Markets

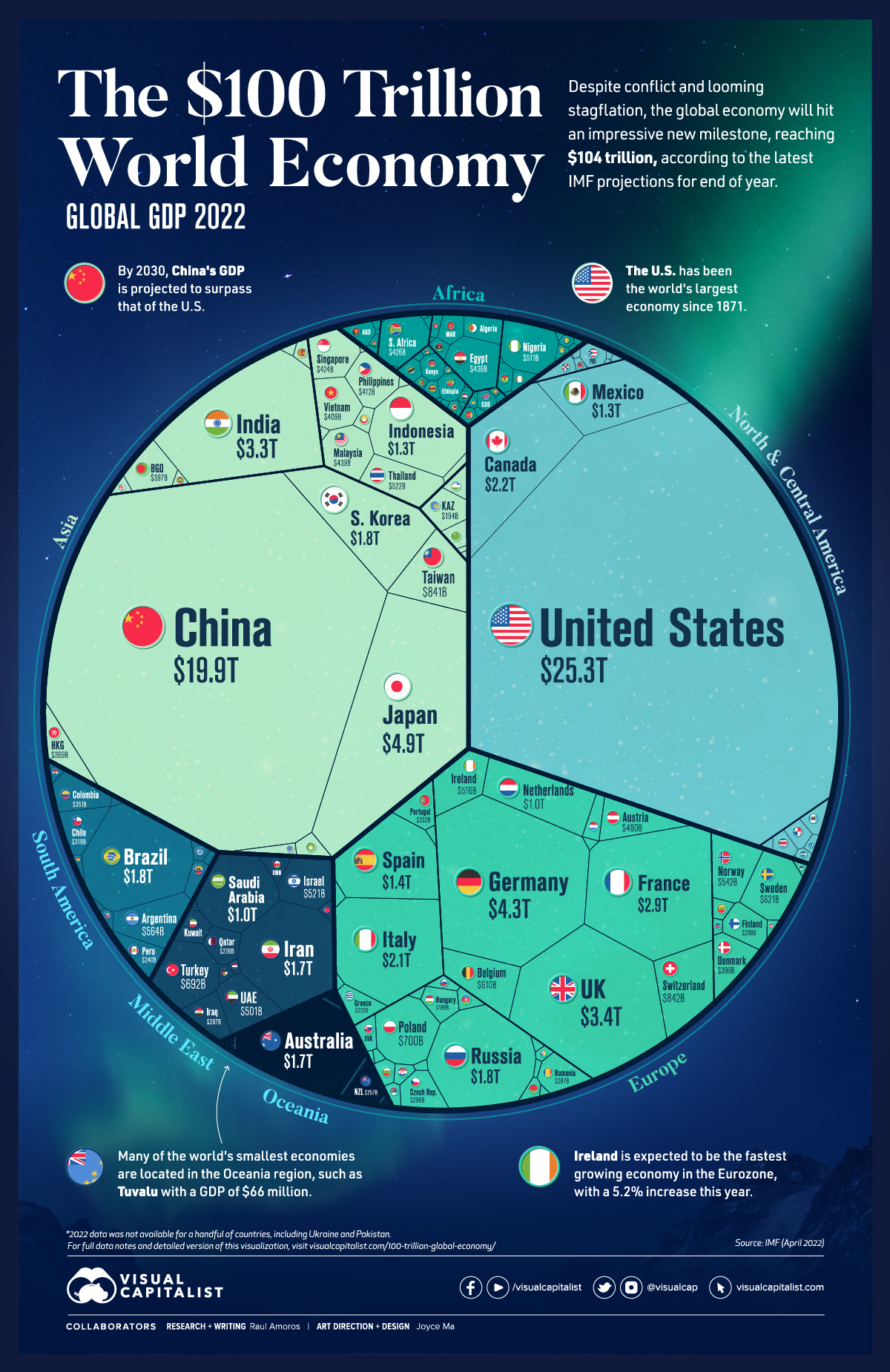

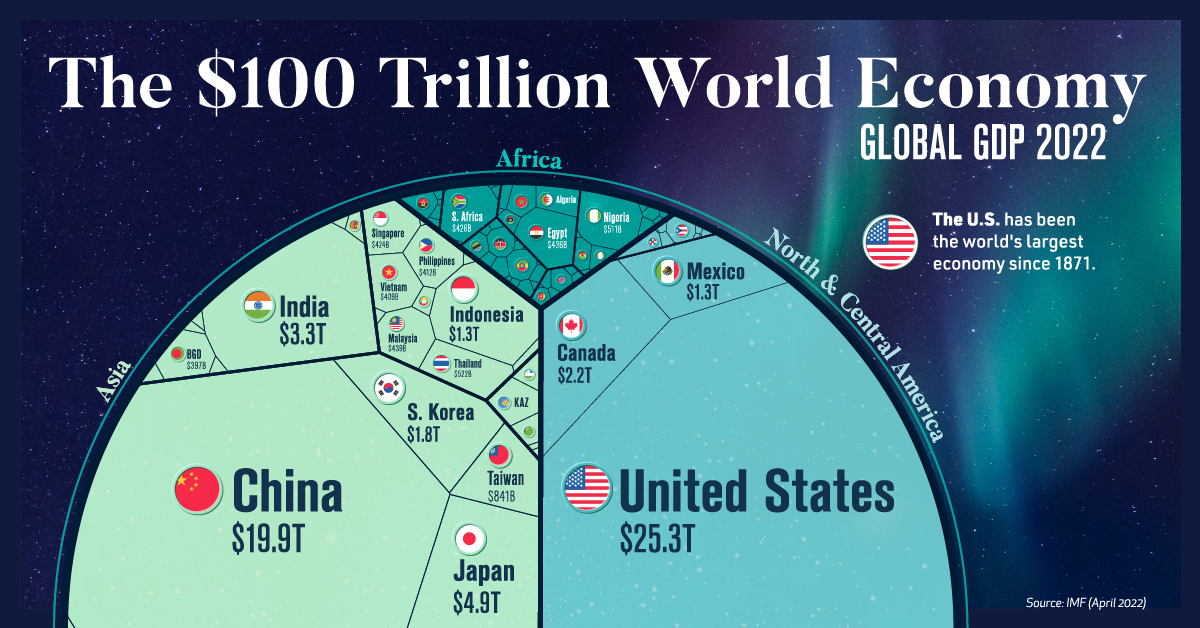

The $100 Trillion Global Economy in One Chart

Check out the latest 2023 update of the global economy in one chart.

Visualizing the $100 Trillion Global Economy in One Chart

Check out the latest 2023 update of the global economy in one chart.

Surpassing the $100 trillion mark is a new milestone for global economic output.

We’ve covered this topic in the past when the world’s GDP was $88 trillion (2020) and then $94 trillion (2021), and now according to the latest projections, the IMF expects the global economy to reach nearly $104 trillion in nominal value by the end of 2022.

Although growth keeps trending upwards, the recovery that was expected in the post-pandemic period is looking strained. Because of recent conflicts, supply chain bottlenecks, and subsequent inflation, global economic projections are getting revised downwards.

Global annual GDP growth for 2022 was initially projected to be 4.4% as of January, but this has since been adjusted to 3.6%.

Note: This data from the IMF represents the most recent nominal projections for end of year as of April 2022.

The 50 Largest Economies in the World

The United States is still the economic leader worldwide, with a GDP of $25.3 trillion—making up nearly one quarter of the global economy. China follows close behind at $19.9 trillion. Here’s a look at the top 50 countries in terms of GDP:

