themselves during periods of global uncertainty and economic decline.

It is for this reason that gold has performed rather strongly in recent years, and especially in 2024. Persistent inflation combined with multiple wars has driven up demand for gold, helping it set a new all-time high of over $2,400 per ounce.

To put this into perspective, we visualized the performance of gold alongside the S&P 500. See the table below for performance figures as of April 12, 2024.

| Asset/Index | 1 Yr (%) | 5 Yr (%) |

|---|---|---|

| 🏆 Gold | +16.35 | +81.65 |

| 💼 S&P 500 | +25.21 | +76.22 |

Over the five-year period, gold has climbed an impressive 81.65%, outpacing even the S&P 500.

Get Your Gold at Costco

Perhaps a sign of how high the demand for gold is becoming, wholesale giant Costco is reportedly selling up to $200 million worth of gold bars every month in the United States. The year prior, sales only amounted to $100 million per quarter.

Consumers aren’t the only ones buying gold, either. Central banks around the world have been accumulating gold in very large quantities, likely as a hedge against inflation.

According to the World Gold Council, these institutions bought 1,136 metric tons in 2022, marking the highest level since 1950. Figures for 2023 came in at 1,037 metric tons.

See More Graphics on Gold

If you’re fascinated by gold, be sure to check out more Visual Capitalist content including 200 Years of Global Gold Production, by Country or Ranked: The Largest Gold Reserves by Country.

-

Mining2 weeks ago

Mining2 weeks agoCharted: The Value Gap Between the Gold Price and Gold Miners

-

Real Estate1 week ago

Real Estate1 week agoRanked: The Most Valuable Housing Markets in America

-

Business1 week ago

Business1 week agoCharted: Big Four Market Share by S&P 500 Audits

-

AI1 week ago

AI1 week agoThe Stock Performance of U.S. Chipmakers So Far in 2024

-

Misc1 week ago

Misc1 week agoAlmost Every EV Stock is Down After Q1 2024

-

Money2 weeks ago

Money2 weeks agoWhere Does One U.S. Tax Dollar Go?

-

Green2 weeks ago

Green2 weeks agoRanked: Top Countries by Total Forest Loss Since 2001

-

Real Estate2 weeks ago

Real Estate2 weeks agoVisualizing America’s Shortage of Affordable Homes