| Rank | Country | GDP (current prices, USD) |

|---|---|---|

| #1 | 🇺🇸 United States | $25.3 trillion |

| #2 | 🇨🇳 China | $19.9 trillion |

| #3 | 🇯🇵 Japan | $4.9 trillion |

| #4 | 🇩🇪 Germany | $4.3 trillion |

| #5 | 🇬🇧 United Kingdom | $3.4 trillion |

| #6 | 🇮🇳 India | $3.3 trillion |

| #7 | 🇫🇷 France | $2.9 trillion |

| #8 | 🇨🇦 Canada | $2.2 trillion |

| #9 | 🇮🇹 Italy | $2.1 trillion |

| #10 | 🇧🇷 Brazil | $1.8 trillion |

| #11 | 🇷🇺 Russia | $1.8 trillion |

| #12 | 🇰🇷 South Korea | $1.8 trillion |

| #13 | 🇦🇺 Australia | $1.7 trillion |

| #14 | 🇮🇷 Iran | $1.7 trillion |

| #15 | 🇪🇸 Spain | $1.4 trillion |

| #16 | 🇲🇽 Mexico | $1.3 trillion |

| #17 | 🇮🇩 Indonesia | $1.3 trillion |

| #18 | 🇸🇦 Saudi Arabia | $1.0 trillion |

| #19 | 🇳🇱 Netherlands | $1.0 trillion |

| #20 | 🇨🇭 Switzerland | $842 billion |

| #21 | 🇹🇼 Taiwan | $841 billion |

| #22 | 🇵🇱 Poland | $700 billion |

| #23 | 🇹🇷 Turkey | $692 billion |

| #24 | 🇸🇪 Sweden | $621 billion |

| #25 | 🇧🇪 Belgium | $610 billion |

| #26 | 🇦🇷 Argentina | $564 billion |

| #27 | 🇳🇴 Norway | $542 billion |

| #28 | 🇹🇭 Thailand | $522 billion |

| #29 | 🇮🇱 Israel | $521 billion |

| #30 | 🇮🇪 Ireland | $516 billion |

| #31 | 🇳🇬 Nigeria | $511 billion |

| #32 | 🇦🇪 United Arab Emirates | $501 billion |

| #33 | 🇦🇹 Austria | $480 billion |

| #34 | 🇲🇾 Malaysia | $439 billion |

| #35 | 🇪🇬 Egypt | $436 billion |

| #36 | 🇿🇦 South Africa | $426 billion |

| #37 | 🇸🇬 Singapore | $424 billion |

| #38 | 🇵🇭 Philippines | $412 billion |

| #39 | 🇻🇳 Vietnam | $409 billion |

| #40 | 🇩🇰 Denmark | $399 billion |

| #41 | 🇧🇩 Bangladesh | $397 billion |

| #42 | 🇭🇰 Hong Kong SAR | $369 billion |

| #43 | 🇨🇴 Colombia | $351 billion |

| #44 | 🇨🇱 Chile | $318 billion |

| #45 | 🇫🇮 Finland | $298 billion |

| #46 | 🇮🇶 Iraq | $297 billion |

| #47 | 🇨🇿 Czechia | $296 billion |

| #48 | 🇷🇴 Romania | $287 billion |

| #49 | 🇳🇿 New Zealand | $257 billion |

| #50 | 🇵🇹 Portugal | $252 billion |

The frontrunner in Europe is Germany at $4.3 trillion, with the UK coming in second place. One significant change since the last reported figures is that Brazil now cracks the top 10, having surpassed South Korea. Russia falls just outside, in 11th place, with a GDP of $1.8 trillion.

While China’s GDP growth has slowed in recent years, projections still indicate that the country will overtake the U.S. by 2030, dethroning the world’s economic leader.

One region also expected to experience growth in the near future is the Middle East and North Africa, thanks to higher oil prices—Iraq and Saudi Arabia in particular are leading this charge. Regional GDP growth in the area is expected to be around 5% in 2022.

The 50 Smallest Economies in the World

Some of the world’s smallest economies were hit particularly hard by the pandemic, and have subsequently been the most affected by the inflation and food supply shortages resulting from the war in Ukraine.

Here’s a look at the countries worldwide with the lowest GDP in 2022:

| Rank | Country | GDP (current prices, USD) |

|---|---|---|

| #191 | 🇹🇻 Tuvalu | $66 million |

| #190 | 🇳🇷 Nauru | $134 million |

| #189 | 🇰🇮 Kiribati | $216 million |

| #188 | 🇵🇼 Palau | $244 million |

| #187 | 🇲🇭 Marshall Islands | $267 million |

| #186 | 🇫🇲 Micronesia | $427 million |

| #185 | 🇸🇹 São Tomé and Príncipe | $1 billion |

| #184 | 🇹🇴 Tonga | $1 billion |

| #183 | 🇩🇲 Dominica | $1 billion |

| #182 | 🇼🇸 Samoa | $1 billion |

| #181 | 🇻🇨 Saint Vincent and the Grenadines | $1 billion |

| #180 | 🇻🇺 Vanuatu | $1 billion |

| #179 | 🇰🇳 Saint Kitts and Nevis | $1 billion |

| #178 | 🇬🇩 Grenada | $1 billion |

| #177 | 🇰🇲 Comoros | $1 billion |

| #176 | 🇦🇬 Antigua and Barbuda | $2 billion |

| #175 | 🇬🇼 Guinea-Bissau | $2 billion |

| #174 | 🇸🇧 Solomon Islands | $2 billion |

| #173 | 🇸🇲 San Marino | $2 billion |

| #172 | 🇸🇨 Seychelles | $2 billion |

| #171 | 🇹🇱 Timor-Leste | $2 billion |

| #170 | 🇧🇿 Belize | $2 billion |

| #169 | 🇨🇻 Cabo Verde | $2 billion |

| #168 | 🇱🇨 Saint Lucia | $2 billion |

| #167 | 🇬🇲 The Gambia | $2 billion |

| #166 | 🇱🇸 Lesotho | $3 billion |

| #165 | 🇪🇷 Eritrea | $3 billion |

| #164 | 🇨🇫 Central African Republic | $3 billion |

| #163 | 🇧🇹 Bhutan | $3 billion |

| #162 | 🇸🇷 Suriname | $3 billion |

| #161 | 🇦🇼 Aruba | $3 billion |

| #160 | 🇦🇩 Andorra | $3 billion |

| #159 | 🇧🇮 Burundi | $3 billion |

| #158 | 🇱🇷 Liberia | $4 billion |

| #157 | 🇩🇯 Djibouti | $4 billion |

| #156 | 🇸🇱 Sierra Leone | $4 billion |

| #155 | 🇸🇿 Eswatini | $5 billion |

| #154 | 🇫🇯 Fiji | $5 billion |

| #153 | 🇲🇻 Maldives | $6 billion |

| #152 | 🇧🇧 Barbados | $6 billion |

| #151 | 🇸🇸 South Sudan | $6 billion |

| #150 | 🇲🇪 Montenegro | $6 billion |

| #149 | 🇹🇯 Tajikistan | $8 billion |

| #148 | 🇸🇴 Somalia | $8 billion |

| #147 | 🇹🇬 Togo | $9 billion |

| #146 | 🇰🇬 Kyrgyzstan | $9 billion |

| #145 | 🇲🇷 Mauritania | $9 billion |

| #144 | 🇽🇰 Kosovo | $10 billion |

| #143 | 🇲🇺 Mauritius | $11 billion |

| #142 | 🇲🇼 Malawi | $12 billion |

The smallest economy in the world measured in the IMF rankings is Tuvalu at $66 million. Most of the bottom 50 are considered low- to middle-income and emerging/developing countries. According to the World Bank, in developing countries, the level of per capita income in 2022 will be about 5% below the pre-pandemic trends.

Some countries are actually projected to experience negative GDP growth this year, particularly emerging and developing economies in Europe.

For example, Russia is expected to experience a GDP growth rate of -8.5% in 2022, though it still remains to be seen how the cost of war and increasingly harsh global sanctions impact the country’s economic prospects.

Inflation, Stagflation, Recession – How Bad is it?

While global economic growth has already been revised downwards, it’s possible the situation could be even more serious. Organizations like the World Bank say that risks of stagflation are rising. Stagflation, which hasn’t occurred since the 1970s, is defined as an economy that’s experiencing rising inflation combined with a stagnant economic output.

Currently, global consumer inflation is currently pegged at 7%. Daily goods are becoming increasingly difficult to purchase and interest rates are on the rise as central banks worldwide try to control the situation. As recent events in Sri Lanka demonstrate, low-income countries are particularly at risk to economic volatility.

Markets

The European Stock Market: Attractive Valuations Offer Opportunities

On average, the European stock market has valuations that are nearly 50% lower than U.S. valuations. But how can you access the market?

European Stock Market: Attractive Valuations Offer Opportunities

Europe is known for some established brands, from L’Oréal to Louis Vuitton. However, the European stock market offers additional opportunities that may be lesser known.

The above infographic, sponsored by STOXX, outlines why investors may want to consider European stocks.

Attractive Valuations

Compared to most North American and Asian markets, European stocks offer lower or comparable valuations.

| Index | Price-to-Earnings Ratio | Price-to-Book Ratio |

|---|---|---|

| EURO STOXX 50 | 14.9 | 2.2 |

| STOXX Europe 600 | 14.4 | 2 |

| U.S. | 25.9 | 4.7 |

| Canada | 16.1 | 1.8 |

| Japan | 15.4 | 1.6 |

| Asia Pacific ex. China | 17.1 | 1.8 |

Data as of February 29, 2024. See graphic for full index names. Ratios based on trailing 12 month financials. The price to earnings ratio excludes companies with negative earnings.

On average, European valuations are nearly 50% lower than U.S. valuations, potentially offering an affordable entry point for investors.

Research also shows that lower price ratios have historically led to higher long-term returns.

Market Movements Not Closely Connected

Over the last decade, the European stock market had low-to-moderate correlation with North American and Asian equities.

The below chart shows correlations from February 2014 to February 2024. A value closer to zero indicates low correlation, while a value of one would indicate that two regions are moving in perfect unison.

| EURO STOXX 50 | STOXX EUROPE 600 | U.S. | Canada | Japan | Asia Pacific ex. China |

|

|---|---|---|---|---|---|---|

| EURO STOXX 50 | 1.00 | 0.97 | 0.55 | 0.67 | 0.24 | 0.43 |

| STOXX EUROPE 600 | 1.00 | 0.56 | 0.71 | 0.28 | 0.48 | |

| U.S. | 1.00 | 0.73 | 0.12 | 0.25 | ||

| Canada | 1.00 | 0.22 | 0.40 | |||

| Japan | 1.00 | 0.88 | ||||

| Asia Pacific ex. China | 1.00 |

Data is based on daily USD returns.

European equities had relatively independent market movements from North American and Asian markets. One contributing factor could be the differing sector weights in each market. For instance, technology makes up a quarter of the U.S. market, but health care and industrials dominate the broader European market.

Ultimately, European equities can enhance portfolio diversification and have the potential to mitigate risk for investors.

Tracking the Market

For investors interested in European equities, STOXX offers a variety of flagship indices:

| Index | Description | Market Cap |

|---|---|---|

| STOXX Europe 600 | Pan-regional, broad market | €10.5T |

| STOXX Developed Europe | Pan-regional, broad-market | €9.9T |

| STOXX Europe 600 ESG-X | Pan-regional, broad market, sustainability focus | €9.7T |

| STOXX Europe 50 | Pan-regional, blue-chip | €5.1T |

| EURO STOXX 50 | Eurozone, blue-chip | €3.5T |

Data is as of February 29, 2024. Market cap is free float, which represents the shares that are readily available for public trading on stock exchanges.

The EURO STOXX 50 tracks the Eurozone’s biggest and most traded companies. It also underlies one of the world’s largest ranges of ETFs and mutual funds. As of November 2023, there were €27.3 billion in ETFs and €23.5B in mutual fund assets under management tracking the index.

“For the past 25 years, the EURO STOXX 50 has served as an accurate, reliable and tradable representation of the Eurozone equity market.”

— Axel Lomholt, General Manager at STOXX

Partnering with STOXX to Track the European Stock Market

Are you interested in European equities? STOXX can be a valuable partner:

- Comprehensive, liquid and investable ecosystem

- European heritage, global reach

- Highly sophisticated customization capabilities

- Open architecture approach to using data

- Close partnerships with clients

- Part of ISS STOXX and Deutsche Börse Group

With a full suite of indices, STOXX can help you benchmark against the European stock market.

Learn how STOXX’s European indices offer liquid and effective market access.

-

Economy2 days ago

Economy2 days agoEconomic Growth Forecasts for G7 and BRICS Countries in 2024

The IMF has released its economic growth forecasts for 2024. How do the G7 and BRICS countries compare?

-

Markets1 week ago

Markets1 week agoU.S. Debt Interest Payments Reach $1 Trillion

U.S. debt interest payments have surged past the $1 trillion dollar mark, amid high interest rates and an ever-expanding debt burden.

-

United States2 weeks ago

United States2 weeks agoRanked: The Largest U.S. Corporations by Number of Employees

We visualized the top U.S. companies by employees, revealing the massive scale of retailers like Walmart, Target, and Home Depot.

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

This graphic shows the states with the highest real GDP growth rate in 2023, largely propelled by the oil and gas boom.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

In this graphic, we show the highest earning flight routes globally as air travel continued to rebound in 2023.

-

Markets2 weeks ago

Markets2 weeks agoRanked: The Most Valuable Housing Markets in America

The U.S. residential real estate market is worth a staggering $47.5 trillion. Here are the most valuable housing markets in the country.

-

Education1 week ago

Education1 week agoHow Hard Is It to Get Into an Ivy League School?

-

Technology2 weeks ago

Technology2 weeks agoRanked: Semiconductor Companies by Industry Revenue Share

-

Markets2 weeks ago

Markets2 weeks agoRanked: The World’s Top Flight Routes, by Revenue

-

Demographics2 weeks ago

Demographics2 weeks agoPopulation Projections: The World’s 6 Largest Countries in 2075

-

Markets2 weeks ago

Markets2 weeks agoThe Top 10 States by Real GDP Growth in 2023

-

Demographics2 weeks ago

Demographics2 weeks agoThe Smallest Gender Wage Gaps in OECD Countries

-

Economy2 weeks ago

Economy2 weeks agoWhere U.S. Inflation Hit the Hardest in March 2024

-

Environment2 weeks ago

Environment2 weeks agoTop Countries By Forest Growth Since 2001